China's Envision Group is considering building a battery making plant in India to take advantage of a push by authorities to upgrade the grid to handle more renewables.

Once the nascent market takes off, Envision, one of the main wind turbine manufacturers in India, hopes to enter the sector with a 5 gigawatt hours-a-year, $34 million unit, Suman Nag, the company's global head for contracts, said in an interview. The project will procure cells from China and build racks and software infrastructure locally.

“As an Indian subsidiary of a Chinese company, we'll be happy to localize,” Nag said. “Just passing the equipment through our books and counting it as sales adds no value to our company in India,” he said, adding that he expects to be able to make a decision based on the market's trajectory within 18 months.

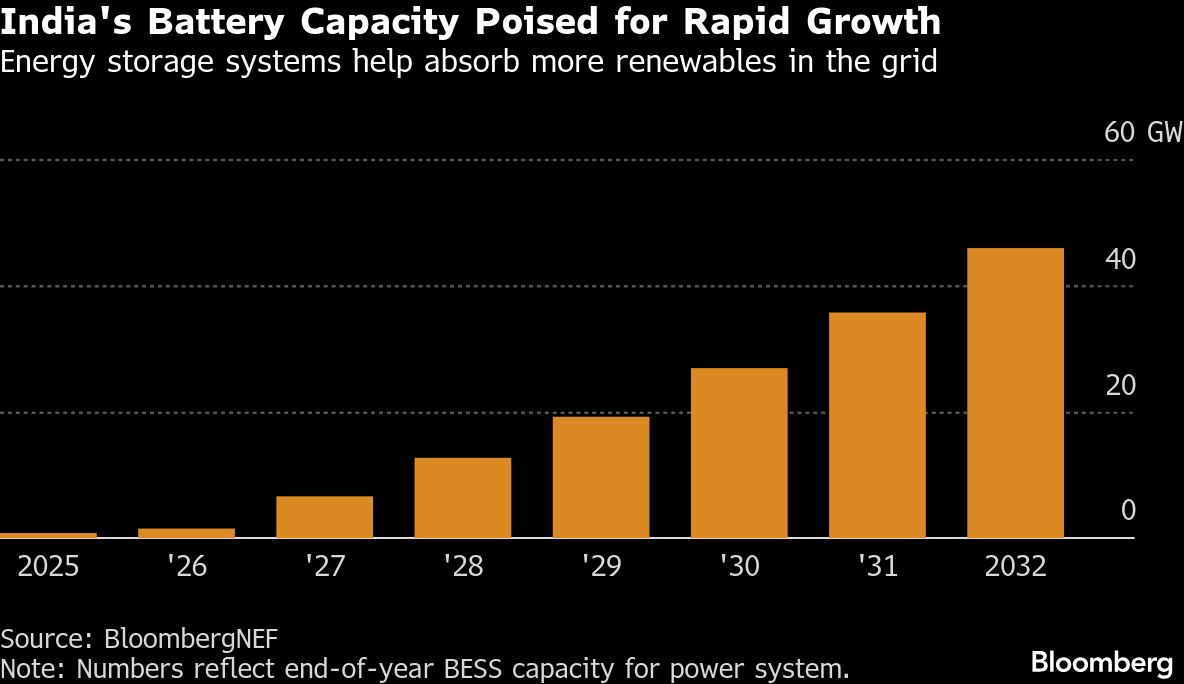

India's ability to accelerate the installation of renewables is threatened by a lack of storage systems that are needed to stabilize power transmission. That has led to grid operators curtailing excess solar energy, which could have otherwise been used to charge batteries during the day and supply reliable power during the night. While the country's battery storage capacity currently sits at less than one gigawatt, investors are taking an interest in its huge potential for growth, estimated to reach 46 gigawatts by 2032.

“There's a lot that a battery can do in India today,” Nag said. “We are currently trying to do grid frequency management from our coal plants, which take hours to ramp up and ramp down. Batteries can do that job in milliseconds.”

Nag expressed concerns over inexperienced businesses aggressively bidding in battery tenders. In a recent auction in Rajasthan, the winners included a consumer goods company and one that sells packaged basmati rice, according to data tracked by BloombergNEF.

“We'll need to see whether these players are backed up with techno-commercial capability to actually get those projects built,” Nag said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.