Radico Khaitan has been a market darling in the liquor space, delivering 577% returns over the last five years. Its performance has been driven by one structural shift: premiumisation. Radico's Prestige & Above (P&A) portfolio has grown at a 13% CAGR since FY19, and its share of total volume has doubled from 21.6% to 46.1%.

This richer mix has translated into faster bottom-line growth, as higher-margin premium brands expand profitability far more strongly than volumes alone. This trend is unfolding across sectors, and coincides with India's rising per capita income.

As per the School of Intrinsic Compounding, at around $2,700 (2024), India is nearing the discretionary spending inflexion point, where consumers upgrade to higher-quality, higher-value products. Household spending on food has also fallen to less than half for the first time since 1947, signalling a shift toward aspirational consumption. The liquor industry clearly reflects this transition.

The Indian alcohol story has been on a steady growth path. (Image: NDTV Profit)

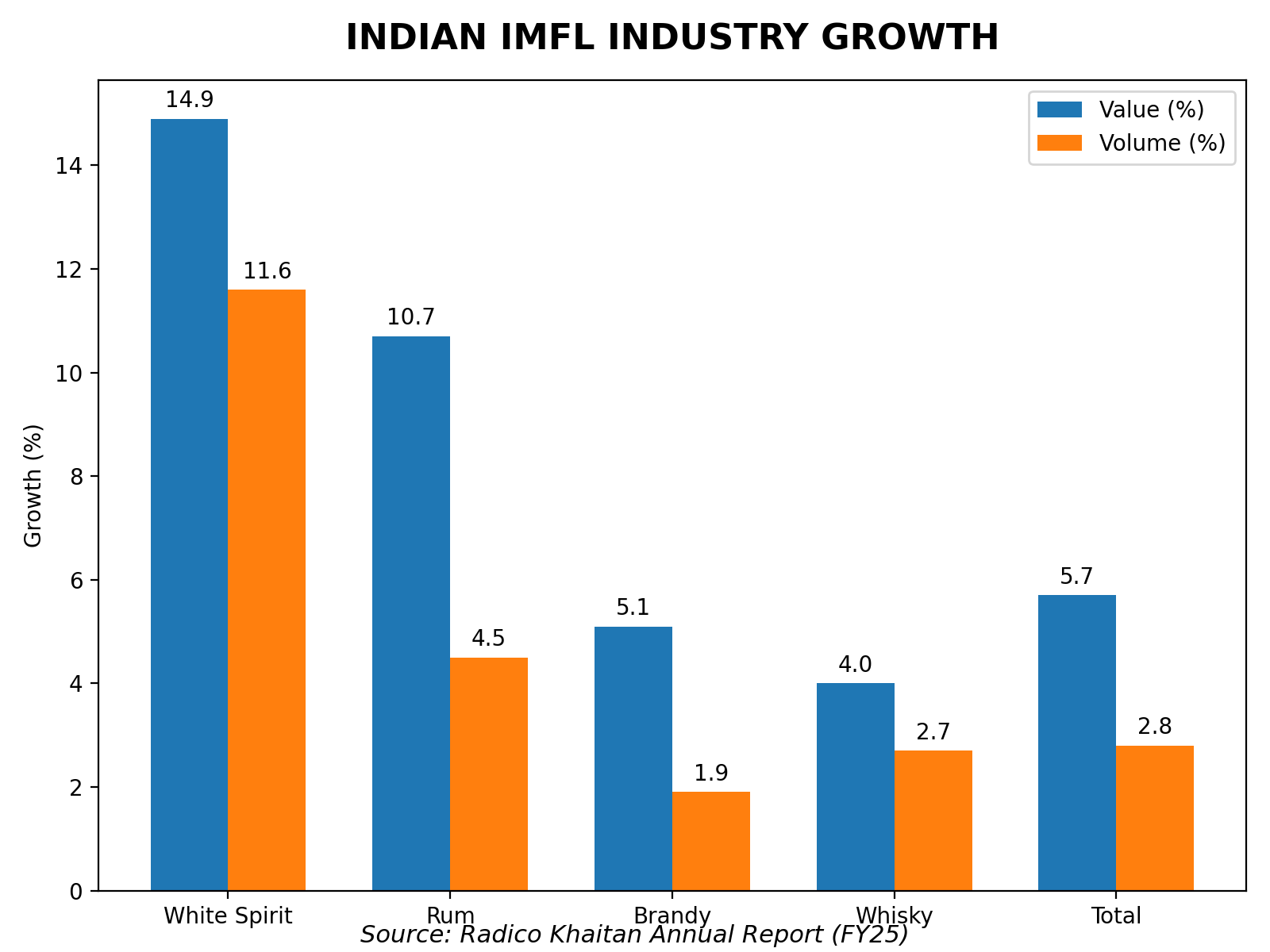

Radico Khaitan notes that the value growth of Indian Made Foreign Liquor (IMFL) at 5.7% is nearly 2x the volume growth of 2.8%. Nuvama estimates that industry value growth (12%) will outpace volume growth (8% CAGR) during FY22-28, driven by a growing drinking population and rapid urbanisation.

Radico Khaitan's premiumisation-led trajectory set the tone for the industry, and other players are now repositioning their portfolio to ride the same wave. Allied Blenders, the company behind Officer's Choice Whisky, has begun repositioning its portfolio to participate in this shift.

How it is attempting this transition is worth examining.

Market Leader In Spirits Market

To begin with, Allied Blenders (ABD) is India's largest domestic spirits company by volume, with a 25-brand portfolio spanning whisky, rum, brandy, vodka, and gin. By revenue, ABD is India's fourth-largest spirits franchise, trailing Radico.

