- Bank of America survey shows Blinkit leads quick commerce with 31% user preference

- Consumers use multiple delivery apps, with 53% using Blinkit and 48% Flipkart Minutes

- Grocery shopping drives quick-commerce use, with 40% for monthly stock-up needs

Bank of America (BofA)'s latest internet survey on India's online consumers points to robust demand for quick commerce and food delivery apps

According to a survey of over 1,000 users conducted in early November, Blinkit is the preferred quick commerce platform for Indian consumers. The report also shows growth in the overall reliance on multiple delivery apps and quick-commerce for grocery needs.

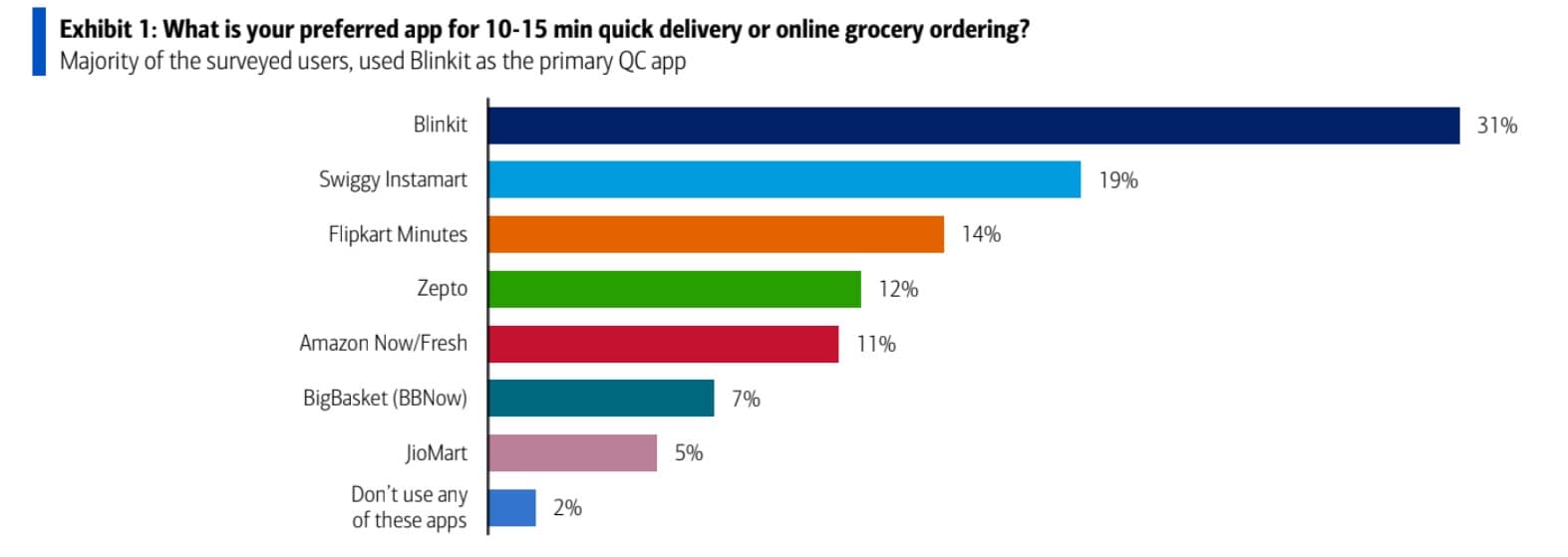

Blinkit was cited as the primary app by 31% respondents, ahead of Swiggy Instamart at 19%. Flipkart's quick-commerce offering was chosen by 14% users, slightly ahead of Zepto at 12%.

Blinkit was cited as the primary app by 31% of respondents, ahead of Swiggy Instamart at 19%. (Photo source: BofA)

