Have you ever received a call where someone claims your father has instructed them to credit money into your account? Sounds harmless enough at first, right? But sometimes, these innocent-seeming phone calls can turn into an elaborate scam. Here's a personal story that sheds light on how fraud can happen in the blink of an eye—and how to respond swiftly to avoid falling victim.

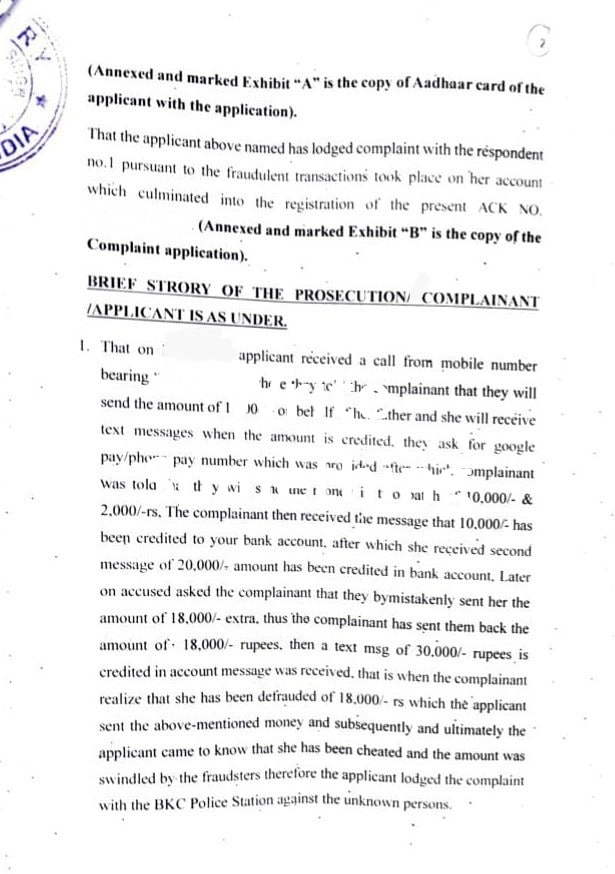

It was July 25 when I received a call from a man who seemed to know far too much about me. He greeted me by my name, confirming my father's name, and then mentioned that he had been asked by my father to credit some insurance policy money into my account. A day before this call, my father had indeed asked me for an updated photograph for some insurance-related work, which made the call seem legitimate.

The man continued, saying he would be transferring money to me, and asked for my Google Pay number. Without much thought, I provided it, thinking it was all part of the insurance procedure my father had mentioned.

While the man was on call, I received a message on my phone: Rs 20,000 credited to your account.(The man was to send the money in two batches, one of Rs 2000 and the other one of Rs 10,000.) It seemed like a genuine transaction.

Then came the twist: the caller mentioned that due to an error, he had mistakenly transferred Rs 20,000 instead of the intended Rs 2,000. He asked me to return Rs 18,000 immediately. Confused but still trusting the process, I did as instructed. Within moments, I transferred the money back.

However, things took an even stranger turn. The caller then sent me another fake bank message, claiming Rs 30,000 had been credited to my account. That's when my instincts screamed something was off. I hung up the phone and immediately called my father, only to find out that he had not given my number to anyone. Panic set in, and I rushed to call my bank to stop the transaction. Unfortunately, the damage was already done. The money had already left my account.

Step 1: Freeze Your Account Immediately

As soon as I realised I had been scammed, I contacted my bank to freeze my account and stop any further transactions. The bank representative informed me that there was little they could do except freeze my account to prevent future fraudulent activity. By this time, the scammer had already transferred the money to another account, and I was left with no choice but to seek external help.

Step 2: Report The Fraud To The Authorities

As the panic settled in a little, I knew the importance of acting fast. I went online and tried to file a complaint through the Cyber Crime Portal. (https://cyberpolice.nic.in/) However, the portal was not opening at the time, and I couldn't submit my complaint despite multiple attempts. Frustrated but determined, I decided to visit the local crime department, which fortunately was close to my office. I walked in, hoping they would help me file the complaint.

To my surprise, the officers there were also struggling to submit complaints through the same portal I had been trying to use. They too faced server issues, and after almost an hour of trying, I was told that I would have to leave my details with them, and they would file the complaint once the portal was up and running.

