(Bloomberg) -- Oil's move higher is making waves around the world as supplies buckle amid a growing appetite for crude and petroleum products, threatening to complicate the task of central bankers in their efforts to tame inflation. Meanwhile, the International Energy Agency hosts three events this week in Paris focused on the energy transition, including one on critical minerals Thursday.

Here are five notable charts to consider in commodity markets.

Oil Prices

As global crude futures climb, the question now becomes increasingly focused on when — not if — prices will return to the $100 per barrel mark. While that level is helpful for producers, the concern is that consumers will start to feel the pinch amid other inflationary pressures, which in turn could impact global growth prospects and ultimately reverse the recent price gains. For now, production cuts by Saudi Arabia and Russia have steadily tightened supplies at a time when consumption has soared to a record, creating greater competition for the available barrels. That has pushed up the premium that oil for near-term delivery commands over later-dated contracts.

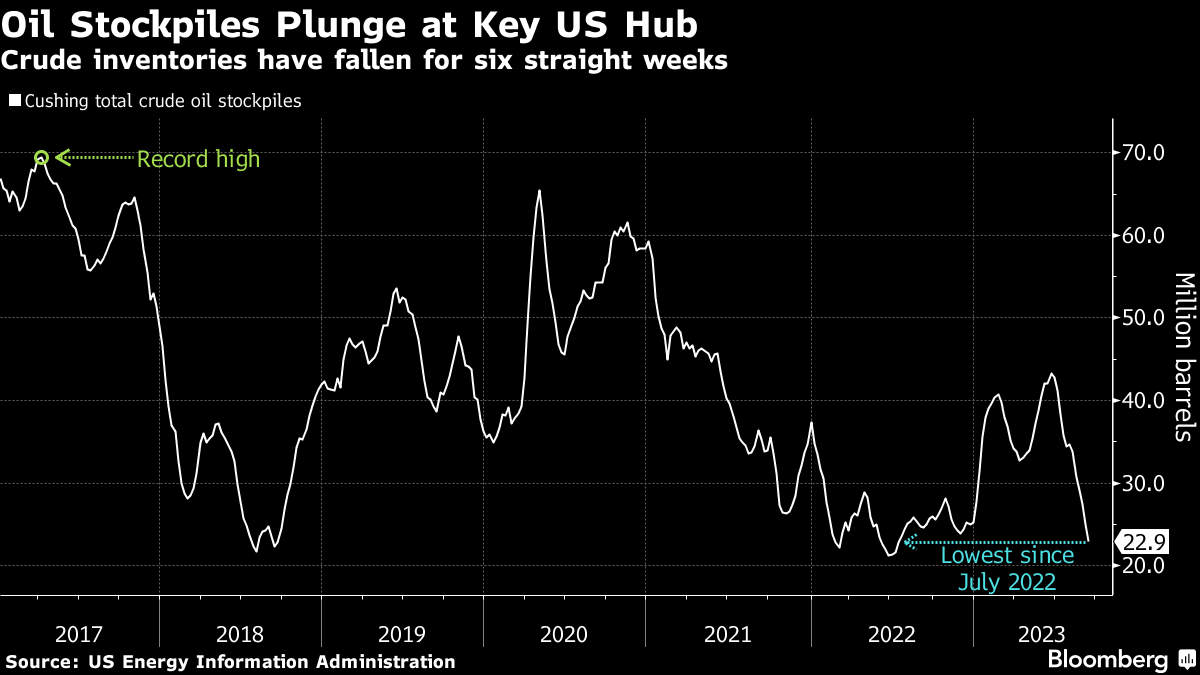

Oil Inventories

Stockpiles of crude oil at the largest US storage hub in Cushing, Oklahoma, are falling closer to critically low levels. Six weeks of declines have depleted the cache to 22.9 million barrels, which isn't far off the 20 million - 22 million barrel cushion that most analysts deem essential in maintaining the operational integrity of the facility. Since Cushing is the delivery point for US benchmark crude futures, traders are paying a premium for West Texas Intermediate to be delivered sooner due to dwindling inventories. Should Wednesday's weekly report from the US Energy Information Administration show a further decline, expect that premium to move higher.

