Shares of ITC Ltd. are at an 'attractive valuation' following the sell-off caused by British American Tobacco Plc. announcement to offload stake in the cigarette-to-staples maker, according to analysts tracking the stock.

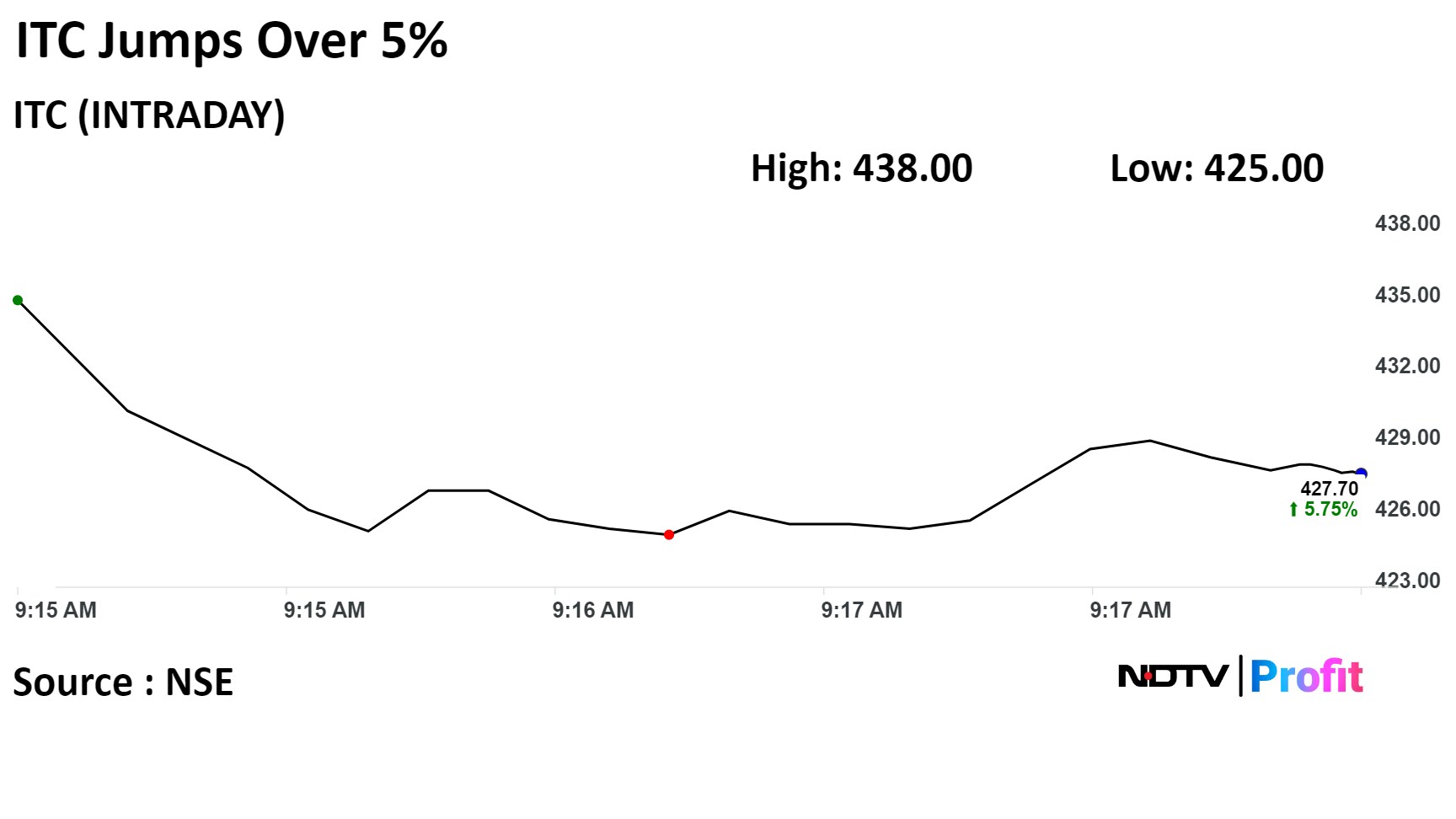

On Wednesday morning, the scrip jumped over 8%, the highest jump since April 2020, pushing the benchmark Nifty 50 higher.

BAT, the largest public shareholder of ITC, has launched a block trade to offload up to 3.5% stake in the company for over Rs 17,482 crore. The London-listed BAT plans to sell up to 43.68 crore shares to institutional investors through an accelerated book-build process, it said in a statement on Tuesday.

Given the selloff in the stock price on news of the BAT stake sale, ITC's share price now trades at an attractive 12-month forward PE of 23x and offers a reasonable margin of safety, according to HSBC Global Research.

The cigarette business could continue to grow the EBIT (earnings before interest and taxes) structurally in the range of 5-6%, the research firm said in March 13 note. This sell-off implies an attractive valuation for the cigarette business. The research firm leave the valuations for ITC's other businesses unchanged.

Morgan Stanley remain bullish on ITC based on the expectation of a moderate cigarette tax environment, continued scale-up of non-cigarette businesses and reasonable valuations.

What Brokerages Have To Say

HSBC Global Research

HSBC Global Research upgrades the stock 'buy', with an unchanged target price of Rs 480. This implies an upside of 17.2%.

The research firm upgrades the stock to 'buy' from 'hold' as risk reward appears favourable post the recent stock correction.

Any further decline in stock price could also make the valuation of ITC's other FMCG business more attractive.

FMCG is a low-margin business, but margins are consistently rising, and revenue growth remains consistently above the peer group. "This makes ITC's FMCG business a structurally high-growth business with strong capabilities and moat", it said.

Downside risks: Excessive taxation shocks to which ITC's share price is sensitive; worse than-expected cigarette volume growth; and slower-than-anticipated progress or loss of market share in growing categories in the “FMCG-Others” segment.

The taxation overhang is still likely to persist; an absence of excessive tax increases could still serve as a catalyst;

"We think ITC's appeal is largely tactical as the cigarette business is always at the risk of additional taxation to mitigate demand. Consequently, the cigarette business looks set to remain low growth", it said.

Morgan Stanley

Morgan Stanley has an 'overweight' rating, with a target price Rs 491. This implies an upside of 21%.

Sum-of-the-parts, residual income-based values for different businesses. Skew reflects strong cash generation, a relatively high dividend yield and a better cigarette business outlook.

BAT noted ITC as a valued associate in an attractive market with long-term growth potential. BAT continues to be fully supportive of ITC's management team, performance and strategy, and plans to remain an important shareholder in ITC

Risks to Upside

Benign tax environment for tobacco.

Successful launch of differentiated products in the FMCG business and better-than-expected margin improvement.

Business restructuring and separate listing of the FMCG arm.

Risks to Downside

Adverse policies on cigarette consumption (steep tax hikes, loose cigarette bans, etc.).

Inability to drive profitable growth in FMCG.

Severe downturn in cyclical businesses.

Shares of ITC rose as much as 8.30% to Rs 438 on Wednesday. At the time of publishing the stock is trading 6.13% higher at Rs 429.25. This compares to a 0.02% decline in the NSE Nifty50 a day before. It has risen 11.89% in the last 12 months.

Of the 37 analysts tracking the company, 34 maintains a 'buy' rating, two recommend 'hold' and one recommend a 'sell', according to Bloomberg data. The average 12-month analysts' price target implies a potential upside of 24.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.