The government plans to sell part of its holding in Life Insurance Corporation of India through an initial public offering as it set a record disinvestment target for 2020-21.

“Listing on the stock exchanges disciplines the company, provides access to financial markets and unlocks value,” Finance Minister Nirmala Sitharaman said in her Budget 2020 speech. “It also gives an opportunity to retail investors to take part in the wealth so created.”

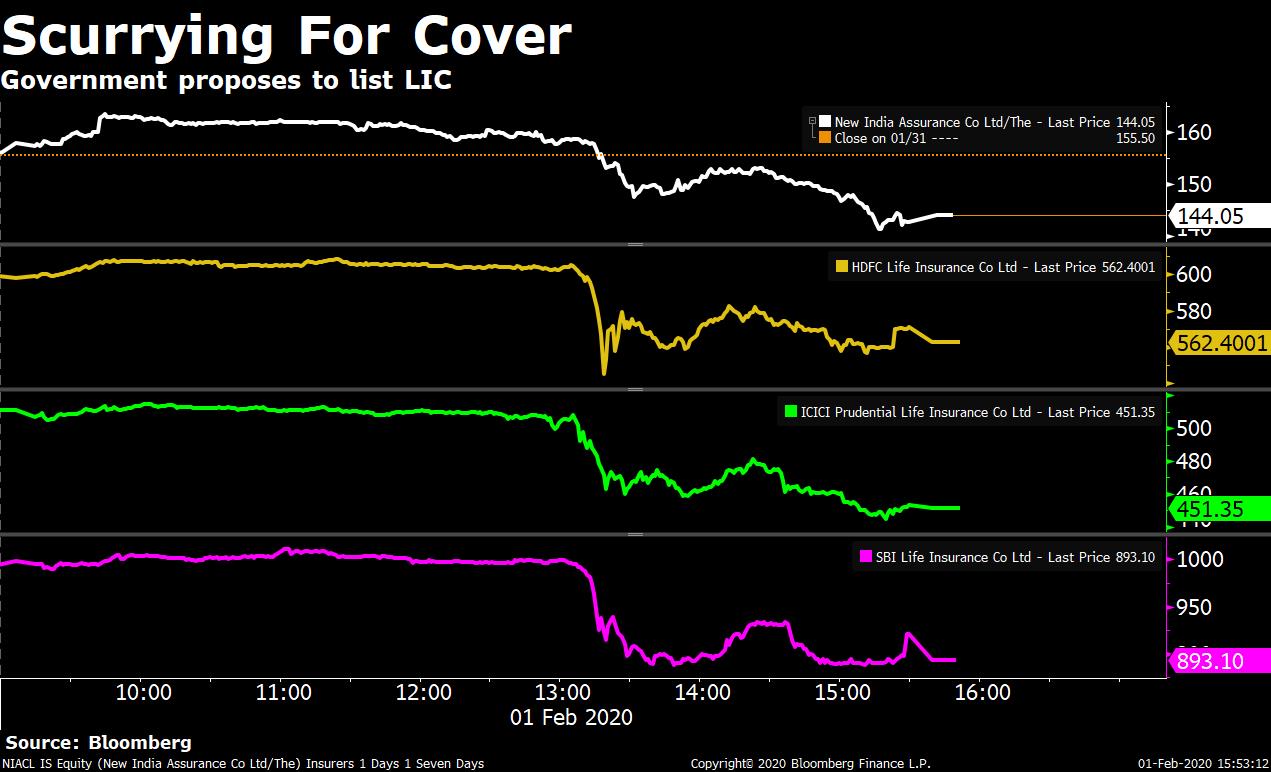

LIC, established in 1956 and fully owned by the government, is a financial behemoth with assets of more than Rs 36 lakh crore. A successful share sale will be crucial for the Modi administration as it plans to mop up Rs 2.1 lakh crore by selling stakes in public sector units in FY21. More so, after it estimates to miss its FY20 disinvestment target by more than a third. The plan to list LIC comes after the November 2017 IPOs of state-run General Insurance Corp. of India Ltd. and The New India Assurance Co. Ltd.

There has been a very severe shortfall for the government in meeting its disinvestment targets this year, C Rangarajan, former governor of the Reserve Bank of India, told BloombergQuint. Therefore, by listing LIC, “they are taking the easy way out”, he said.

India's largest insurer has been used as an investor of last resort in the past to support the markets by buying shares of state-owned peers and government bonds. LIC acquired significant stakes in the IPOs of Oil and Natural Gas Corporation Ltd. and Hindustan Aeronautics Ltd. in recent years, and bailed out struggling IDBI Bank Ltd. by buying a 51 percent stake last year.

Also Read: Budget 2020: Government Looks To Exit IDBI Bank Fully

The insurer, set up under the LIC Act of 1956, is regulated by the insurance Regulatory Development Authority of India. To take it public through an IPO, the government will have to amend the law.

Finance Secretary Rajiv Kumar told reporters that the government expects about Rs 90,000 crore from the stake sale in LIC and IDBI Bank. Given that its holding in the lender is worth nearly Rs 18,000 crore at current prices, the government could fetch about Rs 72,000 crore from the LIC divestment.

Rangarajan said since LIC has been doing well on the whole, the government may be able to divest a bit of their stake in the insurer easily. But the more important thing is that it's really “skirting the issue”, he said. “The problem is really to address other public sector enterprises which are in the manufacturing and other areas, and they failed to accomplish that.”

Disinvestment in its true sense should bring about change in the management and also bring out change also in the way the company is run, according to Rangarajan. “But that will not happen, the LIC will function as it has functioned before.”

Former Finance Secretary Subash Chandra Garg said the listing of LIC was over-due and being a big behemoth it would receive a large valuation. “My calculations suggest that if you do a 10 percent disinvestment in LIC you might get about Rs 80-90,000 crore,” he told BloombergQuint. Garg based his calculations on the valuations in recent IPOs in the life insurance sector.

Given the LIC is a statutory corporation owned by the government, the challenge, according to Garg, would be to corporatise the entity before the disinvestment process can begin. The government will need to conduct the process quickly and professionally, otherwise a similar situation like Bharat Petroleum Corporation Ltd.'s disinvestment, which has been pushed to next year, could repeat, he said.

Also Read: Budget 2020 Highlights: 10 Key Announcements Made By FM Nirmala Sitharaman

LIC In Numbers

- LIC's total assets rose nearly 9 percent year-on-year to Rs 36.11 lakh crore in 2018-10, according to its annual report.

- In FY19, the insurer's non-linked business held Rs 18.5 lakh crore worth of government securities, Rs 2.8 lakh-crore bonds and debentures and around Rs 6.29 lakh crore worth of equities.

- The linked-business had around Rs 34,271 crore worth of government securities, Rs 5,282-crore debentures and bonds, and around Rs 30,669-crore in equities.

- Total premium income rose about 6 percent to Rs 3.37 lakh crore in 2018-19.

- Total income, including from investments, increased 7 percent to Rs 5.6 lakh crore.

- Claims rose 26.6 percent about Rs 2.5 lakh crore.

- As of March 2019, total non-performing assets comprised 6.1 percent of its total loans—investments in debt paper and loans—worth more Rs 4.03 lakh crore. Sub-standard assets stood stood at 0.3 percent, while doubtful assets were 4.1 percent of total debt investments.

- About Rs 6,772 crore worth of debt extended by LIC has been recognised as loss assets.

- The insurer made provisions worth Rs 23,760 crore against the NPAs in FY19.

- The total paid-up capital of the life insurer stands at Rs 100 crore as of March 2019.

Watch | the government plans to take LIC public...

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.