Budget 2023 is in and as always the devil lies in the data. So here's a first read on budget numbers, the ones you should focus on and how credible they are.

Big Number 1: Fiscal Consolidation To Continue

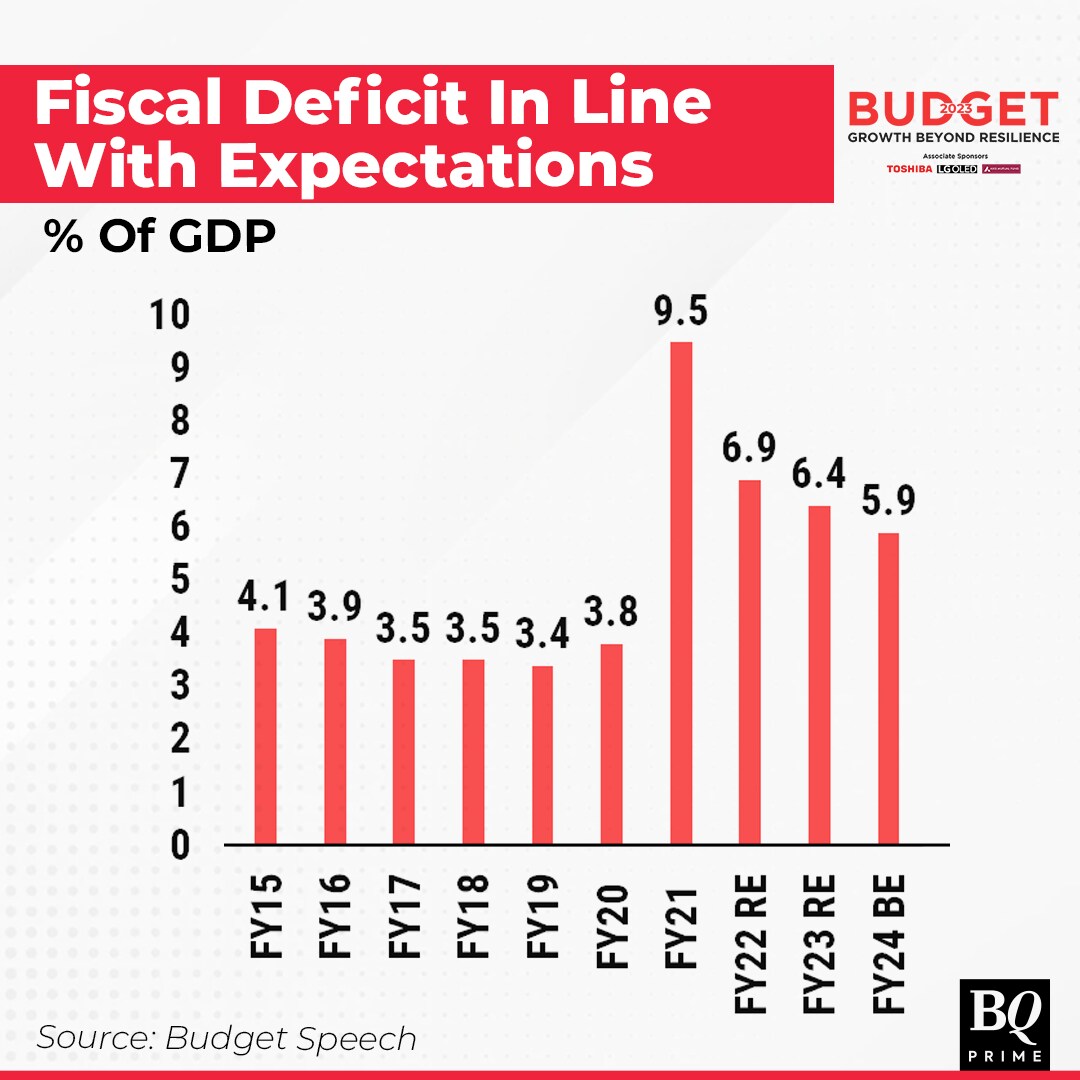

The government will target a fiscal deficit of 5.9% for FY24, Finance Minister Nirmala Sitharaman announced in her Budget 2023 speech. The country's fiscal deficit settled at 6.4% in FY23, the same as the budget estimate.

