.jpg?downsize=773:435)

India's largest lender State Bank of India, public sector lender Bank of Baroda, oil marketer Bharat Petroleum Corporation Ltd., drugmakers Sun Pharmaceutical Ltd. and Cipla Ltd., the country's biggest aluminium producer Hindalco Industries Ltd. and auto components supplier Bosch Ltd. are among the Nifty 50 companies that report first quarter earnings on Thursday.

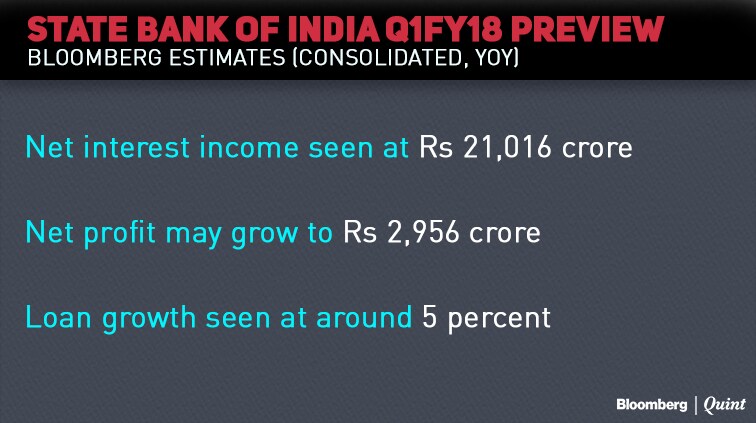

State Bank of India is likely to report a net interest income of Rs 21,016 crore and a net profit of Rs 2,956 crore, according to Bloomberg consensus estimates.

The year-on-year numbers will not be comparable for the lender since this is the first consolidated quarter after the merger of associate banks. Consolidation is likely to keep cost pressures high.

While addition of stressed assets will continue to remain high, it may be lower than the previous quarter.

What To Watch

- Outlook on merger and cost-benefit

- Commentary on watchlist exposure for combined entity

- Guidance on loan growth, margins and operating expenses

- Impact on NIM of savings bank interest rate reduction going forward

- Farm loan waiver impact on agri NPAs

- Non-core asset sales besides SBI Life Insurance IPO timeline

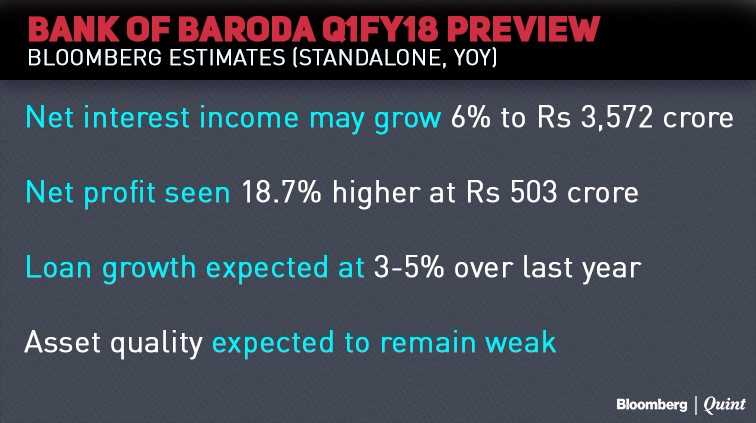

Bank of Baroda's net interest income is seen 6 percent higher on a year-on-year basis to Rs 3,572 crore, according to the Bloomberg consensus estimate while net profit is likely to rise nearly 19 percent. The lender's asset quality is expected to remain weak.

