Finance Minister Nirmala Sitharaman will on Feb. 1 present the interim budget before the general election in April-May.

An interim budget broadly includes an assessment of the current state of the economy, capex expenditures and receipts, as well as revised estimates of the current financial year and estimates for the year ahead. It's difference from a vote-on-account that seeks approvals for essential expenditure outlays until the elections. The next government will present a full budget after the Lok Sabha polls.

Despite being an interim budget, investors will focus on the government's commitment to the medium-term fiscal consolidation path, if capex growth can continue with fiscal consolidation, and the supply of government bonds that the market may be able to absorb, according to a Goldman Sachs note.

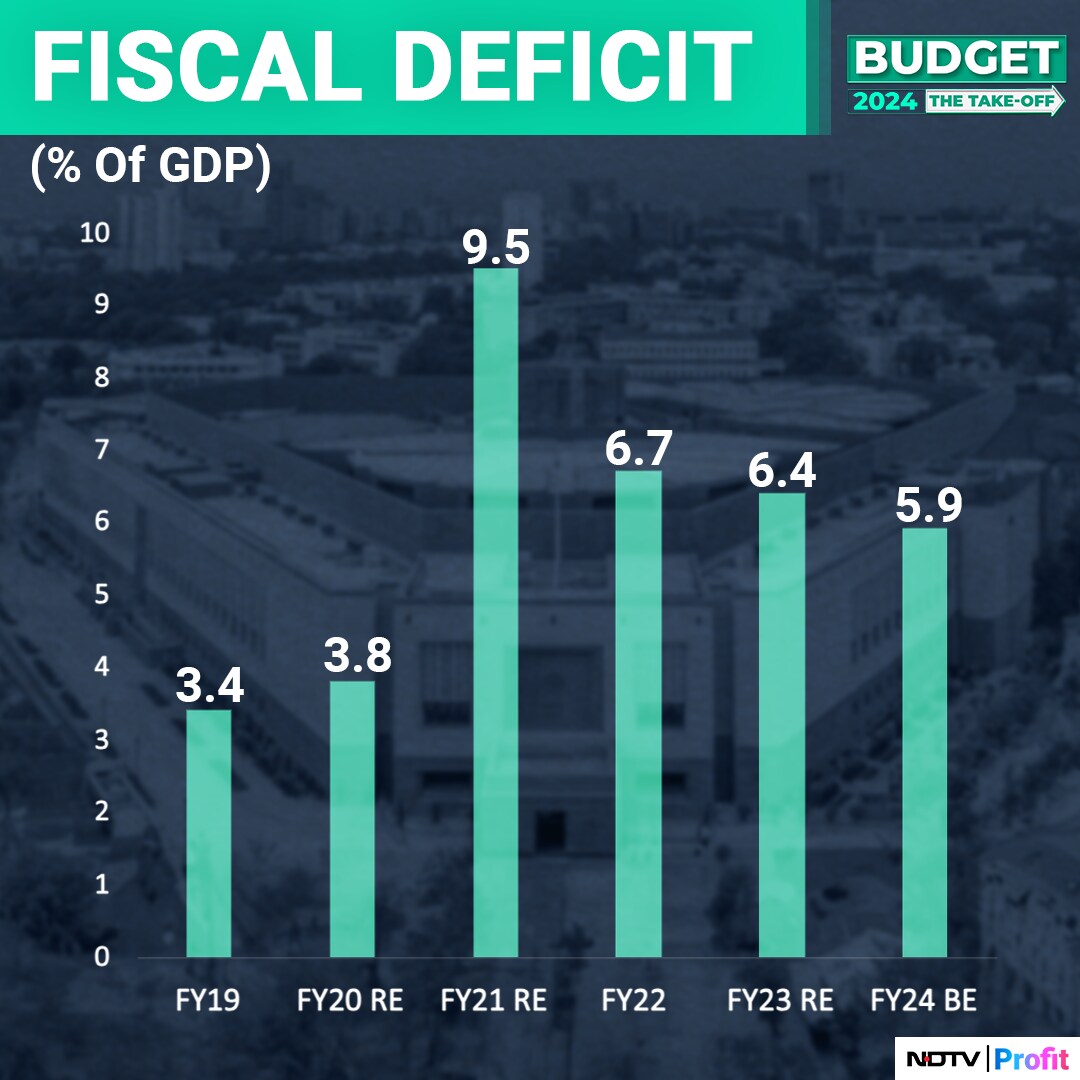

Fiscal Deficit: In Search Of Consolidation

Fiscal deficit is likely to be around the government's target of 5.9% of the GDP in FY24, aided by better-than-expected revenue receipts.

Up to November 2023, fiscal deficit was at 50.7% of the target for the full fiscal.

"We expect the government to meet the FY24 fiscal deficit target of 5.9% of GDP, as we expect a receipts upside of 0.2% of GDP," Goldman Sachs said. In fact, if spending remains muted in the current quarter, the deficit may end up at 5.8% of GDP, it said.

This is despite nominal GDP growth projections of 8.9% on an annual basis for FY24, according to the first advance estimates. That's below the growth assumption of 10.5% in the budget estimates.

A lower nominal GDP number than what the budget had pencilled in--NSO's first advance estimate of Rs 296.6 lakh crore versus FY24 budget estimate of Rs 301.8 lakh crore)--is likely to result in the fiscal deficit printing at 6% of GDP, according to Aditi Nayar, chief economist at ICRA. This, along with the robust inflows into small savings schemes, suggest that the government's market borrowings are likely to remain in line with the budgeted amount for FY24 at a gross of Rs 15.4 lakh crore and net borrowing at Rs. 11.8 lakh crore.

ICRA expects the fiscal deficit target for FY25 to be set at 5.3% of GDP, midway through the expected print of 6.0% for FY24 and the medium-term target of sub-4.5% by FY26.

