Finance Minister Nirmala Sitharaman presented Modi 3.0's first full year budget on Feb. 1, 2025.

The budget provided income tax breaks expected to boost consumption, along with continuing fiscal targeting and consolidation.

“The budget gives a simultaneous boost to the government's steadfast record of post-pandemic fiscal discipline, while also addressing the slump in urban consumption by offering income tax concessions to the middle class, while retaining the broad focus on capex, manufacturing, and exports," said Aurodeep Nandi, India Economist, Nomura.

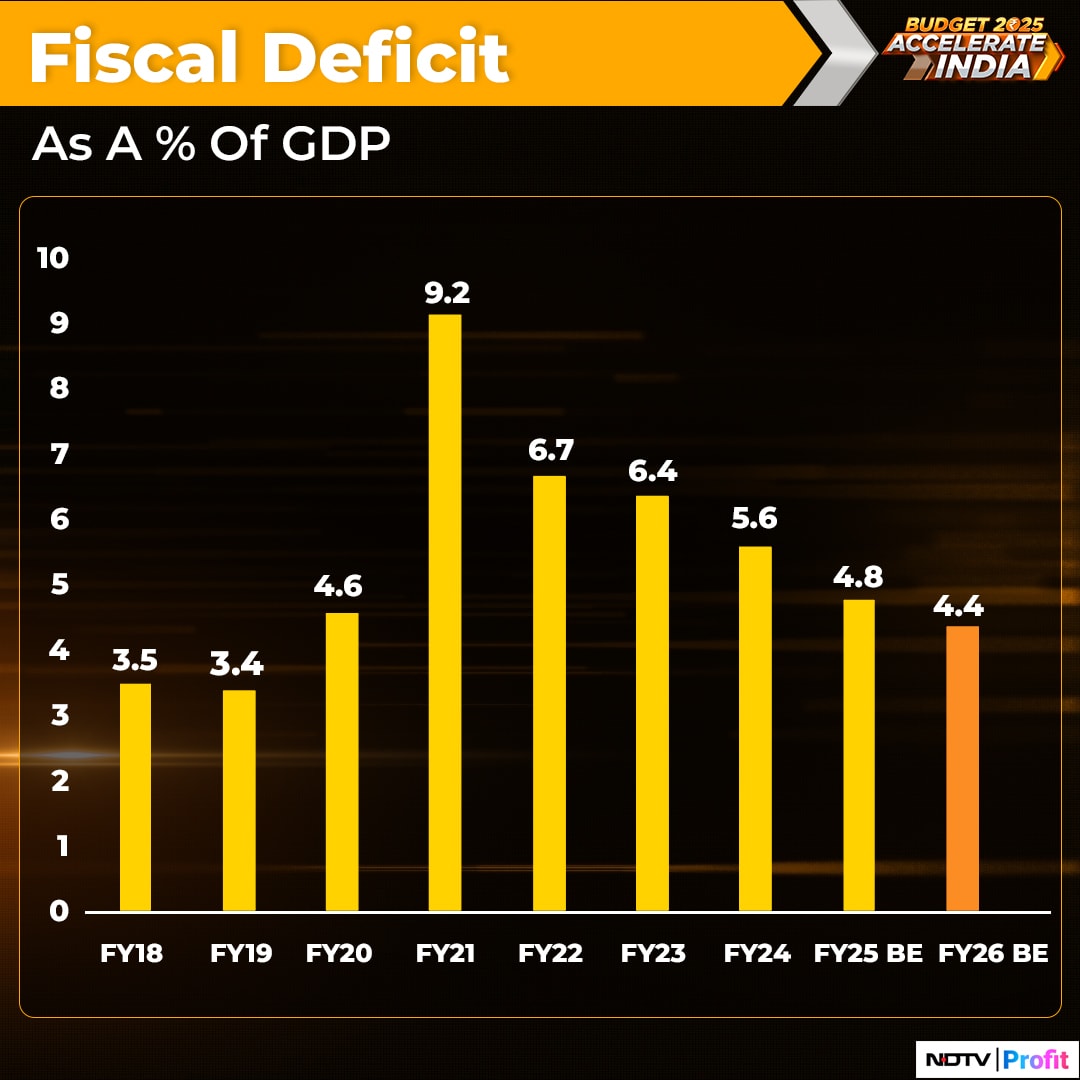

The fiscal wizardry of the numbers has helped cut fiscal deficit from 4.8% of GDP in FY25 to 4.4% of GDP in FY26, while simultaneously announcing income tax concessions and retaining a decent public investment outlay, he said.

