- Supreme Court allowed Centre to reconsider Vodafone Idea's AGR dues up to FY 2016-17

- Relief package can only apply to Vodafone Idea, excluding Bharti Airtel and others

- Bharti Airtel faces AGR liabilities estimated between Rs 40,000 crore and Rs 50,000 crore

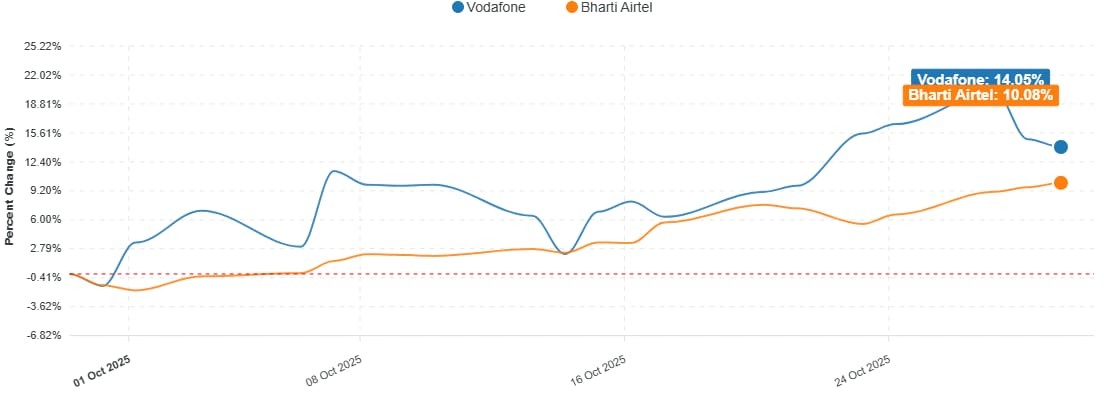

Telecom majors Bharti Airtel Ltd., Vodafone Idea Ltd., and Indus Towers Ltd. have dawn focus after the Supreme Court's judgment on adjusted gross revenue (AGR) dues was made public, with analysts flagging limited room for relief.

The apex court this week allowed the central government to reconsider issues related to Vodafone Idea's adjusted gross revenue dues raised for the period up to fiscal year 2016-2017, offering a potential breather to the debt-laden telecom operator.

The order's Point 7 clarified that any relief package from the government can only be extended to the company and not to other players. This has been viewed as negative for Bharti Airtel, which still faces AGR liabilities estimated between Rs 40,000 crore and Rs 50,000 crore.

For Vodafone Idea and Indus Towers, Point 6 of the order stated that any claim is restricted only to the additional AGR demand raised for the period up to the financial year 2017.

Analysts believe this means even if relief is granted, it would apply only to the newer AGR demand of about Rs 9,450 crore, which represents just 12% of VI's total AGR dues and about 5% of its overall debt.

Market participants said the judgment dims hopes of broad-based relief for the telecom sector, reinforcing concerns around high leverage and regulatory uncertainty.

VI, Airtel One Month Stock Movement

AGR Case

The Supreme Court said that, given the “peculiar facts and circumstances of the case,” there would be no impediment to the Centre reviewing the issue and taking a fresh decision in accordance with law.

The bench clarified that the matter falls within the policy domain of the Union government and that the Court would not interfere in such policy-related considerations. “As per the peculiar facts and circumstances of the case, the Union of India, keeping in view the larger public interest, desires to reconsider the issue. There is no reason to restrain or prevent it from doing so,” the order on Wednesday stated.

In September, the troubled carrier sought a waiver of penalty and interest on adjusted gross revenue demand of Rs 9,450 crore raised by the Department of Telecommunications, contending that a substantial portion of the demand pertained to the pre-FY17 period already settled by the apex court in 2020.

The company argued that the demand goes beyond the scope of the apex court's earlier ruling on AGR liabilities, as per reports. Of the total dues, Rs 2,774 crore pertains to the post-merger Vodafone Idea entity, while Rs 5,675 crore relates to liabilities of the pre-merger Vodafone Group.

The government has become the single largest shareholder in Vodafone Idea after acquiring shares worth Rs 36,950 crore in lieu of outstanding spectrum auction dues in March. Earlier, the government had acquired around 33% stake in 2023 in lieu of statutory dues worth over Rs 16,000 crore.

WATCH | Vodafone AGR verdict explained

Supreme Court's AGR judgement has now been made available.

October 30, 2025

Have telcos been positively impacted? @soumeet_sarkar breaks it down ⬇️ pic.twitter.com/fp1wM6cVuOEssential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.