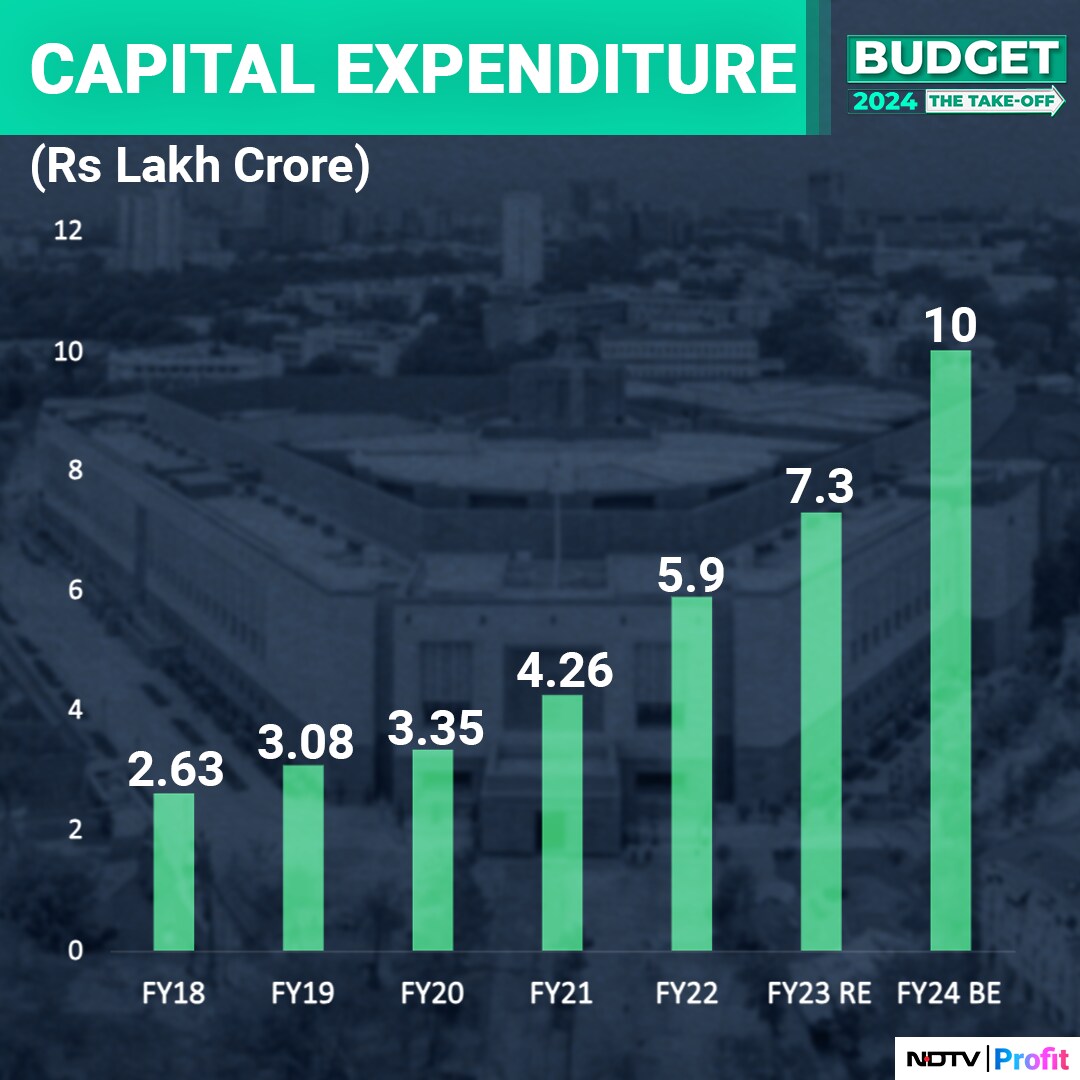

Focus On Capex To Continue

Nayar estimates capex target of Rs. 10.2 lakh crore for FY25, 10% higher than the expected level for FY24. That's below the average pace of over FY21-FY24. A higher capex target would impinge on the government's ability to bridge half the required fiscal consolidation in FY25, thereby making the task of reaching medium-term fiscal deficit target by FY26 even more challenging, she said.

