The Indian government is expected to tread on the path of fiscal consolidation, despite continuing the spend on subsidies and welfare programmes at the pre-Covid-19 pandemic levels, Goldman Sachs said ahead of the upcoming Union Budget 2025-26.

The central government's fiscal impulse, however, will remain a drag on growth in fiscal 2026, the global brokerage said on Monday. "We continue to believe the fastest growth pace in public capex is behind us, and we expect capex to grow at or below nominal GDP growth rates from here on."

The upcoming budget, according to Goldman Sachs, will also likely make an overarching statement about long-term economic policy of the government towards 2047, which will mark 100 years of Indian independence.

"We see continued emphasis on job creation through labour-intensive manufacturing, credit for MSMEs, promoting rural housing programs, and sustained focus on domestic food supply chain and inventory management to control price volatility," it said.

Goldman Sachs, in its note, answered five key questions on Budget 2025. Here's a look:

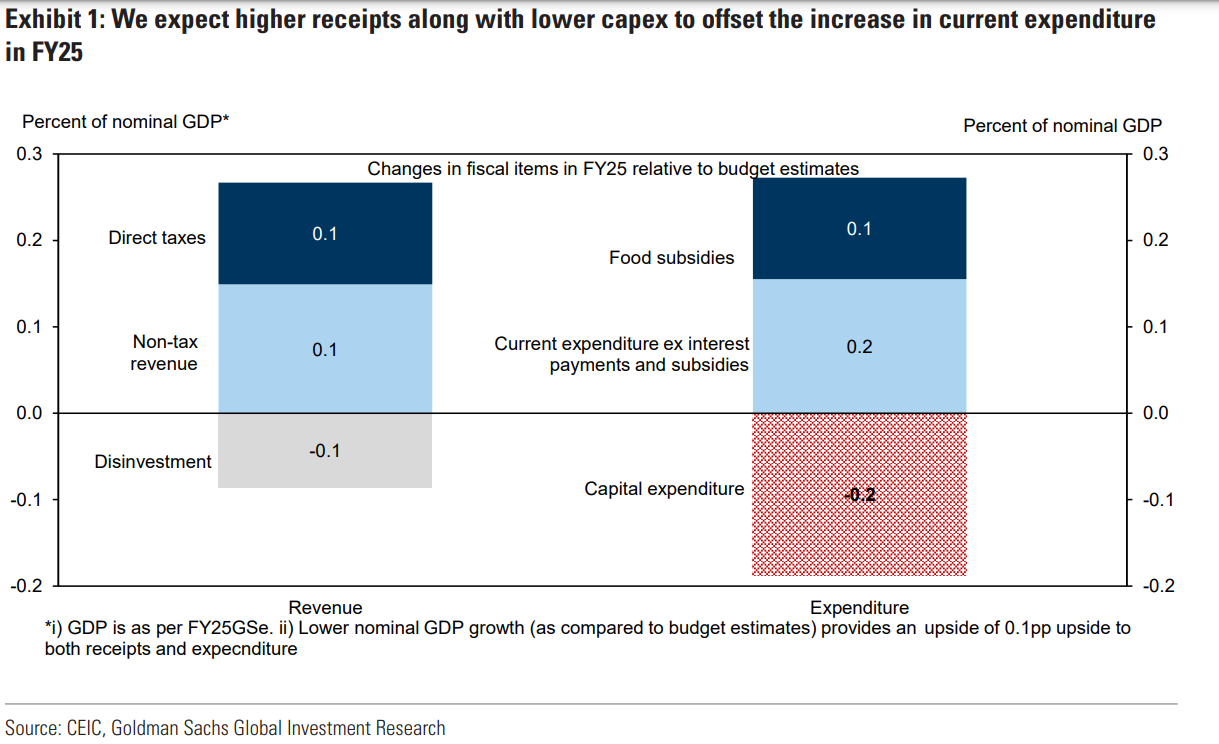

1. Will the government meet the 4.9% of GDP fiscal deficit target in FY25?

"Yes, receipts upside of 0.2% of GDP and lower-than-budgeted capex will likely enable the government to meet the fiscal deficit target despite lower nominal GDP growth," Goldman Sachs said.

