Tata Consultancy Services Ltd. and Infosys Ltd., India's two leading information technology companies, are better equipped to absorb costs due to the rise in H-1B visa application fees in the US, according to Moody's Ratings.

"Large IT firms like TCS and Infosys are better equipped to manage these pressures because of their higher profitability, strong balance sheets and increased focus on local hiring over the last few years," said Sweta Patodia, assistant vice president at Moody's.

The Trump administration has imposed a $100,000 one-time fee on fresh H-1B visas, a vast majority of which have historically gone to high-skilled Indian workers. The H-1B is a classification of non-immigrant visa in the US that allows American employers to hire foreign workers in specialty occupations.

These visas are awarded based on a system where employers file petitions by March for a lottery in April, with 65,000 visas available, plus 20,000 for US master's graduates. In 2025, over 470,000 applications were submitted, as per a Bloomberg News report.

Indian companies have steadily pared back their dependence on H-1B visas since Trump threatened to raise immigration barriers in his first term. They have also stepped up local hiring in the US.

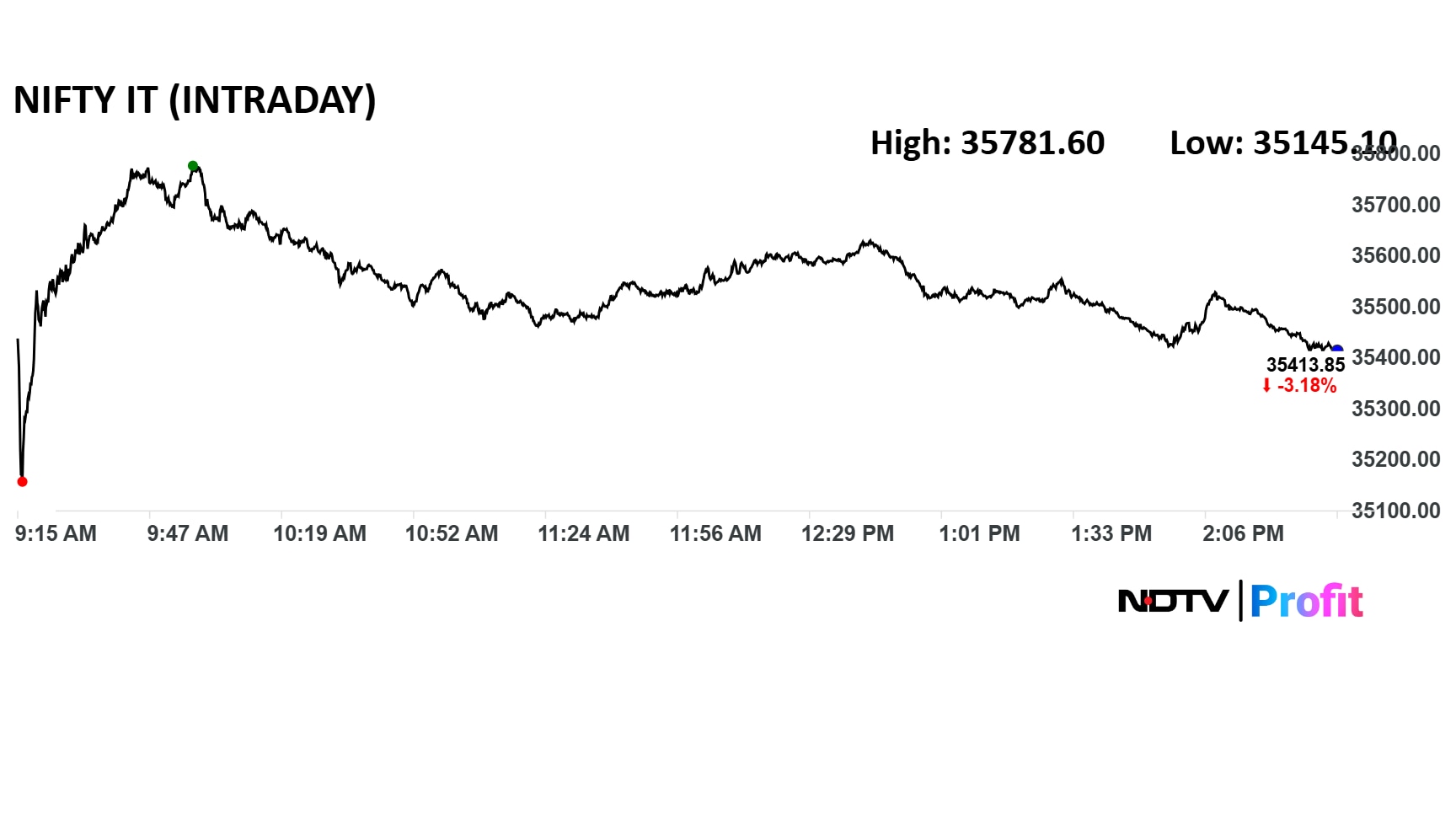

