Finance Minister Nirmala Sitharaman has announced there will now be no income tax payable for up to Rs 12 lakh per annum income under the new tax regime. In fact, up to Rs 12.75 lakh will be exempt with standard deduction.

Sitharaman had last made changes in the new tax regime that was revised in the 2024 Budget. She has revised the income tax slabs in the new income tax regime while presenting the Union Budget 2025 on Feb. 1, today.

According to the latest announcement, there will be no tax imposed on those with income starting from Rs 0 to Rs 4 lakh, 5% tax will be imposed on income between Rs 4 lakh to 8 lakh and 10% tax for income up to Rs 8 lakh to Rs 12 lakh.

There will be 15% tax for income of Rs 12 lakh to Rs 16 lakh and 20% for income of Rs 16 lakh to Rs 20 lakh. There will be a 25% tax on income of Rs 20 lakh to Rs 24 lakh. Any income above Rs 24 lakh will be taxed at 30%.

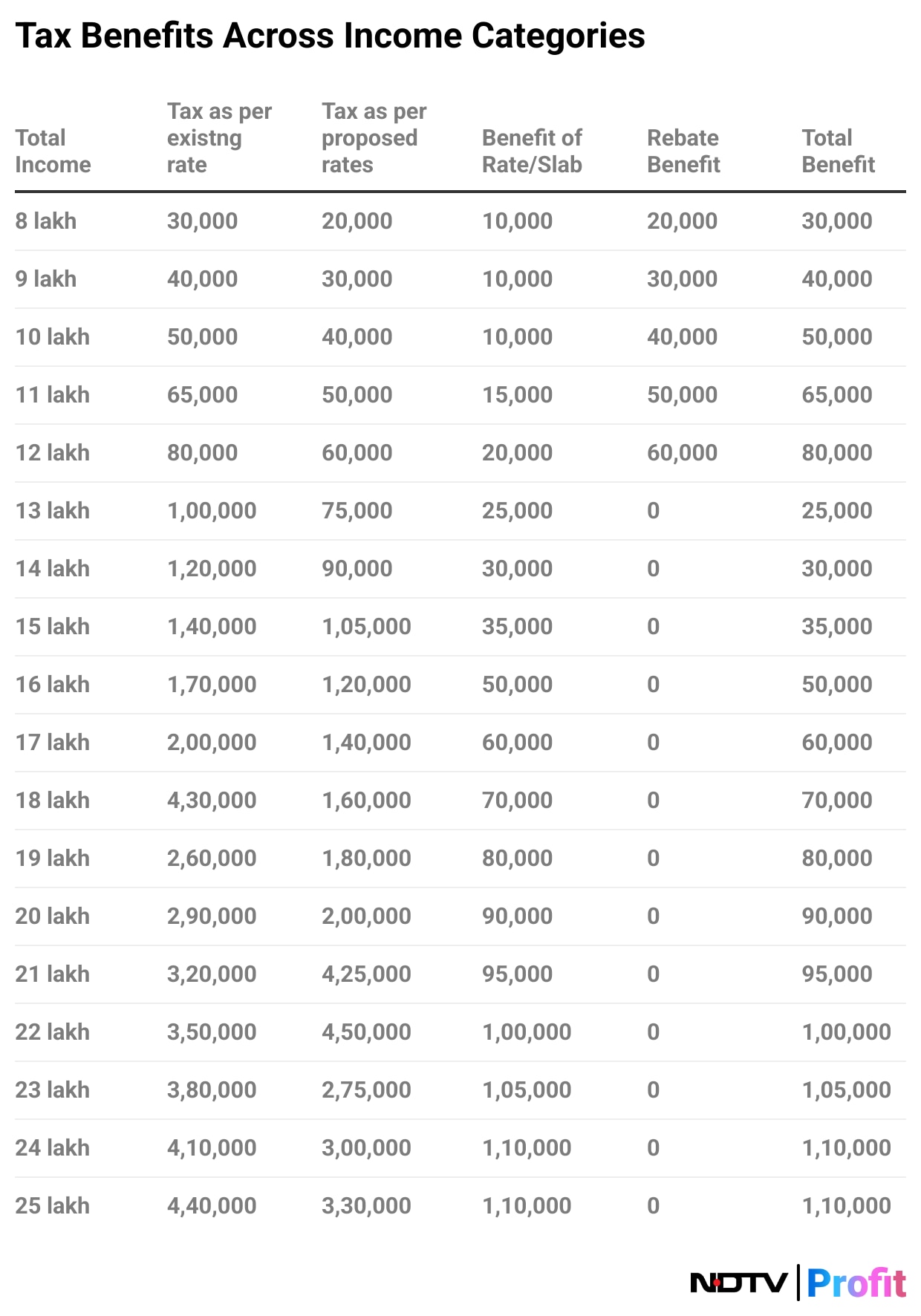

The benefit is set to trickle down across the various income categories. Earlier, the limit of income for 0 income tax payment was Rs 7 lakh. The government has said the increase in this limit will be benefitting around one crore assessees who were earlier required to pay tax varying from Rs 20,000 to Rs 80,000. They will now be paying nil tax. Here's the table that breaks down the tax benefit of each income category of tax payers:

Check by how much you will benefit from the new income tax regime after the announcements made by FM Sitharaman in her Budget 2025 speech.

"Ear on the ground and finger on the pulse, the objectives of proposal is special focus on middle class. Extend current deadline to update income tax returns from two to four years," she said.

Withdrawals from the NPS will be exempt for withdrawals made on or after August 2024. There will be similar treatment for NPS Vatsalya as well.

One other notable announcement is the new Income Tax Bill, aimed at simplifying tax compliance, set to be introduced next week, according to Sitharaman.

New income tax bill will be clear and direct, close to half of the present bill, simple to understand and will have reduced litigation, the finance minister said.

Budget 2024: Previous Changes

In Budget 2024, the standard deduction under the old tax regime was increased from the earlier Rs 50,000 to provide relief for income tax payers. Notably, the provision of rebate on tax was increased to Rs 75,000. The limit for family pensioners was also raised from Rs 15,000 to Rs 25,000.

The deduction limit on an employer's contribution to the National Pension System, also known as the NPS, was also increased in July 2024. The limit was earlier set at 10% and this was raised to 14%.

One other significant change in Budget 2024 was around the capital gains tax. The tax rate for short-term capital gains or STCG was increased from the earlier 15%. The short term taxation rate was raised to 20%. The tax rate for long-term capital gains or LTCG was set at 10% earlier, but this was increased to 12.5% by Budget 2024.

The LTCG exemption limit on equity investments had also been increased from Rs 1 lakh to Rs 1.25 lakh. These changes in the taxation of capital gains were taken up to encourage long-term holding by investors.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.