The narrower fiscal deficit target underscores commitment to longer-term fiscal sustainability and supports the economy amid high inflation and a challenging global environment, according to Christian de Guzman, senior vice president, Moody's Investors Service.

"Although the gradual fiscal consolidation trend remains intact and will help to stabilize the government's debt burden relative to nominal GDP, the high debt burden and weak debt affordability remain key constraints that offset India's fundamental strengths, including its high growth potential and deep domestic capital markets," he said.

The finance minister reiterated the government's intention to bring the fiscal deficit to below 4.5% of the GDP.

States will be allowed a fiscal deficit of 3.5% of the GDP in FY24, she said, taking the general government deficit to 9.4%.

Big Number 2: Borrowing Binge

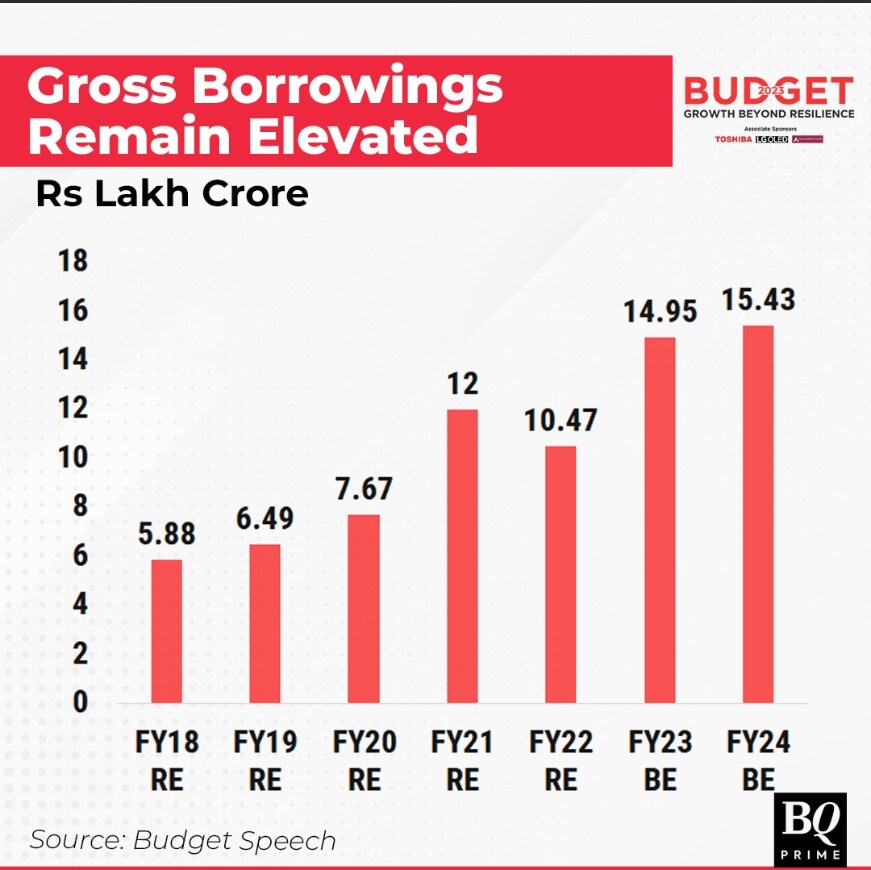

Even as fiscal deficit was targeted lower, the government borrowings remain elevated. India is estimated to borrow Rs 15.45 lakh crore via bonds in FY24, Sitharaman said, with net borrowings at Rs 11.8 lakh crore.

The benchmark 10-year government securities was down by 6 basis points at 7.29%.

However, as a percentage of GDP, the gross and net borrowing is expected to go down to 5.1% and 4.1%, respectively, in FY24, according to the budget estimates. That compares with the FY23 revised estimates of 5.2% and 4.4%, respectively.

