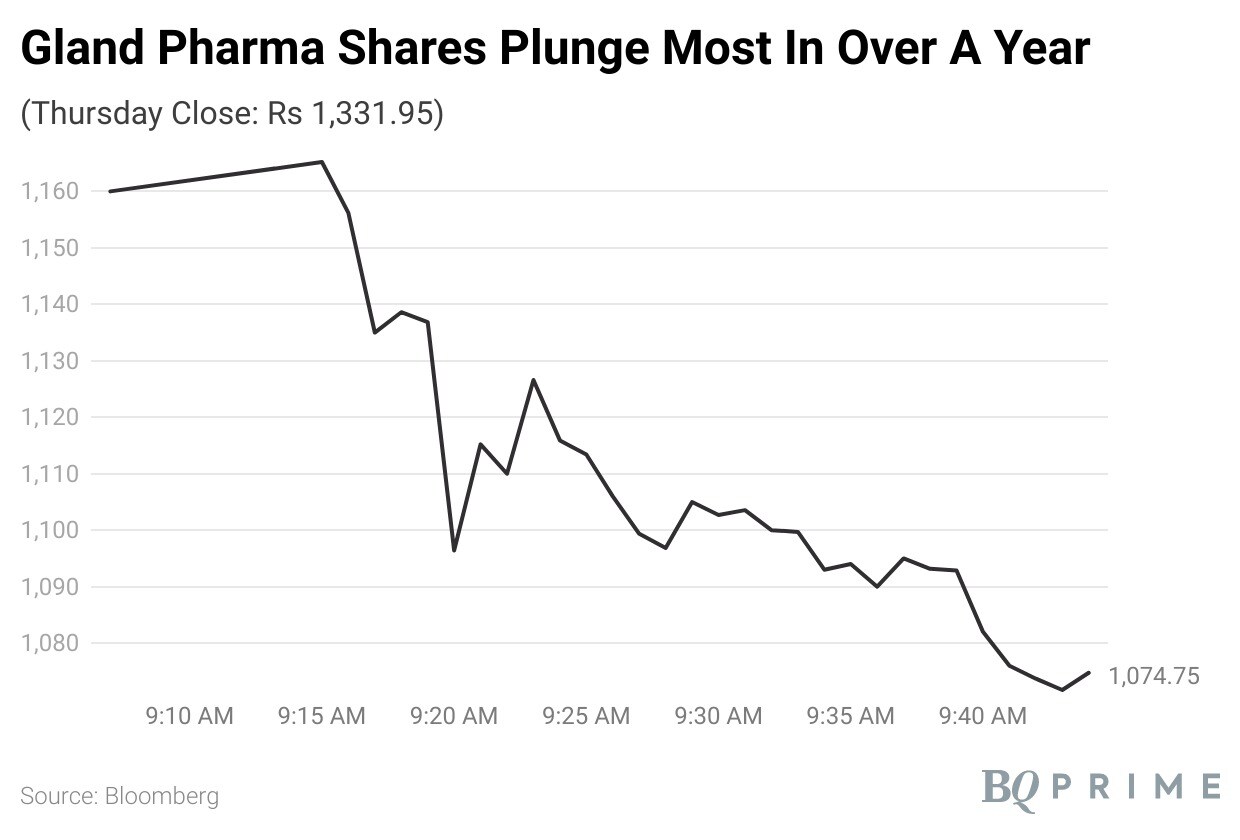

Shares of Gland Pharma Ltd. dropped nearly 20%, the most in more than a year, after its fourth-quarter profit missed estimates. The company's stock price fell around 63% in the past year.

The generic injectables maker's net profit fell 72% year-on-year to Rs 79 crore in the three months through March, according to an exchange filing. That compares with the Rs 269 crore consensus estimate of analysts tracked by Bloomberg.

That caused some analysts to downgrade ratings and cut their price target on the stock due to heightened competition in key products and client-related issues.

Gland Pharma Q4 Results: Key Highlights (YoY)

Revenue down 29% at Rs 785 crore (Bloomberg estimate: Rs 1,114 crore)

Operating profit down 52% at Rs 168 crore (Bloomberg estimate: Rs 351 crore)

Operating margin at 21.5% vs 31.6% a year ago (Bloomberg estimate: 31.5%)

Shares of the Hyderabad-based pharma company fell 19.5% as of 9:49 a.m. compared to a flat benchmark BSE Sensex.

Of the 19 analysts tracking the company, 10 maintain a ‘buy' rating, one suggests a ‘hold' and eight recommend a ‘sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 22.2%.

Brokerages' take on Gland Pharma's quarterly results:

Motilal Oswal

Maintains a ‘buy' rating with a downward-revised price of Rs 1,460 apiece, implying an upside of 10%.

Miss on Q4FY23 earnings, led by lower sales across geographies and higher operating costs because of production line shutdown.

In addition to one of the customers filing for bankruptcy, there has been a shift in business by another customer.

This has impacted company's performance adversely for Q4FY23.

Production line shutdowns for line upgrades also affected revenue and profitability in Q4FY23.

The revenue impact was to the tune of Rs 30-40 crore for Q4FY23.

Tender seasonality led to lower off-take of tender business.

Ebidta margin contracted due to inferior operating leverage (employee cost/other expenses up 450bp/850bp year-on-year as % of sales.

PAT adjusted for bankrupt customers declined 59%.

