A year ago, the new Ford Mustang Mach-E GT had a sticker price around $55,000. A month ago, Jeff Craig, a retired realtor, bought a slightly used 2024 version for $33,000. In exchange for 12 months and 13,000 miles, Craig got a 22% discount.

“I really did want an electric vehicle and I never had any intention of buying new,” he said. “And I know what the depreciation is on any new vehicle, but I also had noticed the depreciation on the EVs appeared to be considerably more than a gas engine.”

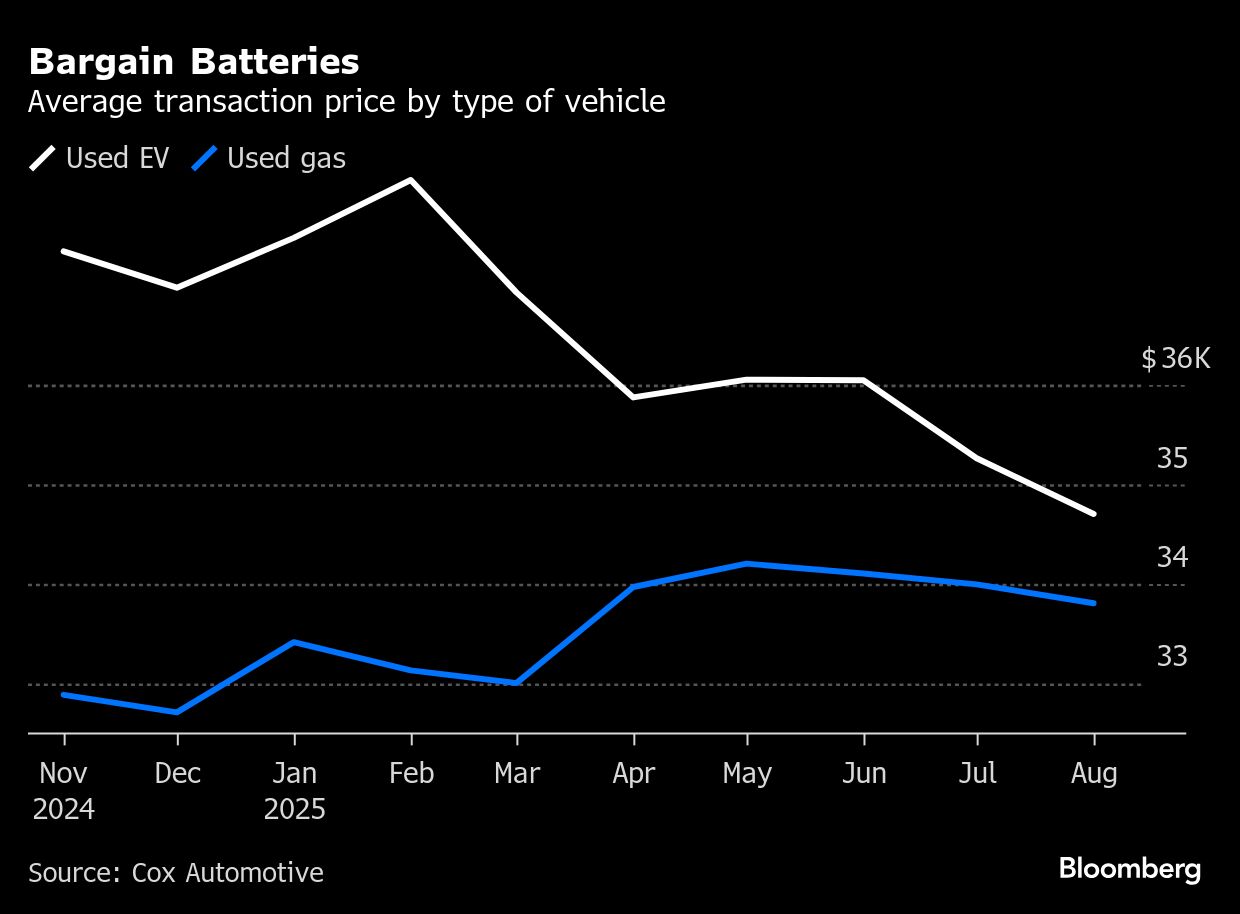

While new EV sales in the US are expected to slow drastically when federal purchase incentives up to $7,500 disappear at the end of the month, the market for used electric vehicles has never been hotter. Pre-owned electric cars and trucks in America are now almost as cheap as used gas-powered vehicles, on average, and are selling even faster, according to Cox Automotive, a services and technology company. What's more, sales of used EVs this year through June increased by 34% over the year-earlier period, while the market for new EVs only ticked up a tad.

