The Adani Group has added a substantial position in India's cement industry to its vast and growing portfolio of business that began with ports and logistics and now includes energy (conventional to hydrogen), infrastructure, consumer goods, data centres, among others.

Here are seven things to know about the Adani-Holcim $10.5 billion deal announced on May 15.

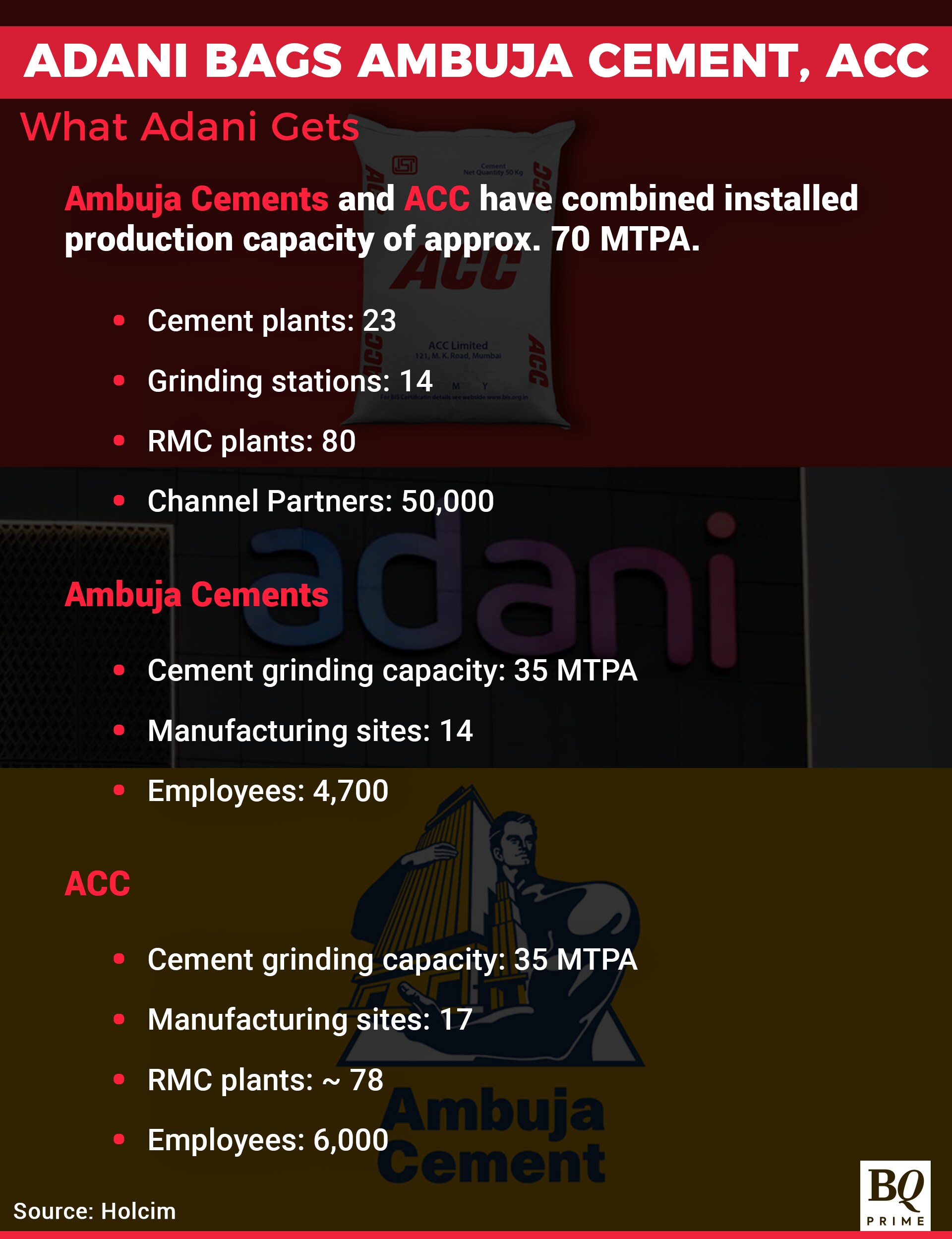

1. Adani Is Now India's Second-Largest Cement Player

The acquisition of Holcim's shareholding in two of India's leading cement companies, Ambuja Cements Ltd. and ACC Ltd., has catapulted Adani's nascent cement plans to almost pole position.

With a combined capacity of 70 million tonnes per annum, the deal puts Adani just behind India's largest cement maker—Aditya Birla Group's UltraTech Cement Ltd.—with a capacity of 120 MTPA.