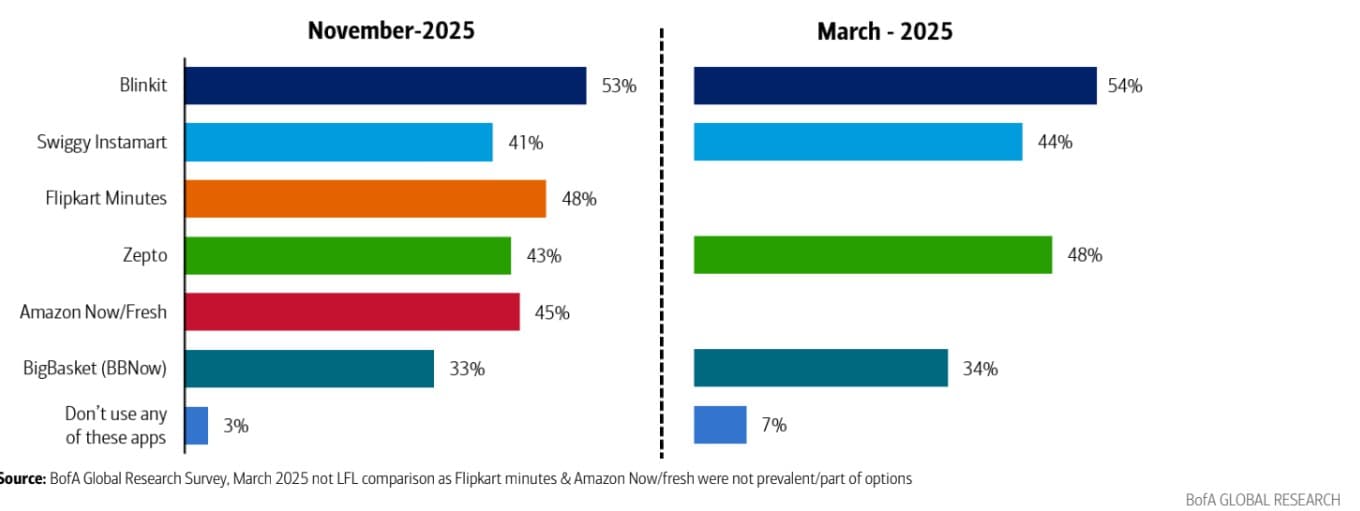

The study also points to elevated multi-app behaviour. A majority of users continue to rely on more than one quick-commerce service: 53% reported using Blinkit, 48% use Flipkart Minutes, 45% use Amazon, while Zepto and Swiggy Instamart are used by 43% and 41% of respondents, respectively. This suggests that consumers are mixing and matching platforms based on availability, pricing and delivery experience.

Grocery remains the core use case driving quick-commerce adoption. A total 40% of users said they use these platforms for full-month grocery shopping, while 37% rely on them for unplanned or impulse purchases.

Delivery speed is critical for 35% of respondents, and 22% said they are primarily drawn by discounted offers. For Blinkit and Zepto users, both monthly stock-up and unplanned purchases are key drivers, while Swiggy Instamart appears more bent toward impulse and top-up shopping.

The study also points to elevated multi-app behaviour. (Photo source: BofA)

