Aster DM Healthcare Ltd. is to become one of the largest hospital chains in India after completing merger with Blackstone- and TPG-backed Quality Care India Ltd, brokerages said. The merger is expected to close by the third quarter of the financial year 2026.

HSBC Global Research kept a 'Buy' rating on the stock with a target price Rs 550. PL Capital maintained a 'Buy' rating on Aster DM Healthcare Ltd. and raised the target price to Rs 620 from Rs 500.

The merged entity will have a significant rise in bed capacity. HSBC Global Research estimates that the number of beds will be at 10,166. The market presence will increase in Southern and Central India, the brokerage said in a note.

"Both Aster DM and QCIL plan to add 1,900 and 1,600 beds, respectively. Of total bed expansion, 65% will be through brownfield in nature which will be margin accretive."

Aster DM Healthcare currently holds a cash balance of Rs 10,000 crore, which PL Capital deems sufficient to fund its expansion plans. Quality Care's capital expenditure requirements can be comfortably met through internal accruals, the brokerage said in a note on Monday.

There's potential of revenue and mic synergies due to a larger network of best doctors. HSBC sees synergies in procurement costs and corporate overheads due to its large scale.

Varun Khanna will assume the role of the managing director and group chief executive officer.

However, HSBC Global Research seeks better clarity on definite merger synergies which may lead to a notable pick–up in Ebitda margins. The management of Aster DM Healthcare estimates that there'll be 10–15% upside to the operating profit.

"Our pro forma analysis indicates the merger deal should be slightly EPS accretive," HSBC Global Research said. "We wait for deal closure before we can include QCIL financials in our estimates."

PL Capital estimates combined entity will have revenues of Rs 7,300 crore and operating profit of Rs 1,400 crore with occupancy at 65%. The average revenue per occupied bed is seen at Rs 39,100 per day. "Payor mix will stand at 82% cash + insurance while key therapies contributes 52%. Net cash of Rs 560mn as of Q2FY25."

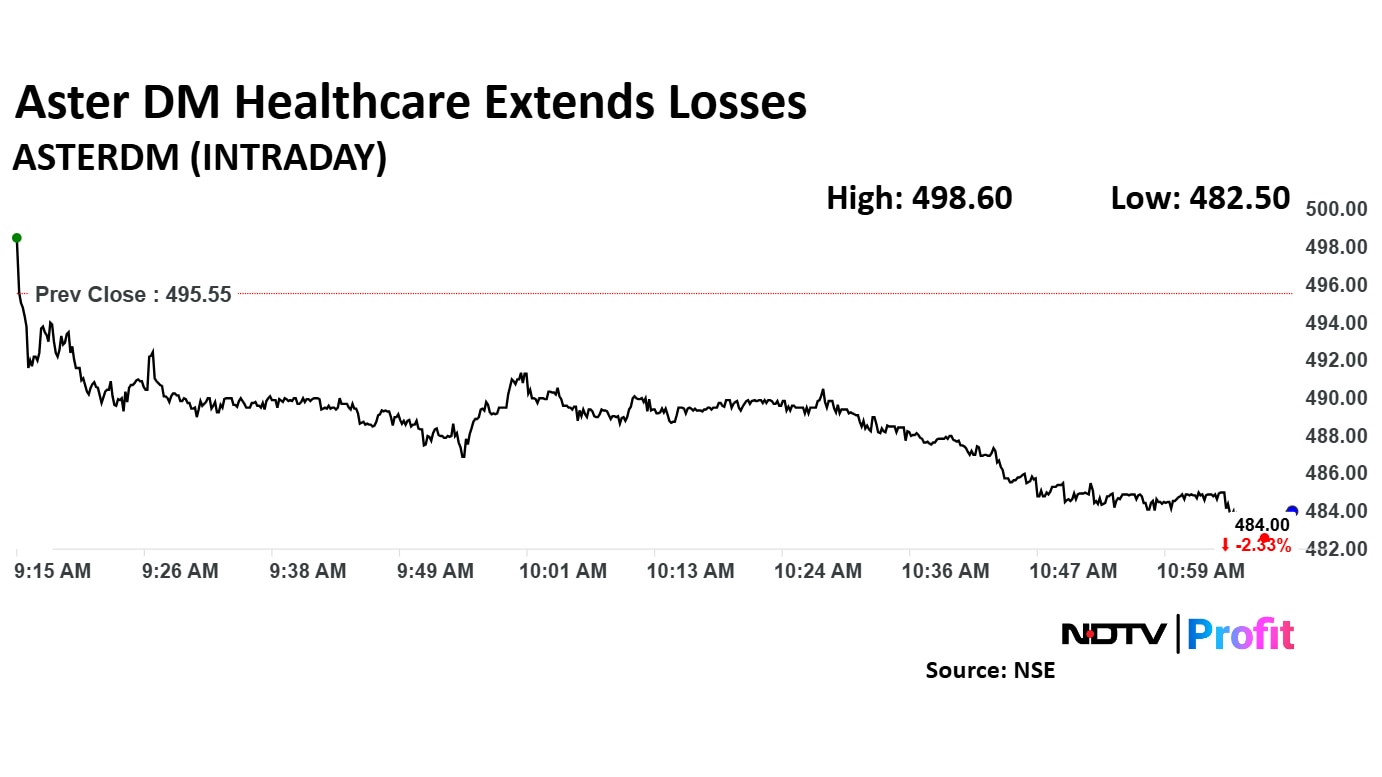

Aster DM Healthcare share price declined 2.62% to Rs 482.55 apiece, the lowest level since Nov. 28, as compared to a 0.59% advance in the NSE Nifty 50 index.

The stock gained 20.41% in 12 months, and 53.2% on year to date basis. Total traded volume so far in the day stood at 0.7 times its 30-day average. The relative strength index was at 66.86.

Out of 10 analysts tracking the company, nine maintain a 'buy' rating, one recommends a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 13.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.