What To Watch

- Asset quality movement, provisions and progress on resolutions

- Guidance on loan growth, margins and operating expenses

- Savings deposit rate cut impact on net interest margins

- Incremental provisioning requirement for 12 RBI-referred accounts

- Farm loan waiver impact on agri NPAs

- Fund raising options

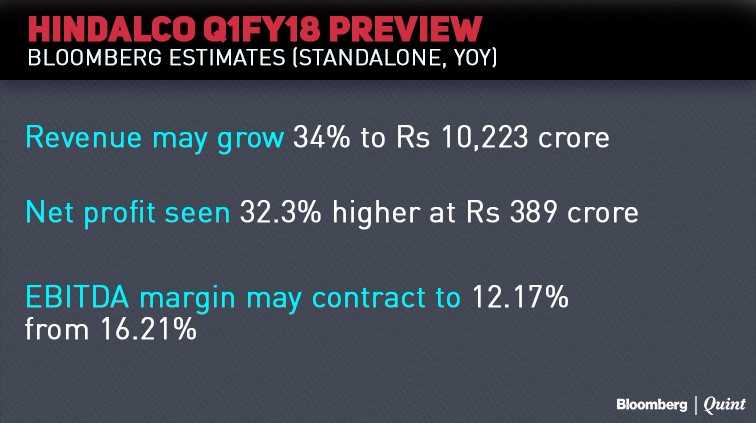

Hindalco's topline and bottomline are expected to jump more than 30 percent each on a year-on-year basis. The operating profit is likely to remain flat compared to the same quarter last year while the margin may see a contraction.

What To Watch

- Aluminium sales volumes may rise 4.8 percent year-on-year and 7 percent quarter-on-quarter

- Copper volumes may see a 63 percent increase year-on-year and 6 percent rise quarter-on-quarter

- Volume growth may moderate due to annual shutdown in the previous quarter

- Aluminium EBITDA per tonne to decline sequentially to $380 per tonne versus $420 per tonne

- Segmental EBITDA from copper is expected to be stable

- Aluminium price increase largely offset by a rise in alumina transfer price

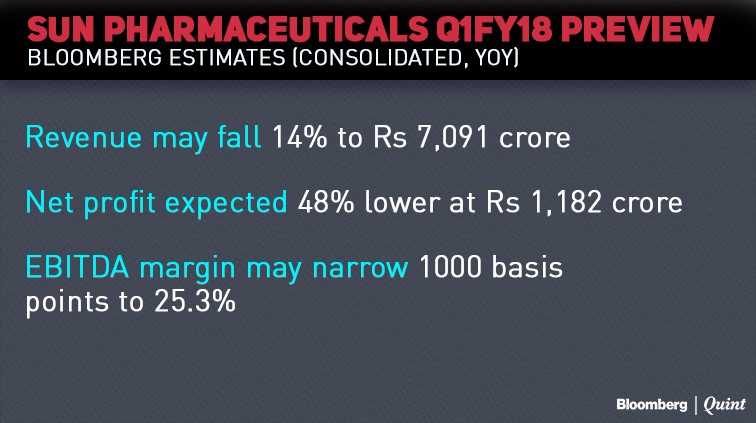

Sun Pharmaceutical's net profit may fall 48 percent to Rs 1,182 crore year-on-year, according to Bloomberg consensus estimates. Revenue is expected to decline 14 percent to Rs 7,091 crore but the weakness will be offset to an extent by deferred sales from the previous quarter. Operational performance is also expected to be weak

What To Watch

- Taro reported a weak set of earnings for Q1

- Sales will drop on account of high base due to Gleevec last year

- Deferred sales from Q4 expected to flow into Q1 which may aid revenues

- Price erosion and competition will be impacting volumes

- India to grow in low single digit due to GST impact

- Management has indicated a possible single-digit decline in revenue in FY18

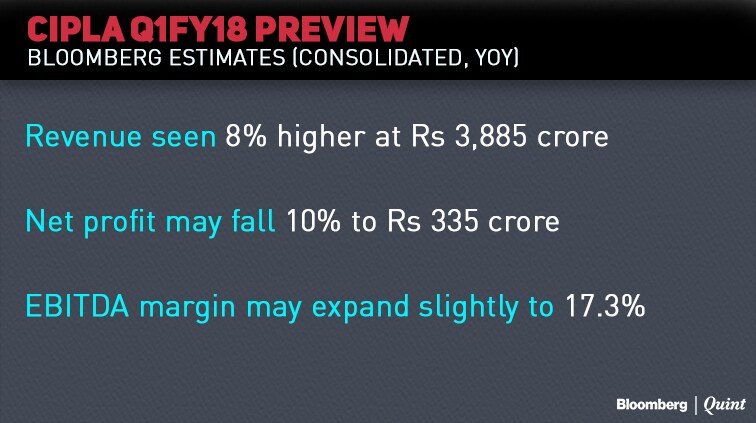

Cipla may report a 10 percent decline in the bottomline on a year-on-year basis while topline increases 8 percent, Bloomberg consensus estimates show. Earnings before interest, tax, depreciation and amortisation is expected to rise 10 percent while margin is likely to increase only marginally.

