When Vis Raghavan heard that Citigroup Inc. Chief Jane Fraser was struggling to find someone to oversee investment banking last year, he called her with an audacious pitch: The London-based banker, whose star was dimming at Jamie Dimon's JPMorgan Chase & Co., said he could work wonders for Citigroup's franchise.

Fraser's decision to hire him after just a few days of talks — including his quick flight to meet her in New York — appears to be paying off.

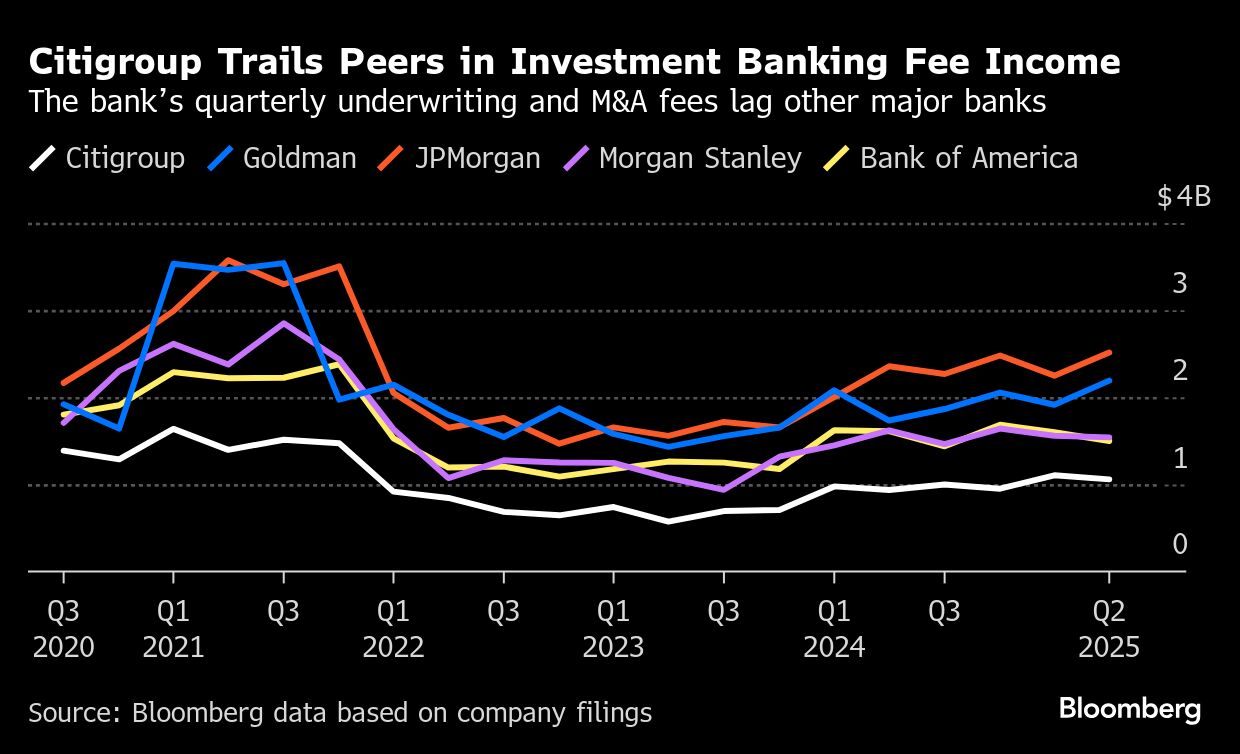

The hard-charging banker's arrival last year has energized the division, pushing his team to relentlessly pursue deals while cutting underperformers to make way for marquee hires. Such was the signing-on pact Raghavan struck with Fraser: To propel Citigroup's investment-banking revenue after years of languishing behind rivals who dominate the top three spots on Wall Street.

Citigroup has scaled the M&A advisory ranking and displaced rivals on at least two recent deals. And it's not just the bank's fortunes that are rising. Raghavan, whose lucrative welcome package lines him up to become Citigroup's biggest individual shareholder, has emerged as a potential candidate to succeed Fraser one day, with some observers viewing his ability to revive the banking division as a test run for that role.

It's a notable turn for a banker whose abrasive style had alienated some top leaders at his former employer. When JPMorgan shook up its ranks to position senior executives as potential Dimon successors early last year, Raghavan wasn't among them. Negative feedback about his demanding personality also helped rule him out from another more senior banking position, according to people familiar with the matter, who asked not to be identified discussing private information.

