Fixed deposits are once again looking like an attractive investment option, with banks having passed on the central bank's rapid-fire rate hikes and the tax treatment of fixed income mutual funds having changed from the start of the new financial year.

Since May last year, the Reserve Bank of India has raised the policy repo rate by 250 basis points to 6.5% to contain runaway inflation. While the pace of price rise has eased, the Monetary Policy Committee of the RBI in its most recent meeting decided to hit pause. Market and economy watchers are increasingly confident that this could spell the end of the rate increases.

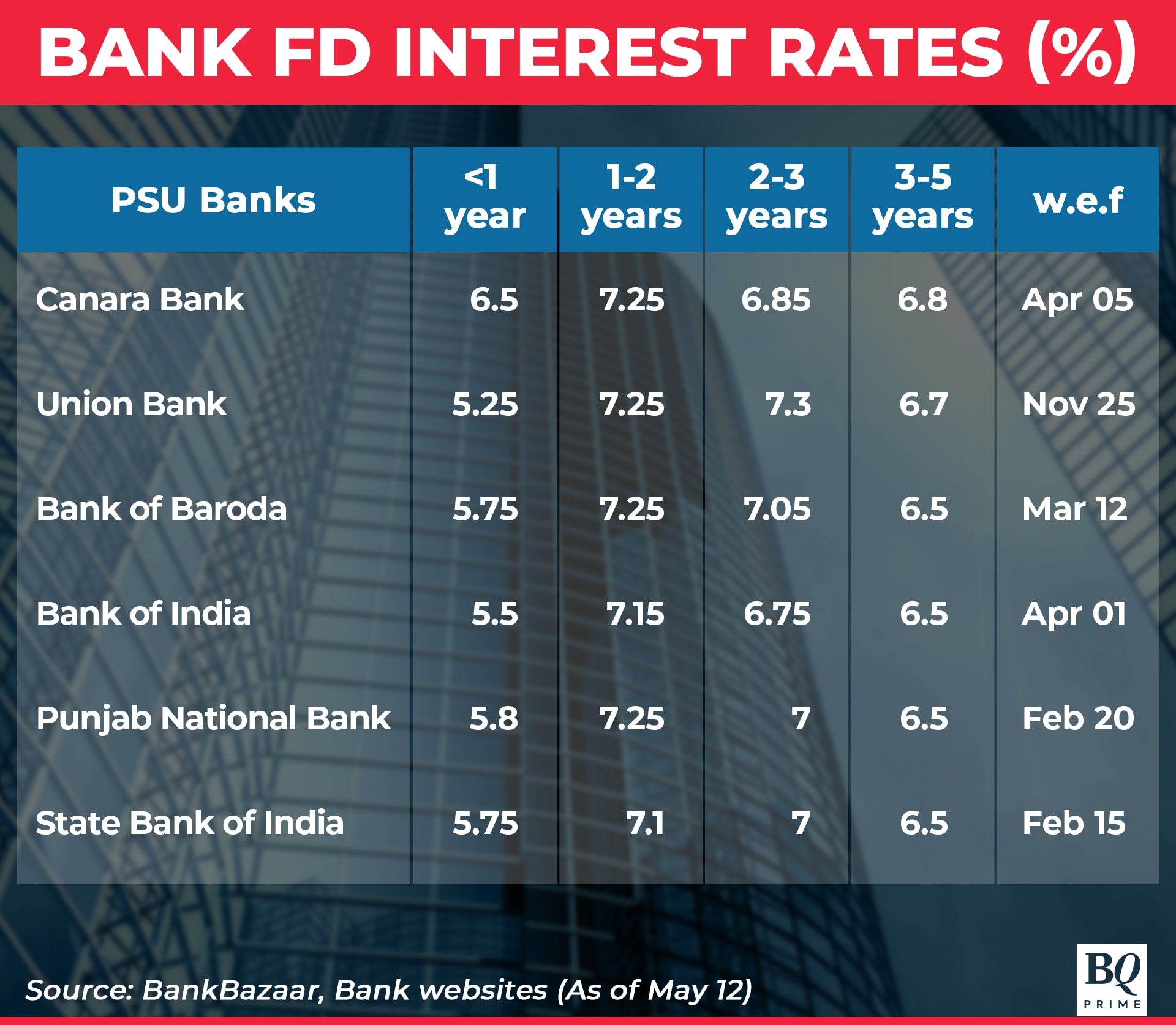

Banks have been increasing the rates being offered on fixed deposits. As of May 12, public sector lenders are offering 6.5% and 6.8% on fixed deposits between three and five years, according to data compiled by BankBazaar.

For the same tenor, private lenders were offering 6.5% to 7.75%.

"The interest rates are more or less at their peak now, and barring any major disturbances, the interest rates are expected to remain stable for the next few months," said Adhil Shetty, chief executive officer, BankBazaar.com.

"The ideal tenor is a mix of returns and liquidity. Choose the tenor with the highest return according to your liquidity projections," he said. "Ladder your fixed deposits to make the most of good returns and periodic liquidity. Tenors of one-two years usually tend to provide the best rates."

The lower tenors also provide liquidity at regular intervals, according to Shetty. While longer tenors may offer tax breaks, they come at the cost of liquidity, he said.

Investments into fixed deposits should be made taking into account three criteria—liquidity, returns and taxation, he said.

Bond Yields Higher, But Debt Funds Lose Advantage

In most cases, the rates are still lower than the yield to maturity being offered on some passive debt funds. For example, the Edelweiss PSU SDL Index Fund 2027 offered a yield to maturity of 7.36% as of May 11. Like other target maturity funds, this fund allows investors to lock in yields when they invest and if they remain invested until the date of maturity.

However, the draw to invest in debt mutual funds has not been as strong since the start of the new financial year, on account of a change in the tax treatment of such investments. Starting April 1, all gains arising from debt mutual funds will be treated as short-term capital gains and will attract taxes at an individual's slab rate. So, if the individual falls under the highest tax bracket, gains from such schemes that are invested after April 1 will attract a tax of 30%.

What Should Senior Citizens Do?

Traditionally, senior citizens have gravitated towards fixed deposits because of the predictability of returns. Such individuals should first consider exhausting the limits under the Senior Citizen Saving Scheme — a government sponsored scheme, which is currently offering a very attractive rate of return, according to Arnav Pandya, founder of Moneyeduschool.

The Senior Citizen Savings Scheme is currently offering an interest rate of 8.2%. What's more, the limits under the scheme were increased in the Budget earlier in the year to Rs 30 lakh per individual. The tenure on such deposits is five years, with an option to increase it by three years.

Beyond the Senior Citizen Saving Scheme, individuals can also look to lock in higher rates using fixed deposits, Pandya said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.