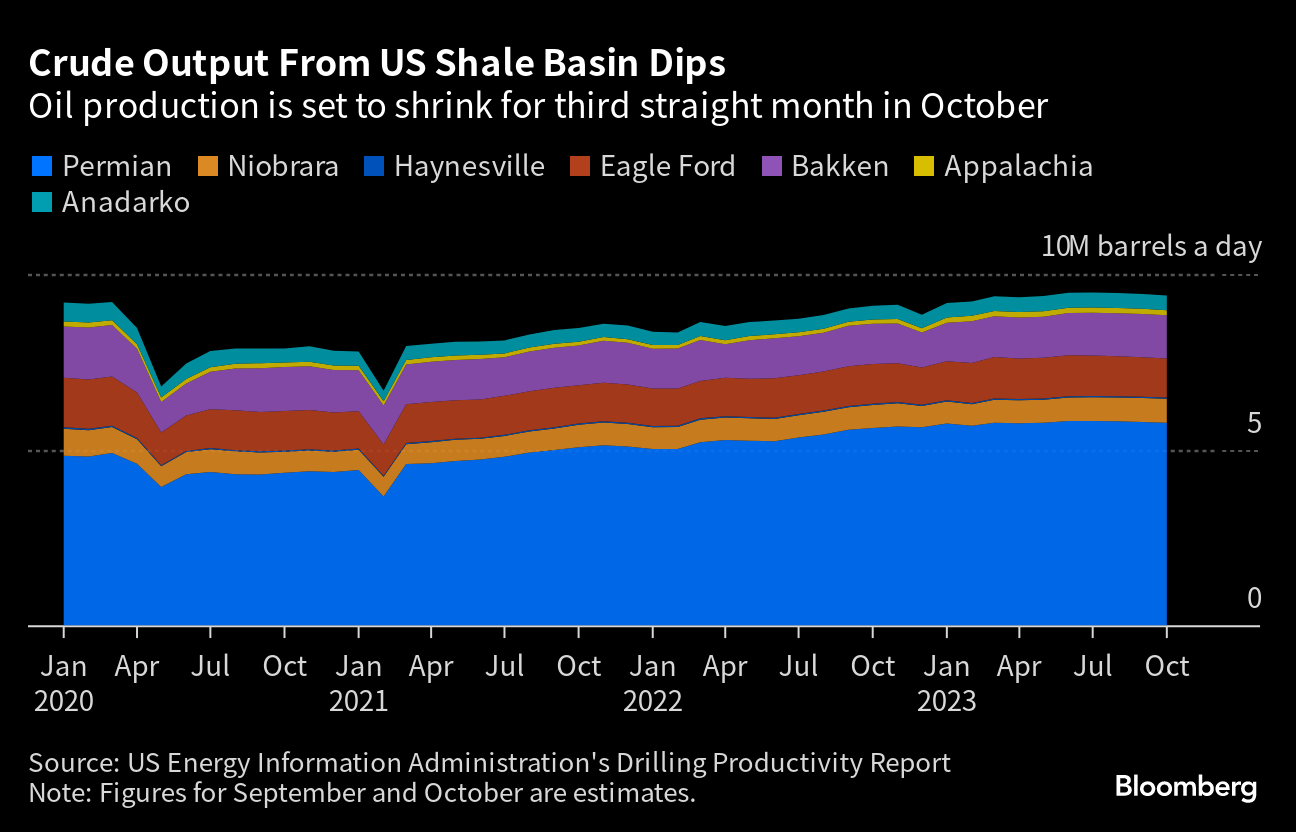

Shale Oil

Rising energy prices are putting a renewed spotlight on crude output from the US shale patch, but it's not great news. A pullback in oil production is accelerating, with the EIA forecasting a decline for a third straight month in October after hitting a record in July. The three-month skid — the first since February 2022 — will add further stress to tight global supplies as oil futures hover around $90 a barrel.

