(Bloomberg) -- Traders in China were able to access widely used bond price feeds again after an abrupt suspension of the data earlier in the week roiled the $21 trillion market.

At least three data vendors were showing bond quotes on Friday for the first time since Tuesday, according to a company statement and screenshots seen by Bloomberg. The resumption came after the regulator told some brokers they could restart providing feeds to financial data platforms, Bloomberg reported earlier.

The suspension has drawn attention to the risks of unexpected regulatory shifts in China, which makes up a growing portion of global fixed-income portfolios. Transactions plunged as much as 60% as traders struggled to access data, according to brokers, with some turning to chatboxes on Tencent's WeChat and QQ to share prices.

“Policy predictability in China is increasingly low,” said Alicia Garcia Herrero, chief Asia-Pacific economist at Natixis SA. “Many foreign financial institutions have doubled down on their investment in China including asset management and brokerages, and they are clearly penalized by the lack of transparency on pricing.”

East Money Information Co., Wind Information Co. and Dealing Matrix were offering their price feeds again on Friday, according to a company statement and screenshots of their software.

Not all data platforms resumed their feeds. One of the most popular, Qeubee, hasn't received approval to offer bond price data, according to a spokesperson at Ningbo Sumscope Information Technology Co., which operates the service.

Information providers such as Qeubee are privately-run firms that emerged about a decade ago to fill demand for real-time price quotes from brokers. China has six fixed-income brokers, which include joint ventures of Tullett Prebon, BGC Partners and NEX International Ltd. Reuters reported earlier that the halt was ordered by China Banking and Insurance Regulatory Commission to address data security concerns.

Bloomberg LP, the parent company of Bloomberg News, also offers fixed-income trading, data and information to the financial services industry.

New Regulator

The issue of bond pricing is especially acute in China, which has a predominantly over-the-counter market where identifying counterparties and accessing quotes have long been headaches for traders. The turbulence in the market comes just after China announced plans to set up an enlarged national regulator that will absorb the banking and insurance watchdog and oversee all financial sectors except the securities industry.

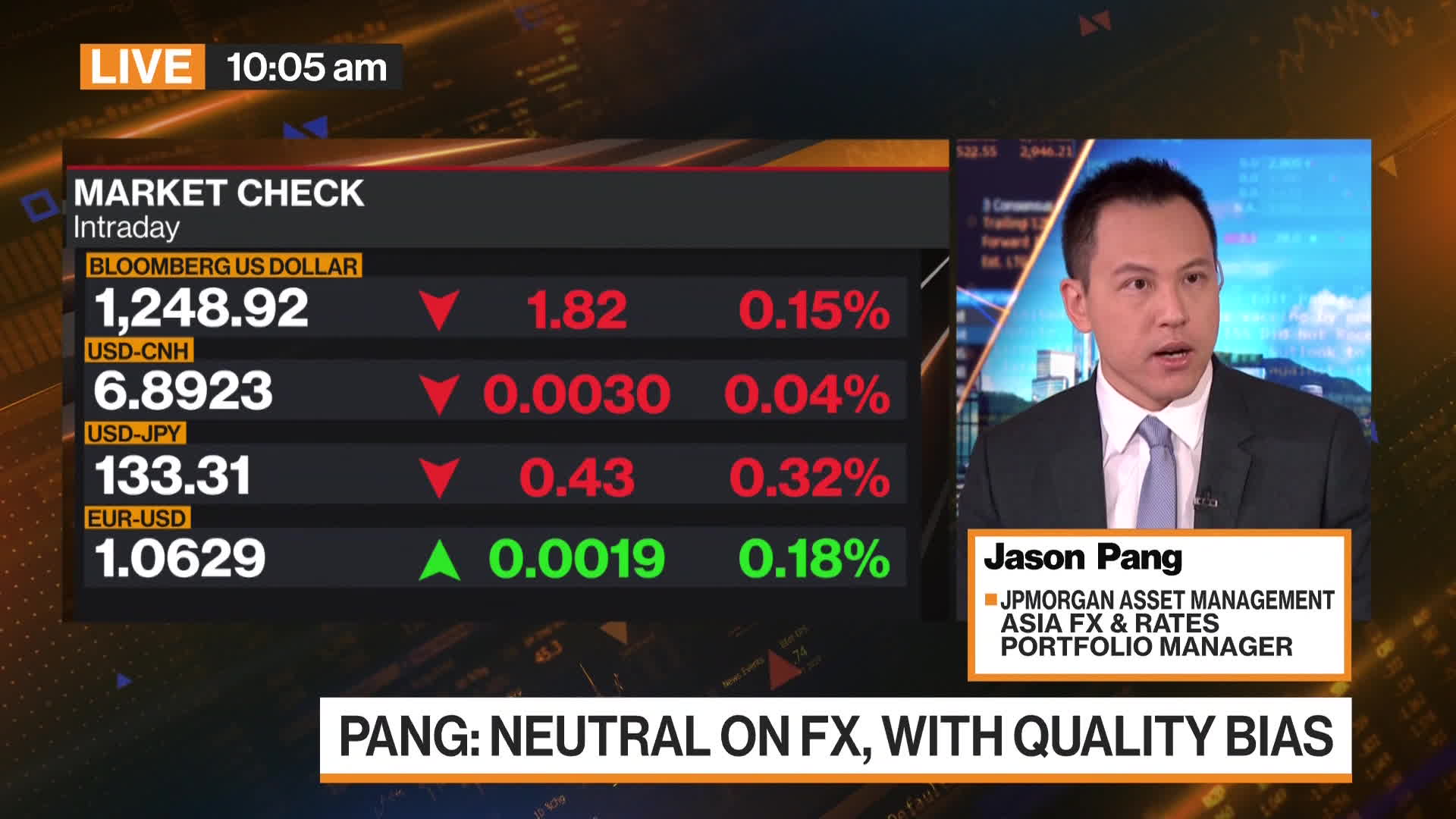

“Onshore credit markets were never too liquid in credit so it doesn't change the business operation in particular,” Jason Pang, Asia FX and rates portfolio manager at JPMorgan Asset Management, said in a Bloomberg TV interview.

China has been seeking to make its financial markets more efficient and transparent to attract much-needed foreign capital. Overseas funds sold a record $91 billion of Chinese bonds in 2022, the first annual net selling since at least 2014 when the data was first compiled.

While foreigners are selling because yields on Chinese debt are too low relative to US dollar assets, the latest incident may further blunt the appeal of the country's bonds, Herrero said.

“The blackout on pricing data will clearly not help.”

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.