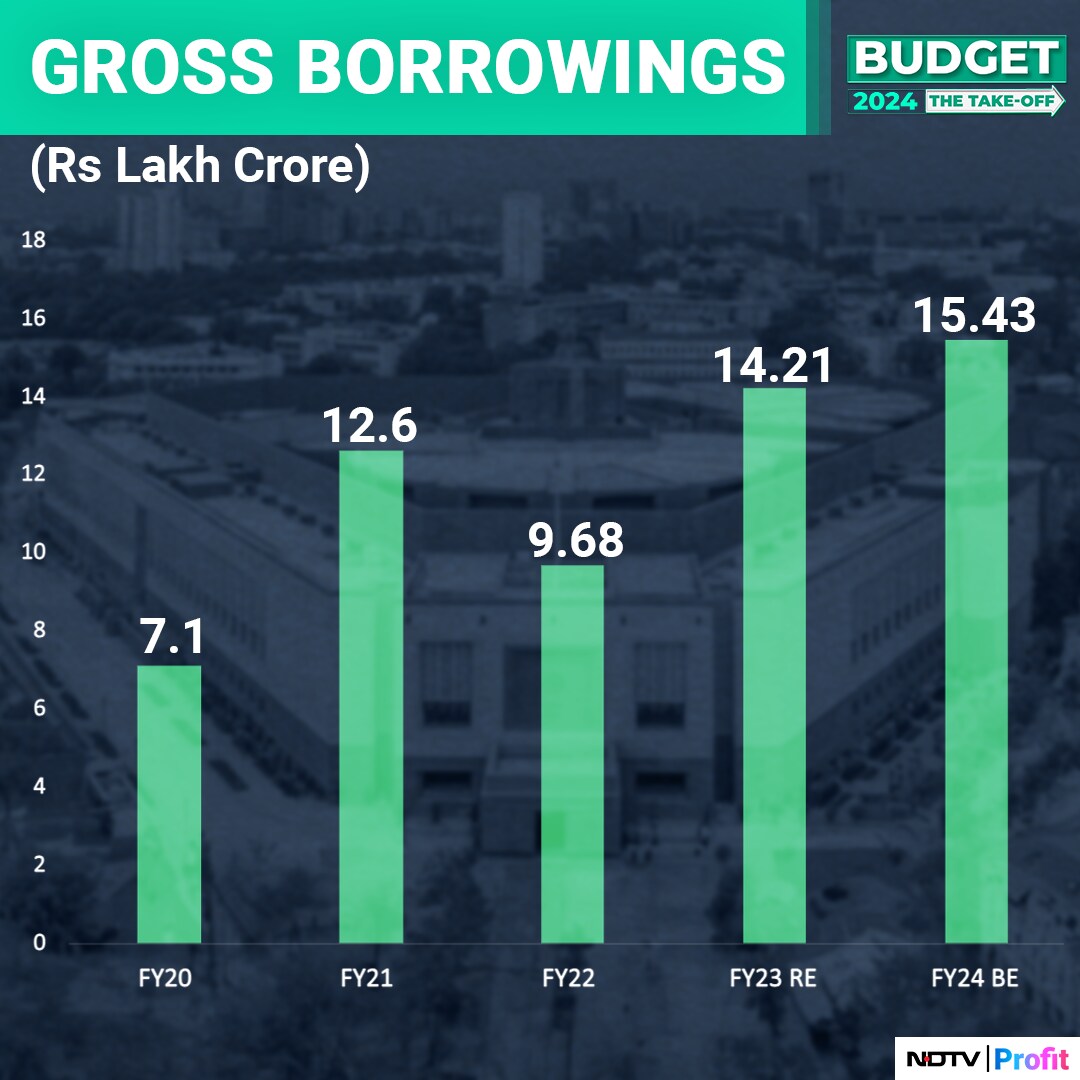

Gross Borrowings To Remain Elevated

Goldman Sachs expects government borrowings to remain elevated in FY25. However, with adequate demand for government bonds from foreign and domestic institutions in a policy rate easing cycle, the RBI may be a net seller of government bonds in FY25, it said.

Goldman Sachs expects two repo rate cuts of 25 basis points each in July-September and October-December of 2024.

The research firm pegs the overall issuance for the centre and state governments in FY25 to be around Rs 17-18 lakh crore. To fund the central government's fiscal deficit of nearly Rs 18 lakh crore in FY25, net borrowings are expected to be around Rs 12 lakh crore, after accounting for non-market financing from small savings, and state provident funds, with states borrowing Rs 5.8 lakh crore in FY25.

