(Bloomberg Businessweek) -- Banks aren't supposed to fail. If they did so with any regularity, one of the most critical cogs in our economic machinery—the transformation of deposits (a liability) into loans (an asset)—would just seize up and stop functioning.

We rely on the magic of credit creation for everything from leasing cars to buying homes to funding city budgets. That's why, when a bank fails, it's so essential to figure out what happened and ensure the same mistakes won't be made again.

In the case of Silicon Valley Bank, the lender that failed so spectacularly, the specific cause is easy to see in hindsight. As deposits poured in during the pandemic, the bank bought tens of billions of dollars in bonds just before the Federal Reserve began raising rates to fight inflation. As rates shot up, the value of those holdings suffered huge losses. SVB was in deep trouble.

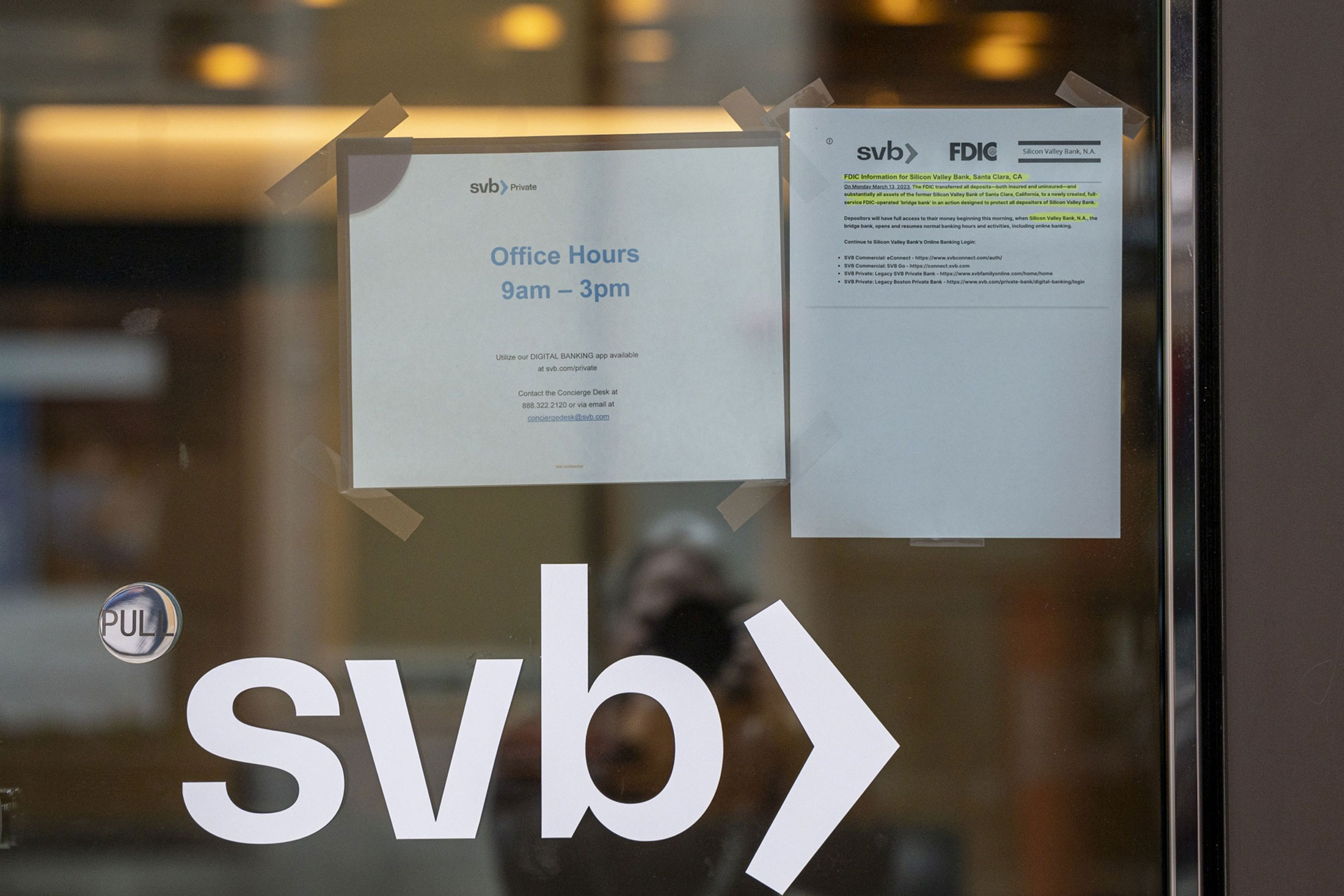

When, on March 9, the bank tried to instill confidence by raising money, it brought about the opposite. Depositors fled en masse—a classic bank run. The next day, regulators had to seize SVB and take emergency measures to keep the sudden collapse from metastasizing into a broader financial disaster.