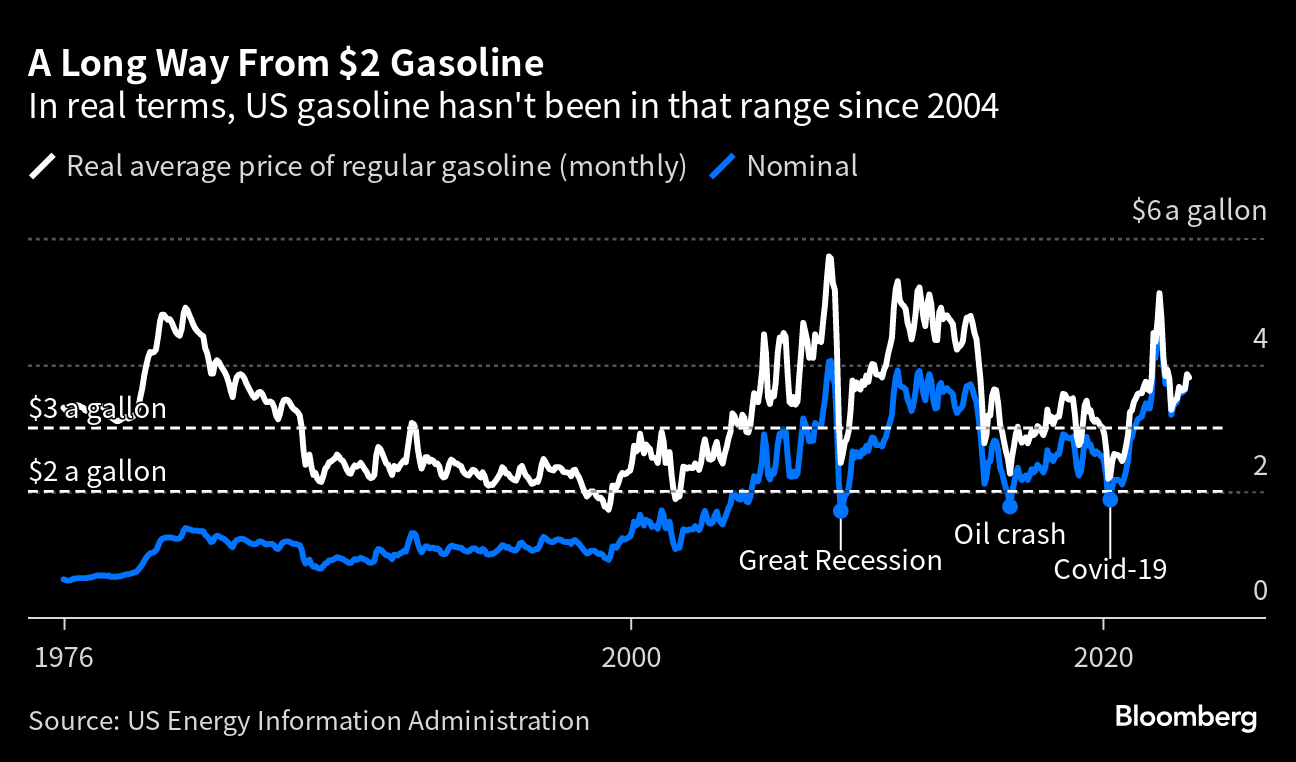

Gasoline Prices

US Republican presidential candidate Ron DeSantis unveiled his energy plan last week that included boosting oil production and lowering the cost of gasoline to $2 a gallon in his first year in office. That's pretty ambitious given the US has only seen $2 pump prices on a nominal basis three times in the past 15 years, EIA data show. In real terms, the last time was in 2004. Oil prices surged for most of the decade after that, catalyzing the shale boom, writes Bloomberg Opinion's Liam Denning. But in the process, a lot of investor dollars got burned — even as consumers eventually benefited when oil prices crashed in 2014 — and the past five years have witnessed a shift toward a more sustainable business model for frackers. Ultimately, DeSantis's vision of delivering $2 gasoline would be destroyed by that same $2 gasoline, Denning warns.

