The Burman family, the owner of the Dabur India Ltd., on Monday announced an open offer to buy 26% stake in Religare Enterprises Ltd. for up to Rs 2,116 crore as it looks to build a financial services business.

M.B. Finmart Pvt., Puran Associates Pvt., VIC Enterprises Pvt., and Milky Investment & Trading Co. announced an open offer to buy over 9 crore fully paid-up equity shares at Rs 235 apiece, according to an exchange filing. The shares represent 26% of the expanded voting share capital.

The four companies acquired 5.27% of the issued and outstanding equity share capital and 5.00% of the expanded voting share, triggering the open offer, according to the filing. That took the Burman family's holding in the financial services firm above 25% of the expanded voting share threshold.

Prior to the transaction, the four companies held 21.25% of the equity capital and 20.15% of the expanded voting share. If the open offer is fully subscribed, the group will hold more than 51% stake in Religare.

“The proposed transaction is in line with our vision to create a leading financial services platform that encompasses lending, broking and health insurance services," Anand Burman, chairman emeritus at Dabur India Ltd., said in a statement. "We are convinced that REL is the right platform and positioned for sustained success. With our guidance, REL will continue its journey to being one of India's distinguished financial services platforms.”

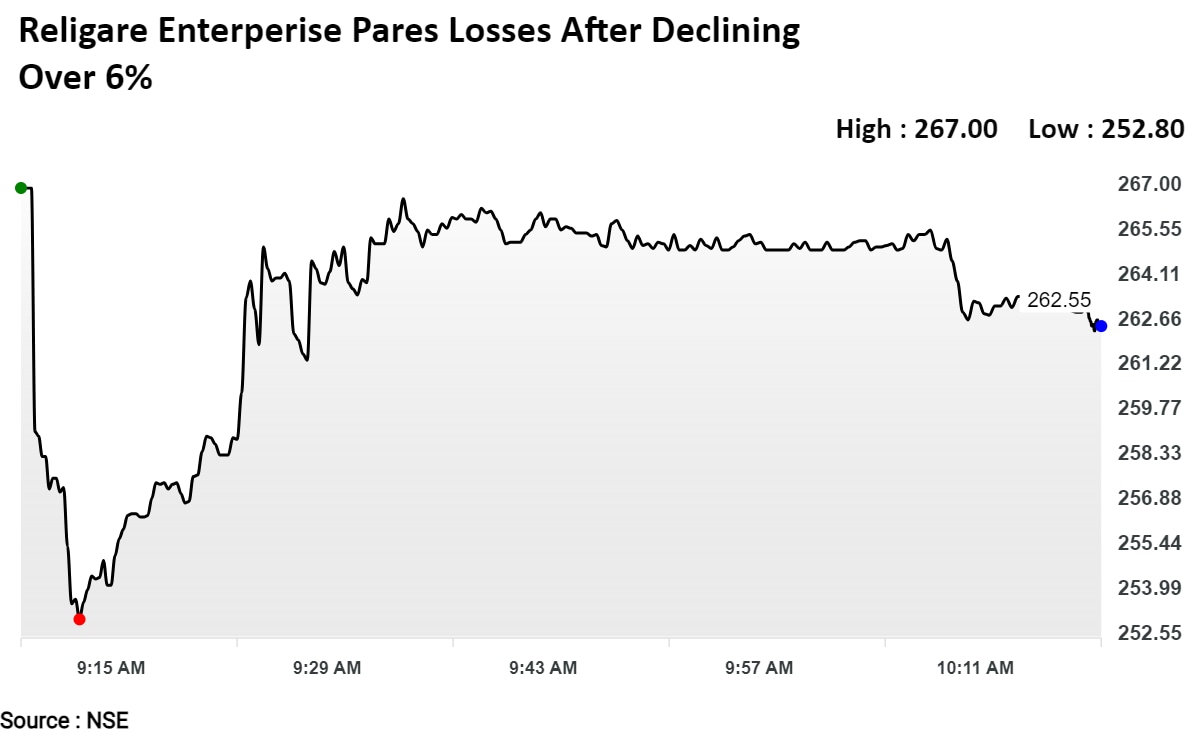

Religare Shares Drop

Shares of Religare Enterprises declined 6.90% intraday, the most since Sept 12. The stock pared some of the losses to trade 3.04% lower at 263.30 apiece at 10:20 a.m. compared to a 0.24% decline in the NSE Nifty 50.

The stock has gained 51.54% year-to-date. Total traded volume so far in the day stood at 1.7 times its 30-day average. The relative strength index was at 65.62.

Both analysts tracking the company maintain a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month price target implies an upside of 5.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.