Eris Lifesciences Ltd. announced the acquisition of Biocon Biologics Ltd.'s Indian-branded formulations business on a slump-sale basis.

The company will be paying a consideration of Rs 1,242 crore for the acquisition. The transaction will be financed by debt. It includes the transfer of all trademarks of the business, its net working capital and over 430 employees, according to an exchange filing on Thursday.

The acquisition will expand Eris' presence in the India-branded sterile injectables market and enable harnessing of synergies with the recently acquired Swiss Parenterals Ltd.

In a release, Biocon Ltd. said that in addition to the transaction:

A wholly owned subsidiary, Biocon Biologics, signed a 10-year supply agreement with Eris.

The transaction is expected to come into effect before April 15, subject to customary closing conditions.

The transaction value represents an accretive multiple of 3.4 times revenues and 18 times Ebitda.

"This strategic collaboration with Eris Lifesciences for our portfolio of metabolics, oncology, and critical care products in India aligns with our commercial strategy to maximise patient reach and market potential," said Shreehas Tambe, chief executive officer of Biocon Biologics.

"It builds on the success of our existing partnership with Eris for our nephrology and dermatology products and will allow us to deliver our high-quality, lifesaving biosimilars to millions of patients in India," he said.

Biocon remains committed to its long-term aspiration of providing insulin to "one in five" insulin-dependent people with diabetes, and this collaboration is an important step towards realising this in India, it said.

The business sold by Biocon Biologics had a revenue of Rs 412 crore, contributing 3.7% of the consolidated revenue of Biocon in the last financial year.

Eris Lifesciences Acquisition Update

The company also announced acquisition of an additional 19% equity stake in Swiss Parenterals Ltd. from promoters, for a cash consideration of Rs 237.5 crore. This is in addition to the 51% stake acquired earlier on Feb. 13 for Rs 637.5 crore.

Eris Lifesciences' Management View

The management highlighted the following:

Deal expected to create fifth largest diabetes care portfolio in India.

Expects company's insulin franchise to leapfrog to leadership position with addition of two Rs 100 crore plus brands—Insugen and Basalog.

Management targets next Rs 1,000 crore vertical from the deal.

Aims for 3-4% market share in the Rs 30,000 crore Indian injectables market in the next three to four years.

Expects significant margin expansion in acquired portfolio by leveraging Swiss Parentals' manufacturing (in-sourcing) and long-term supply agreement with Biocon.

Company to continue existing insulin brands Xsulin and Xglar too, expects higher share in market by targeting different segments.

The deal includes working capital of the acquiree which is Rs 50 crore.

Company aims to deleverage balance sheet.

Debt servicing and principal repayment will start from FY25 onwards.

Expects net debt at the end of FY25 to be less than two times of one-year forward Ebidta.

Company is targeting an Ebidta of Rs 110 crore next year, versus Rs 70 crore currently.

Overall guidance is Rs 5,000 crore revenue in FY28 from value creation and balance sheet deleveraging.

Analyst View

"A good deal overall, as Eris gets access to a portfolio of insulin and monoclonal antibodies, most of which come with a U.S. FDA approved tag," said Vishal Manchanda, pharma analyst with Systematix.

Eris is a powerhouse in diabetes and may be able to build the franchise much stronger, he said. While the insulin market volume growth has weakened in the last one or two years, Manchanda expects the strong historical growth in the insulin franchise to re- emerge.

