(Bloomberg) -- Federal Reserve policymakers said borrowing costs need to keep rising to curb high inflation, putting a peak above 5% next year in potential view.

“It is entirely conceivable to me we would end up over 5%,” Richmond Fed President Thomas Barkin said in an interview Friday on CNBC. “But to me, that's not a plan -- that would be an output of our efforts to try to keep inflation under control.”

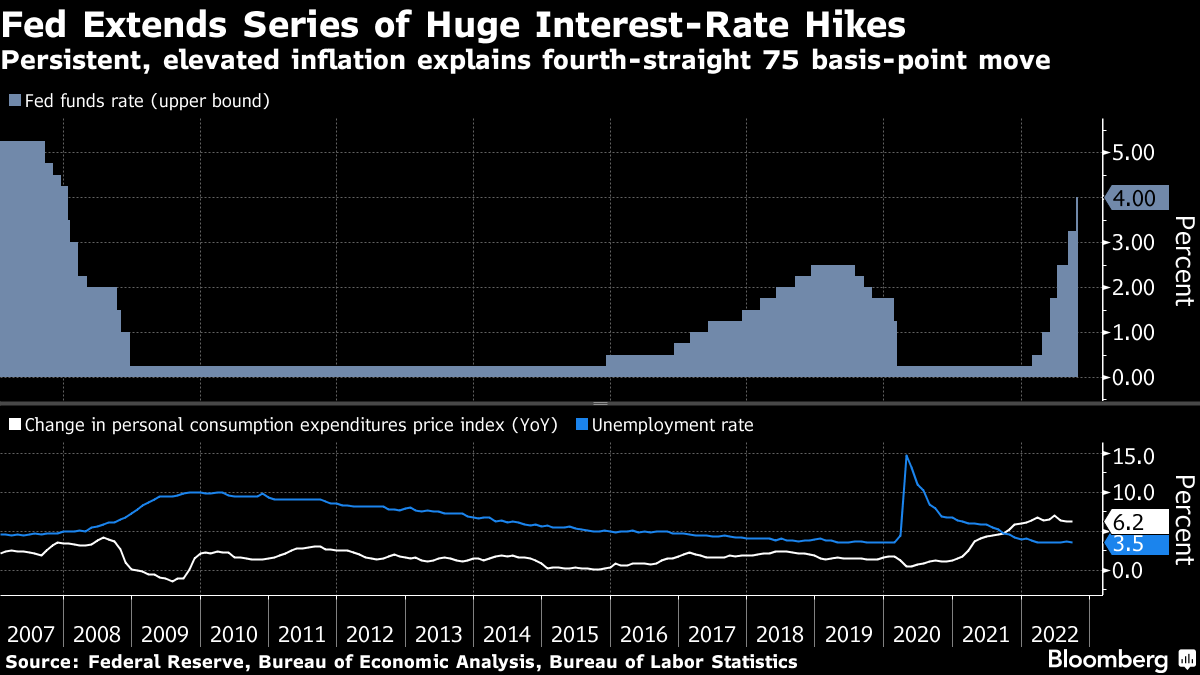

US central bankers this week raised rates by 75 basis points for the fourth straight time, lifting their benchmark to a target range of 3.75% to 4%. Chair Jerome Powell told reporters that officials could soon move to smaller interest-rate increases while ultimately taking borrowing costs to a higher level than the 4.6% previously expected.

“We need to get inflation down to target, and we need to do whatever we need to do with the rates to get inflation back to target,” Barkin said, while echoing the Fed chief's comment that officials could reduce the size of their rate hikes, even as they end at a higher terminal rate.

Investors see the same thing, with pricing in futures contracts leaning toward a 50 basis-point hike in December, but they see rates peaking a bit above 5.1% next year.

US inflation is still near the highest levels in 40 years and the labor market also remains tight. US employers added 261,000 jobs in October, according to Labor Department data released earlier on Friday, significantly above the 193,000 jobs expected.

Minneapolis Fed President Neel Kashkari said the latest payroll report showed that hiring is “quite healthy.”

“That tells me we have more work to do to try to cool down the economy and bring demand and supply into balance,” he said in an interview with the Associated Press.

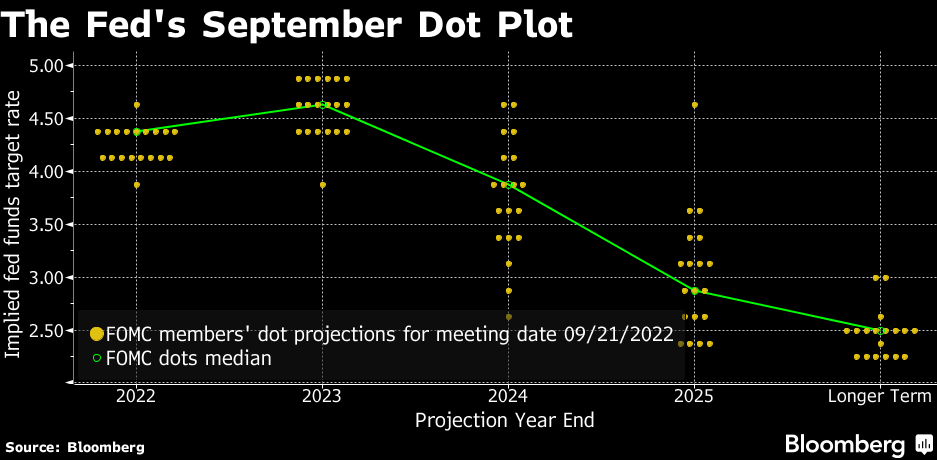

Officials in September projected rates at 4.4% by the end of this year and 4.6% in 2023, according to their median forecast. They will update those forecasts at their Dec. 13-14 meeting, when they will have two more months' worth of consumer inflation data in hand.

“I had interest rates in September peaking at around 4.9% in the March-April kind of time frame,” Kashkari said. “Given what I know right now, I would expect to go higher than that. How much higher than that, I don't know.”

Chicago Fed President Charles Evans, speaking in an interview with Reuters, said he expects the Fed to eventually raise rates “slightly higher” than the dot plot projections of September.

“From here on out, I don't think it's front-loading anymore, I think it's looking for the right level of restrictiveness,” Evans said. “Stepping down to a pace that's not 75, giving the Committee a little bit of runway to see more data before you get too far ahead of where you eventually want to be, makes sense to me.”

Premature Call

Boston Fed President Susan Collins, in separate remarks, said it was premature to judge how high rates should go. But her views had shifted higher since submitting her projections for the Fed's quarterly forecasts in September.

“There has been a bit of disappointment in some of the data and so that has, I would say, broadened my view of where the rate that will be sufficiently restrictive might be,” she said during an event hosted by the Brookings Institution.

The Boston Fed chief said that with interest rates now at restrictive levels that could slow growth, monetary policy is entering a new phase that could require smaller rate moves as policymakers balance their efforts to tame inflation with the risks that they tighten too much and spark a deep downturn.

But she said another jumbo-sized hike should remain among the options on the table.

“In thinking about how to reach the level of the funds rate at which the Committee will deem appropriate to hold policy, I believe it is important for us to consider the various options for policy moves,” she said. “This will include 75 basis points, as well as smaller increments. I note that a 50 basis-point move was considered a large move in the past.”

--With assistance from .

(Updates with Evans comments in 11th paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.