12_02_2024..jpg?downsize=773:435)

- Axis Bank approved raising Rs 5,000 crore via non-convertible debentures (NCDs)

- The NCDs have a 10-year tenure with a 7.27% annual coupon, rated AAA/Stable

- Bank's net profit fell 24% to Rs 5,090 crore due to one-time provisioning

The board of directors of Axis Bank Ltd. on Wednesday approved plan to raise Rs 5,000 crore through non-convertible debentures.

The company approved the allotment of 5 lakh paid, senior, rated, listed, unsecured, taxable, redeemable and long-term NCDs worth Rs 1 lakh each, the company said in an exchange filing on Wednesday.

The NCDs are rated "AAA/Stable" by Crisil Rating Ltd. and India Ratings & Research Pvt. The tenure for the NCDs has been set at 10 years with a coupon of 7.27% per annum. The interest will be payable annually on Nov. 24 each year till maturity of the debentures, the company added.

This is part of the bank's board-approved Rs 35,000 crore fundraising plan via the issue of debt securities on a private placement basis.

Axis Bank's net profit fell 24% to Rs 5,090 crore - a nine-quarter low. Profit numbers missed the estimate of Rs 5,838 crore, as projected by the analysts tracked by Bloomberg.

Impact on net profit, though, was largely on account of a one-time standard asset provisioning of Rs 1,230 crore.

Provisions and contingencies of the bank surged sharply by 61% to Rs 3,547 crore in the July-September period, compared to Rs 2,204.09 crore in the corresponding period of the last fiscal.

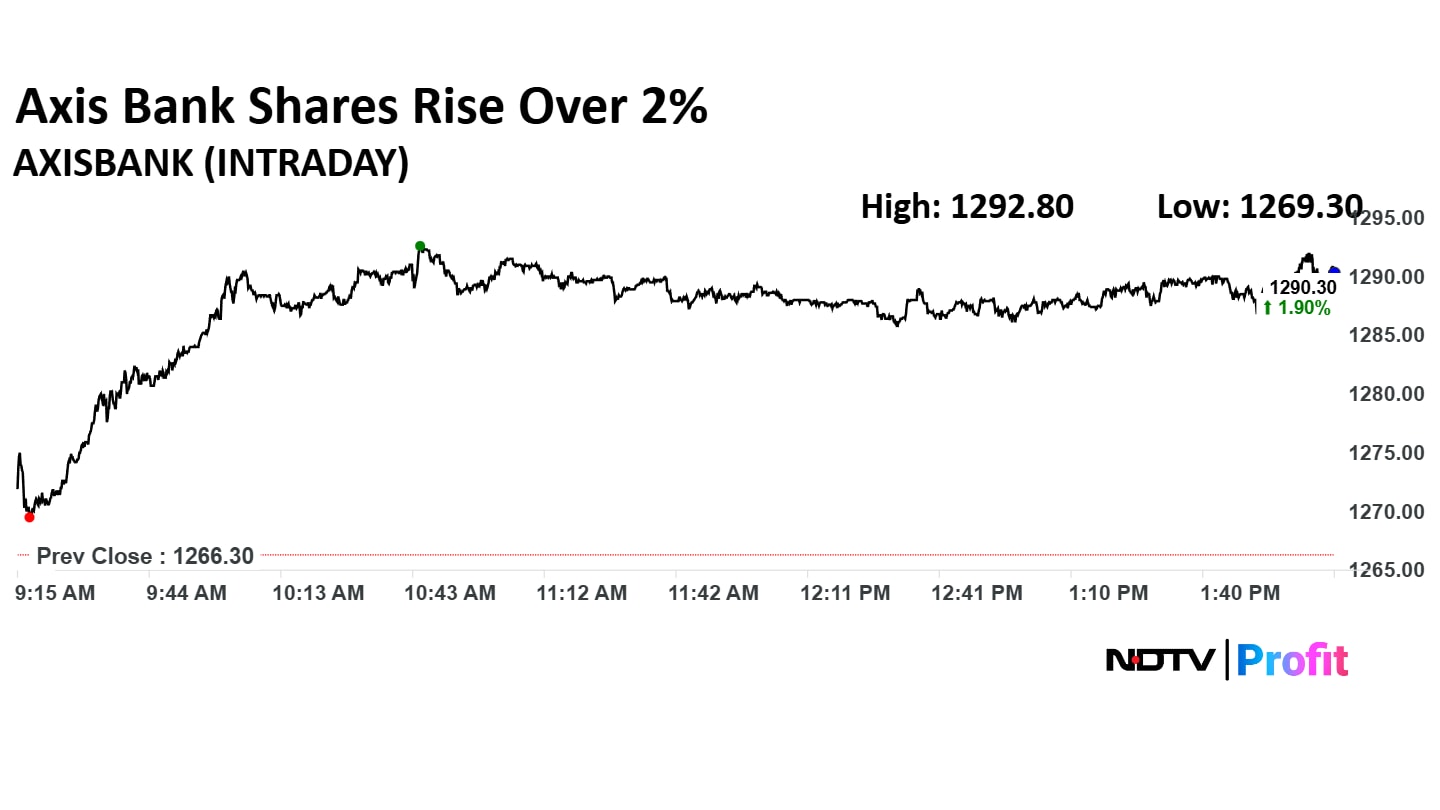

Axis Bank Share Price Today

The scrip rose as much as 2.09% to Rs 1,292.80 apiece on Wednesday. It pared gains to trade 1.83% higher at Rs 1,289.50 apiece, as of 2:08 p.m. This compares to a 1.21% advance in the NSE Nifty 50 Index.

It has risen 12.70% in the last 12 months and 21.19% year-to-date. Total traded volume so far in the day stood at 0.44 times its 30-day average. The relative strength index was at 62.98.

Forty-one out of the 51 analysts tracking L&T have a 'buy' rating on the stock, ten recommend a 'hold'. There are no sell ratings on the counter, according to Bloomberg data. The average of 12-month analyst price targets is Rs 1,356, which implies a potential upside of 11.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.