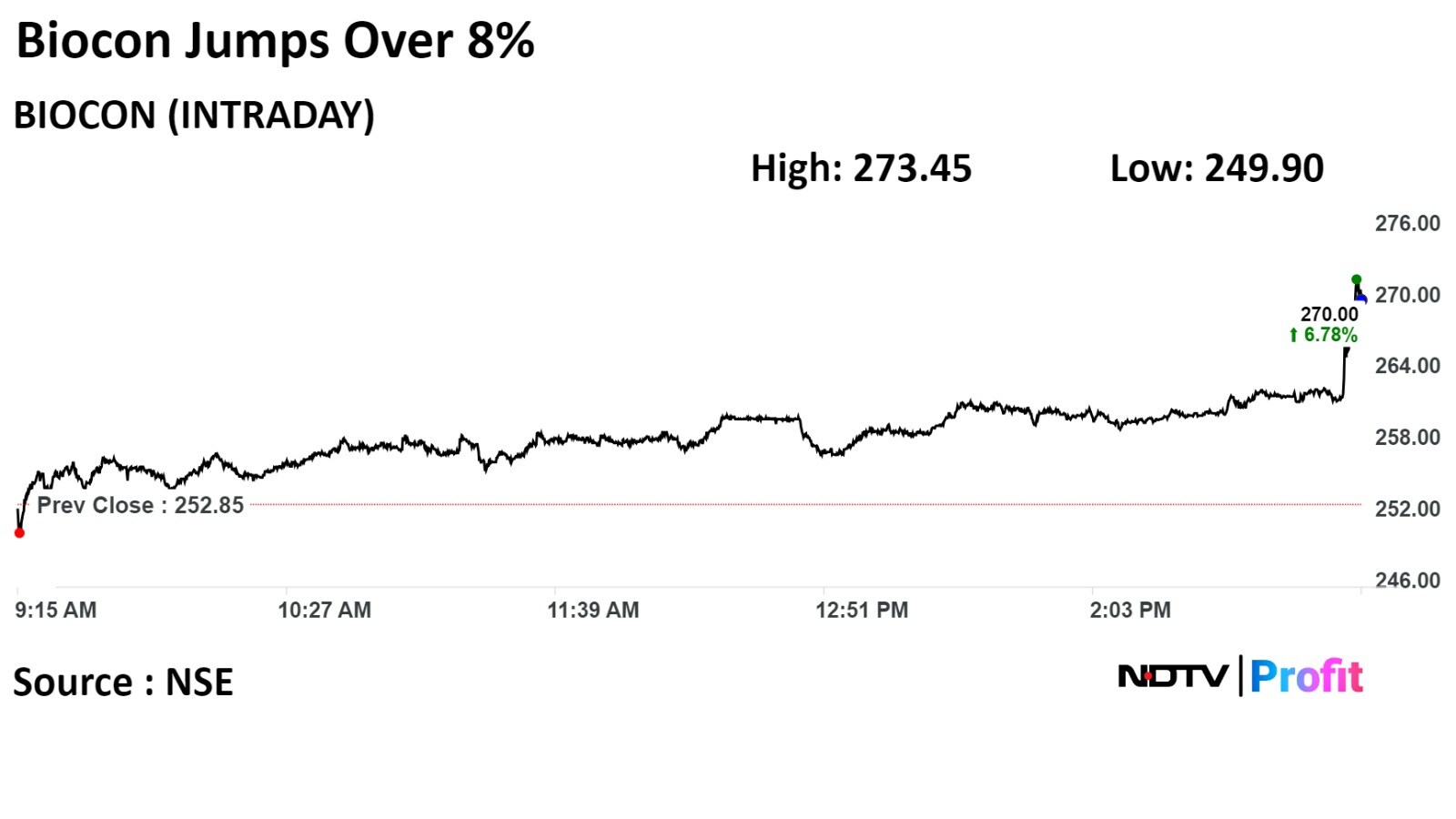

Biocon's stock rose as much as 8.15% during the day on the NSE. It was trading 4.94% higher, compared to a 0.66% advance in the benchmark Nifty 50 at 3:25 p.m.

The share price has risen 21.83% in the last 12 months. The total traded volume so far in the day stood at 0.5 times its 30-day average. The relative strength index was at 44.

Of the 20 analysts tracking the company, nine have a 'buy' rating on the stock, four recommend 'hold' and seven suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 22.4%.

Eris stock closed 3.11% higher on Thursday, compared to a 0.68% rise in the Nifty.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.