Billionaire Francois-Henri Pinault's two-decade-long reign at the helm of Gucci owner Kering SA is ending with the group at one of the lowest points in the family company's history. A key question for investors is whether he'll give his successor leeway to clean up the mess.

The 63-year-old luxury heir, who faces shareholders on Tuesday, is relinquishing his chief executive role to outsider Luca de Meo — a former automotive executive with no luxury experience — after coming under increasing pressure from investors. But he's staying on as chairman and has said he “will be fully involved in the strategic orientation of the group” even as he has pledged to not “step in and short-circuit the new CEO.” De Meo, credited with turning French carmaker Renault SA around, is set to take over on Sept. 15.

Running a dynastic business can be difficult for an outside CEO, especially when it has been led for a long time by an insider who plans to stick around, said the University of Copenhagen's Morten Bennedsen, who's a visiting professor at French business school Insead and an expert on family businesses. The corporate world is replete with such examples — from the Tatas in India to Luxottica in Italy.

“More often than not either the CEO runs away or is fired because it's a completely new situation for the family and the chairman may not be able to let go,” Bennedsen said. “We see this again and again. CEOs don't get the freedom and feel like they are always watched by the family.”

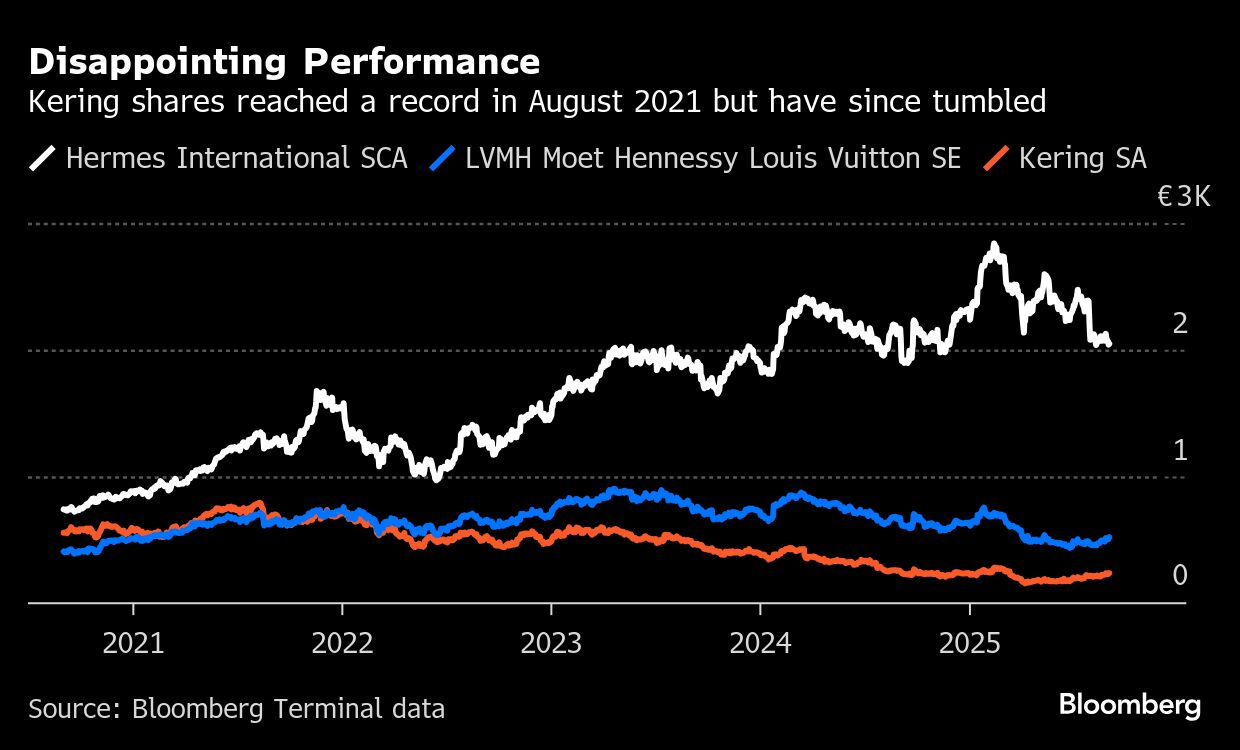

De Meo's appointment, announced in June, drew attention to Pinault's mixed legacy, one that has included a lucrative go-go period at Gucci, but also a series of mostly ineffectual acquisitions and in recent years a revolving door of top managers and brand designers. The group has sunk deeper into crisis as sales and profit evaporated and investors grew increasingly wary. Its stock and the Pinault family's wealth have plunged by about two thirds from their record highs in 2021. The outlook for Gucci remains precarious and labels like Balenciaga and Yves Saint Laurent are also suffering.

