Axis Bank Ltd.'s loan mix will continue to move towards high-yielding segments as the bank does not expect major impact from Reserve Bank of India's tougher norms for unsecured retail loans, according to top brokerages.

The RBI's higher risk weights on unsecured retail loans will not lead to a capital call, HSBC Global Research said citing interaction with the lender's management during an analyst meet. Internal capital accruals should be adequate to provide for solvency or growth capital and recover the loss in capital within a few quarters, the brokerage said.

Axis Bank's focus on high-yielding credit highlights that larger banks with strong capital buffers will be able to absorb higher cost of lending after the central bank raised risk weights on personal loans to contain the surge in the lending. RBI Governor Shaktikanta Das has advised banks and non-bank lenders to take preventive measures to prevent credit "exuberance".

According to Motilal Oswal Financial Services, the private lender has consistently focused on executing its growth, profitability, and sustainability strategy with an aspiration to consistently deliver a return on asset of 1.8% plus and a return on equity of 18%.

Axis Bank reiterated its focus on retailisation of deposits, highlighting that lendable deposits have grown 34% from March 2022 and September 2023, while non-lendable wholesale deposits fell 17%, Jefferies said. The lender's premium on interest rates on term deposits as against large banks has also been reduced, the brokerage said.

What Brokerages Have To Say About The Analyst Meet

HSBC Global Research

The research firm has reiterated its 'buy' rating with a target price of Rs 1,200, implying an upside return potential of 20.1%.

A structural improvement in NIM, growth in high-yielding loans, build-up of granularity in its deposit base, improving fee profile and low credit costs should contribute to a stable medium-term RoA versus peers, HSBC Global added.

Loan growth would remain higher than in industry. The loan mix will continue to move towards higher-yielding segments like small business banking, SME, mid-corporate, higher-yielding retail segments and rural loans.

Deposits remain a key area for the bank, which is focused on improving the share of retail deposits with lower outflow rates.

Axis Bank will continue to focus on building granular, profitable and sustainable businesses, gain market share, and deliver 18% RoE over the medium term.

Axis Bank has been able to retain customers, deposits and wealth management AUM acquired from Citibank India at the levels that were assumed for valuation. Further, the focus is now on materialising synergy benefits.

Jefferies

Axis Bank is Jefferies top pick, as the franchise is getting stronger and the valuation is reasonable.

The research firm has maintained a 'buy' rating with a target price of Rs 1,250, implying an upside return potential of 25%.

Axis Bank reiterated that initiatives to improve deposits are paying off with a ramp-up of wealth clients, corporate salary accounts, and a rise in the share of lendable and retail deposits.

Management showcased that the bank is able to achieve priority sector lending targets through its rural network.

Management reiterated that the partnership with Max Life is in a good place, and the bank is looking to appoint a chairman or more directors on the board besides deepening sales engagement.

While slower deposit growth for the system is a challenge, Axis Bank aims to grow deposits faster with branch expansion, ramp-up of wealth management clients and corporate salary accounts, and customised products for various types of depositors.

The bank also clarified that they see limited impact from the RBI's recent actions on unsecured retail & NBFC loans.

Integration with Citi's card platform is moving well.

Motilal Oswal Financial Services

Motilal Oswal Financial Services has a 'buy' rating on the stock with a target price of Rs 1,150, implying an upside return potential of 15%.

Axis Bank is focused on ramping up Axis 2.0, a fully digital bank within the bank with a comprehensive end-to-end digital solution.

The bank has made heavy tech investments over the past few years to become a digital consumer lending powerhouse.

It further aims to continue the investments to drive scalability and improve its productivity. At present, it has 13 million monthly active users, with average visits per user of 15 times a month.

Macquarie

Macquarie reiterates 'neutral' rating on Axis Bank, with a price target of Rs 980 apiece.

The performance of the Citi portfolio on the deposit and card balances is in line with management expectations.

The cross-selling of products to acquired customers is better-than-expectations. It expects system integration to be completed in 1HFY25.

Citi employee attrition levels are under control, according to the management.

The management said the increase in risk weights would not warrant a capital raise in the near term as internal accruals are adequate to fund organic growth, the brokerage said. "Furthermore, it will increase pricing for personal loans and NBFC loans to compensate for higher weights".

The price increase will not be immediate but will flow over a period of time. "It expects some moderation in growth at the industry level, which is in line with the regulators' intention.

Morgan Stanley

Morgan Stanley maintained a 'overweight' rating on Axis Bank with price target of Rs 1,275 apiece, implying an upside of 28%.