Because few things are so basic to banking as managing the interest-rate sensitivity, or duration, of assets and liabilities, the best explanations for what happened at SVB might be arrogance or incompetence.

But there's a more general cause behind this bank failure, one with potentially far-reaching implications: SVB collapsed in part because it became a creature of the sweeping financialization of the US economy—the exodus of money from public markets in the 2010s, the ascendancy of so-called alternative assets and the concentration of power in the hands of a new generation of tycoons.

As its name suggests, Silicon Valley Bank was built to serve the needs of the technology and life-sciences industries born in Northern California. And 20 years ago, that's largely what it did, providing loans, revolving lines of credit and services such as cash management to startups in communications, software, biotechnology and medical devices.

SVB's revenue followed the ebbs and flows of corporate activity in the region. It boomed in the late 1990s, survived the dot-com bust, then prospered as tech regained its mojo in the mid-2000s.

For bankers who needed new business, there was no network better than the venture capital community. As the lifeblood of early-stage tech and biotech, VC firms controlled access to thousands of corporate treasurers.

Greg Becker joined SVB in 1993 as one of those bankers serving VCs. By 2011, when he became its chief executive officer, a transformation was underway. Venture capital and private equity firms (VC's latter-stage cousin in the world of alternative investments) were displacing tech companies as the bank's top clients. It's no wonder. Total fundraising for investments in nonpublic markets rose to $1.18 trillion in 2021, from $96 billion in 2003.

There were so many ways for a lender such as SVB to serve this ever-growing pool of money. A PE firm might need financing for a leveraged buyout, a currency hedge to lock in the price of a deal or a place to deposit the proceeds from an asset sale. VC firms were continually in need of bankers to manage the initial public offerings of their portfolio companies or to offload them to acquirers.

An executive, flush with the profits from a banner fund, might want a private banker for tax planning or to arrange the mortgage on a multimillion-dollar home. “The more that we can provide one-stop shopping across all the needs of our clients, and not just doing an OK job but doing an exceptional job, why would you go any other place?” Becker said on a conference call in January 2021.

By the time SVB failed, the transformation was complete. Almost 70% of its $76 billion in outstanding loans was entirely or partly dependent on private equity or venture capital for repayment.

The borrowers didn't need the money, of course, at least not in the traditional sense. But SVB was willing to make loans against the investment commitments of limited partners such as pension plans and endowments. PE and VC firms use these subscription lines of credit to burnish returns by smoothing out lumpy results in the early years of a fund. Those same two groups returned the favor by parking deposits at SVB—some $36 billion as of Dec. 31. It seemed like a virtuous circle.

We now know the symbiosis amounted to something else entirely—an existential risk Becker and his management team either didn't see or didn't understand. Bank regulators missed it, too. The concentration of assets and liabilities in one clubby group of financiers that for so long worked to SVB's advantage proved to be its undoing.

As stocks tanked in 2022, VC investing slowed. Startups, many of them burning through cash, had to withdraw money from their bank accounts, and deposits at SVB dropped for the first time in almost four years.

When analysts peppered him with questions in July, Becker brushed off concerns. “There is so much money out there,” he said. “And when there's so many good companies out there, that money will continue to be deployed from my standpoint at a healthy clip.”

Except deposits kept falling. And on Feb. 24, SVB disclosed that the unrecognized losses on its pandemic-era bond investments were almost enough to wipe out its balance-sheet equity. The end followed swiftly.

In the US, a typical bank of SVB's size has millions of depositors small enough to fall under the $250,000 cap for federal insurance. (Fifth Third Bank of Cincinnati has 6.17 million such accounts, for example.) Because they're so numerous and because they're protected, it takes a lot to trigger the kind of panic that overwhelms a major financial institution.

At SVB, only 6% of deposits were insured. Because its clients were big, sophisticated and mostly unprotected, many behaved differently. Firms that the bank cultivated for decades thought nothing of drawing down their balances in a moment. Founders Fund, Coatue Management, Union Square Ventures and Founder Collective were among those advising the companies in their portfolios to pull out.

As California's bank regulator said in its March 10 order of seizure, “the precipitous deposit withdrawal has caused the bank to be incapable of paying its obligations as they come due, and the bank is now insolvent.”

The managers of private capital in all its forms—venture capital, growth equity, private equity, private debt, infrastructure and natural resources—now oversee a record $8.9 trillion in assets by one estimate. Their influence over the economy has never been greater, and it can work in unpredictable and disquieting ways.

As the cliché goes, it's the desperate borrower, pockets empty, rent unpaid, who begs a banker for mercy. In the final hours at SVB, though, it was Becker pleading with his depositors to “stay calm.”

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.