The middle class is rejoicing as Finance Minister Nirmala Sitharaman in her Budget speech on Saturday announced a major revision in income tax slabs and revised the tax rebate limit under the new regime from Rs 7 lakh to Rs 12 lakh.

The announcement has been made in order to leave more money in the hands of the middle class, boosting household consumption, savings and investment. This in turn is expected to accelerate India's economy, which has in recent months slowed down due to consumption issues amid inflation.

According to the government, the new tax slabs and hiked rebate would bring relief to nearly 85% of 7.5 crore taxpayers. With the standard deduction of Rs 75,000, the Budget 2025 announcement effectively means there will be no income tax on earnings up to Rs 12.75 lakh in a year for the salaried taxpayers.

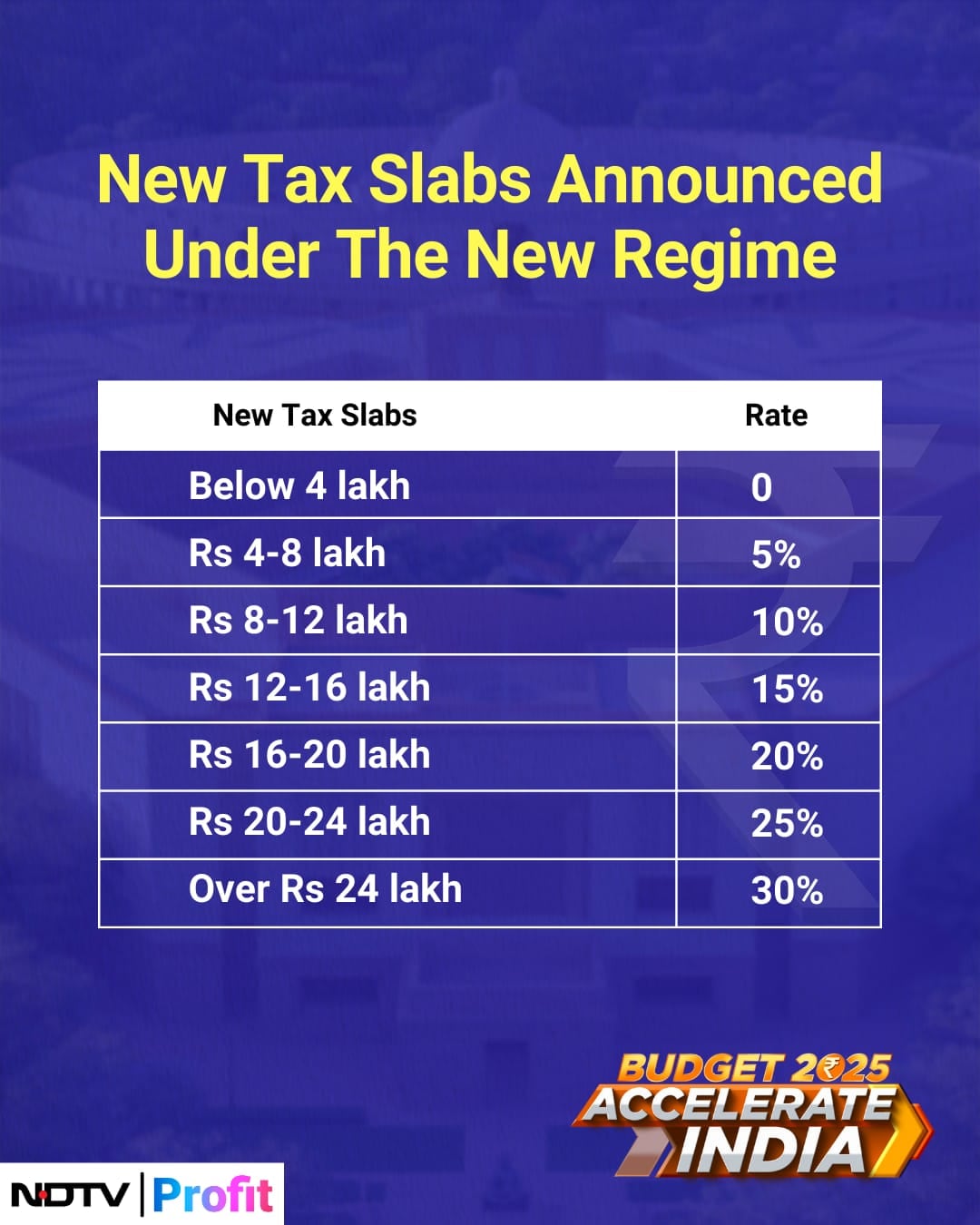

The finance minister has also announced revised tax slabs under the new tax regime, where income up to Rs 4 lakh has been made tax exempt. For incomes between Rs 4 lakh and 8 lakh, a 5% tax will be applicable.

Here are the revised tax slabs under the new tax regime:

The confusion over no tax on income up to Rs 12 lakh

The tax slabs of 5% and 10% for incomes between Rs 4 lakh and 8 lakh, and between Rs 8 lakh and 12 lakh have confused many people. Many have raised questions about the need for 5% and 10% tax rates for the slabs between Rs 4 lakh and Rs 12 lakh if they don't need to pay any tax for incomes up to Rs 12.75 lakh per annum.

However, it's not that simple. As the total non-taxable income is limited to Rs 12 lakh in a financial year, the income tax becomes nil for income up to Rs 12.75 lakh, along with the standard deduction under the new regime. However, the slab rates will be applicable to the full income if the total taxable income exceeds Rs 12 lakh in a year.

Let's understand this with an example:

Suppose your income is within Rs 12 lakh. For the first Rs 4 lakh of your income, you pay no tax. For the next Rs 4 lakh, you pay a tax at the rate of 5%, which amounts to Rs 20,000. For the next Rs 4 lakh, you pay a tax at 10% rate, which amounts to Rs 40,000.

Therefore, the total tax payable is Rs 60,000. However, with rebates and deductions, you will not have to pay any taxes.

“There will be no income tax payable up to income of Rs. 12 lakh (i.e. average income of Rs 1 lakh per month other than special rate income such as capital gains) under the new regime. This limit will be Rs 12.75 lakh for salaried tax payers, due to standard deduction of Rs 75,000,” FM Sitharaman said in her Budget speech.

The tax rebate is being provided on top of the benefit due to slab rate reduction in such a manner that there is no tax payable by them, she added.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.