During the Union Budget 2025 presentation, Finance Minister Nirmala Sitharaman announced that salaried taxpayers earning up to Rs 12 lakh will now be exempt from income tax under the new tax regime. This marks the biggest tax relief for India's middle class since 1997.

Presenting her eighth Union Budget on Feb. 1, Sitharaman unveiled a slew of direct tax reforms, with the most significant being an increase in income tax rebates. The rebate threshold extends up to Rs 12.75 lakh, factoring in standard deductions, providing much-needed relief to salaried professionals.

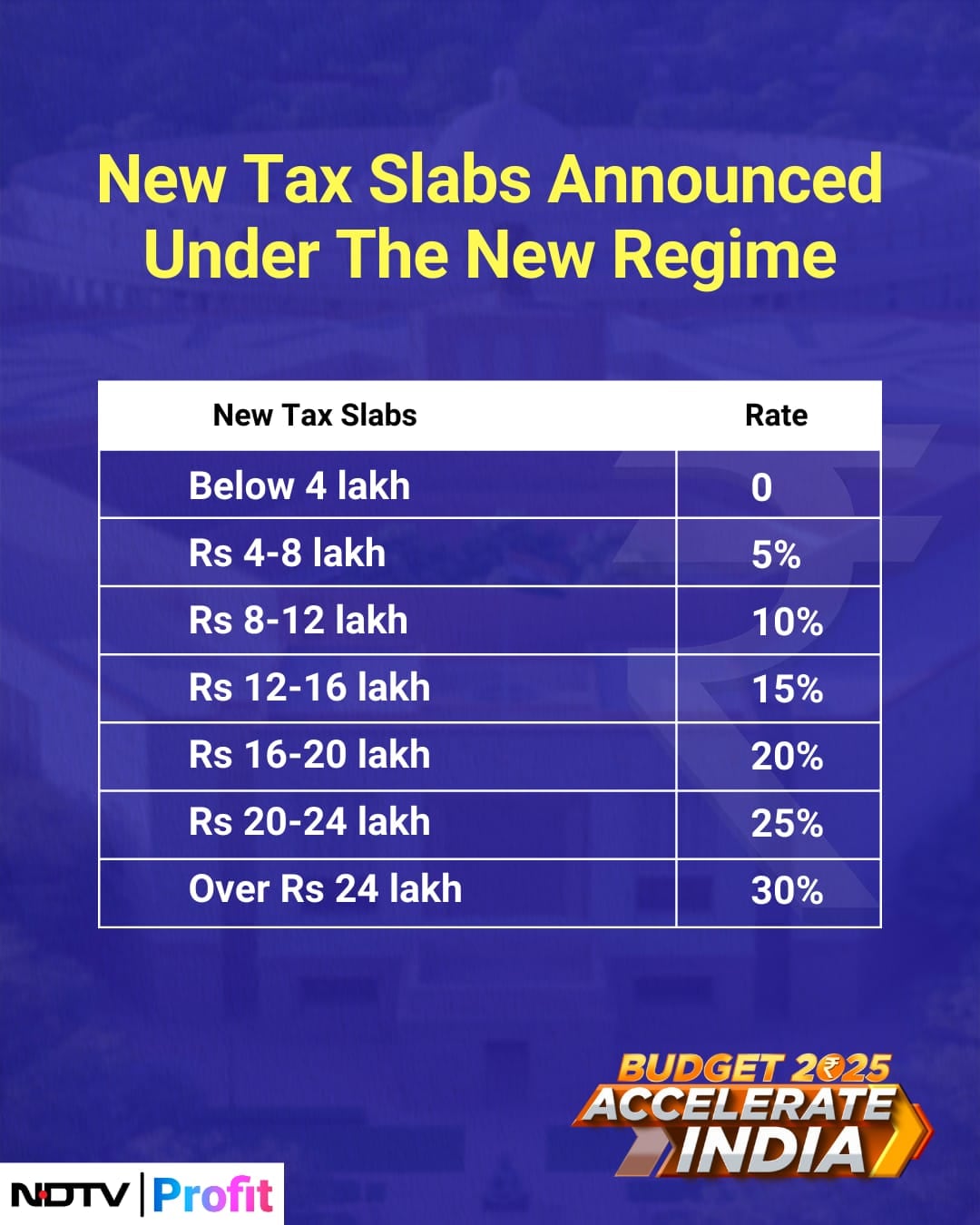

Here are the updated tax slabs for salaried taxpayers:

Read The Full Text Here

Personal Income Tax reforms with special focus on middle class. Democracy, Demography and Demand are the key support pillars in our journey towards Viksit Bharat. The middle class provides strength for India's growth. This Government, under the leadership of Prime Minister Modi, has always believed in the admirable energy and ability of the middle class in nation building. In recognition of their contribution, we have periodically reduced their tax burden.

Right after 2014, the ‘Nil tax' slab was raised to Rs 2.5 lakh, which was further raised to Rs 5 lakh in 2019 and to Rs 7 lakh in 2023. This is reflective of our Government's trust on the middle-class tax payers. I am now happy to announce that there will be no income tax payable up to income of Rs 12 lakh (that is, average income of 1 lakh per month other than special rate income such as capital gains) under the new regime. This limit will be Rs 12.75 lakh for salaried tax payers, due to standard deduction of Rs 75,000.

Slabs and rates are being changed across the board to benefit all taxpayers. The new structure will substantially reduce the taxes of the middle class and leave more money in their hands, boosting household consumption, savings and investment.

A tax payer in the new regime with an income of Rs 12 lakh will get a benefit of Rs 80,000 in tax (which is 100% of tax payable as per existing rates). A person having income of Rs 18 lakh will get a benefit of Rs 70,000 in tax (30% of tax payable as per existing rates). A person with an income of Rs 25 lakh gets a benefit of Rs 1,10,000 (25% of his tax payable as per existing rates).

Details of my tax proposals are given in the Annexure 161. As a result of these proposals, revenue of about Rs 1 lakh crore in direct taxes and Rs 2,600 crore in indirect taxes will be forgone. Mr. Speaker Sir, with this, I commend the budget to this August House. Jai Hind.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.