“It was just a matter of time until people sort of started trusting used EVs enough to take the plunge and that would sort of have a ripple effect,” said Liz Najman, director of market insights at Recurrent, which provides range estimates and other EV-centric data to car dealers and shoppers.

A number of factors are feeding the buzz around used EVs. For one, there is finally a lot of product, as three-year leases expire on a crowd of cars purchased in 2022. That was the year a number of new battery-powered models first shipped to customers, including the BMW i4, Cadillac Lyric, Ford F-150 Lightning and Toyota bZ4X.

Meanwhile, prices of used EVs have steadily ticked down, a byproduct of more mainstream, non-luxury models and steep depreciation rates. Electric vehicles shed their value quickly, largely because consumers expect the technology to improve quickly.

Like their new counterparts, used EVs are losing federal purchase credits as well, in their case, of up to $4,000. But prices on slightly worn EVs are already on par with other options. In August, the average used electric vehicle traded hands for $34,700, nearly level with the average used car or truck running on gas, according to Cox Automotive. And the EVs were generally only two to three years old, while internal-combustion options average about six or seven years old.

There's also evidence that electric vehicles may prove to be more reliable over time than gas-powered machines. Without radiators, spark plugs or oil, they require little in the way of scheduled maintenance. Meanwhile, EV batteries are proving to be more durable than expected and in the US they are generally covered under warranty for at least eight years or 100,000 miles.

A three-year old EV, for example, is no longer much of a compromise, according to Najman at Recurrent. It's still likely to have a fairly long range, charge quickly and be stocked with amenities like a large touchscreen and a heat pump, for more efficient climate control. “These are modern cars that have, you know, all the bells and whistles you would want,” she said.