A key focus at Axis Bank over the past three years has been on increasing share of lending segments that have better risk adjusted returns.

The bank continues to work on 70 synergy initiatives across cross-sell (on a wider product base), deepening, sales productivity.

Axis Bank mentioned that trends post Citi integration have been in-line with their expectations.

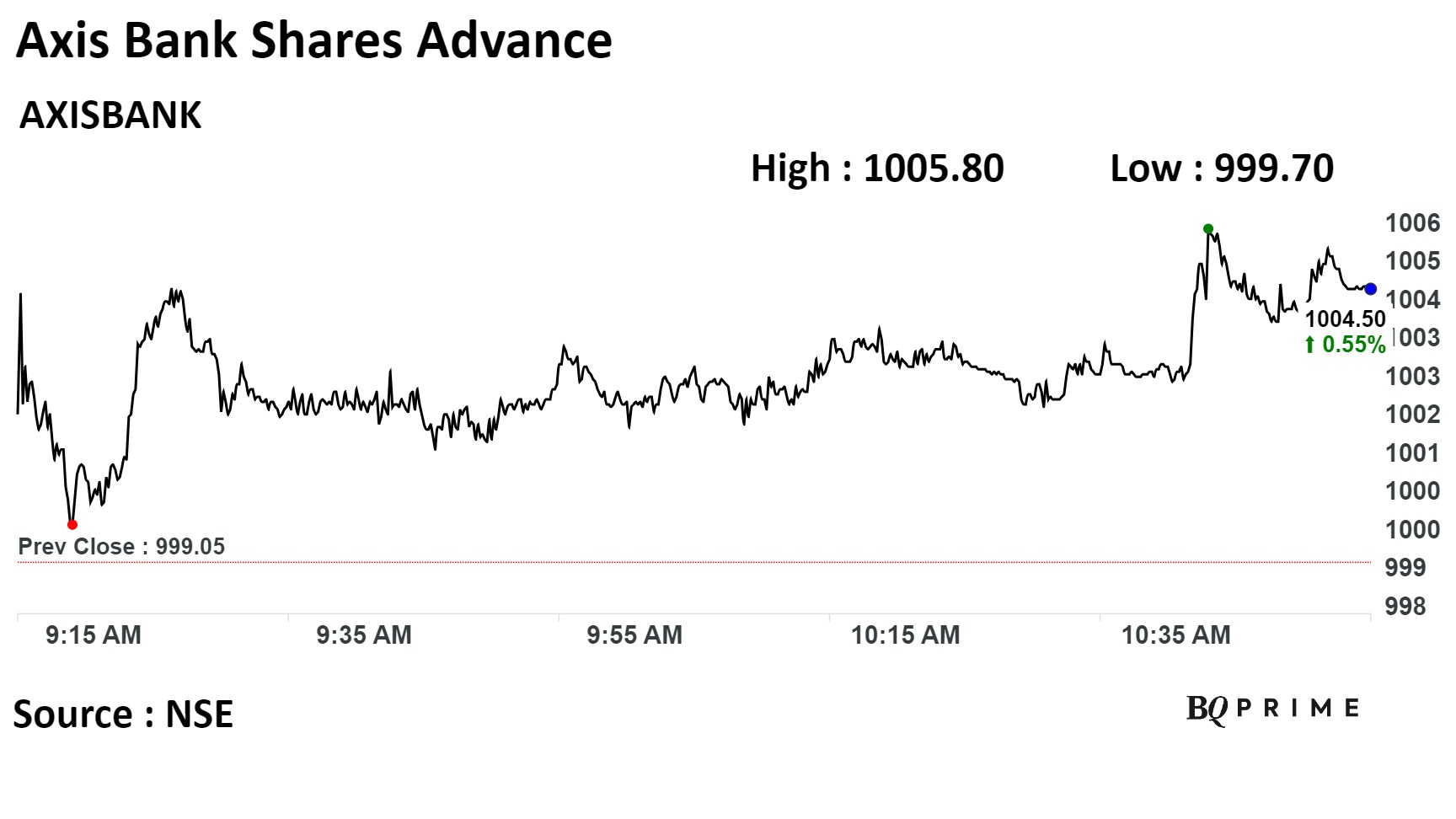

Shares of Axis Bank were trading 0.58% higher at Rs 1,004.85 apiece on the NSE, compared to 0.08% advance in Nifty 50 as of 10:54 a.m.

Forty-five out of the 50 analysts tracking Axis Bank maintain a 'buy' rating on the stock, while five recommends a 'hold', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 18.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.