Beyond The Bubble: Indian AI Startups Grow In Their Lane

Most Indian startups are trying to solve unique problems that are sector-specific; and not trying to become the next ChatGPT but building specific products using these large platforms.

Nothing lasts forever, and neither did the much-celebrated AI valuations. After celebrated investor Micheal Burry shorted AI stocks and most other banks became wary of AI-fuelled data centre boom, questions have risen on the survival of the budding AI startups in India. Sector experts insist that Indian startups are building their own niches and there is no shortage of funds coming their way, as yet.

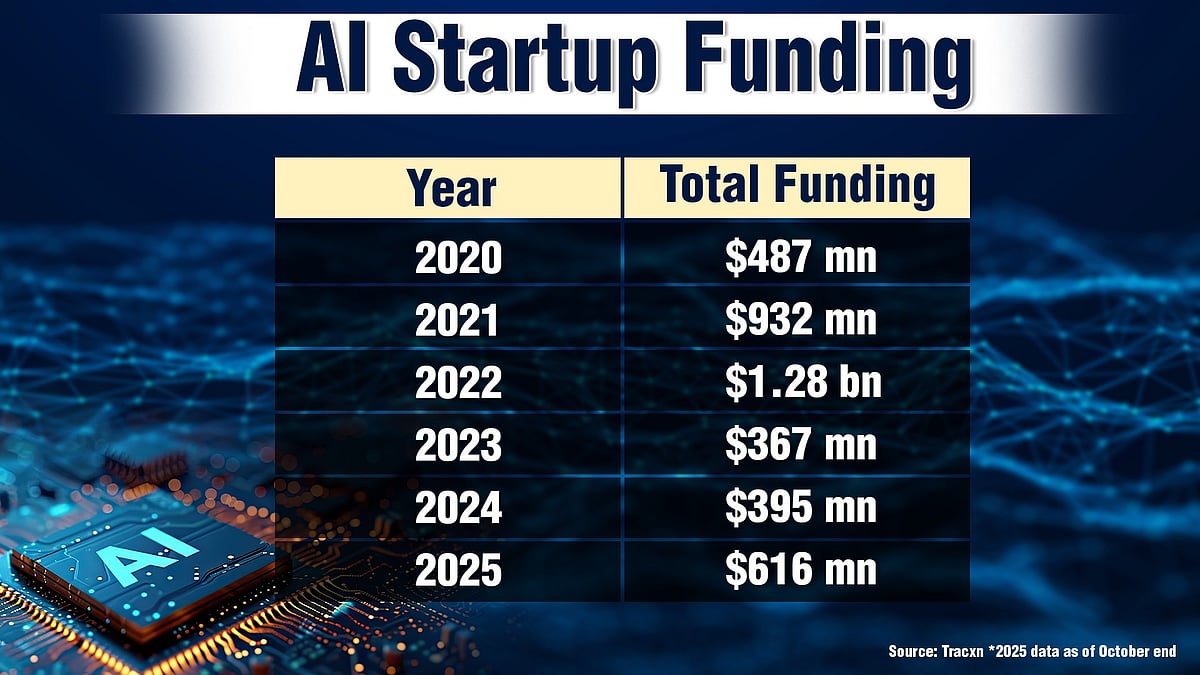

The country has around 1,400 AI startups, as per Tracxn, out of which 451 raised as much as $4.9 billion as of now. Only around 10% of them are in the Series C stage, while around a quarter of them are in Series A. As of now, few of them are reporting drying up or delay in funding.

"A large number of AI startups are between seed to Series A and I do not see funding stopping at least for a year. Some of the founders and investors do feel the bubble, but for the right startups will always receive funding," says Rahul Borude, CEO of StampMyVisa, an AI-based startup which simplifies visa applications.

The VC funding ecosystem has evolved since the last Dotcom bubble that has wiped off billions. "VCs of today have the ability to look through capital market valuations; to take a three-to-seven-year view of companies. If valuations do dip, VCs will see it as an opportunity to buy more," says Bruce Keith, CEO of InvestorAi, which provides AI powered investment advice.