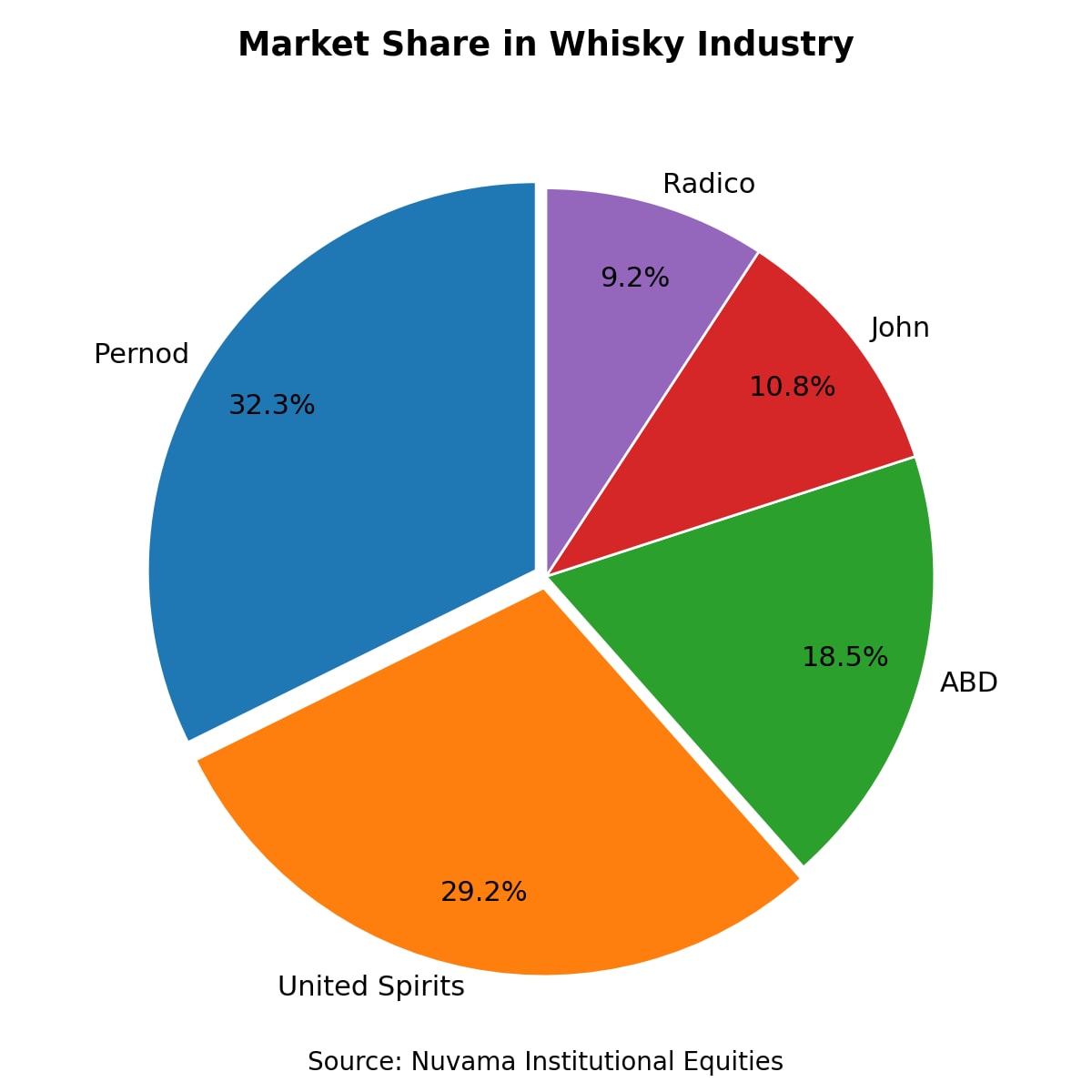

Whisky is the core of the business, accounting for about 80% of sales. In the overall whisky industry, ABD is the third-largest whisky player with 12% market share, trailing Pernod (21%) and United Spirits (19%).

The top players in India's whisky market. (Image: NDTV Profit)

It is also the world's fifth-largest whisky brand and India's largest spirits exporter by volume, with a presence in 30 countries. ABD manages 4 Millionaire Brands and retains leadership in key categories. Its flagship Officers Choice Whisky is India's leading mass-market whisky by volume, with 35%+ market share.

ABD P&A portfolio, priced between Rs 840 and Rs 5,300 per bottle, caters to faster-growing segments. The brand includes Officer's Choice Blue, Sterling Reserve, Srishti Whisky, Kyron Brandy, and Golden Mist Brandy. ABD has also begun building a presence at the super-premium and luxury end through ICONiQ White Whisky, the Arthaus Collective, and Zoya Gin.

Four key brands, including Officers Choice and Blue variant, ICONiQ White, and Sterling Reserve, account for 95% of the 33 million volume in FY25.

Pivot Toward Premium, Luxury and Super-Luxury Segment

The company is strategically reducing its reliance on the low-margin mass-premium segment and shifting focus to the higher-margin P&A portfolio. This shift coincides with a shift in the industry as P&A, with 10% of volume, contributes 42% of profits. As a result, mass-premium volumes are expected to remain subdued, while P&A volumes are expected to scale steadily. This structural shift is already visible.

