(Bloomberg Opinion) -- Imagine a tech giant wanting a strategy “reset” while its major shareholders are selling.

That is Alibaba Group Holding Ltd.

On Thursday, the Chinese e-commerce giant walked back plans to spin off its cloud operations and paused the listing of its supermarket unit, two of the most important routes to unlocking the value of its sprawling business. Meanwhile, founder Jack Ma's family trust disclosed plans to sell 10 million shares for about $871 million within the next week.

Chairman Joe Tsai's attempt to alleviate investor disappointment by announcing that Alibaba will start paying annual dividends did not work. The stock dropped in New York, wiping $20 billion off the company's market value, before continuing to slide during Friday trading in Hong Kong.

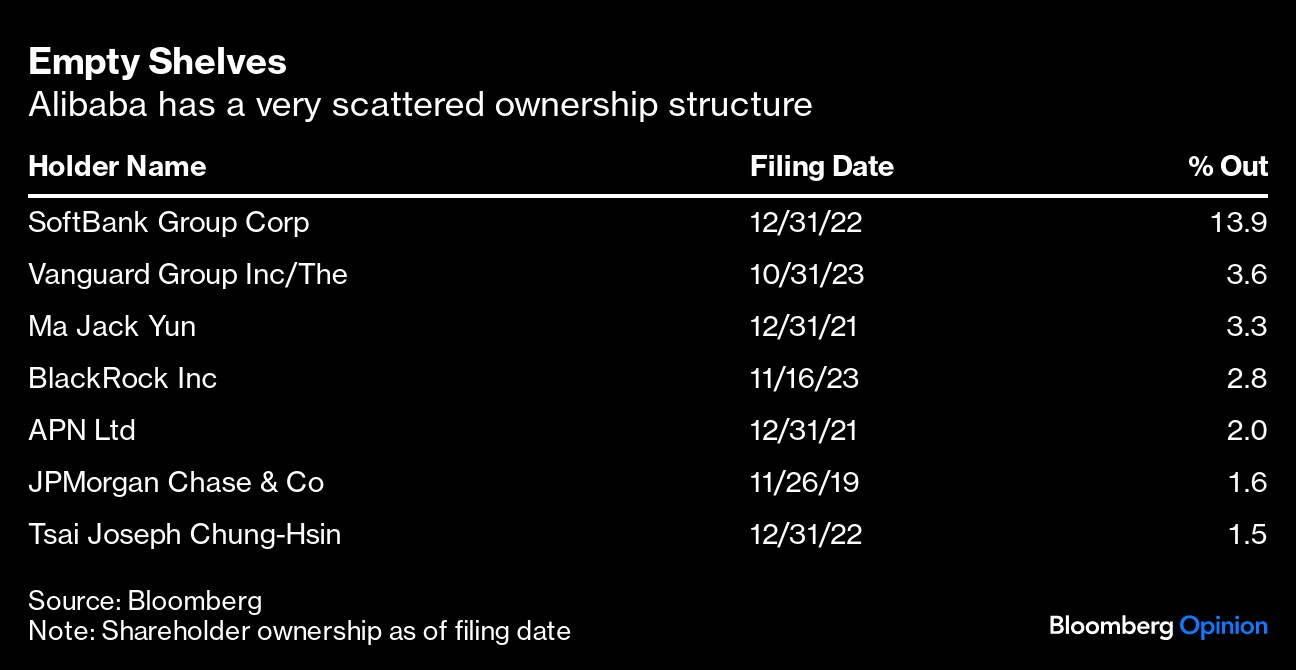

While Ma is no longer actively involved in Alibaba's operations, his decision to sell is a chilling reminder that the firm doesn't have a controlling shareholder at the top, just when billions of dollars need to be spent to move into new fields such as generative AI. Earlier this year, SoftBank Group Corp., which once owned a third of Alibaba, sold much of its remaining shares. According to Alibaba's filings, as of July, SoftBank was listed as the only stakeholder with more than 5% beneficial ownership.

Investors are left wondering who will be held accountable for all the checks Alibaba will need to write. In China, it is rare for such a big corporation to attempt ground-breaking transformations without a major stakeholder. In fact, a few that tried ended up bankrupt.

Tsinghua Unigroup Co., a commercial arm of the prestigious Tsinghua University, is a good example. The company, a crown jewel of President Xi Jinping's “Made in China 2025” plan, had been trying to establish itself as the leader in China's nascent memory-chip industry since 2015. By 2019, Yangtze Memory Technologies Co., its flagship flash-memory business, already spent more than 20 billion yuan ($2.5 billion) on a new plant in Wuhan and earmarked $30 billion in total spending. Meanwhile, the university made several attempts to disentangle itself from the company, aware that chip manufacturing was an expensive, capital-intensive endeavor. Unigroup defaulted on its bonds in 2020 and entered bankruptcy proceedings the year after.

To be sure, given that Ma has already stepped away, a reduction in his stake was just a matter of time. But the optics are terrible. Alibaba is going through a rough patch, having chosen to replace much of its C-suite and undertake a major business revamp. Having the man who started it all look like he's nonchalantly walking away is the polar opposite of the confidence boost management and shareholders need right now.

At the height of his powers, Ma dressed as Michael Jackson and danced to the tune of . Today the music has stopped — he's selling his shares and watching the company seemingly fall apart. This can't have been what China's once-richest man imagined for his empire.

More From Bloomberg Opinion:

- Alibaba's Latest Shakeup Highlights Its Conundrum: Tim Culpan

- Arm's $55 Billion IPO Smacks of Bankers' Desperation: Shuli Ren

- Michael Burry's China Bet Was Bold But Premature: Tim Culpan

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Shuli Ren is a Bloomberg Opinion columnist covering Asian markets. A former investment banker, she was a markets reporter for Barron's. She is a CFA charterholder.

Tim Culpan is a Bloomberg Opinion columnist covering technology in Asia. Previously, he was a technology reporter for Bloomberg News.

More stories like this are available on bloomberg.com/opinion

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.