In 2025, the amount of funding that AI startups received almost doubled, as of October this year. Funding to the sector has been steadily growing to Indian AI startups, beyond the 2022 peak cycle.

AI Makes AI (Much) Better

Experts are of the opinion that most AI startups with business-to-business focus especially are not as capital hungry as most other consumer-based startups. For example, those which cater to BFSI, healthcare and more are in a better stead. Of course, there are AI products in the market offering free access, bundled with other products and looking to acquire customers, which would be burning cash.

But a large chunk of B2B companies which work on a model of "improving efficiencies to a client" are closer to revenue. "In the next few years, you will see many companies shift from cost side to revenue side, with newer sales and more products. They are not profitable but are generating revenue. Also, product development cycles are coming down, newer products are seeing even shorter cycles," says Sougata Basu, CEO of Cashrich, a fintech, which uses AI for personalized wealth management and more.

In a rather interesting case of spiralling efficiency, AI itself is helping improve the turnaround time of AI startups. "The buzzword that we hear now is vibe coding where AI is being used to write code," says Keith. Borude, too, agrees that fewer engineers are required these days for AI-based startups nowadays and that the evolution cycle has improved much more quickly.

The Cost Of Creation

Indian AI startups are catching a unique niche where they are not creating products at scale like their international counterparts or using large language models — which are time and cost intensive. Most Indian startups are trying to solve unique problems that are sector-specific; and not trying to become the next ChatGPT but building specific products using these large platforms.

"To give an analogy, Meta and other such large companies are creating energy and AI startups are using that energy to create products for a sector. Depth wins over breadth when it comes to AI startups," comments Borude.

A large number of Indian companies are working in voice AI or automation and solving sector-specific problems using AI.

"There are two types of AI companies — horizontal companies which are not sector specific and vertical companies which are. Startups that focus on vertical AI, deeptech and knowledge based will move up the value chain," opines Keith.

Not all the products that Indian startups are creating are only for the domestic market. In fact, a chunk of them are creating world-class products targeting US clients and more such. The cost of creating a product in India is much cheaper than creating the same abroad, most experts feel.

While the US is an aspirational market, Asia Pacific’s AI pie is growing fast too. As per GlobalData, Asia-Pacific has become the world's largest agentic AI market with $3 billion in 2025 revenue, surpassing North America's $2.6 billion.

"This rapid growth is fueled by government-backed AI missions, manufacturing automation, and widespread deployment in financial services, public sector, and healthcare. China, Japan, India, and South Korea continue to build AI infrastructure at record pace, supported by national LLM programs and emerging AI innovation zones," says a report by GlobalData.

A Fast-Moving Needle

In this fast-evolving industry, however, AI startups also have to keep spending on innovation. "As much as 20% of my cost base is R&D spending," says Bruce. The spending on hardware and more such also adds to it.

Invisible costs could also arise from changing regulations, believes Basu. "For example, if we create a voice agent product for loan recovery, a regulation could arise around that. It doesn’t exist now, but it could come and the cost of compliance adds to it," he points out.

AI startups have large competitors too. Major outsourcing-based tech companies have all started training their employees in AI and are also in the market to bag AI-based deals. Yet, few believe that they’d be any real competition to the startups.

"Startups are nimble and hence have a competitive advantage. From an innovation point of view, a startup can outperform a big company," Basu says.

Indian IT's AI Upgrade

The question, however, remains if India has enough talent to aid large-scale innovation. Most experts believe that we already do. "We have very good talent when it comes to AI and I see many of them upgrading as well too. I know an engineer who took a year to research and learn and transformed into an AI engineer," says Borude.

Large companies are also taking a long hard step towards it. TCS has already committed to train 350,000 employees in generative AI, Infosys has committed to train 250,000 and Wipro has committed as much as $1 billion towards the same.

The wave of GCC and their extensive growth in India will also do its part in creating an AI workforce too. "The rise of GCCs will aid the growth of an awfully large talent pool in India from an international perspective. GCCs drive transformation via adoption of agentic AI," says Keith.