Fiscal Deficit: Consolidation Continues

The union government will target a fiscal deficit of 4.4% of the GDP in the next fiscal, Finance Minister Nirmala Sitharaman announced in her budget speech on Saturday.

For the current financial year, the government has slightly revised the target downwards to 4.8% of the GDP, compared to a revised target of 4.9% in the budget in July. This, too, was lower than the target of 5.1% set in the interim budget. The lower than previously targeted fiscal deficit for FY25 was on account of a slowdown in spending, led by lower government capex.

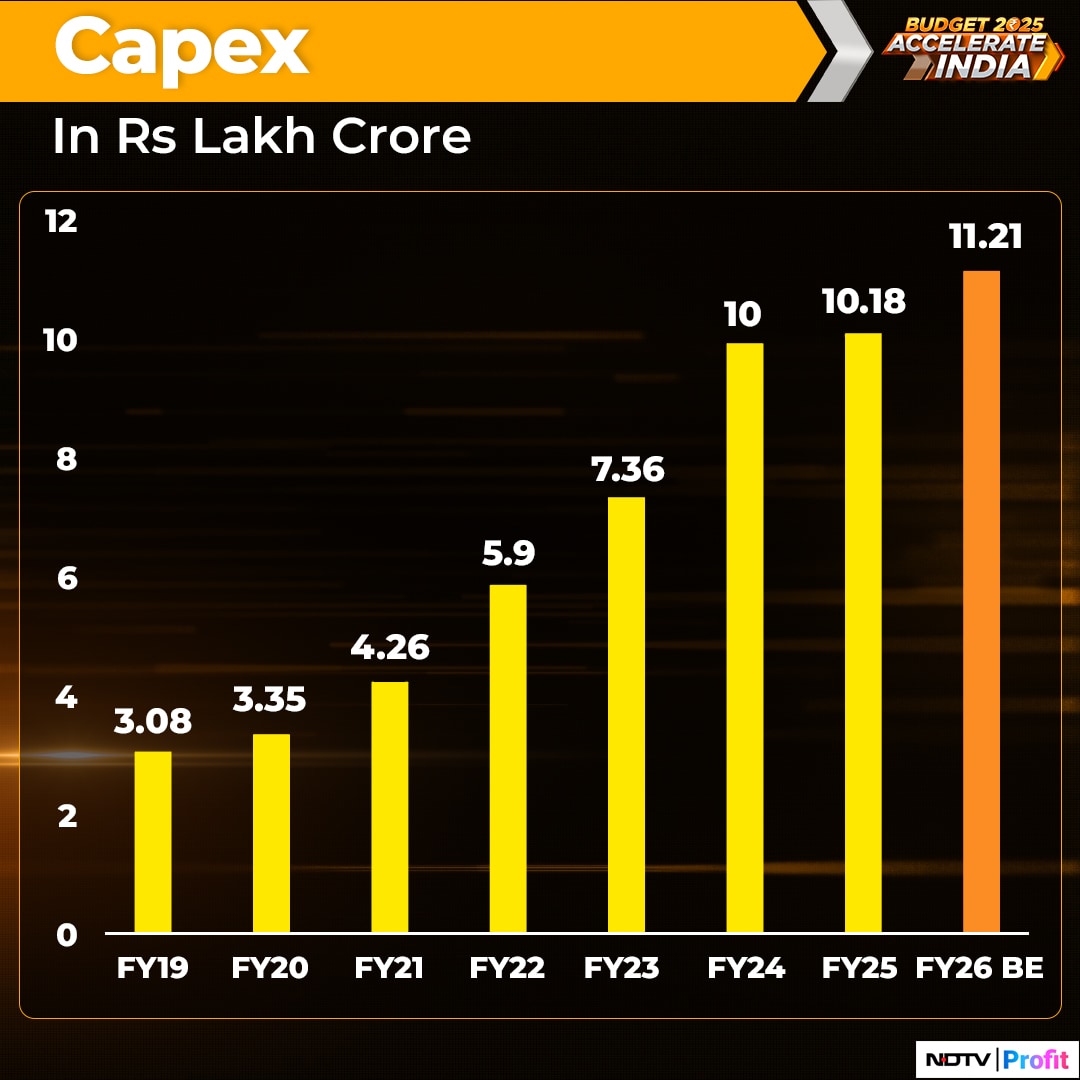

Capital Expenditure: Growing At A Slower Pace

Capex outlay for FY26 was set at Rs 11.2 lakh crore, while the target for FY25 was revised to Rs 10.2 lakh crore from Rs 11.11 lakh crore.