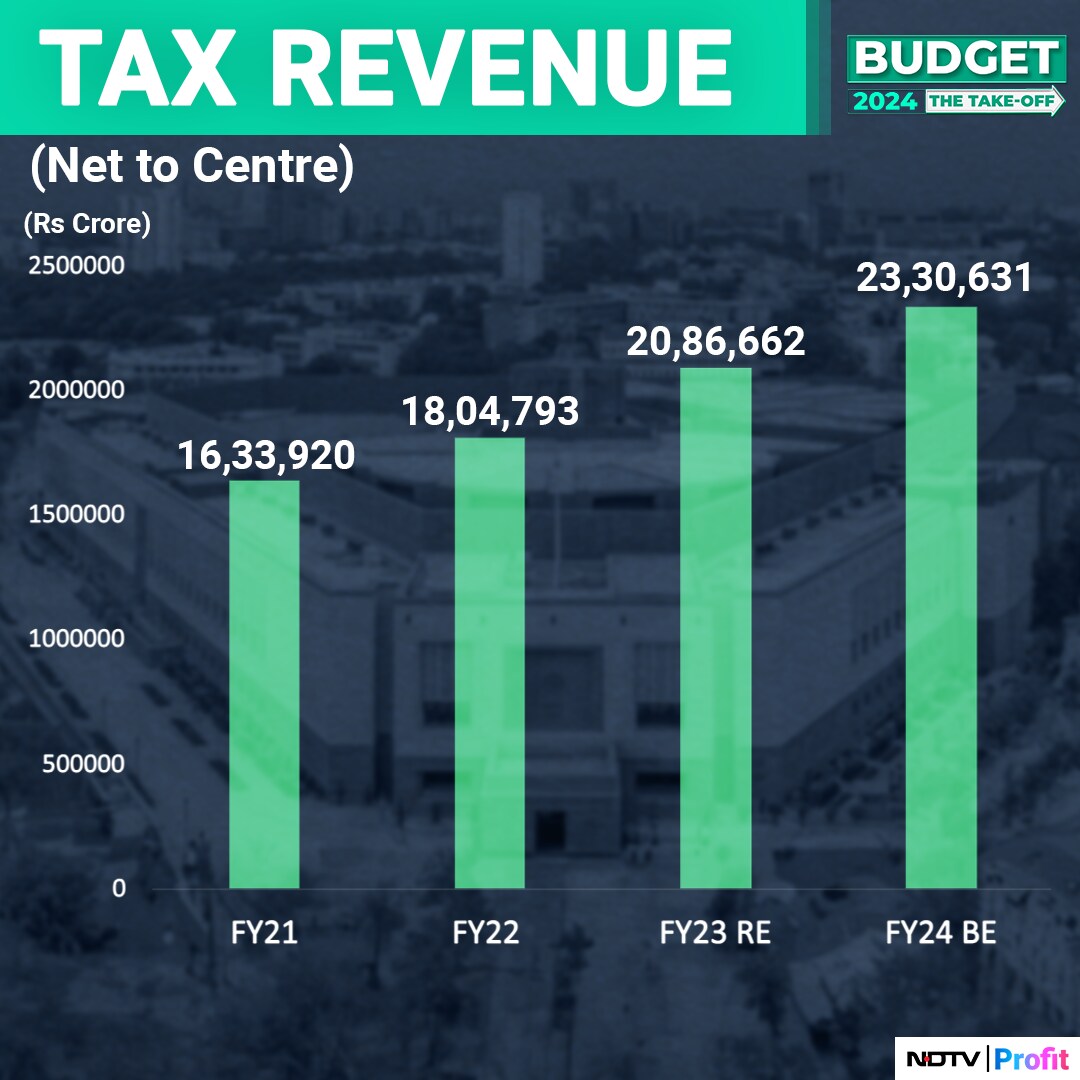

Revenue Receipts To Stay Strong

For FY25, nominal GDP growth is expected to be higher at 11.3% compared with 9.6% in FY24, but real GDP growth will slow marginally to 6.5% compared with a forecast of 6.7%, Rahul Bajoria, chief economist at Barclays, said. "Accordingly, we project tax revenue receipts will grow 15% on an annual basis in FY25, with broad based growth across direct and indirect taxes."

In step with the performance of direct tax receipts, growth in non-tax receipts has also surprised on the upside. This is due not just to the windfall RBI dividend, though admittedly this has been a major driver of overall non-tax collections, said Bajoria.

The RBI had announced a dividend of Rs 87,416 crore to be paid to the government of India. Unchanged retail fuel prices in the face of falling crude meant the margins of oil marketing firms have also widened, which resulted in higher dividends for the government from the public sector units, Bajoria said.

