Credit Suisse has tactically cut its India position as higher oil prices are seen to hurt the nation's current account, add to inflationary pressures and increase sensitivity to Fed rate hikes.

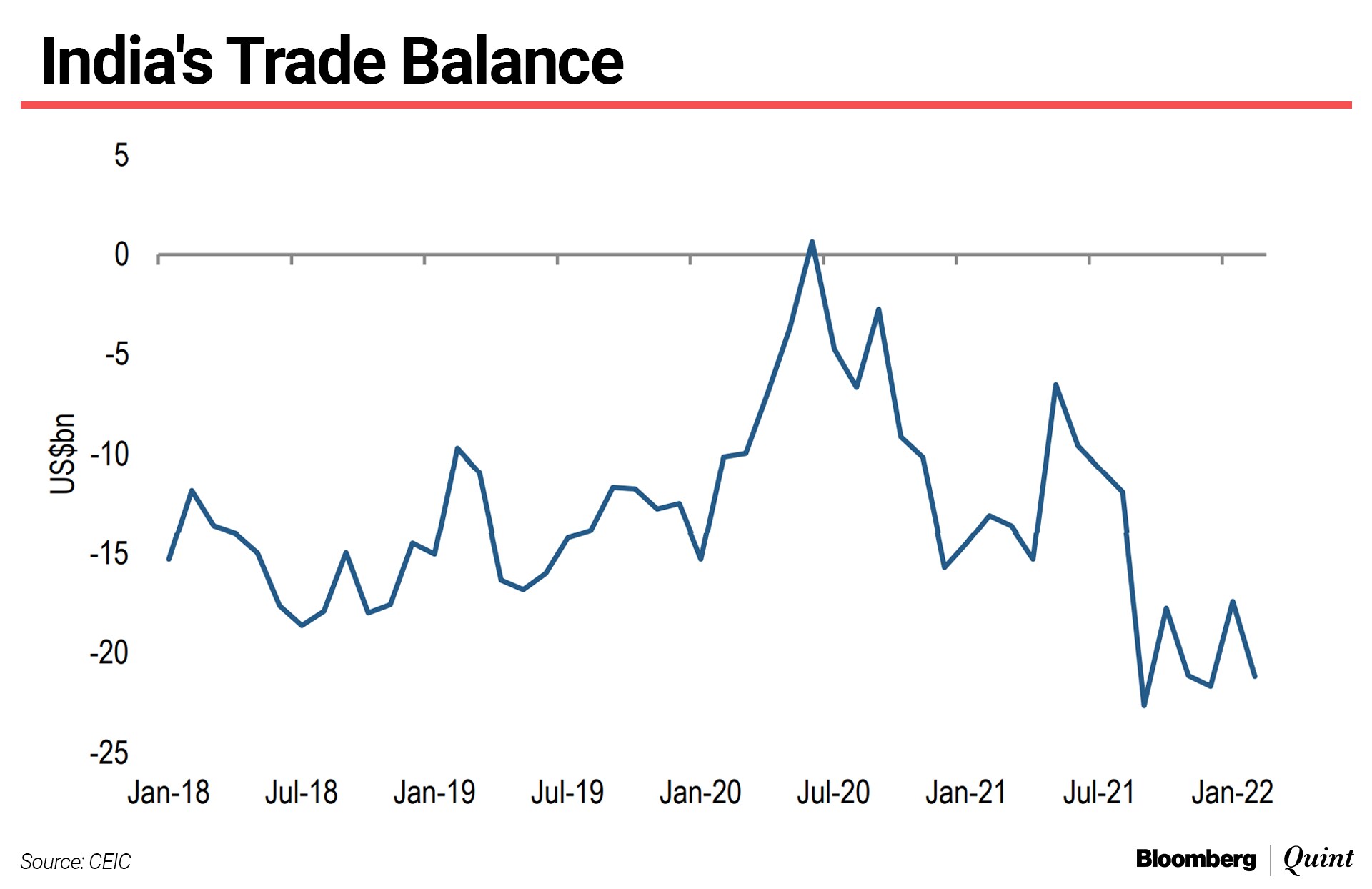

Brent crude of $120 a barrel could add $60 billion to import bill of India, one of the biggest oil importers, the research house said in a March 8 report. It downgraded its position on India to ‘underweight' from ‘overweight'.

“Price rises for gas, coal, edible oils and fertilisers could add another $35 billion. In total, the current account could fall by close to 3% of GDP," it said. "If oil stays above $120, the hit would be bigger.”

