ICICI Bank Q4 Results Review: Margins To Remain Under Pressure In Near Term

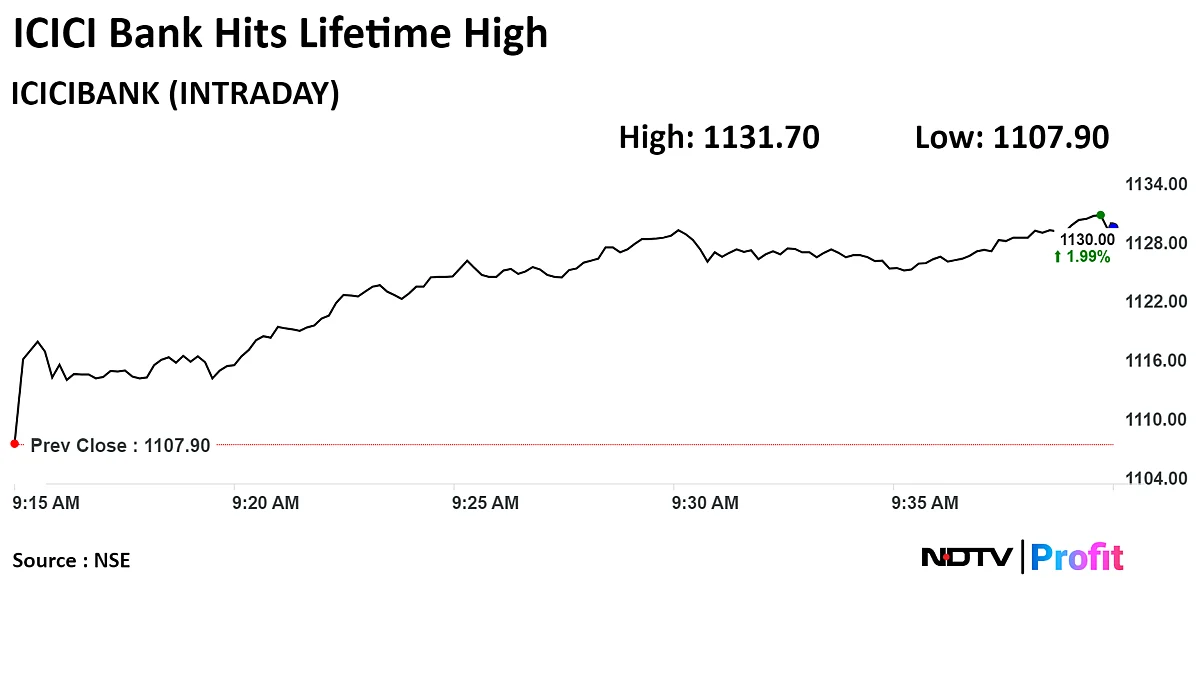

ICICI Bank's market capitalisation topped the Rs 8-lakh-crore mark for the first time as its shares hit a fresh all-time high on Monday.

ICICI Bank Ltd.'s margins may continue to remain under pressure in the short term due to persistent funding cost pressure, even as brokerages raised the private lender's earnings outlook after it reported fourth-quarter results mostly in line with analysts' estimates.

The private lender's net profit rose 17% year-on-year to Rs 10,707 crore in the quarter ended March 2024, backed by healthy deposit growth and a sharp decline in provisions, according to an exchange filing. Bloomberg polled analysts estimated the net profit at Rs 10,489.09 crore.

The lender's net interest income, or core income, grew 8% year-on-year to Rs 19,093 crore. The net interest margin stood at 4.4% in Q4, compared to 4.43% in the previous quarter and 4.90% in the same quarter a year ago.

Total deposits increased by 19.6% year-on-year to Rs 14.1 lakh crore, with term deposits growing by 27.7% on a yearly basis. The bank's credit-deposit ratio stood at 82.3% as of March 31, up from 84.6% in Q3.

Here Are Brokerages' Views On ICICI Bank Q4 Results

Nirmal Bang Institutional Research

The net interest margin continued to compress due to a lag in deposit repricing and the absence of IT refunds. In the short term, the NIM will remain under pressure.

There is a healthy growth outlook and earnings trajectory, with return ratios expected to remain healthy.

Momentum in balance sheet growth is expected to remain strong.

Expect earnings to clock a growth of 13.2% over FY24-26.

Maintains a 'buy', with a target price of Rs 1,315 apiece.

ALSO READ

ICICI Bank, Maruti Suzuki, SBI Life, RBL Bank, Tanla Platforms Q4 Results Review: HDFC Securities

Motilal Oswal Financial Services

Healthy net interest income, controlled opex, and provisions backed by healthy asset quality led to a steady Q4.

The stable mix of a high-yielding retail and business banking portfolio, as well as continued traction in business banking, SME, and secured retail, drives broad-based growth.

Even as the pace of NIM contraction has decelerated, persistent funding cost pressure may keep margins low.

The additional contingency provisioning buffer, at 1.1% of loans, provides further comfort.

For FY26, EPS estimates increased by 2%.

Expects a return on assets of 2.26% and a return on earnings of 18.0% in FY26.

Reiterates a 'buy' rating, with a revised target price of Rs 1,300 apiece.

Bernstein Research

The return on assets remained higher, thanks to another quarter of ultra-low credit costs, which more than offset a marginal decline in the NIM and lower non-interest income.

A deposit growth of 20% YoY was a key positive, especially with the system deposit growth at 13% YoY.

Despite credit costs, the RoA remained healthy.

The NIM witnessed a marginal decline sequentially, led by continued deposit repricing but remains much higher than peers.

ALSO READ

ICICI Bank Q4 Review - Revise Estimates, Target Price On Better Than Expected Results: Systematix

ICICI Bank's market capitalisation topped the Rs 8-lakh-crore mark for the first time as its shares hit a fresh all-time high on Monday. The stock rose as much as 5.01% during the day to an all-time high of Rs 1,163.45 apiece on the NSE. It was trading 4.59% up at 1,158.7 per share, compared to a 0.89% advance in the benchmark Nifty as of 2:53 p.m.

The share price has risen 17.96% on a year-to-date basis and 24.66% in the last 12 months. The total traded volume so far in the day stood at 2.1 times its 30-day average. The relative strength index was at 71.45.

Forty-eight out of the 51 analysts tracking the company have a 'buy' rating on the stock and three recommend 'hold, according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 14.8%.