Big Number 3: Capex As A Share Of GDP

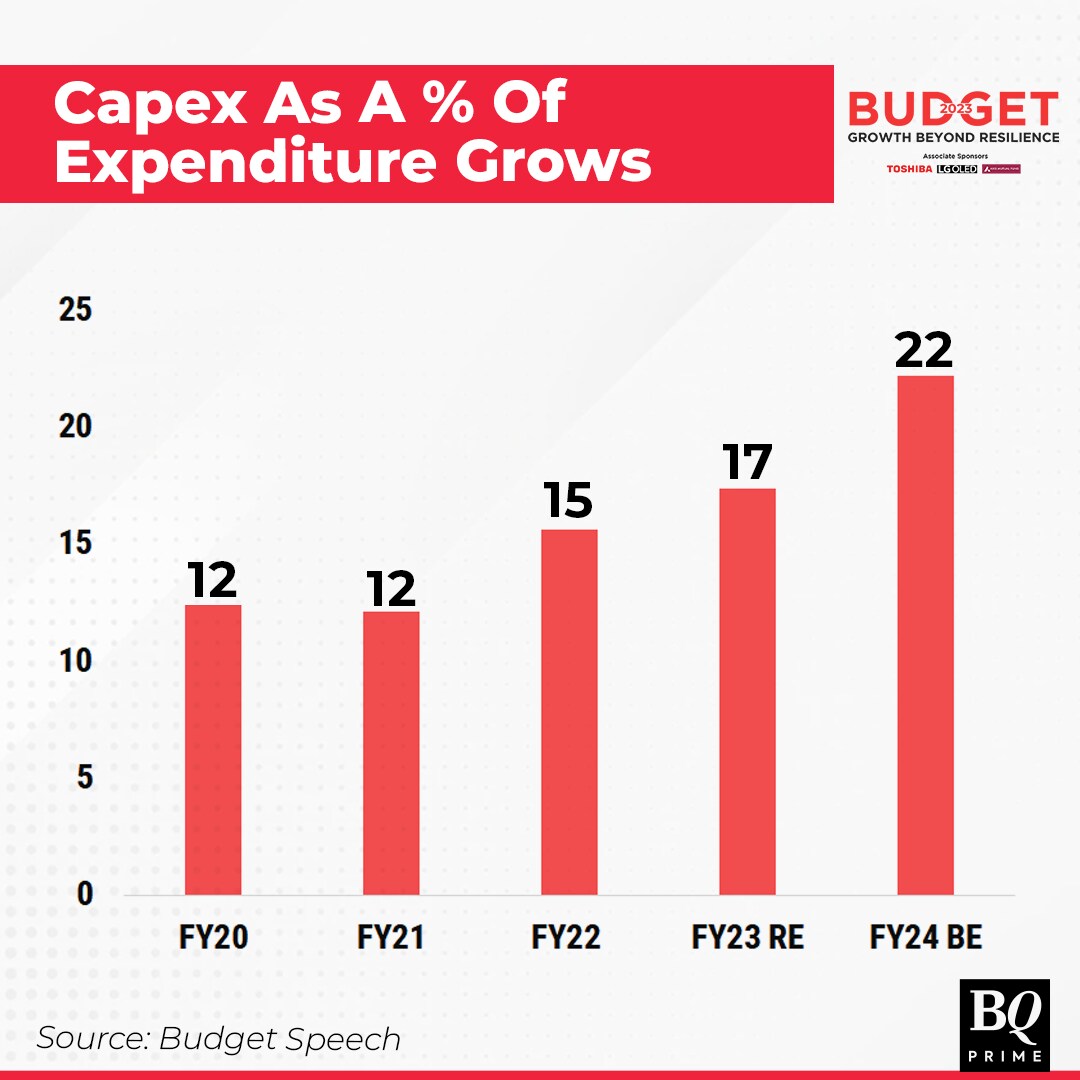

The government capital expenditure for FY24 is pegged at Rs 10 lakh crore, forming about 3.3% of the GDP, Sitharaman said. The revised estimate for FY23 capital expenditure stood at Rs 7.28 lakh crore.

As a share of total expenditure as well, capex rose to 22%.

At 3.3% of GDP, the capex spend is almost double the pre-pandemic prints, said Madhavi Arora, lead economist at Emkay Global. This especially implies larger fiscal multiplier on employment and growth and will support crowding in of still-lacking private capex, she said.