What To Watch

- Weak quarter due to GST impact in India

- Expect double-digit de-growth in India

- U.S. upside should kick-in from second quarter of FY18

- U.S. is supported by Zegerid and Tricor launches

- Steady performance from South Africa, Europe and emerging markets

- Q1FY17 had a low tax rate

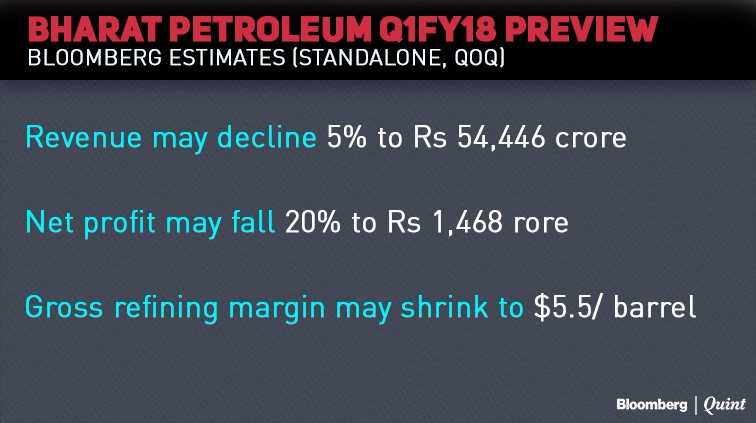

BPCL's revenue is seen 5 percent lower to Rs 54,446 crore compared to the previous quarter, according to Bloomberg consensus estimate. Net profit may decline 20 percent sequentially. The gross refining margin is likely to come in at $5.5 per barrel versus $6 per barrel last quarter. Employee costs are expected to decline due to one-offs in the fourth quarter.

What To Watch

- Inventory losses

- Impact of foreign exchange and inventory changes

- Crude production numbers

- Kochi refinery expansion

Other Results

What To Watch

- Volume growth and realisation

- Commentary on volume ramp-up and future capital expenditure

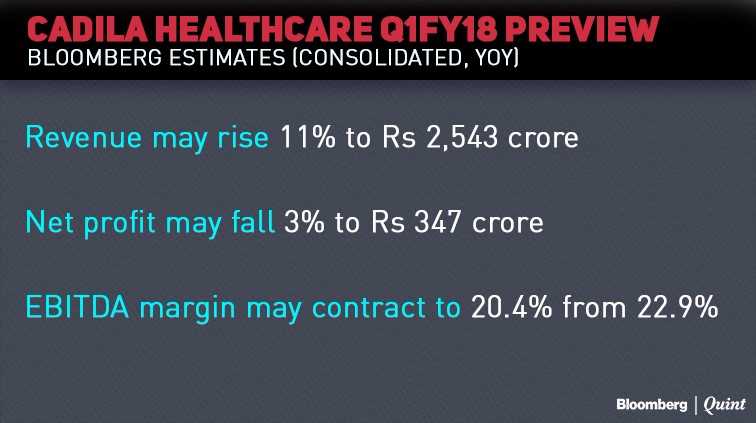

What To Watch

- Weak quarter due to GST-related hit in India

- Full quarter consolidation of Sentynl to aid U.S. revenue

- Revenue will also be aided by new launches including Lialda

- Seasonal boost from Tamiflu and Ribavirin is over

- India business decline due to Merck acquisition

What To Watch

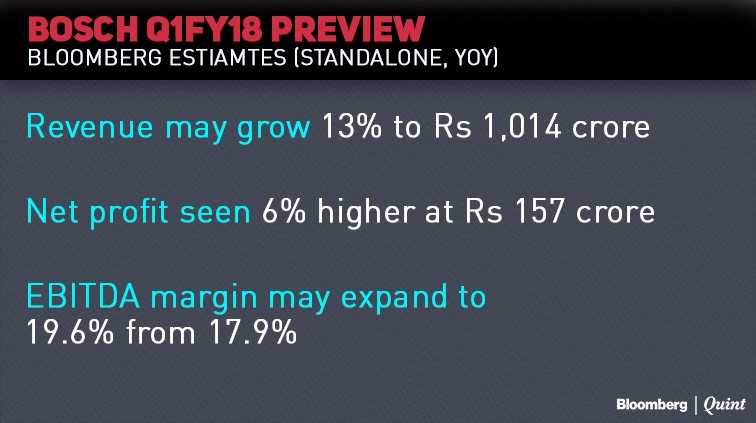

- Higher realisation seen on higher BS-IV parts and higher passenger vehicle sales