Food Delivery Usage Preferences

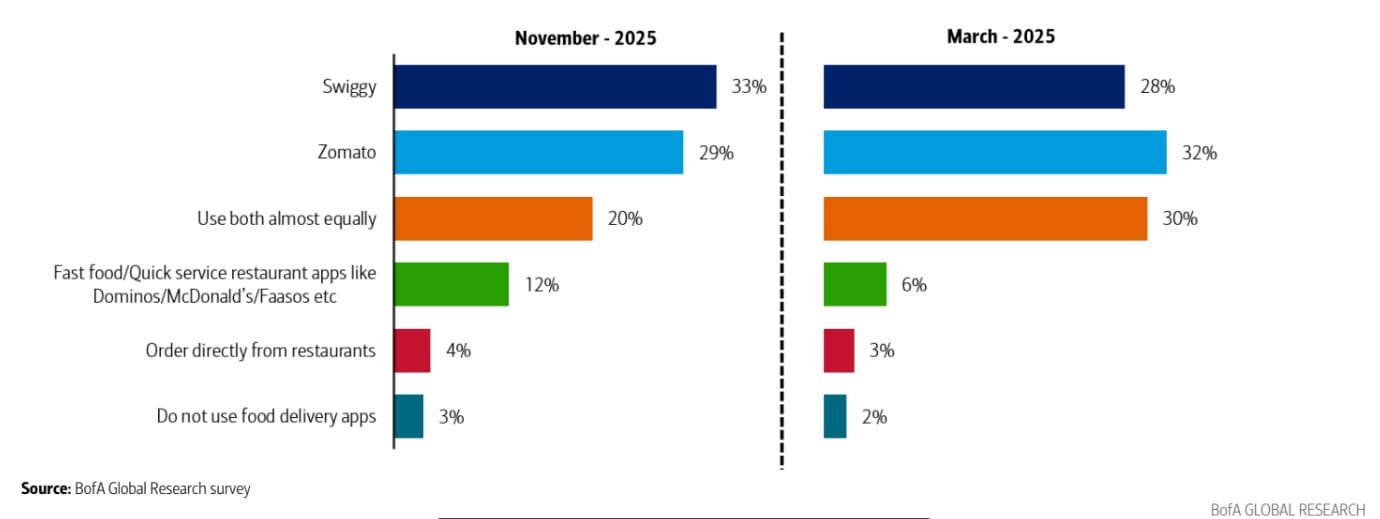

When it comes to ordering food online, 33% of the surveyed participants indicated that they primarily order food delivery online via Swiggy, while 29% have Zomato as their preferred app.

Around 20% of the surveyed users indicated that they use both the Zomato and Swiggy apps equally. Interestingly, the users indicating preference for direct ordering from fast food/QSR apps has increased to 12% now vs 6% when compared to their earlier survey.

When it comes to ordering food online, 33% of the surveyed participants indicated that they primarily order food delivery online via Swiggy. (Photo source: BofA)

Food Orders By Geography

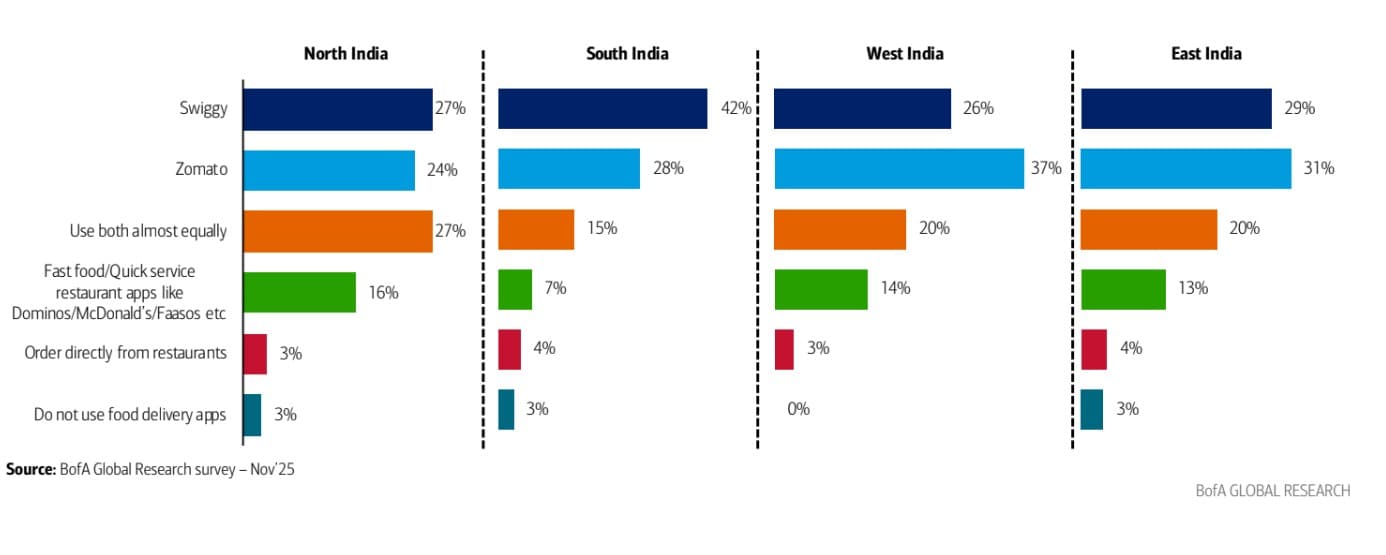

According to the survey, North Indian users indicated Zomato was the preferred app for 24% vs 27% using Swiggy, while in the South, Swiggy, at 42%, appears to have a higher preference among the surveyed users.

Across West India, the gap was wider between the user preference, with 37% preferring Zomato vs 26% preferring Swiggy.

East India survey results also indicated Zomato pulling ahead of Swiggy and being the preferred app for 31% users

Metro respondents showed a slightly higher preference toward Swiggy at 34% vs 29% for Zomato and 20% indicated almost equal usage preference for both apps.

However, in beyond Tier 1 cities, the surveyed users indicated an equal preference for each app. A total 54% of the survey participants said their online ordering frequency had increased over the last six months, while 11% said they order less now.

North Indian users indicated Zomato was the preferred app for 24% vs 27% using Swiggy more often. (Photo source: BofA)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.