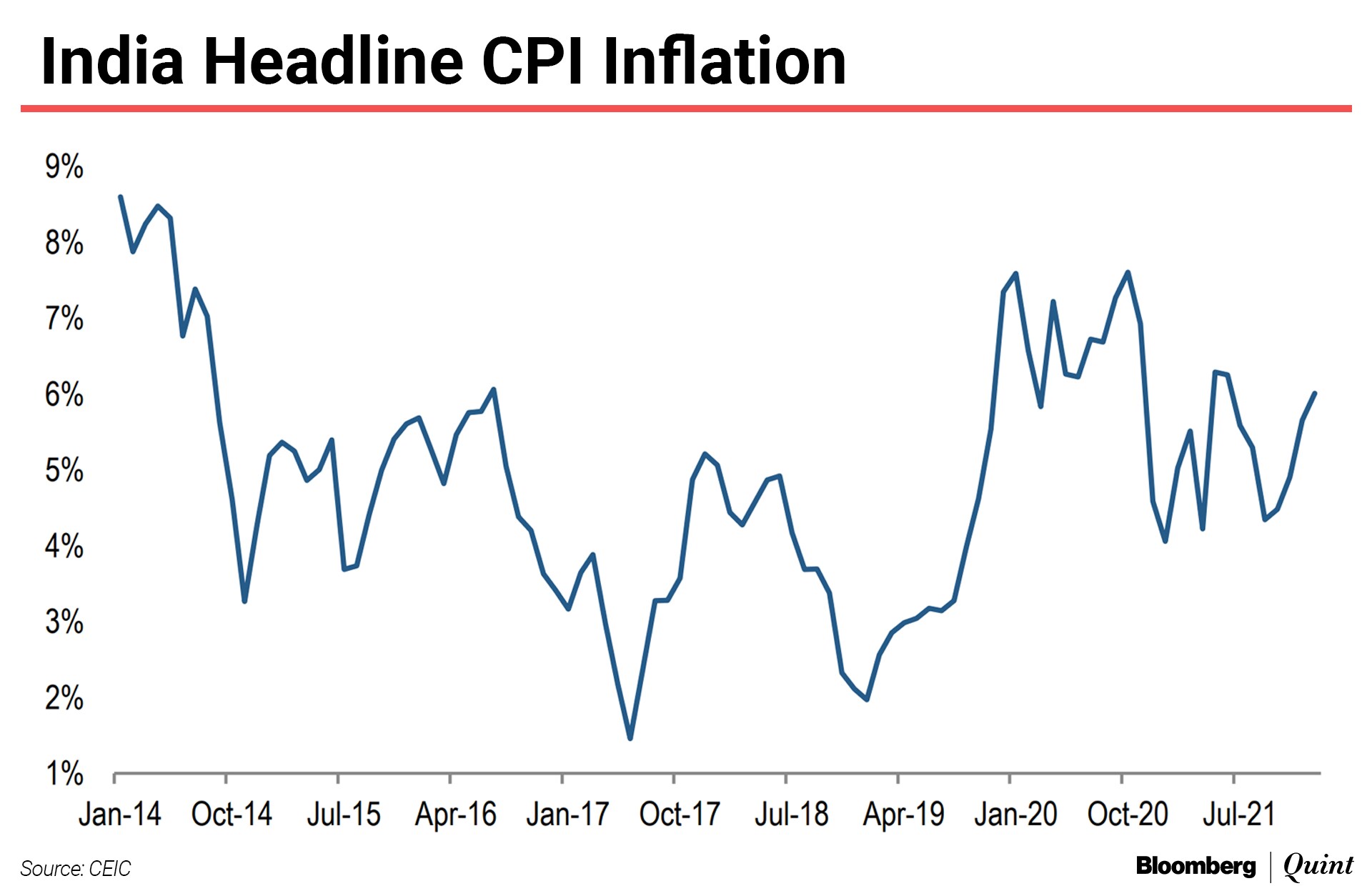

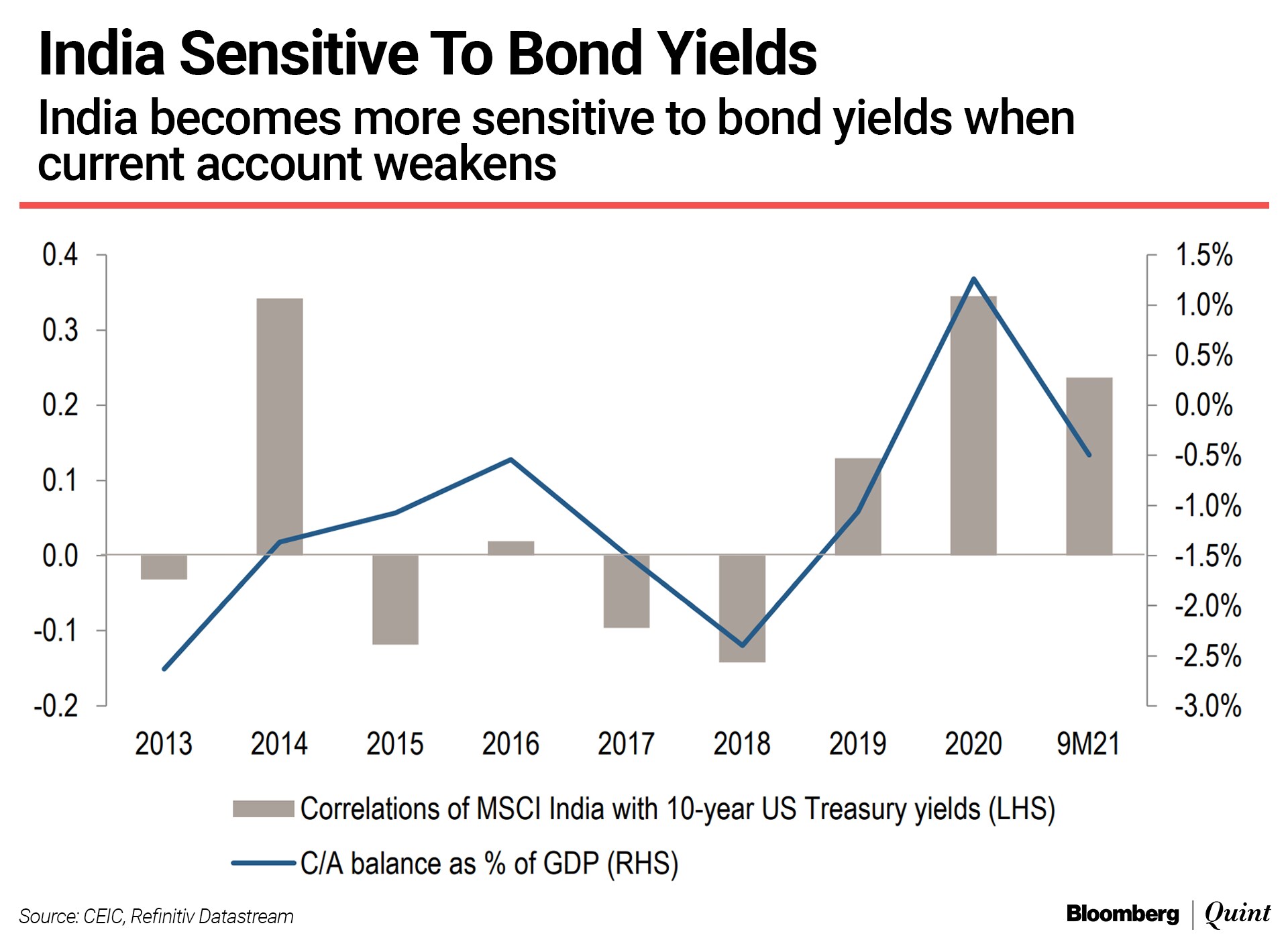

A weaker current account, the report said, could magnify a previously diminishing vulnerability to Fed rate hikes and global bond yields. Inflation also becomes more worrisome with higher oil. “If Brent stayed above $120 a barrel for a year, it could add 100 basis points to inflation and subtract 2.5-3 percentage points from GDP.”

And elevated valuations, according to the report, could magnify losses in such a scenario. India's relative price-to-equity to APAC remains close to an all-time high.

Credit Suisse, however, said it will look for opportunities to re-enter the Indian market because of its robust EPS momentum and strong structural prospects.

India's Pain Is China And Australia's Gain

Credit Suisse said it used the funds freed from India to raise China from ‘market weight' to ‘overweight'. “China's credit intensity still clouds long-term prospects, but we like the country's low oil import bill, insulation from Fed rate hikes, improving macro indicators and wealth of potential policy tools.”

The research house also raised Australia from ‘market weight' to ‘overweight'. “We like the positive turn in EPS revisions, the favourable leverage to inflation and the neutral position on energy imports.”

Key Assumptions Driving The Tactical Shift

The tactical shifts in Credit Suisse's Asia-Pacific model portfolio from India to China and Australia reflects the likelihood that oil pricing stays higher for longer than anticipated.

Markets underestimating the depth of inflationary pressures and the extent of the Fed rate hike.

Ukraine raising the risk of policy error.

Credit Suisse also made smaller adjustments in Korea and Asean. It raised its Malaysia overweight from 1.1x benchmark to 1.2x due to positive commodity exposure, while the Korea overweight was trimmed from 1.2x to 1.1x due to high oil imports.

Singapore overweight was lowered from 1.4x to 1.2x to account for a less hawkish stance by the U.S. Fed, while Thailand overweight was cut to 1.1x from 1.2x due to potential disruption to tourism from Russia and European Union.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.