The upside will be driven by higher income tax collections and non-tax revenues from "higher than budgeted dividends from the RBI and state-owned companies", the note stated. This should offset the shortfall from corporate taxes and excise collections, it added.

2. How much fiscal consolidation is likely in FY26?

"We think the government will try to consolidate the fiscal deficit towards 4.4% to 4.6% of GDP (with 4.5% of GDP as our base case) in FY26," Goldman Sachs said.

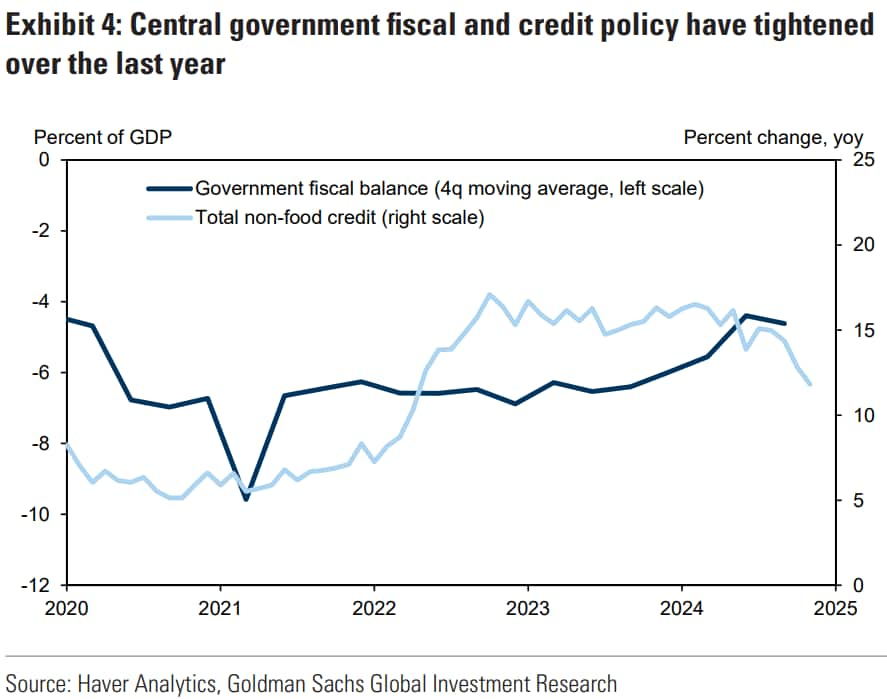

The fiscal deficit was consistently lower throughout much of calendar year 2024, but this resulted in a "drag on growth", the note stated. It further claimed that the slowdown in GDP growth in the second quarter of fiscal 2025—which fell to a nearly two-year low of 5.4%—was "mainly driven" by by fiscal tightening and macro-prudential tightening by the RBI to curb unsecured lending growth.

3. Why is fiscal consolidation important?

Answering this question, Goldman Sachs explained that fiscal tightening is necessary to bring down India's general government debt, which "remains higher than most" of its emerging market peers.

"Based on our estimates, a reduction of general government fiscal deficit by 1pp to ~7% of GDP by FY30 from FY25 with a nominal GDP growth of ~11% would eventually reduce the general government debt to below 80% of GDP," the global brokerage said.

Thus, to maintain a sustainable and declining debt trajectory over the medium term, it is imperative that the Union government sticks to its path of fiscal consolidation, it added.

Notably, the fiscal deficit had peaked to 9.1% in fiscal 2021, in the aftermath of Covid-19 pandemic, as the government's current spending peaked to mitigate the economic impact of the pandemic. Over the last fours years, however, the government has tightened the deficit.