Big Number 4: Squeezing Subsidies And MGNREGA Spends

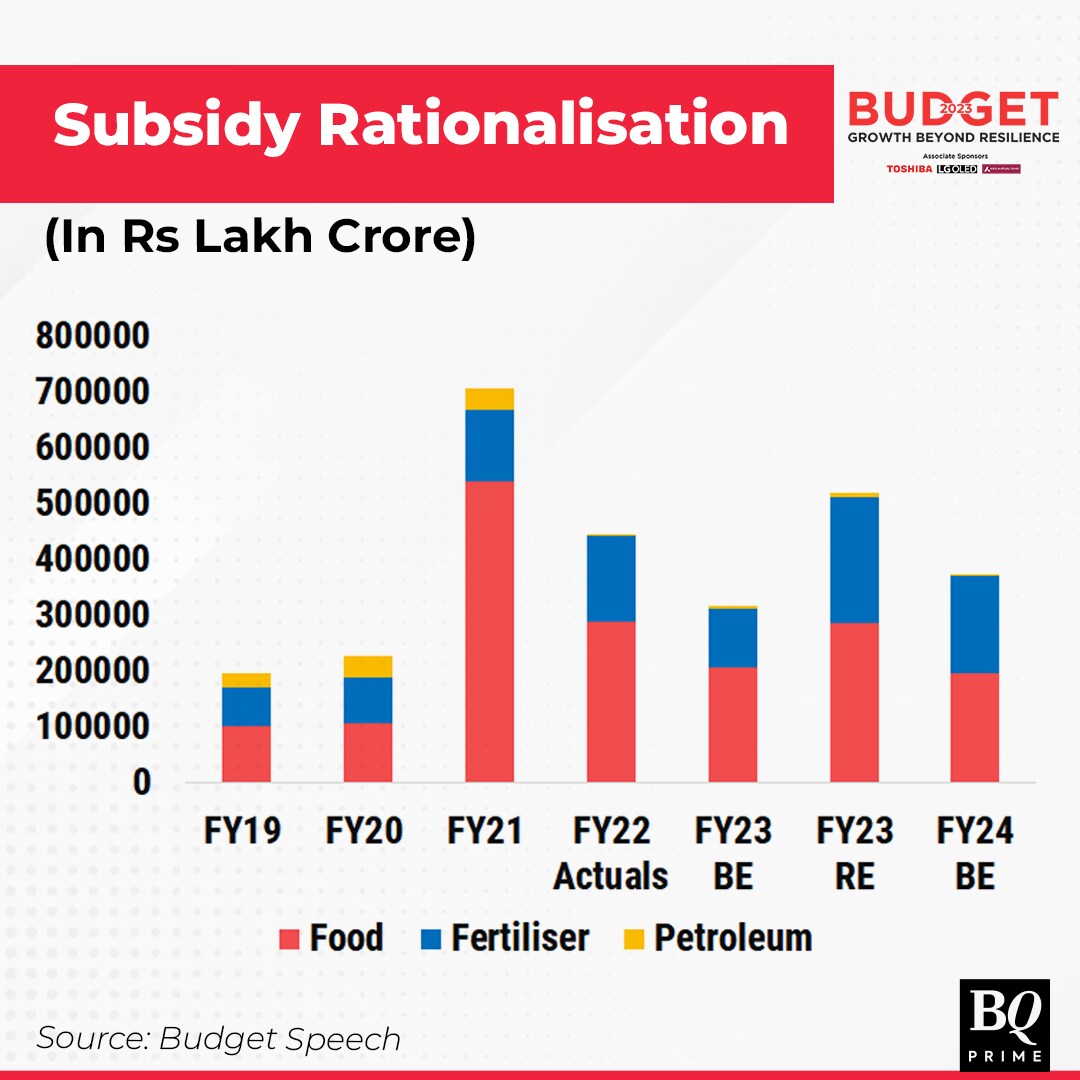

Expenditure on food, fertilisers and petroleum—the government's largest revenue expense after interest payments—is expected at Rs 3.74 lakh crore for FY24, 28% lower than the revised estimates for the ongoing financial year, according to Budget 2023 documents.

Subsidies in FY23, however, were 64% higher than the budget estimate as the government had to step up support in the form of free food grains and fertiliser subsidies amid higher commodity inflation.

For FY24

Food subsidies have been budgeted at Rs 1.97 lakh crore, a decline of 31% from the revised estimate for FY23.

Fertiliser subsidy has been pegged at Rs 1.75 lakh crore, a drop of 22% from the revised estimate for FY23.

Fuel subsidies have been budgeted at Rs 2,257 crore, a fall of 75% from the revised estimate for FY23.