In its media statement, the Adani Group pointed out that India's per capita cement consumption is 242 kg versus a global average of 525 kg per capital. The growth potential and synergies with other group companies such as logistics, energy and real estate will drive the Adani cement business model, according to the statement. It also mentions "significant capacity expansion".

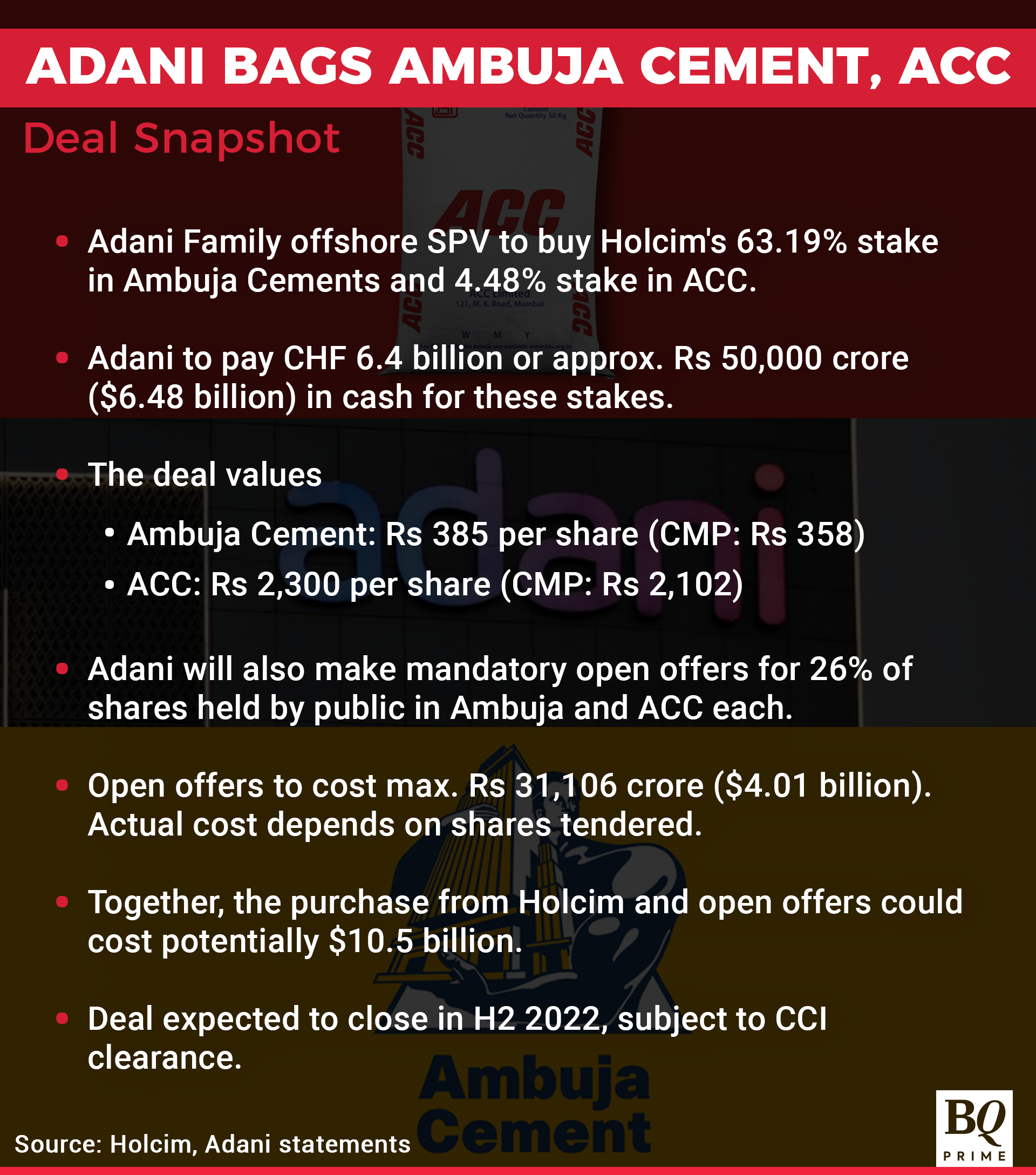

2. The Deal Is Being Done At Premium Valuation

Not only is Adani paying Holcim more than the last traded price of Ambuja Cements and ACC prior to the deal announcement, the enterprise value per tonne also puts this acquisition above all deals done in the past five years.

ADANI TO PAY

By Share Price

For Ambuja Cements: Rs 385 per share (May 13: Rs 358).

For ACC: Rs 2,300 per share (May 13: Rs 2,102).

