- Blackstone will acquire a minority stake in Federal Bank Ltd for Rs 6,196 crore

- Federal Bank will issue over 27 crore warrants to Blackstone's affiliate Asia II Topco XIII

- Each warrant will be priced at Rs 227, with 25% payable at subscription

Blackstone Inc., the world's largest alternative asset manager, will acquire a minority stake in Federal Bank Ltd. for Rs 6,196 crore.

The Kerala-based bank will issue over 27 crore warrants via a preferential allotment to Blackstone affiliate Asia II Topco XIII Pte. Ltd. for Rs 227 apiece, according to an exchange filing on Friday.

An amount equivalent to 25% of the warrant issue price will be payable at the time of subscription, and the remaining 75% will be payable at the time of allotment of equity shares after exercise of warrants. The warrants have to be converted in 18 months.

After the exercise of warrants into shares, Blackstone will own a 9.99% shareholding in Federal Bank.

The US firm will be granted a special right to nominate one retiring non-executive director on the Federal Bank board upon exercise of all the warrants after it holds at least 5% of the paid-up share capital.

The deal requires approval from shareholders, the Reserve Bank of India and the Competition Commission of India.

Federal Bank will convene an Extra Ordinary General Meeting on Nov. 19, 2025, to seek their approval. The record date has been fixed as Nov. 12 for ascertaining the names of the shareholders.

Large Deals

The Blackstone investment in Federal Bank is the lastest in a string of deals in India's booming financial sector that has attracted attention of global institutions.

This month, UAE's second largest lender Emirates NBD agreed to acquire a majority stake in RBL Bank Ltd. for $3 billion.

IDFC FIRST Bank Ltd. received investment commitments from Warburg Pincus and Abu Dhabi Investment Authority.

Sammaan Capital Ltd. had drawn interest from Abu Dhabi's International Holding Co. for Rs 8,850 crore.

In May, Japan's Sumitomo Mitsui Banking Corp. announced a $1.6 billion deal for 20% stake in Yes Bank Ltd.

Bain Capital plans to go for an 18% stake in Manappuram Finance Ltd. for Rs 4,385 crore, followed by an open offer.

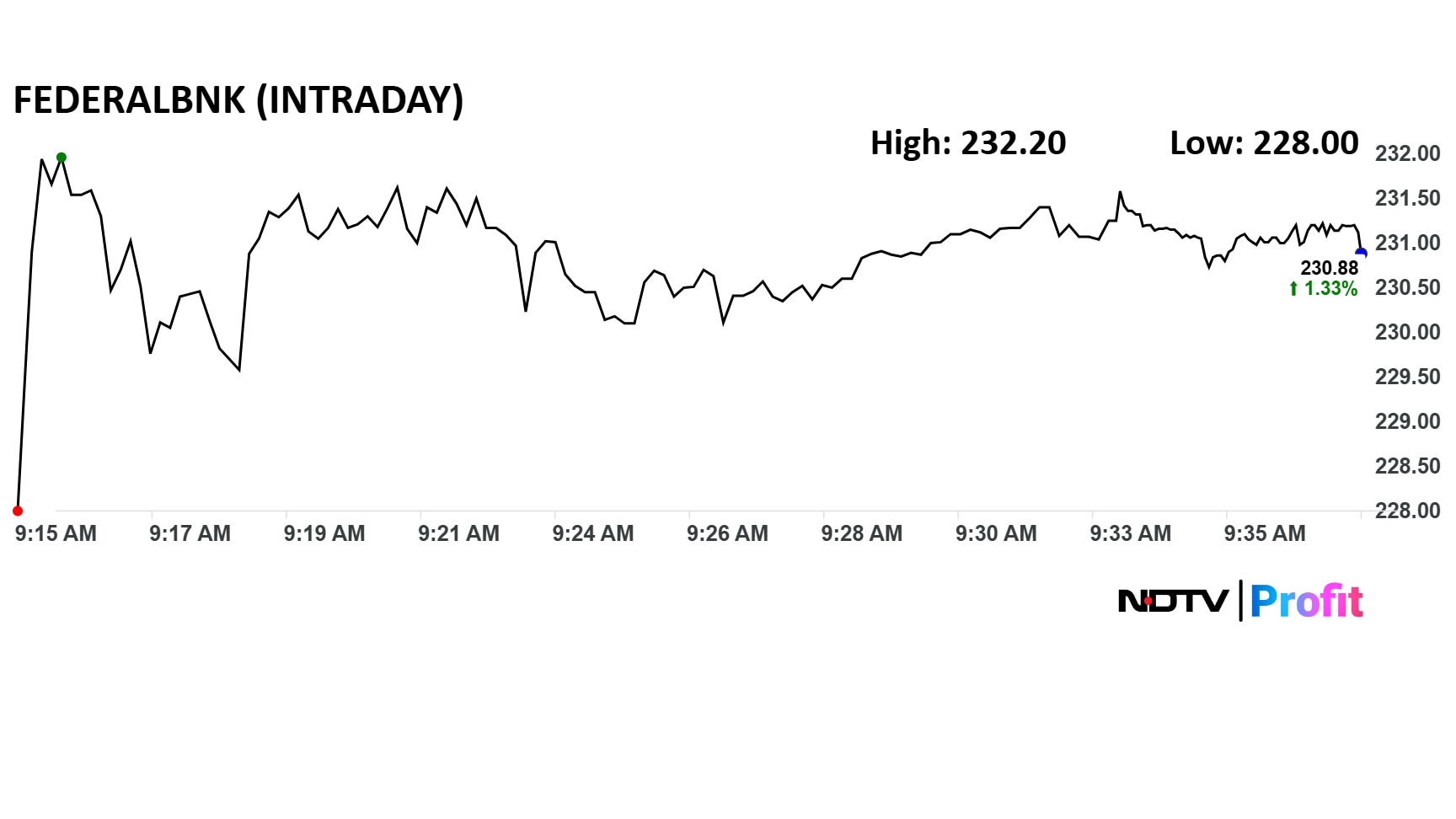

Federal Bank Share Price Movement

Federal Bank share price rose as much as 1.9% to Rs 232 apiece, after the announcement, compared to a flat Nifty 50 index.

The total traded volume so far in the day stood at 8.2 times its 30-day average. The relative strength index was at 81, indicating the stock is in overbought zone.

The stock advanced 22% in 12 months, and 15% on year-to-date basis.

Out of 47 analysts tracking the company, 32 maintain a 'buy' rating, 14 recommend a 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies a upside of 4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.