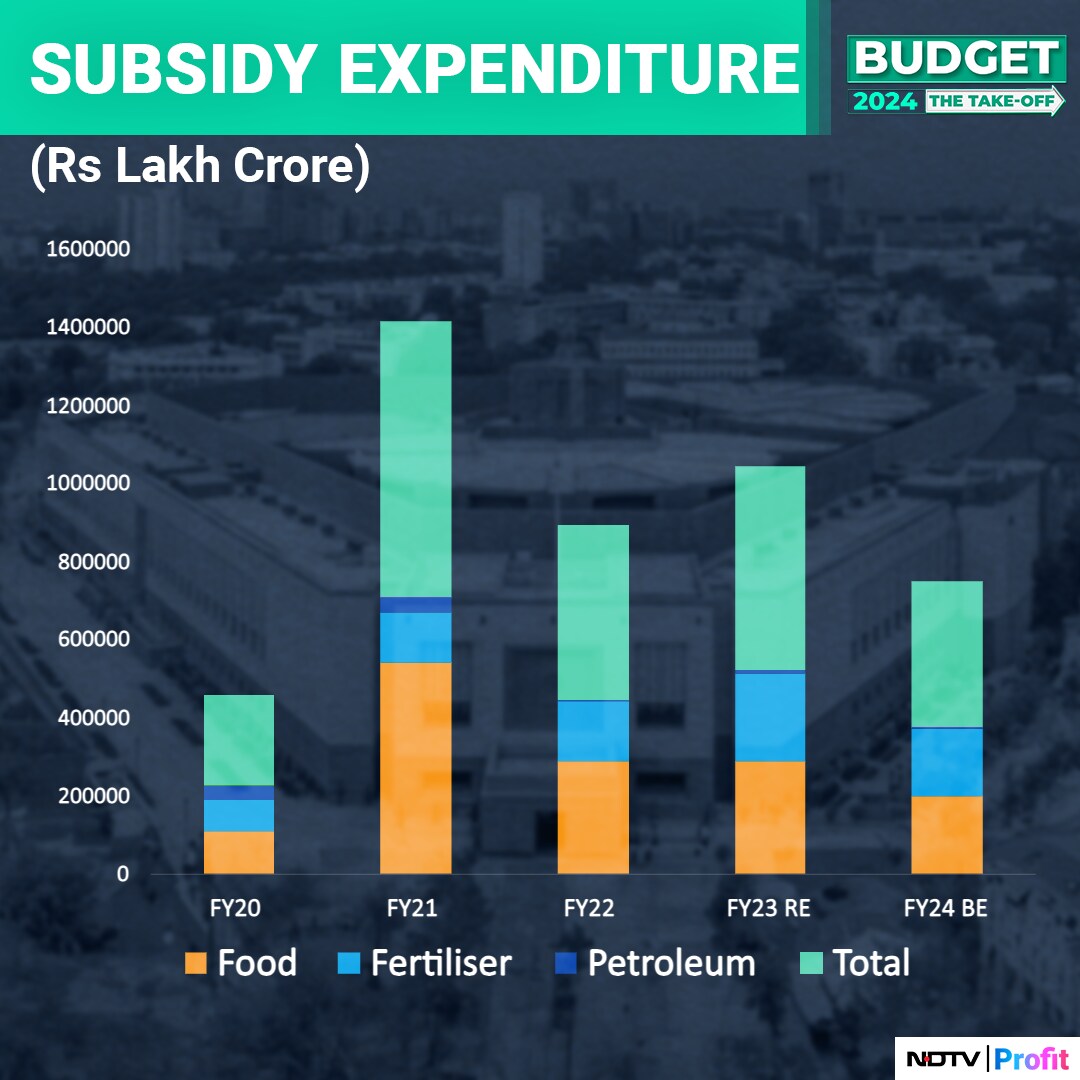

Subsidies May Be Lower Than FY24

The government's extended the free food program to over 80 crore beneficiaries for the next five years is expected cost 0.7% of GDP in FY25, according to estimates by Goldman Sachs. While cooking gas subsidy is expected to be below 0.1% of GDP on the back of lower oil prices, fertiliser subsidy is expected to be slightly above the pre-pandemic average of 0.5% of GDP in FY25 as natural gas prices are expected to increase from the lows seen in December 2023. As such, Goldman Sachs forecasts a slight reduction in subsidies as a share of GDP to 1.4% in FY25 from an estimate of 1.6% in FY24.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.

.jpg?im=FeatureCrop,algorithm=dnn,width=350)