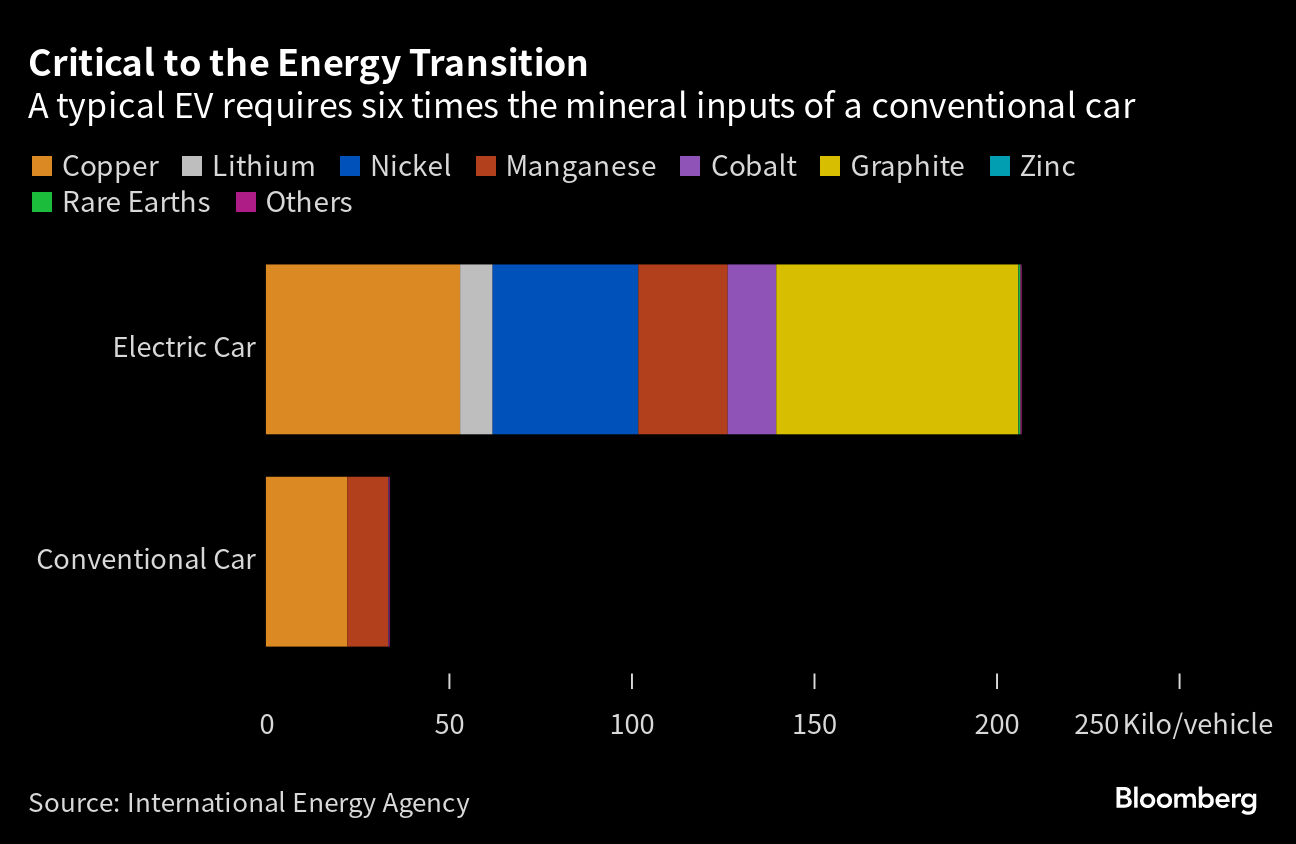

Energy Transition

Despite so much uncertainty revolving around oil markets and the transition to cleaner sources of energy, one thing is clear: Efforts to decarbonize the transportation sector are set to boost demand for metals that are key to electric-vehicle batteries. Lithium, nickel, cobalt, manganese and graphite are crucial to battery performance and energy density, while copper is at the heart of all electricity components. The IEA will host its first-ever summit on critical minerals and their role in the clean-energy transition on Thursday in Paris. Ministers from countries around the world — including both large mineral producers and consumers — as well as business leaders and investors will gather to discuss diversifying supply chains, processes to enhance market transparency and promoting sustainable and responsible development practices.

--With assistance from David Wethe and Julia Fanzeres.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.