“It's almost been like a textbook on how not to run a company in recent years,” said Flavio Cereda, a luxury brand portfolio manager at GAM UK Ltd. “There have been odd decisions made again and again and again resulting in significant, self-inflicted destruction of value.”

The first thing De Meo should do, if required, he said, is “kitchen sinking” by looking at the numbers carefully and getting the real story out. “I would be extremely surprised if there aren't a couple of heads rolling by the end of the year.”

Kering declined to comment.

Since the unprecedented surge in demand for luxury goods in the early post-pandemic era, most industry players, including closely held Chanel Ltd. and Burberry Group Plc have registered a downturn. But none seem to have plumbed the depths of Kering, which experienced a series of stock market downgrades and was given a negative outlook by Standard & Poor's in August related to ballooning debt.

Pressure on Pinault to drop the CEO role began some time ago, according to Marco Taricco, co-founder of Bluebell Capital Partners, which took a stake in Kering in 2023. The activist investor wrote to Pinault the following year, outlining how Kering had underperformed peers since Pinault took the helm in 2005, urging him to move on to a non-executive chairman role “in the best interest of shareholders.”

“The key ask was a step back by Pinault. He did it,” said Taricco, noting that the fund that held the Kering stake decided to shut down last year.

In a letter to investors in August, Pinault acknowledged the company's results remain “well below our potential.” Last year he told them he shares their pain — his family holds a roughly 42% stake and 59% of voting rights. The net worth of the clan, led by his 89-year-old father Francois Pinault — who founded the company — has tumbled to almost $23 billion from a peak of about $59 billion in August 2021, according to the Bloomberg Billionaires Index.

Pinault said the company is ready for “a new vision,” but it remains to be seen whether that will translate into freedom for De Meo to make the drastic fixes the group badly needs.

In recent years, Kering brands have seen changes in designers and top executives including the departure of Pinault's longstanding No. 2, Jean-Francois Palus. The March announcement of the transfer of designer Demna to Gucci from Balenciaga was panned by the market, but will be difficult for De Meo to undo since the artistic director is getting ready to unveil his creations.

Over the years, Pinault tried and failed to lower reliance on Gucci through acquisitions. The Italian label still generates over half of Kering's profit. Forays into lifestyle and sportswear brands didn't pan out, and Kering sold its stake in Puma SE and the Volcom skatewear brand. Pinault also abandoned a move into luxury watches with the sale of two brands Kering had acquired.

Investments in high-end eyewear aren't yet major earnings contributors, while many analysts say Pinault overpaid for fragrance maker Creed and Kering's 30% stake in Valentino — a combined outlay of roughly €5.1 billion ($5.94 billion). Pinault also spent heavily on prime property acquisitions, and is now offloading some of them to cut debt.

“Bringing in someone fresh from outside the sector is probably not a bad idea,” said GAM's Cereda. “I'm assuming De Meo has carte blanche. I would be very surprised if he made the move without getting carte blanche.”

Still, at the upcoming shareholders' meeting, investors will not only vote on de Meo's €20 million sign-on bonus and the splitting of the chairman and CEO roles, but also on raising the age limits for the two jobs to 70 and 80, respectively, from 65. That will allow Pinault to helm the board for at least another decade and a half.

The change in the C-suite will usher in deep changes in governance at the firm, and some have speculated that De Meo may be a stop-gap along the path to a third generation of the family. His hiring came on the heels of a series of succession steps within the Pinault clan's sprawling empire. While the father and son are managing partners of family holding firm Artemis, Pinault's sister Laurence, 64, and brother Dominique, 61, head the supervisory board.

Artemis and the clan's ultimate holding company, Financiere Pinault, added to their boards three members of the third generation: one child from each sibling. They are Laurence's daughter, Olivia Fournet, 38, who works at Balenciaga; Pinault's son Francois Louis Pinault, 27, an Artemis account manager; and Dominique's 25-year-old daughter Gaelle Pinault. While it's not yet clear whether any of them, or the founder's other grandchildren, will eventually run the group, their relatively young ages indicate a hiatus is taking shape.

Pinault himself worked for more than two decades within the family group, which started out as a lumberyard in Brittany, before becoming chairman and CEO in 2005. He took on the top job after his father had already made a major pivot into fashion. The son then sold assets to focus the company on luxury and ride the wave of Chinese demand. The executive did chalk up some wins, with Kering experiencing a boom that was helped by the popularity of Alessandro Michele's designs for Gucci, with revenue at the Italian label crossing the symbolic €10 billion mark in 2022.

In what now seems prescient, Pinault talked last year about success and failure. During a commencement speech at HEC Paris, one of France's leading business schools and his alma mater, he offered words of advice for the graduates.

“Success is short-lived,” he said. “In success, as in difficulty, you can't lead a fulfilling career as a solitary hero.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.