4. What are likely to be the spending priorities in FY26?

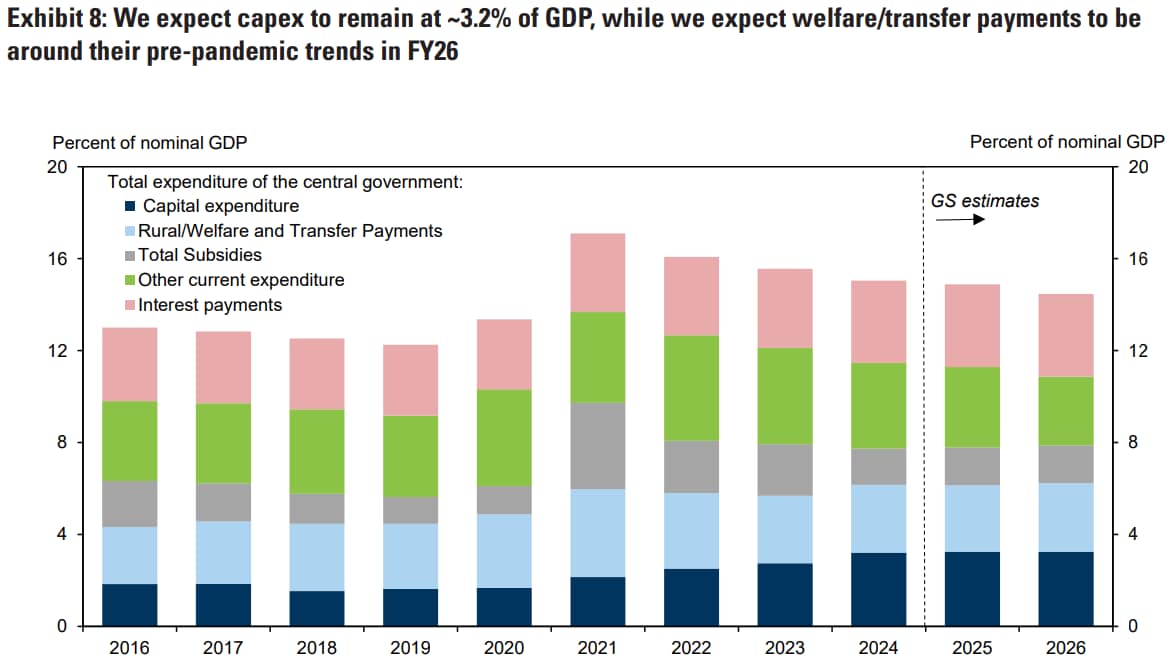

Goldman Sachs expects expenditure on "rural, welfare, transfer schemes and subsidies", to be around their pre-pandemic trends, which is about 3% of GDP in fiscal 2026.

"Given the reduced majority of the NDA (National Democratic Alliance) in the 2024 elections, there might be some re-allocation in expenditure towards rural transfers and welfare spending," it said.

Capital expenditure in fiscal 2026 is expected at 3.2% of the GDP, which could imply a 13% year-on-year growth, as per the note.

The estimated capex growth of 13% is slower from "over 30% in FY21-24", Goldman Sachs said, while explaining that there might be a "tilt towards welfare expenditure or transfer payments".

Total subsidies include PM housing scheme and PM Free electricity scheme.

Source: CEIC, Goldman Sachs Global Investment Research.

5. Will the RBI be a net buyer in the government bond market in fiscal 2026?

"Although we expect demand for government bonds to remain adequate in FY26, in a policy rate easing cycle, we believe the RBI may end up being a net buyer of government bonds in FY26 to infuse liquidity in the system to offset some of the drag from fiscal tightening," Goldman Sachs said.

As per the note, the overall issuance for the central and state governments in fiscal 2026 is expected to be around Rs 19 lakh crore.

In order to fund the central government's fiscal deficit of an estimated Rs 16 lakh crore in fiscal 2026, "we estimate net market borrowing of ~INR 11tn (Rs 11 lakh crore)", it said. For the state governments, Goldman Sachs assumes 70% of fiscal deficit in fiscal 2026 to be financed by market loans.

On the demand side, it expects bond purchases by banks, insurance companies and provident funds to continue given lower credit growth and robust assets under management growth in both insurance companies and provident funds.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.