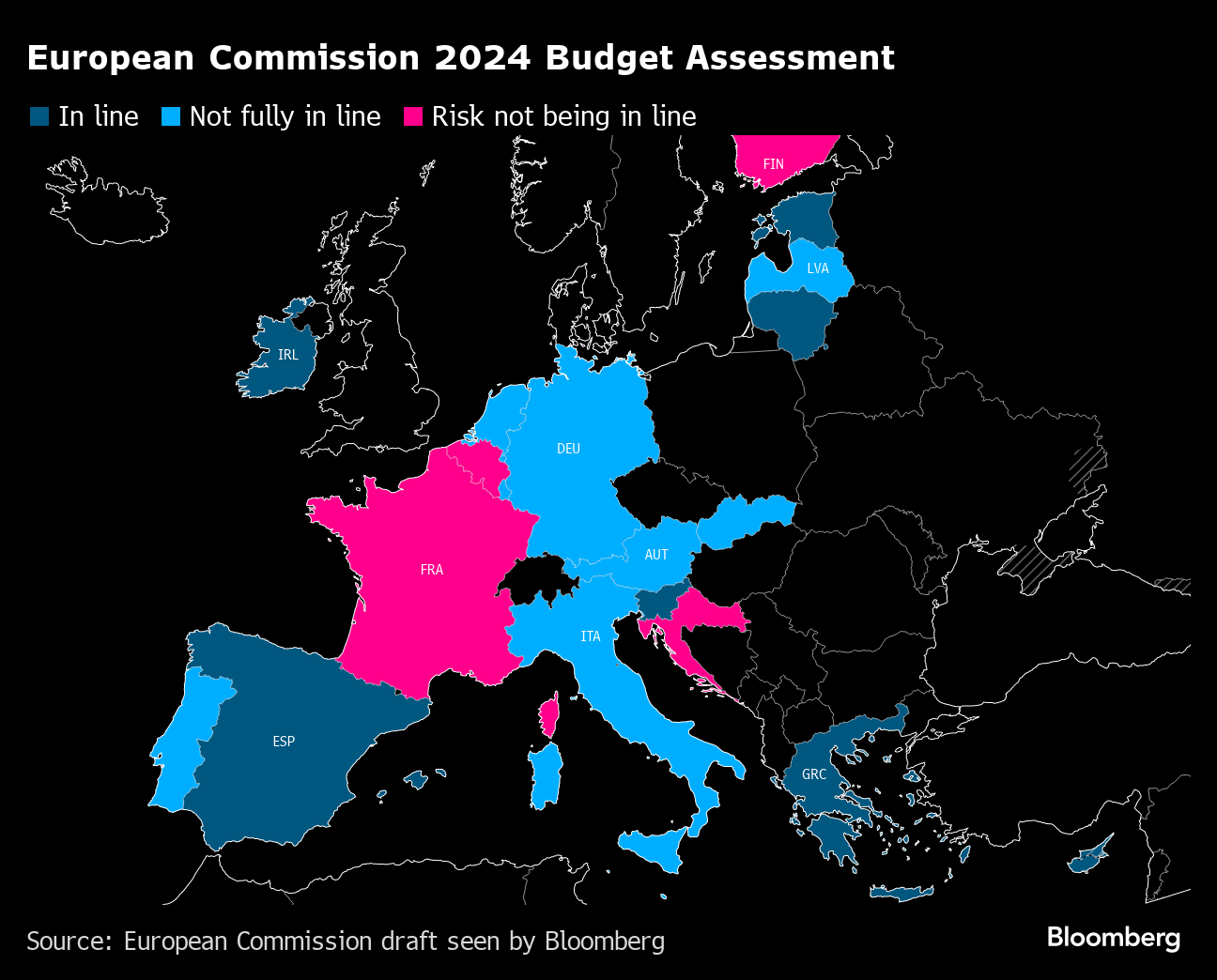

(Bloomberg) -- France is at risk of flouting European Union fiscal guidance while Germany and Italy aren't seen to be fully complying, people familiar with the matter said in advance of an annual scorecard from Brussels.

The draft watch list of countries — scheduled for release on Tuesday — forms part of the European Commission's opinion on national budgets for 2024, a year when the bloc is set to reinstate debt and deficit rules suspended during the pandemic.

While the verdicts could still change, the assessment reveals how brazen Brussels officials judge some of Europe's most indebted countries to be at a time of rising borrowing costs and heightened scrutiny on public finances. Being on the list doesn't have automatic repercussions, though it could prompt sanctions at a later stage.

France's place on the scorecard highlights how Emmanuel Macron's government is struggling to balance the country's fiscal profile with voter demands for more spending. Debt as a percentage of output is expected by the commission to rise to 110% by 2025, according to forecasts released last week.

Belgium, Finland and Croatia are in the same category as France, according to the people, who declined to be identified because the report is confidential.

Austria, Latvia, Luxembourg, the Netherlands, Portugal and Slovakia are in the same group as Italy, they said. The latter country is nursing a debt ratio of around 140%.

It's not clear how Germany — Europe's biggest economy — isn't fully complying, at a time when its deficits are all projected to be small. The country's public finances are however in a state of flux after a constitutional court decision against the use of off-balance sheet funding to target climate change.

The EU's assessment follows a pandemic-induced suspension of the fiscal regime limiting deficits to 3% of gross domestic product, a ceiling that both France and Italy are expected to keep flouting in the coming two years.

The hiatus during Covid also gave the bloc a chance to reflect on a potential revamp of the entire budget rulebook that binds the euro zone's eclectic economies — known as the Stability and Growth Pact.

There's general agreement that the SGP framework is in need of a root-and-branch overhaul, but governments with competing strategic visions are struggling to agree on how to go about it. If no decision is reached by the end of the year, the old rules kick back in as before.

The EU watch list will ultimately form the basis for the commission to decide whether to trigger the so-called excessive deficit procedure if a country fails to take sufficient efforts to correct the risk of non-compliance, which could eventually lead to financial penalties.

The history of sanctions is patchy. Spain and Portugal were first to officially breach the pact, but the bloc decided then not to impose penalties.

France and Germany have breached the rules repeatedly — and Jean-Claude Juncker, the EU Commission President in 2016, said in 2016 that Paris was getting extra time to reduce its deficit “because it is France.”

--With assistance from William Horobin.

(Updates with context throughout)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.