By EV/Tonne

For Ambuja, ACC: $162 per tonne.

Average deal valuation since 2016: $119 per tonne.

3. Adani Family Needs Big Money To Finance The Deal

The Adani statement offers no detail on how the Adani Family will finance this almost $10.5-billion transaction. All it says is 'Adani Family' is doing the deal via an 'offshore special purpose vehicle'.

The Adani Family SPV will purchase Holcim's 63.11% stake in Ambuja Cements (which owns a 50.05% interest in ACC), and its 4.48% direct stake in ACC for 6.4 billion Swiss Francs in cash, according to a Holcim statement.

According to Indian securities regulations, Adani will have to also provide for the mandatory open offers to public shareholders of the two cement companies.

Deal Cost

Cash to Holcim: Approx. Rs 50,000 crore/$6.5 billion.

Open Offers: Rs 31,000 crore/$4 billion.

"The acquisition is fully funded by way of approved commitments from our relationship banks - Barclays, Deutsche Bank and Standard Chartered Bank - and equity infusion from the Adani family," Gautam Adani said in an interview to Economic Times.

For most deals this size, there is some equity financing, provided by the promoter and sometimes by other investors too, as well as large amounts of debt.

An offshore SPV makes it easier to induct international equity investors such as large sovereign funds and private equity players. It will also facilitate raising loans against shares owned by a promoter, either in their own companies or even in the target companies.

In April, Adani's fortune crossed $100 billion, according to a Bloomberg report. Much of it on account of his shareholding in listed companies such as Adani Ports and Special Economic Zone Ltd., and Adani Green Energy Ltd.

Recently, three Adani group companies raised $2 billion from Abu Dhabi IHC, Bloomberg reported.

Another, less popular, way is a leveraged buyout or LBO that involves raising debt using the target company's assets. Depending on the structure this would require approval of the public shareholders of the two listed companies and hence is a cumbersome route to be used.

4. Regulatory Clearance Should Be A Breeze

A Holcim investor presentation states only one key condition precedent for the deal to close—approval by the Competition Commission of India.

That is unlikely to be a big hurdle as Adani has no cement business of its own. In 2021, it had announced intentions to build a cement facility but that has yet to commence.

This potential regulatory clearance certainty may have helped swing the deal in Adani's favour as all other bidders have small or large cement businesses and would face CCI scrutiny or even strictures.

The open offer announcements will have to be filed with the stock exchanges. And, while shareholders can vote with their feet, that's the only vote they have. The deal requires no shareholder approval in its current form.

5. Ambuja, ACC Shareholders Have Opportunity To Exit At Premium

The direct acquisition of Ambuja Cements and indirect purchase of ACC as well as change in promoter control at both companies triggers mandatory open offers under India's takeover regulations.

Hence, Adani will have to offer to purchase up to 26% of shares held by public shareholders in each of these companies.

Any public shareholder can tender shares if they prefer to exit at the prices being offered—Rs 385 for Ambuja Cements and Rs 2,300 for ACC.

Often market prices climb to open offer prices and that too provides an exit opportunity. Or shareholders can choose to remain invested.

If 26% and more public-owned shares are tendered at both companies, Adani's stake will climb over 89% in Ambuja Cements and 81% in ACC, above the maximum promoter shareholding limit of 75% applicable under Indian laws.

6. Adani Family Could Delist Both Companies If It Wants

To be clear, the Adani statement makes no mention of taking private or delisting either Ambuja Cements or ACC.

That said, recent regulatory changes make it much easier for an acquirer to delist companies, but such intent must be made public at the time of open offer announcement. The process thereafter involves an indicative delisting price at a suitable premium and acquisition of at least 90% of the company's shares.

In this case, Adani would have to run two acquisition-to-delisting processes.

All this requires public shareholder approvals and participation. And will cost a small fortune.

It would also run counter to the group's efforts to list various businesses in the recent past—case in point Adani Wilmar.

7. India Taxman Goes Empty Handed

Holcim began its India journey some 17 years ago in 2005 when it first bought a stake in ACC by investing in an Ambuja Cements holding company. In about a year's time the Swiss major consolidated ownership and control of both companies with a total capacity of approximately 34 MTPA. Now, the business, over twice that size, has returned to an Indian owner.

While Holcim will cash out with 6.4 billion swiss francs, close to 3 times what it originally invested, it will pay no capital gains tax in India on the transaction as the deal is protected under the India-Netherlands treaty.

And earlier version of this story has been expanded to include a seventh point on tax.

Disclaimer: Adani Enterprises is in the process of acquiring a 49% stake in Quintillion Business Media Pvt. Ltd., the owner of BQ Prime.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.