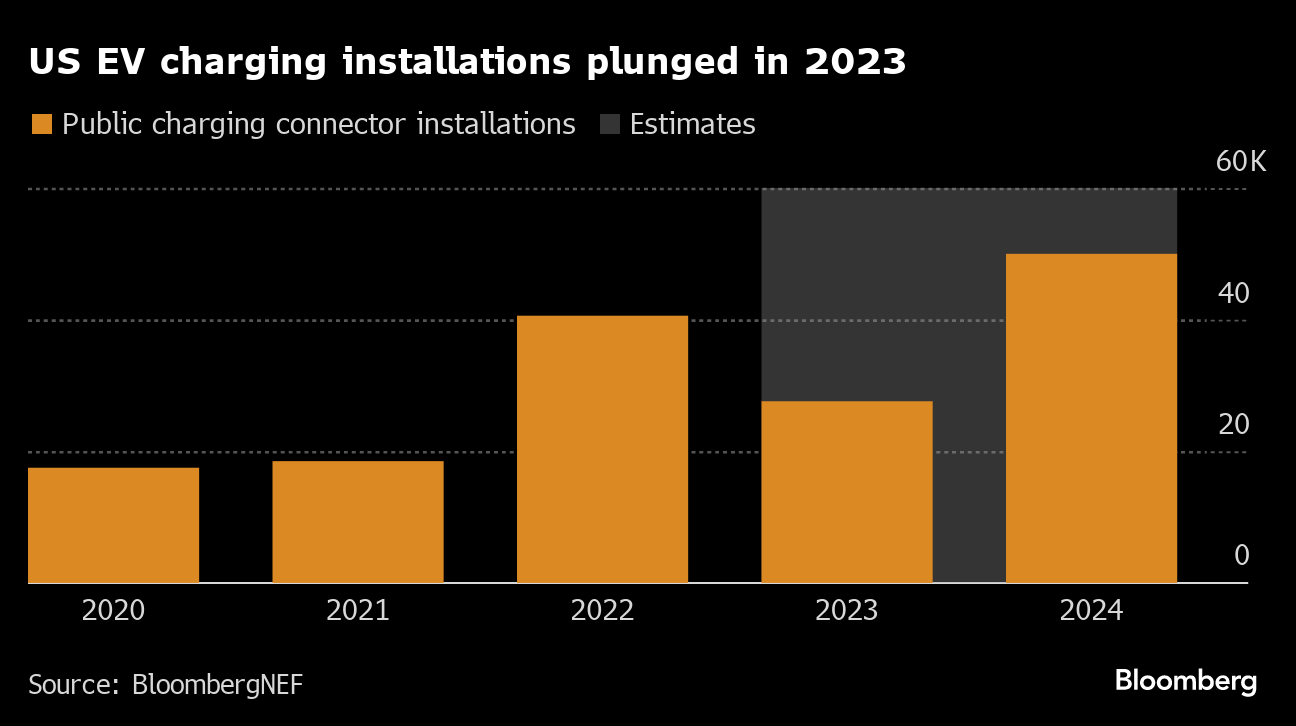

(Bloomberg) -- US electric vehicle charging installations fell significantly last year as companies grappled with financial challenges, according to a BloombergNEF report.

US public charging installations were 76% below BNEF's forecast in 2023 and they are expected to lag behind China and Europe this year, the report said. The lack of investment from charging operators could be in part attributed to the companies awaiting federal funds from a national electric vehicle infrastructure program, BNEF said. ChargePoint Holdings Inc. and Electrify America grew slightly in 2023, adding just 410 and 588 fast chargers, respectively, the report noted. EVgo Inc. added 850 fast chargers compared with Tesla Inc., which installed 6,000.

“Charging companies will struggle with the challenging financial climate and poor performance in 2024, leading to more acquisitions as companies look to grow and survive,” the BNEF report said.

Charging installers have found it difficult to compete in the US with Tesla, which has built a vast network of plugs with a different connector design than those from the rest of the industry. Shares of charging companies were hammered last year as operators struggled with sluggish sales. ChargePoint, which operates the largest US EV charging network, lost 75% of its market value last year and replaced its chief executive officer.

ChargePoint's new top executive, Rick Wilmer, said many of the company's customers hesitated to invest in more chargers last year due to the economy's uncertain direction. Businesses looking to install EV chargers for employees held off for fear the economy might tip into recession.

“They felt they could wait a quarter or two to see how things would settle economically before continuing to invest,” Wilmer said in an interview Monday. “It's getting better, as we're getting more and more data around the economy and it appears we're heading for a soft landing.”

--With assistance from David R. Baker and Tope Alake.

(Adds comments from ChargePoint chief executive officer in paragraphs five and six. An earlier version of this story corrected the spelling of Tesla Inc.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.