Now, Raghavan, 58, sits on Citigroup's executive management team and is the only person with the executive vice chair title. He's also the firm's second-highest paid executive with a package of $22.6 million last year. And to compensate him for rewards accrued at JPMorgan, Fraser agreed to a $52 million make-whole award to be paid over seven years from his arrival at Citigroup, largely in deferred equity. In the words of one JPMorgan insider, Raghavan's switch to Citigroup might be the greatest trade a banker ever made.

Representatives for Citigroup and JPMorgan declined to comment.

Fraser is forging ahead with the firm's biggest restructuring in decades. She has ditched storied businesses and shaken up sprawling operations to help boost profitability and turn around a stock that long lagged behind rivals.

Some personnel decisions have come at the expense of other aims. The bank — which was first among the largest US lenders to name a woman as CEO — contacted female candidates for the role Raghavan later landed, one of the people familiar said. In the end, all five key business units at Citigroup remain run by men.

Since Raghavan started in June last year, he's beefed up the unit with dozens of bankers at the managing director level — almost all of them men. Among his hires were close JPMorgan allies Achintya Mangla, who oversees financing, and Drago Rajkovic and Guillermo Baygual to co-lead mergers and acquisitions.

Multiple longtime Citigroup bankers who previously were sole leaders of units, including North America investment banking head Jens Welter, have also gotten co-heads from the new hires.

Raghavan, who oversees commercial and corporate banking as well as dealmakers, has also guaranteed pay for some top hires for their first year and sold recruits on the upside of growing the business, according to some of the people. To free up budget, less productive senior bankers have been let go, though dealmakers are still waiting to see how the recruiting costs will affect year-end bonuses, the people said.

The moves have vexed some members of the old guard at Citigroup, who've expressed frustration they're being shut out of hiring decisions. And new arrivals have come disproportionately from JPMorgan, with some of those bankers scoring higher posts at Citigroup than they were likely to get at their former firm. JPMorgan turned down chances to match some recruiting offers, according to people familiar with the matter.

Leaving ‘Wallet'

With little tolerance for complacency, Raghavan has instilled a culture with more accountability and less room for excuses when bankers miss out on deals, people familiar with his working style said. That's stoked tensions within the business, leaving some concerned for their future under Raghavan and his close cadre of staff, they said.

On a recent call with the division's managing directors to discuss progress, Raghavan pushed for improvement. He decried a lack of senior calling — in which bankers reach out to CEOs or finance chiefs to win business. Dealmakers are also leaving “wallet” on the table and should up their efforts to win fees from key clients, Raghavan said, according to some of the people.

At a conference this month, Citigroup Chief Financial Officer Mark Mason said Raghavan had taken a “hard look” at the business's cost structure and identified areas to boost talent. Mason pointed to Citigroup's bigger-than-expected increase in investment-banking revenue in the second quarter, with fees up 13% on the prior year.

Citigroup ended last year fourth in M&A advisory in Bloomberg's league table — a position it hadn't reached since 2019 and now still holds — after surpassing Bank of America Corp. Citigroup this year also beat out JPMorgan to be adviser to Johnson & Johnson on its $14.6 billion purchase of Intra-Cellular Therapies Inc., which stands as the biggest biopharma deal in more than two years. The bank's stock is also the best performing of its largest rivals so far this year.

Shares of the company are up 47% this year, compared with 32% for JPMorgan and 40% for Goldman Sachs Group Inc.

Still, some in Citigroup attribute many of the wins to existing relationships and groundwork, with hires made to build some teams before Raghavan's arrival. And the bank still remains far behind Goldman Sachs, Morgan Stanley and JPMorgan in market share for overall dealmaking.

Helping Raghavan's cause is that he has the ear of Fraser, according to some of the people. She told investors in April last year that Raghavan will bring “added intensity” to the franchise. That intensity could help take him to the top of the bank.

If property records are anything to go by, Raghavan, who has a penchant for high-end Italian ties from the firm Battistoni, has invested in a New York future. Last year, the longtime London resident bought a Manhattan penthouse for $15 million that was once rented by the rapper Bad Bunny.

Meanwhile, back at JPMorgan, a new moniker has emerged to describe colleagues most likely to depart for Citigroup: FOV, or “Friend of Vis.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.