The central government has allocated Rs 60,000 crore for India's rural jobs guarantee programme in the upcoming fiscal, compared to a revised estimate of Rs 89,400 crore, according to budget documents.

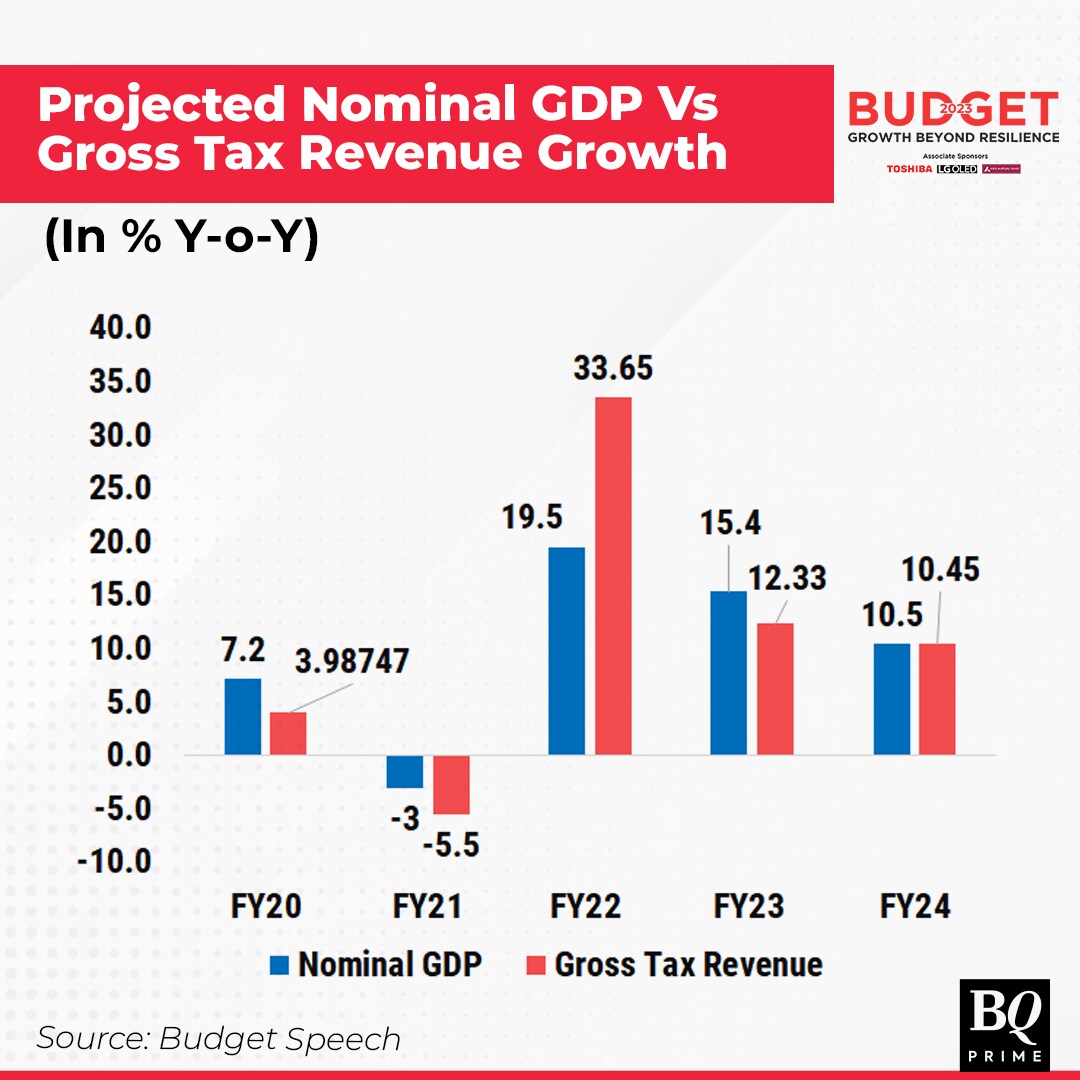

Big Number 5: Nominal GDP And Tax Revenue Projections

First, the nominal GDP growth for FY24 is projected at a very conservative 10.5%. Gross tax revenue is projected to rise by 10.45%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.