Shares of Avenue Supermarts Ltd. rose to a two-year high on Thursday after its revenue rose in the fourth quarter.

The Ramesh Damani-owned company's standalone revenue rose 19% year-on-year to Rs 12,393.5 crore, according to an exchange filing. The total number of stores stood at 365 as of March 31, 2024.

In addition, the operator of the DMart retail chain remains one of the top picks for brokerages, as they see healthy sales momentum bolstering their belief in the company's value proposition. Macquarie expects a fourth-quarter consolidated profit of Rs 590 crore, aided by the healthy performance of the e-commerce business.

"Improving trends in growth and efficiency metrics support our thesis on DMart's ability to re-engineer growth with its grocery-first strategy," Morgan Stanley said in a statement. Over the long term, the large grocery market and DMart's business model keep the brokerage excited about the business and the stock, the brokerage said.

Meanwhile, Citi believes that revenue per square feet continues to be impacted by inferior product mixes and new store additions in smaller towns.

Citi On Avenue Supermarts

The brokerage maintains a 'sell' rating with a target price of Rs 3,200 per share.

Believes revenue per square feet continues to be impacted by inferior product mixes and new store additions in smaller towns.

Remains cautious at the current valuation given the risks around store additions, earnings and the P/E multiple.

Morgan Stanley On Avenue Supermarts

The brokerage is 'overweight' with a target price of Rs 4,695 per share.

DMart's fourth-quarter revenue was marginally higher than the brokerage's estimate.

Improving trends in growth and efficiency metrics support their thesis on the ability to re-engineer growth with its grocery-first strategy.

The large grocery market and DMart's business model keep the brokerage excited about the business and the stock.

Macquarie On Avenue Supermarts

Macquarie maintains an 'outperform' rating with a target price of Rs 4,500 apiece.

Encouraged by healthy sales momentum in DMart, which bolsters our belief in DMart's value proposition.

Further, no material change in price-based competitive intensity drives their constructive outlook.

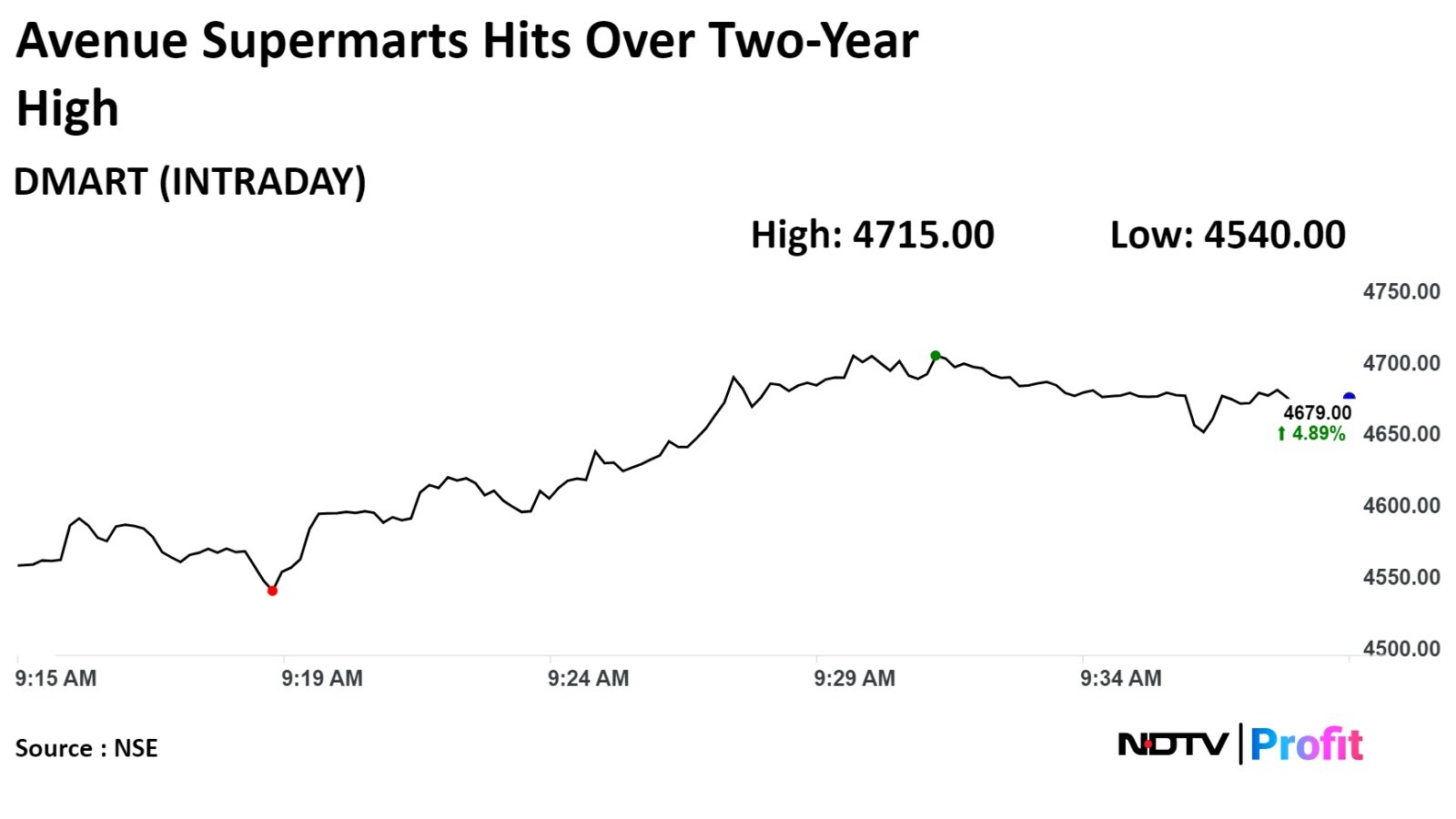

Shares of DMart rose as much as 5.7% to over a two-year high of Rs 4,715 apiece on the NSE. It was trading 4,61% higher at Rs 4,666.75 apiece, compared to a 0.08% advance in the benchmark Nifty 50 as of 9:50 a.m.

The stock has risen 27.6% in the past 12 months. The total traded volume so far in the day stood at 9.5 times its 30-day average. The relative strength index was at 76.

Twelve out of the 26 analysts tracking Dmart have a 'buy' rating on the stock, five recommend a 'hold' and nine suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 11.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.