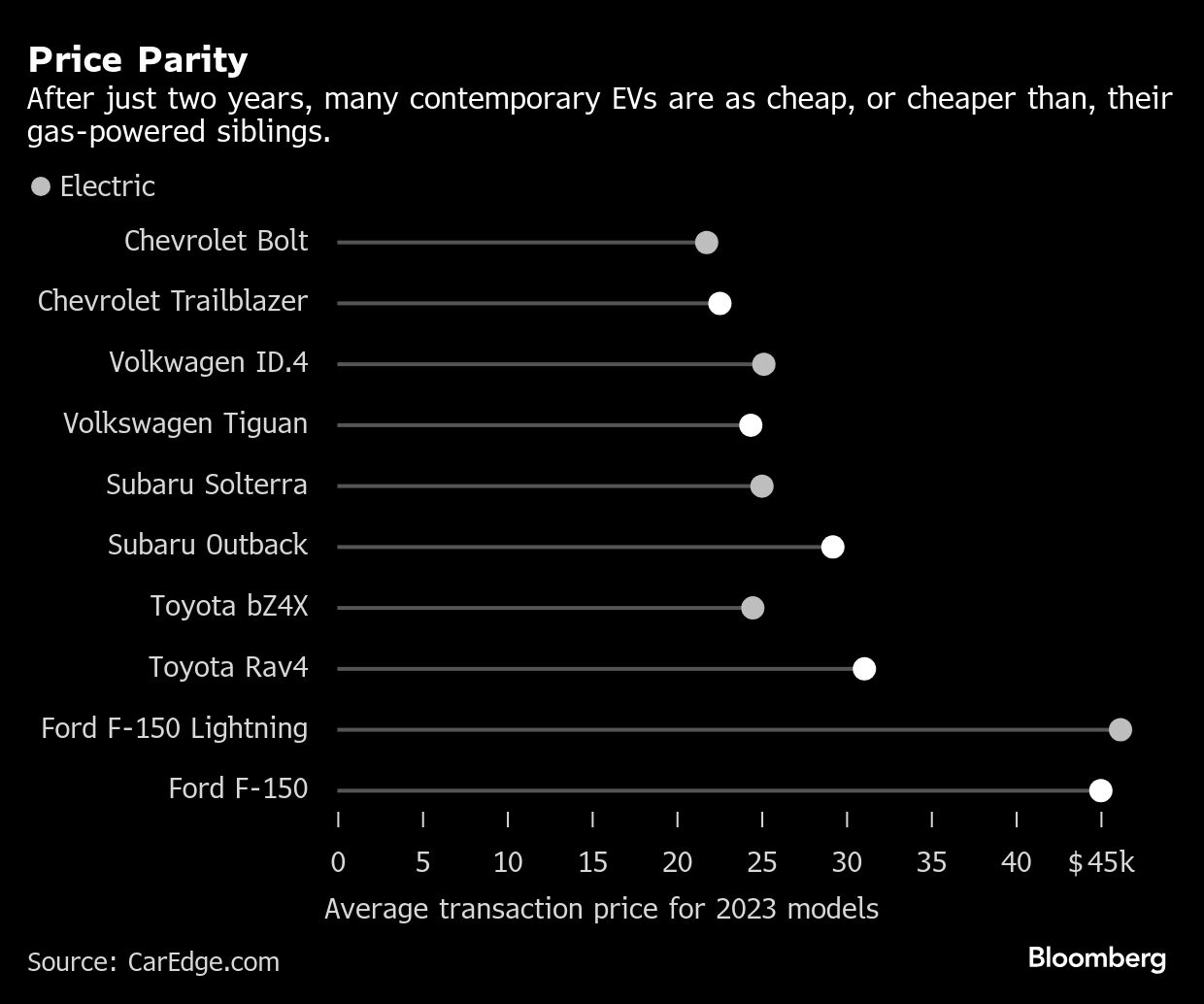

For some brands, including Chevrolet, Subaru and Toyota, a used electric model is now cheaper than a similar gas-powered sibling.

Consider a two-year-old Toyota Rav4. The popular gas-burning SUV is selling for $31,100 on average in the US, while a battery-powered Toyota bZ4X from the same year can be had for $6,600 less, according to CarEdge.com, an AI-driven platform that helps car shoppers negotiate with dealerships.

Both rigs have loads of cargo space and all-wheel drive. Though, the electric Toyota accelerates more quickly, has a bigger touchscreen and, unlike the Rav4, it won't need new engine coolant and a drive belt inspection after 60,000 miles.

Given the recent pace of sales, the current fleet of used EVs on the market will disappear in 36 days, compared with 42 days for internal-combustion cars, according to Cox.

The relatively low prices have “normalized EVs for people who maybe didn't even realize they were an option,” Najman said, “or thought they were just toys for rich people.”

There's also a subtle network effect fueling the market, according to Justin Fischer, an analyst at CarEdge.com. For every battery-powered convert, there's a circle of family, friends and neighbors who get familiar with the technology.

Fischer, who lives in a small, conservative West Virginia town and drives an electric Hyundai, has seen this effect first-hand, as neighbors chat him up in the grocery store parking lot. “It's been shocking to see how open people are to EVs in rural America,” he said. “And the main concerns I hear never have to do with politics. It's access to charging and what happens if the battery dies.”

The moment, however, may be fleeting. Najman at Recurrent suspects depreciation for EVs will temper, as drivers realize that these models are still durable and relevant even after a few years.

That said, the wave of used vehicles is only growing. Recurrent expects another 240,000 machines to come off three-year leases next year. And in short order, Americans will be buying more used EVs than new ones, which has long been the case for gas-powered cars.

That's an important tipping point that will further spur EV adoption. New buyers will no longer worry much about their ability to eventually sell their car.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.