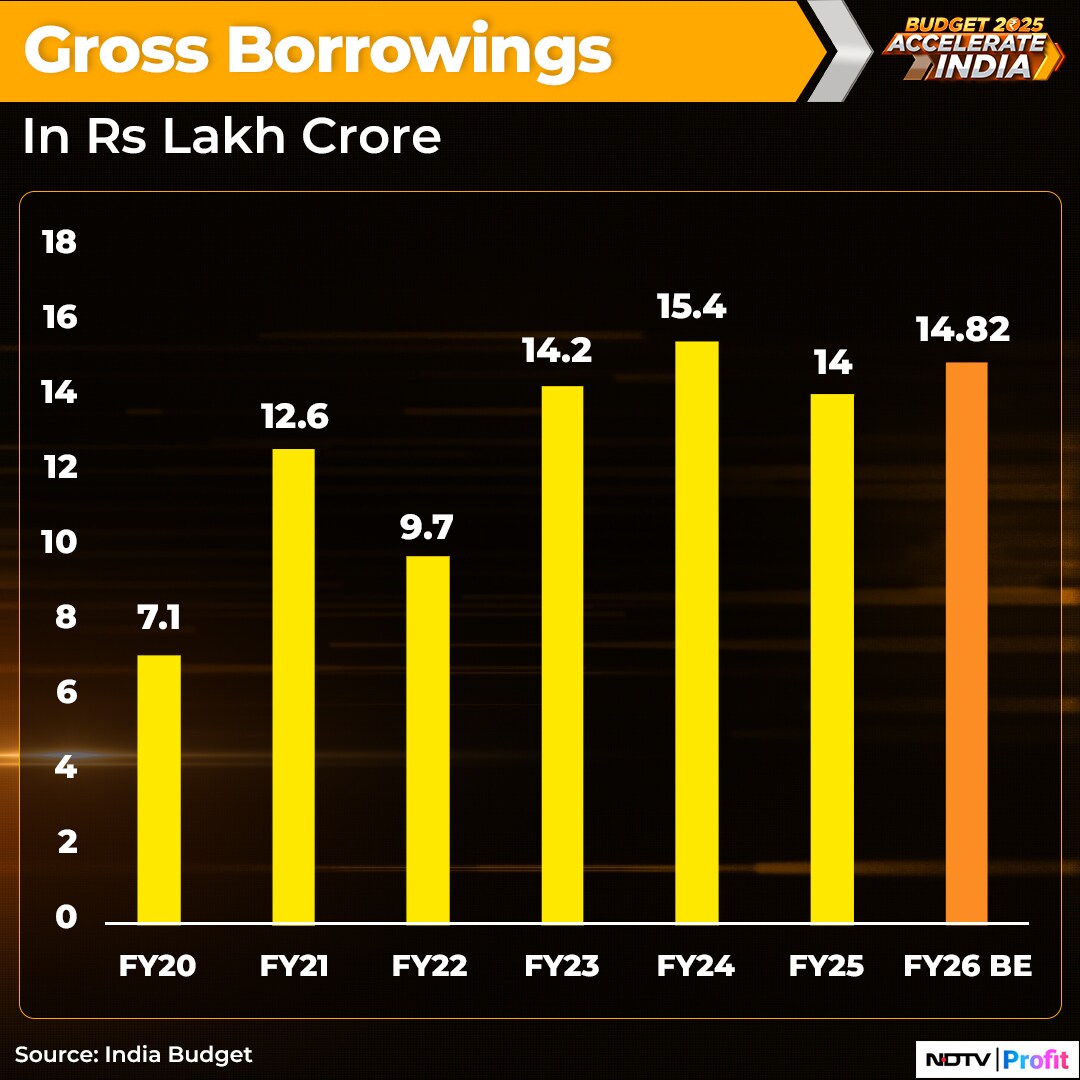

Gross Borrowings

For FY26, gross borrowings are pegged at Rs 14.82 lakh crore, modestly higher than Rs 14.13 lakh crore as estimated for FY25, likely due to the larger amount of repayments this year. To finance the fiscal deficit, the net market borrowings from dated securities are estimated at Rs 11.54 lakh crore.

