In a post on social media platform X on Thursday, ace investor Deepak Shenoy emphasised the need for the government to cut excise duties on fuel, stating that it would have a broad-based positive impact on the economy. According to Shenoy, a reduction in taxes would lead to lower fuel prices, which in turn would reduce inflation, increase consumer spending, and promote economic growth.

"Cutting taxes will improve consumption and push up our economy. We have a bloated government too, so let's cut income taxes, and sell overowned public companies. Also, cut excise duty on fuel...Single largest boost to everyone across the board," Shenoy said. He further added that such a move could help lower inflation and encourage the Reserve Bank of India to reduce interest rates, further stimulating economic activity.

The Confederation of Indian Industry had echoed similar sentiments last month. CII had stated that fuel prices play a significant role in driving overall inflation. As the excise duties on petrol and diesel had remained unchanged since May 2022—despite global crude prices falling by nearly 40%—it's time for the government to adjust the taxes, it has said.

CII highlighted that central excise duty alone accounted for approximately 21% of the retail price of petrol and 18% for diesel. With global crude prices significantly decreasing, a reduction in excise duty would help alleviate inflationary pressures and increase disposable incomes for households, according to the organisation.

As of Jan. 22, fuel prices in Delhi were Rs 94.77 per litre for petrol, and Rs 87.67 per litre for diesel. These prices vary across metro cities, with Kolkata having the highest petrol prices at Rs 105.01 per litre, followed by Mumbai at Rs 103.50 per litre, according to data from the Petroleum Planning & Analysis Cell under the Ministry of Petroleum and Natural Gas.

The last major cut in excise duty took place in May 2022, when the government slashed duties by Rs 8.69 per litre for petrol and Rs 7.05 per litre for diesel. In Delhi, petrol prices dropped from Rs 105.41 per litre to Rs 96.72 per litre after the excise duty reduction.

Tax Components In Retail Fuel Prices

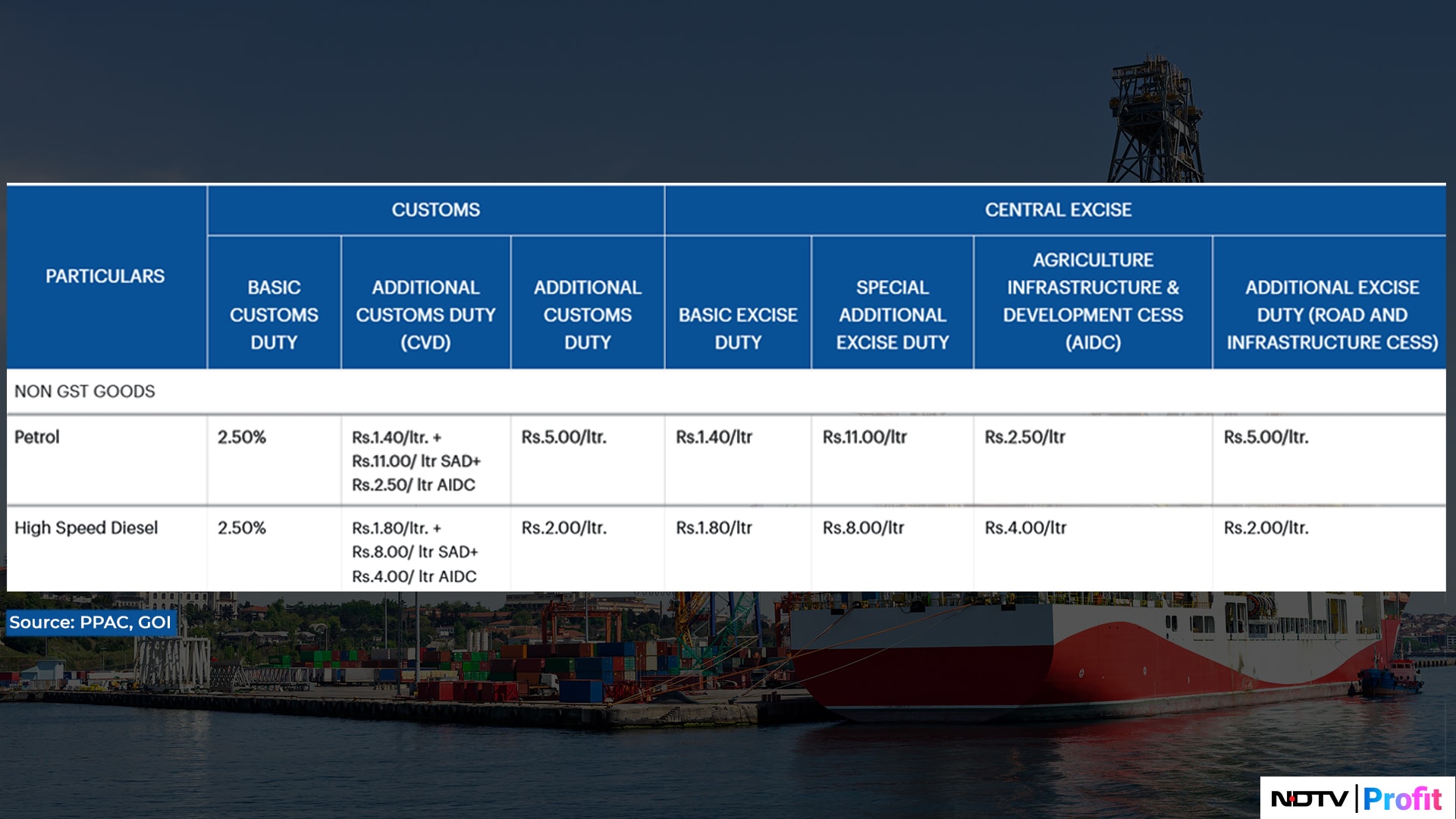

Fuel prices in India are composed of several tax components, including state taxes (VAT) and central excise duties, in addition to the cost of the crude oil and refining processes.

As of January, VAT in the National Capital Region stands at 19.40% for petrol and 16.75% for diesel. In Maharashtra, including cities like Mumbai, Thane, and Navi Mumbai, VAT is 25% on petrol and 21% on diesel, with an additional tax of Rs 5.12 per litre on petrol.

In total, taxes—comprising customs duties, excise duties, and VAT—account for a significant portion of the retail price of fuel in India. For petrol, about 55-60% of the retail price is made up of taxes. This includes:

Customs Duty: 2.5% basic customs duty, Rs 1.40 per litre, special additional duty of Rs 11 per litre, and additional customs duty of Rs 2.50 per litre, along with a cess of Rs 5 per litre for infrastructure development.

Central Excise Duty: Basic excise duty of Rs 1.40 per litre, special additional excise duty of Rs 11 per litre, agriculture infrastructure and development cess (AIDC) of Rs 2.50 per litre, and additional excise duty (road and infrastructure cess) of Rs 5 per litre.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.