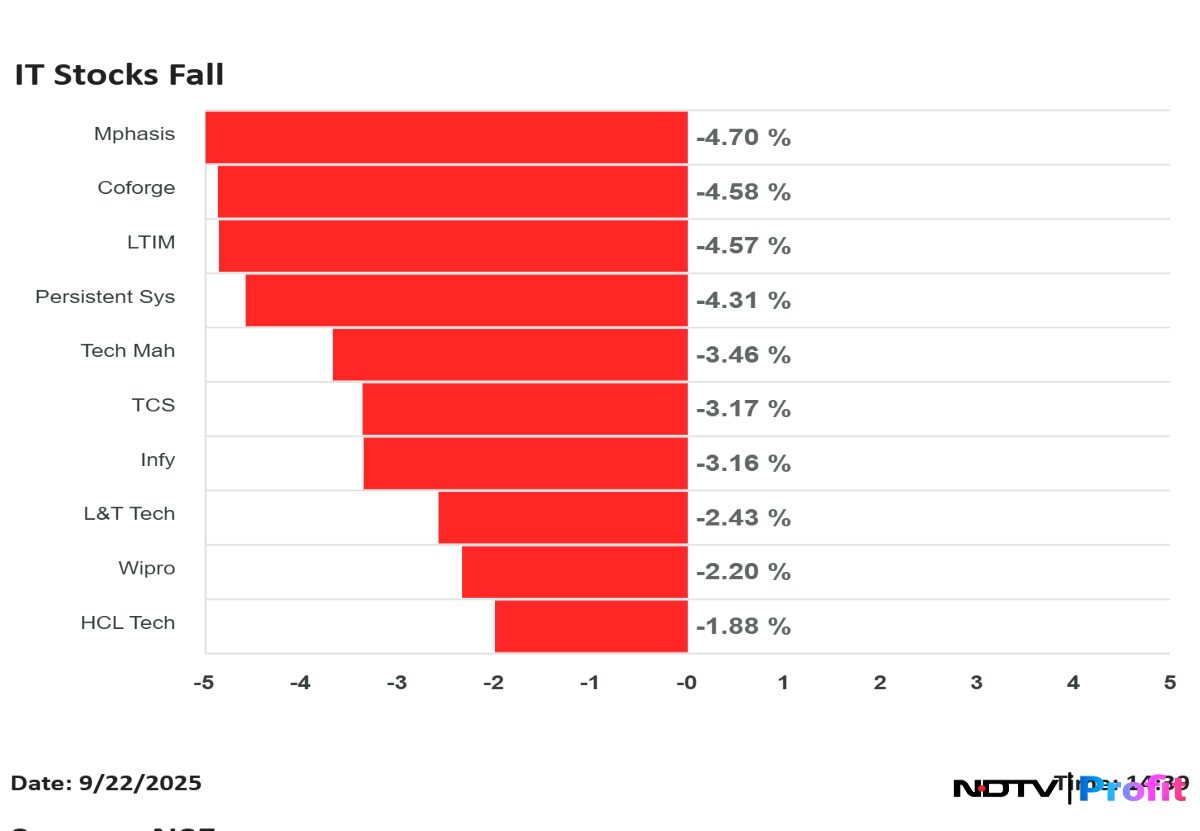

Nifty IT fell nearly 4%.

Patodia said the steep rise in H-1B visa fees will raise operating costs for Indian IT services companies that have the US as their largest and most important market. This adds to a possible 25% tax under the proposed 'HIRE Act', if US companies outsource to foreign entities.

Though steady global demand for IT services will help offset some of these rising costs, she noted.

Besides the impact on individual companies and India's services exports, Moody's said fewer skilled workers going to the US could also reduce remittance inflows. India received approximately $129 billion in inward remittances in 2024, of which $32 billion or nearly 28% came from the US, as per news reports.

"Still, current account deficits will stay within manageable levels," Patodia said.

IT stocks down on Monday.

Indian IT stocks lost nearly Rs 95,000 crore in market capitalisation as the Nifty IT index shed nearly 4% after the visa fee announcement.

Large players, including Infosys, TCS, and Tech Mahindra Ltd., fell by over 3%.

As per an Emkay Global report, Infosys had the largest number of H-1B visa staff among Indian firms in fiscal 2024, followed by TCS, HCLTech and LTMindtree.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.