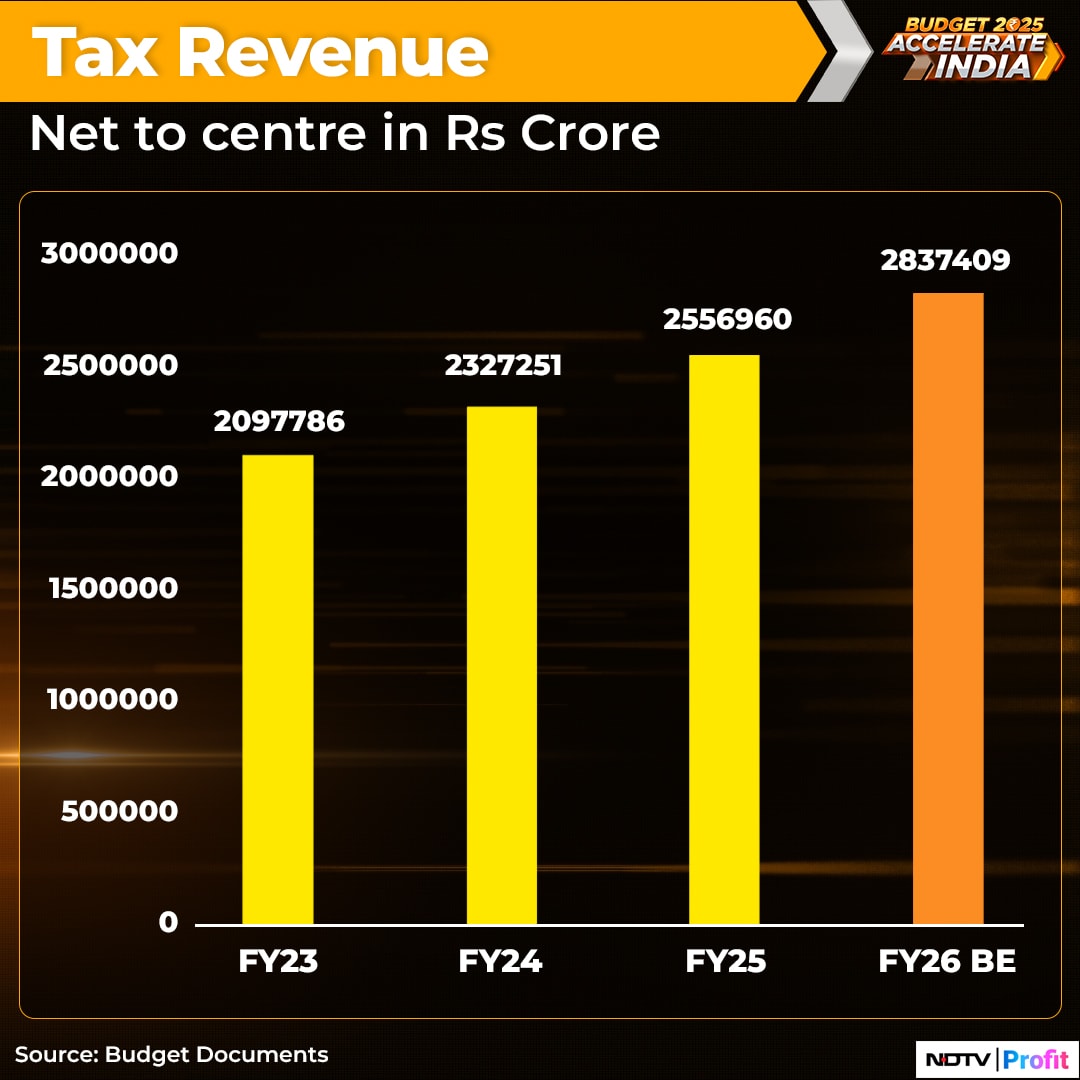

Tax Buoyancy: Too Optimistic?

The budget assumes a nominal GDP growth of 10.1% year-on-year for FY26, and gross tax revenue growth of 10.8%. "Adjusting for the revenue foregone under income tax relief provided to the middle class, the implied tax buoyancy of 1.3 looks optimistic, in our view," said Tanvee Gupta Jain, chief economist at UBS India. This compares with 1.1 estimated in FY25 revised estimates and also in the pre-pandemic period between FY11-19, she said.

Net tax revenue — net to the centre — is expected to rise by 11% to Rs 28.4 lakh crore.