Step 3: Patience Is The Key – Follow Up Constantly

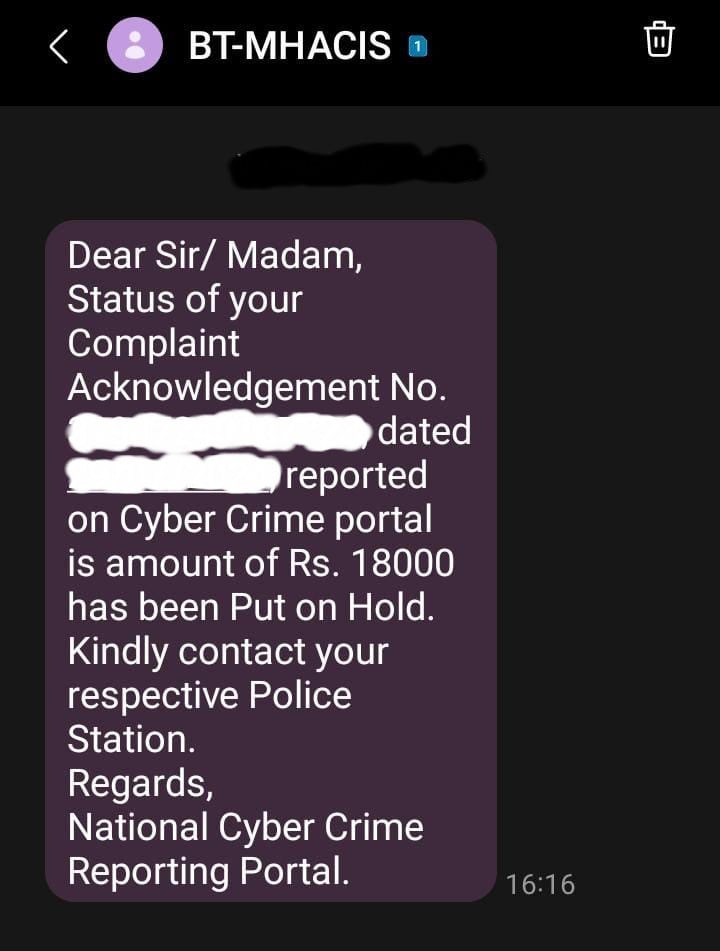

Back at my office, I anxiously awaited updates. Later that evening, I received a message from the cybercrime department confirming that my complaint had been registered. But I was far from relieved. I learnt that the authorities could trace the fraudulent transaction to another bank account using the IFSC code, but this was only the first step in a long, tedious process.

The next part of the journey involved tracing the money. The police explained that if the funds remained in the scammer's account and hadn't been withdrawn, they could freeze it and initiate the process of recovery.

For that, a court order was necessary.

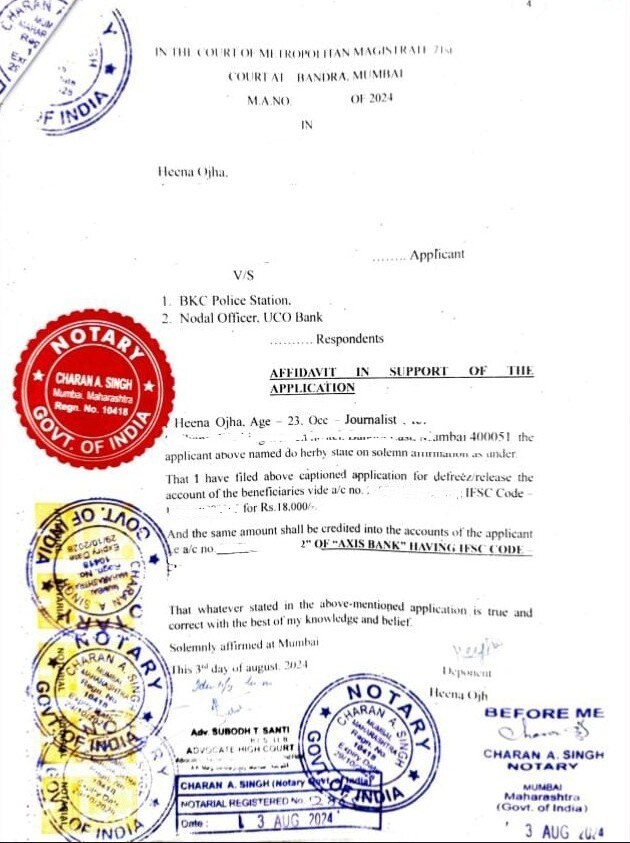

Step 4: Legal Proceedings And Court Orders

Though I was hopeful, I soon realised that the process would be far from quick. The legal process was drawn out, and I had to make multiple trips to the court in Bandra Court, Mumbai.