Cut earnings by 36%/22% for FY24E/FY25E factoring in:

a) reduction in scope of business from a bankrupt customer,

b) gradual revival in business due to a shift of business by another customer to an alternate supplier, and

c) reduced share of profit due to higher competition in the existing product portfolio.

Multiple headwinds on revenue and operational costs have hit its FY23 performance.

Expect a slow recovery over the next 12-15 months, aided by new launches in China or other regulated markets, and newer contracts in the CDMO segment and inventory rationalisation of existing products.

Nirmal Bang

Downgrades to 'sell' from 'accumulate' with a target price of Rs 1,195 apiece, implying a downside of 10.7%.

Missed estimates on all fronts on account of multiple issues.

Q4 Revenue declined mainly due to:

-- subdued growth across geographies

-- maintenance shutdown of Pashamylaram Penems facility,

-- lull in domestic B2C business

-- soft off-take in ROW tender business due to seasonality.

Company reported its worst-ever Ebidta margin of 21.5% mainly due to negative operational leverage.

This was partially offset by a better geographical mix.

Issues keep mounting for Gland, from supply chain issues to now heightened competition, price erosion and client-related issues (including regulatory challenges and inventory rationalisation).

Increased competition is likely to affect future growth as the company is ready to sacrifice growth for margins.

On the positive front, the stopper issue for heparin is almost resolved.

Gland Pharma is cautious due to elevated competition in key products and client-related issues.

If competition intensifies further and margins also abate, then brokerage may further reduce earnings.

But, if growth visibility improves with stable margins, then we may re-rate the stock.

IIFL Securities

Maintains a ‘reduce' rating with a downward-revised price of Rs 1,150 from Rs 1,300 apiece earlier, implying a downside of 14%.

Ebitda missed expectations by 40–45%, owing to:

-- Penem plant shutdowns,

-- tender seasonality in the RoW business, and

-- negative operating leverage due to lower topline/investments for the business.

Visibility on growth normalisation remains poor given:

(1) increasing competitive intensity in key products (Enoxaparin and Heparin),

(2) lower revenue accretion from new launches and

(3) inventory rationalisation being done by customers.

Top-10/30 products declined 20–25% YoY in FY23, as per export data.

Gland has lost one customer to whom it was supplying 14-15 products.

Another customer (likely Athenex) that went bankrupt contributed Rs 200 crore in revenue in FY23 (6% of overall revenue).

Management expects the limited impact from these customer discontinuations.

But there is a downside risk to organic growth assumption of 7% for FY24.

With the base business being under pressure, the brokerage believes Cenexi acquisition is not well-timed.

This is considering potential integration challenges and a further increase in revenue exposure to low-growth developed markets.

Gland's overall margins will contract to 24-25% post-Cenexi acquisition, assumptions imply 29-30% margins for the base business.

Haitong

Maintains a ‘neutral' rating with a downward-revised price of Rs 1,310 apiece, implying a downside of 2% from the pre-result closing price.

The topline decline is a result of the US's and India's weak performance.

US business was impacted by the decline in contribution from important products like Enoxaparin, Heparin, and Micafungin and closure of its Pashamylaram penem facility.

Indian business is still being negatively impacted by the lack of Covid-related sales and pricing pressure.

Poor topline performance and higher R&D spending caused EBITDA to sharply decline.

FY23 was largely a washout year as a result of headwinds such as

-- Raw material supply issues,

-- loss of Covid-related sales, pricing pressure, and

-- plant closure, which negatively impacted overall performance

Additional sales from the Cenexi business will account for the majority of the company's topline growth over the next two years.

But Cenexi's H2CY22 EBITDA margins were only 7%, much lower than anticipated;

This was largely because of inflationary circumstances.

Also lack of significant upcoming launches in the US and the limited opportunity for the base business to recover, has caused a 14–12% reduction in FY24–25E EPS.

Ambit

Maintains a ‘sell' rating with a downward-revised price of Rs 960 from Rs 1,310 apiece earlier, implying a downside of 28% from the pre-result closing price.

The shutdown of Penems production line for upgradation, seasonality in tenders, and inventory reduction by customers were key factors behind the weak topline.

Pricing pressure on key products such as micafungin and heparin did not help either.

Supply chain challenges have largely been resolved, with no significant bottlenecks impacting any components.

Gross margin held up well, but negative operating leverage flowed through to bottomline.

Unlike early FY23, many factors behind current weakness do not appear transient.

This implies a structural downward reset in growth/margin trajectory and pace of recovery is difficult to predict.

Consolidation of the recently acquired Cenexi would put further pressure on margins and RoCE.

Upside due to compliance issues at competitor plants (viz. Intas, Sun) or faster-than-expected traction in China/biologics are key risks to sell rating.

Equirus Securities

Downgrades to 'short' from 'reduce' with a target price of Rs 871 apiece, implying a downside of 35%.

Q4 performance validates the brokerage's long-standing apprehensions about its business not being elusive to price erosions.

It was also forewarned that it could see a loss in its potential customer base as the front-end partner's margins start dwindling.

Expect the business to remain under stress due to stiff competition in the injectables space.

Gland Pharma will be required to operate at lower margins to retain customers and compensate them for erosion.

Since its base business is undergoing consolidation, meaningful big launches will be critical for growth.

The brokerage added that Cenexi acquisition may dilute value.

Losing customers owing to price erosion will move the company's narrative from CDMO to a generic player.

Thus, expect the P/E multiple to de-rate further.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.