Looking at the breakup, while the corporate tax growth (10.4%YoY) and GST growth (10.9%YoY) assumptions look reasonable, it is the personal income tax collections growth estimates (14.4%YoY) which still seem to be on the higher side, Jain said. Equity markets performance this year will also determine revenue collections from capital gains tax and STT, she said.

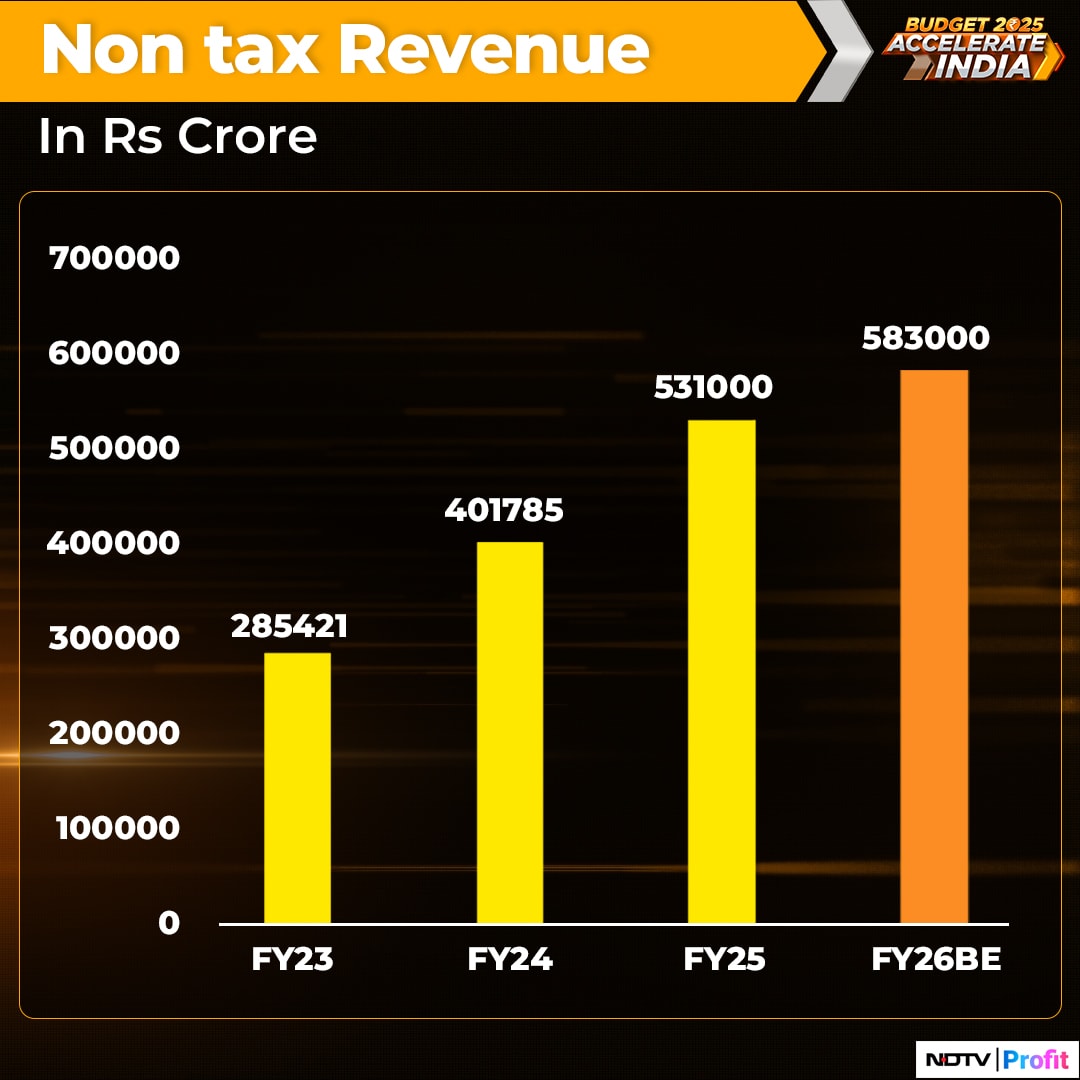

The non-tax revenue growth in FY26's estimate was up 9.8% year-on-year, as government expects higher dividend transfer from RBI (Rs 2.6 lakh crore versus Rs 2.3 lakh crore in FY25RE) and PSUs.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.