P&A's contribution to total volumes has risen from 25% in FY18 to 40% in FY25. ABD now targets raising this to 50% by FY28, supported by a broader premium range. Growth in P&A will be driven by new launches, scaling premium brands, entering the luxury segment, and capacity diversification. In the revenue mix, both P&A and mass premium already contribute 47%.

Scaling Premium Brands

Within premium brands, ABD aims to grow its flagship premium brands– ICONiQ White (the world's fastest-growing millionaire spirits brand for two consecutive years) and Sterling Reserve (B7 and B10). ICONiQ White surpassed 5.7 million cases in FY25 and is already one of India's top five whisky brands. Sterling Reserve is also growing rapidly across India.

Entering the Super-Premium and Luxury Segments

To deepen its presence in the luxury spirits market, ABD has launched the ABD Maestro platform in partnership with actor Ranveer Singh (who holds a 20% stake). This vertical houses super-premium offerings such as Zoya Gin and the Arthaus Collective, as well as partnerships with Russian Standard Vodka and acquisitions like Woodburns Contemporary Indian Whisky.

ABD Maestro is expanding strategically into the airport duty-free retail segment (e.g., Bengaluru and Delhi) for its premium brands (Arthaus, Woodburns, Zoya, Pumori, Russian Standard). This will position its luxury brands among high-value consumers. Zoya Gin is the first luxury brand to be exported, with its UAE debut targeted for FY26.

The company also plans to begin exports to Canada and the European Union (EU), for which it has received approval. The expansion-heavy, ABD Maestro vertical, although still loss-making, aims to become EBITDA-positive by FY28. EBITDA stands for Earnings before Interest, Tax, Depreciation and Amortisation.

