Hyundai Motor India Ltd., the country's de facto No.2 carmaker for decades, has slipped to fourth for three straight months, as Tata Motors Ltd. and Mahindra & Mahindra Ltd. gained. In a way, the Indian rivals are beating the South Korean at its own game—feature-rich cars at attractive price points—amid an outsized demand for oversized cars.

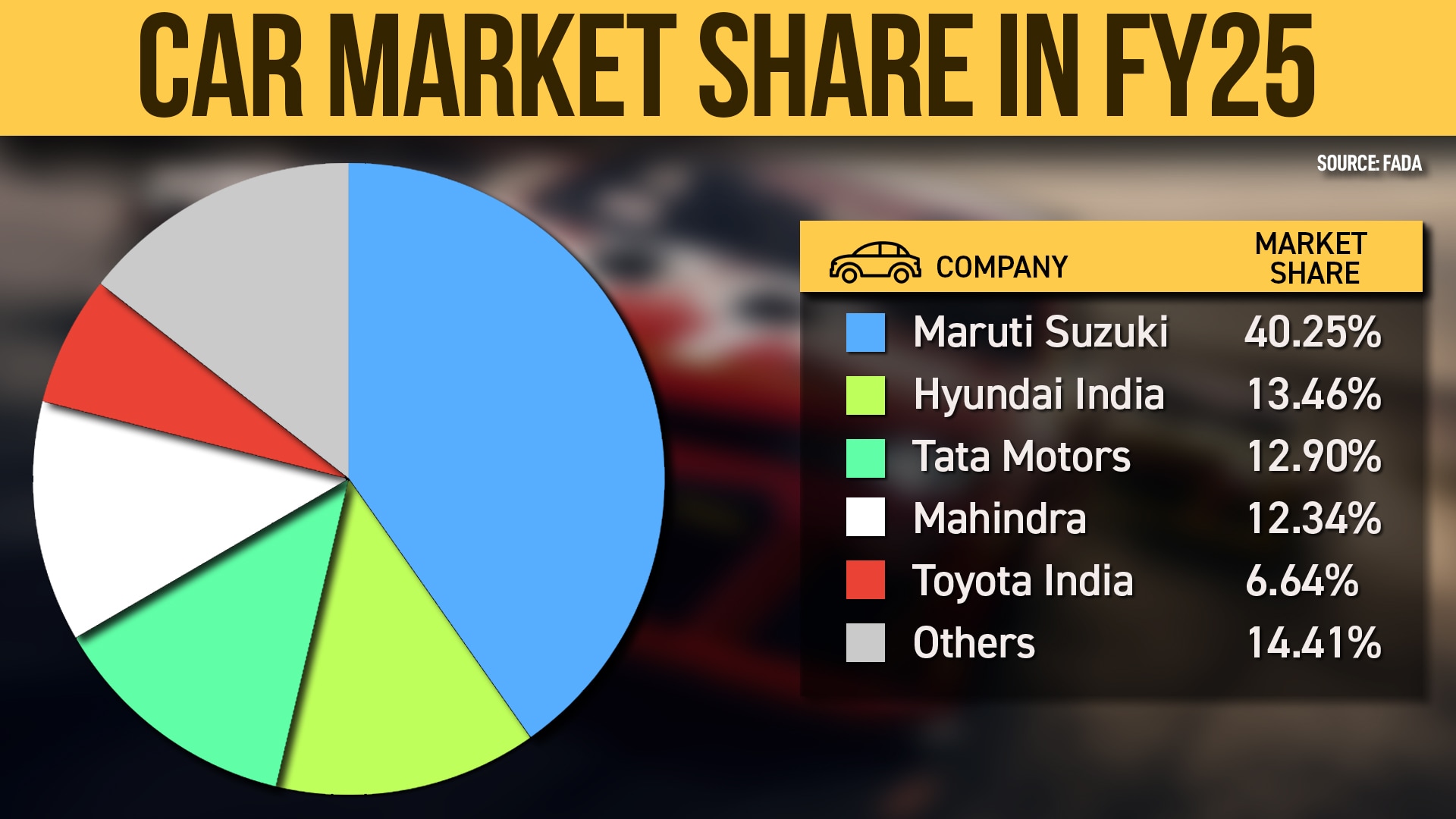

Still, conversations with industry watchers and analysts reveal there are several variables in play to arrive at a clear No.2 to Maruti Suzuki India Ltd.

“Every OEM (original equipment manufacturer) has their target segments across fuel types,” Puneet Gupta, director at S&P Global Mobility (India & Asean), told NDTV Profit. “There are a lot of unknowns which will keep the market share fluctuating among the three OEMs.”

In the fiscal ended March 31, 2025, sports utility vehicles (27,97,229 units) outsold small cars (13,53,287 units) two to one, underscoring the outsized demand for oversized vehicles in the world's third largest car market.

M&M has been the biggest beneficiary of this “SUV-fication”, with sales growing by nearly a fifth every month, even as the wider industry lagged with low single-digit growth. Sure, Tata Motors and Hyundai India have a well-diversified SUV line-up at Rs 10-25 lakh, but the lack of new nameplates is showing in their volumes.