The toughest part among all was to find a lawyer who was willing to take up the case for a nominal fee. Most lawyers I reached out to in the bar council of Bandra Court were expecting a fee that was more than half of the money that I had lost, as the amount was small (Rs 18,000), and they didn't feel it was worth their time.

However, after numerous attempts, I managed to find a lawyer who agreed to represent me. I reached out to the lawyers (seemingly unregistered) standing outside court to take up the case; one of them agreed to do so at a reduced rate and connected me to a lawyer in the bar council who then fought the case.

I had to fill out several documents and provide various details to prove my case. The documents included

Passbook of bank account

UPI transaction details

Aadhaar Card

Police record of accounts through which the money travelled

Police FIR, if any

A Vakalatnama

An affidavit

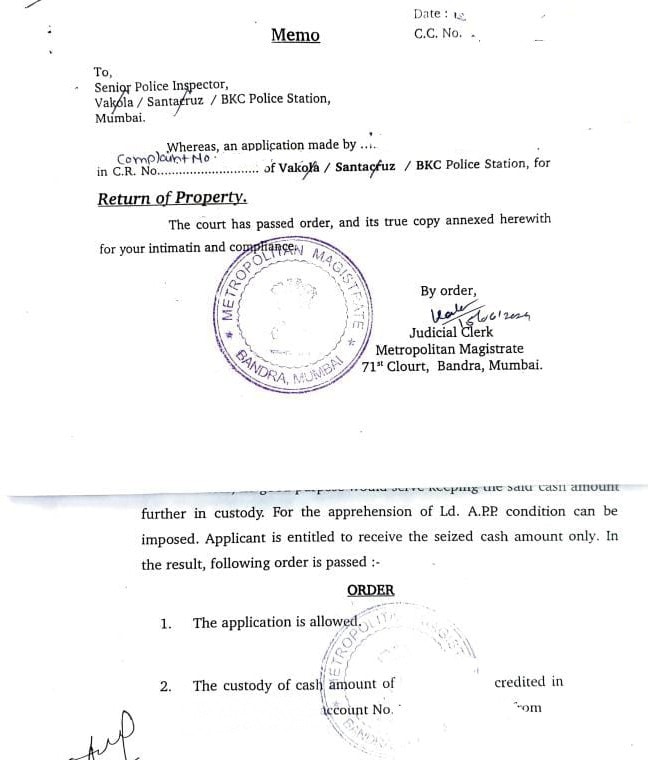

The police also had to file a statement in court, confirming that the money belonged to me, and they took their own sweet time in doing so, delaying the case over two dates.

This took several weeks, with each court hearing dragging on due to the bureaucratic nature of the process. During this time, I found myself seeking a lawyer who could help me navigate the legal system.

Step 5: Persistence Pays Off – The Recovery

After multiple hearings and several visits to both the police and the court, the judge finally issued an order stating that the funds belonged to me. The court order was then submitted to the police, who, after more paperwork, sent it to the bank. Only after a series of reminders and repeated follow-ups with the police did I finally receive my money back.

The entire process took about four months. For a small amount like Rs 18,000, I found myself navigating a legal maze that felt endless. But in the end, it was worth it.

Key Takeaways – What You Should Do if You Get Scammed:

Don't Panic, Act Quickly – Freeze your bank account immediately and contact your bank to stop any further fraudulent activity.

File a Cybercrime Complaint – Use the online portal or visit the local cybercrime office to file your complaint. Don't waste time; every second counts.

Stay Persistent – Follow up constantly. Be patient, but keep pushing the authorities to take action.

Legal Help – If you need to recover the money, be prepared for a long legal process. Seek affordable legal advice if needed, and don't be discouraged by the small amount involved.

Document Everything – Keep a detailed record of all your conversations, bank transactions, and official documents related to the fraud.

Scams like these are becoming more sophisticated, but by acting swiftly and knowing the right steps to take, you can protect yourself and possibly recover the lost money.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.