- GST impact on demand

- Rollout of BS-IV emission norms and impact on revenue

Factors

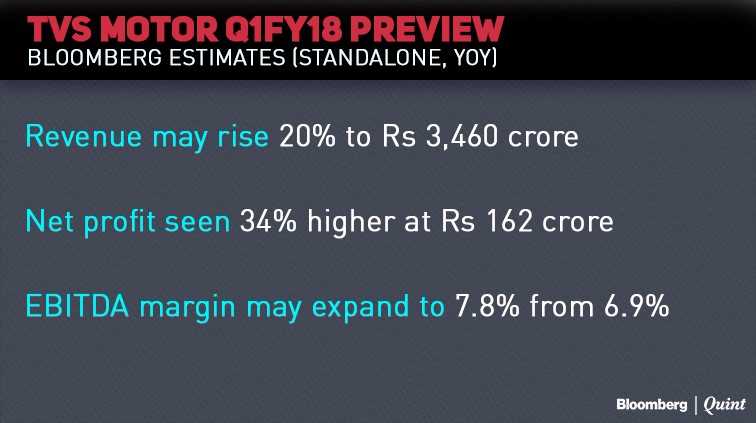

- Sales volume growth of 12 percent to aid growth

- Motorcycle and scooter volumes increased by 17 percent which will boost margins

- Net realisation is likely to increase 7-8 percent year-on-year

What To Watch

- Launch of product with BMW tie-up

- Dealer compensation ahead of GST rollout

- Update on key trends in export markets

What To Watch

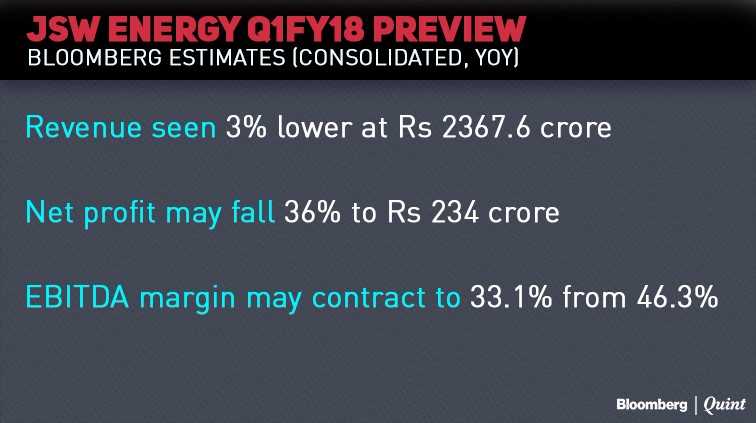

- International coal prices

- Lower generation volumes at Vijaynagar and Ratnagiri plant

- Update on Karnataka power purchase agreement

What To Watch

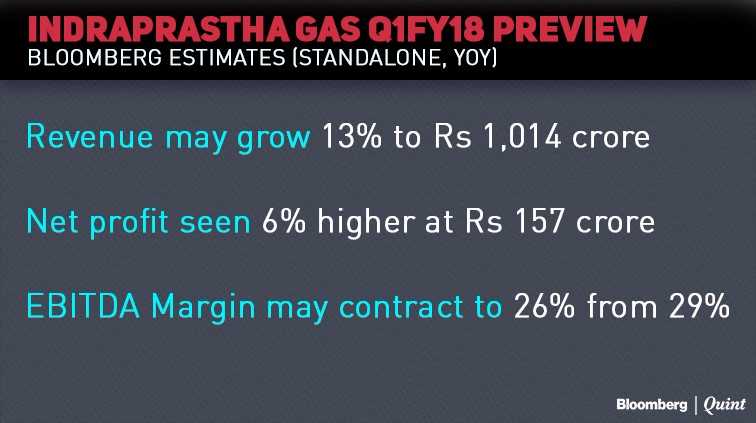

- FY18 volume growth guidance and margin

- Expansion plans; bidding for new cities

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.