Yes, the Tata Curvv (Rs 15-20 lakh) is new, but Tata Motors' first offering in the 4.3-metre SUV space hasn't materially translated into market share gains. In comparison, Mahindra XUV 3XO—M&M's first sub-four metre SUV that's not the three-door Thar—has made significant inroads in the compact SUV space (Rs 10-15 lakh).

The possibility of M&M emerging as a clear No.2 carmaker in India rides on the demand for its pure SUV portfolio, a Mumbai-based car dealer said on the condition of anonymity. While there is demand for the XUV 3XO, there is some fatigue visible for XUV 7OO and Scorpio, even as the Thar 5-Door sells well, the dealer said.

Gupta of S&P Global Mobility pointed out another key trend. “SUV buyers are increasingly moving down the variant list, to arrive at a more value-for-money proposition.”

But is there scope for a comeback of entry-level cars—the likes of Alto?

“The government has recognised that without small-car revival, growth of car industry will always be muted,” Maruti Suzuki's Chairman RC Bhargava said during an earnings call on April 28. “It's a fallacy to think that decline of small cars and surge of SUVs is an indicator of rising aspiration levels.”

“Only 12% of Indian households have an income of Rs 10 lakh/year—which is the average selling price of a car in India right now,” Bhargava had said then, even as he announced a new SUV by India's largest carmaker.

Shailesh Chandra of Tata Motors differed in his assessment.

“India's car penetration is similar to what was China's at this level of per capita income,” the managing director of the Nexon maker said during an interview to NDTV Profit last week. “Entry-level cars have little role to play in higher adoption as aspirations have grown.”

For the budget-constrained, there's a used-car market that has doubled in size since the pandemic. And even they are not looking at entry-level cars.

“Those on a smaller budget—about Rs 4.5-5 lakh—opt to look at the used car market for compact SUVs or premium hatchbacks,” Chandra said. “No one wants to spend Rs 4.5-5 lakh to buy an entry-level small car.”

India's hatchback space may have shrunk from nearly half of the market to a quarter, but it still accounts for 1-1.4 million units per year. Within this space, premium hatchbacks are the fastest-growing.

“What I believe is that SUV growth will continue, but may taper down as its contribution has reached close to 70% of industry,” Mitul Shah, automobile analyst at DAM Capital Advisors Ltd., told NDTV Profit. “The small-car space has reduced to less than 20%, but won't go lower. Not entry-level cars but compact cars/hatchbacks may see a decent revival.”

Chandra of Tata Motors had a similar assessment for his business.

“For us, the Tiago (hatchback), Punch (compact SUV) and Altroz (premium hatchback) are key to drive volume in the Rs 8-15 lakh segment,” he said during the interview. “The new Altroz, with features from a segment above, is an attempt to capture 25% market share in the premium hatchback segment.”

Clearly, compact is the way to go, whether it's a hatchback or SUV, but the car should be packed with features. After all, few are as value-conscious as the Indian car buyer.

The Multi-Powertrain Strategy

The Corporate Average Fuel Efficiency III norms, which come into effect in 2027, can rework the pecking order in India's car industry. That Delhi—a key geography for SUV sales—has pushed back against diesel is yet another unknown for a company like M&M.

CAFE III aims to reduce carbon-dioxide emissions from cars in India, leading to a shift towards environment-friendly vehicles. Meaning, OEMs will need to have a certain number of vehicles powered by electric, hybrid or CNG powertrains.

“Mahindra has large SUVs (which sell) but 80% of their portfolio is diesel, and that's a risk, with an evolving policy picture,” S&P Global Mobility's Gupta said. “With CAFE-III and IV coming in, M&M needs to derisk quickly.”

Sure, the company has taken a step towards electric mobility with its first “electric origin” SUVs selling like hot cakes, but Tata Motors can steal a march here.

“Tata Motors has its own USP—an almost entirely electrified line-up—but fleet demand has been a pain of late,” Gupta said. “Hyundai has hybrid plans as well as a product onslaught that will pan out over the next couple of years.”

But electric vehicles cannot be a deciding factor for bragging rights immediately, as it's still a nascent but fast-evolving space in India. Even an outside player like JSW MG Motor Pvt., with its Windsor and Comet, ate into Tata Motors' EV market share in 2024. Maruti Suzuki's eVitara is still to break cover, even as the Creta EV—Hyundai's best-selling SUV in an electric avatar—hasn't gained much traction since launch in January this year.

What can be a differentiator is CNG—the fastest growing segment in India.

In 2024, CNG car sales grew 35% year-on-year to 7,15,213 units, according to VAHAN data. Maruti Suzuki, with 15 models in its line-up, accounted for two out of three CNG cars sold in India. Tata Motors and Hyundai India followed with 16% and 10% market share, respectively. Mahindra does not have a CNG powertrain.

Final Word

Amid all the bragging rights that come with being India's second largest carmaker, unit sales without revenue growth mean precious little. A higher average selling price means higher margins—and that, at the end of the day, is the deciding factor.

Maruti Suzuki sells the highest number of cars, but its Ebitda margin declined 180 basis points to 10.5% in January-March. That compares with 14.9% for M&M, 12.9% for Hyundai India and 14% for Tata Motors. India's largest carmaker is still chasing 50% market share by 2030—easier said than done with three worthy rivals snapping at your heels.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.