Beyond whiskey, ABD continues to expand its portfolio across categories such as brandy (Kyron, Golden Mist), rum, vodka, and gin to capture broader premiumisation trends. To accelerate growth, the company plans to focus on key domestic markets and the defence channel.

Domestic Expansion and Export Scale-Up

The company's distribution network spans 30+ states and Union Territories, reaching over 79,000 retail touchpoints. ABD is expanding its presence in key accounts and premium on-premise outlets, targeting 2,000 listings and partnerships with luxury hotel chains such as Taj and ITC.

Expanding into the asset-light export market is also a priority, especially since exports generate 1.3x more profit than the domestic market. Given this margin advantage, ABD plans to expand its global footprint from 30 to about 35 countries by Q4FY26. Exports contributed about 8% (Rs 206 crore, up 15.7% from FY24) of total revenue in FY25, and ABD aims to raise this share to 12–15% over the next few years.

Backwards Integration, UK-FTA, and Premiumisation to Boost Margins

ABD's margin trajectory is supported by three pillars. The first is the ongoing shift to high-margin P&A products. As the premium mix rises, the margin profile is expected to expand. The second is backward integration, which is expected to add around 300 basis points (bps) to gross margins by FY28.

To this end, ABD is investing Rs 525 crores to enhance self-sufficiency, quality control, and cost efficiency. This includes an investment of Rs 260 crore in expanding Extra Neutral Alcohol (ENA) capacity by 6x to 63 million litres per annum (MLPA), from 11 MLPA. This expansion will meet about two-thirds of its ENA needs upon full commissioning in Q4FY27.

The company is also investing Rs 75 crore in establishing India's first Single Malt Distillery (4 MLPA), expected to start operations by FY26 end. This capacity prepares the company for participation in the high-growth, high-margin Indian Single Malt segment. ABD is also investing Rs 115 crores in a captive PET bottle plant (annual capacity of 615 million bottles) in Telangana.

This facility, operational in the second half of FY26, will cover 70–75% of packaging needs and is expected to add about 75 bps to gross margins. The third margin lever is policy-driven. The proposed UK-India FTA is expected to halve import duty on whisky, leading to a 200 bps increase in EBITDA margin from Q4 FY26, as ABD is one of the big importers of bulk Scotch whisky.

These levers are already reflected in the numbers: margins improved from 7.5% in FY24 to 12.7% in FY25, and reached 12.9% in the H1 FY26. ABD targets increasing margins to about 17% by FY28, in line with or above the industry level of 15% and Radico (13.8%). As such, improved premium mix, margin expansion, and operational efficiencies will aid ABD revenue and profit growth.

Premium Mix Lifts Revenue and Accelerates Profit Growth

Financial performance has remained strong. Income from operations has increased from Rs 3,158 crore in FY23 to Rs 3,541 crore, largely driven by growth in the P&A segment. Operating leverage is also visible with the ongoing shift toward premiumisation. Gross margin and EBITDA margin both have widened during the period (check graphics above).

This has translated into a sharp turnaround in profitability, with net profit rising to Rs 195 crore from just Rs 1.6 crore in FY23, supported by margin expansion and lower interest costs. With debt repayments, the company's net debt-to-equity has declined to 0.5x from 1.8x in FY24.

Meanwhile, the Return on Capital Employed has strengthened to 22.6%, up from 4.7% in FY23, reflecting better operating efficiency. ABD plans to increase this to 25% as revenue-mix and profitability improve.

The stock trades at 68x P/E, higher than United Spirits (62x) but at a discount to Radico Khaitan (92x). To conclude, ABD is entering a phase where premiumisation, capacity upgrades, and a richer export mix can improve its profitability trajectory. If ABD sustains this shift, margins and returns may move closer to peers. The market will now look for execution to justify its valuation.

Disclaimer: The views expressed in this article are solely those of the author and do not necessarily reflect the opinion of NDTV Profit or its affiliates. Readers are advised to conduct their own research or consult a qualified professional before making any investment or business decisions. NDTV Profit does not guarantee the accuracy, completeness, or reliability of the information presented in this article.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.