L&T Q2 Earnings Conference - Key Highlights

Company is broadening to Africa and Central Asia markets.

Working on debt restructuring of Hyderabad Metro.

Expect domestic orders to pick up momentum in the second half of the fiscal 2024-25.

Source: Bloomberg

Automotive Axles Q2 Results - Key Highlights (Consolidated, YoY)

Revenue down 15% to Rs 495 crore versus Rs 584 crore.

Ebitda down 23% to Rs 51 crore versus Rs 66 crore.

Margin at 10.3% versus 11.3%.

Net profit down 20% to Rs 36 crore versus Rs 45 crore.

DCM Shriram Q2 Results - Key Highlights (Consolidated, YoY)

Revenue up 9% to Rs 2,957 crore versus Rs 2,708 crore.

Ebitda up 59% to Rs 181 crore versus Rs 114 crore.

Ebitda margin at 6.1% versus 4.2%.

Net profit up 95% to Rs 63 crore versus Rs 32 crore.

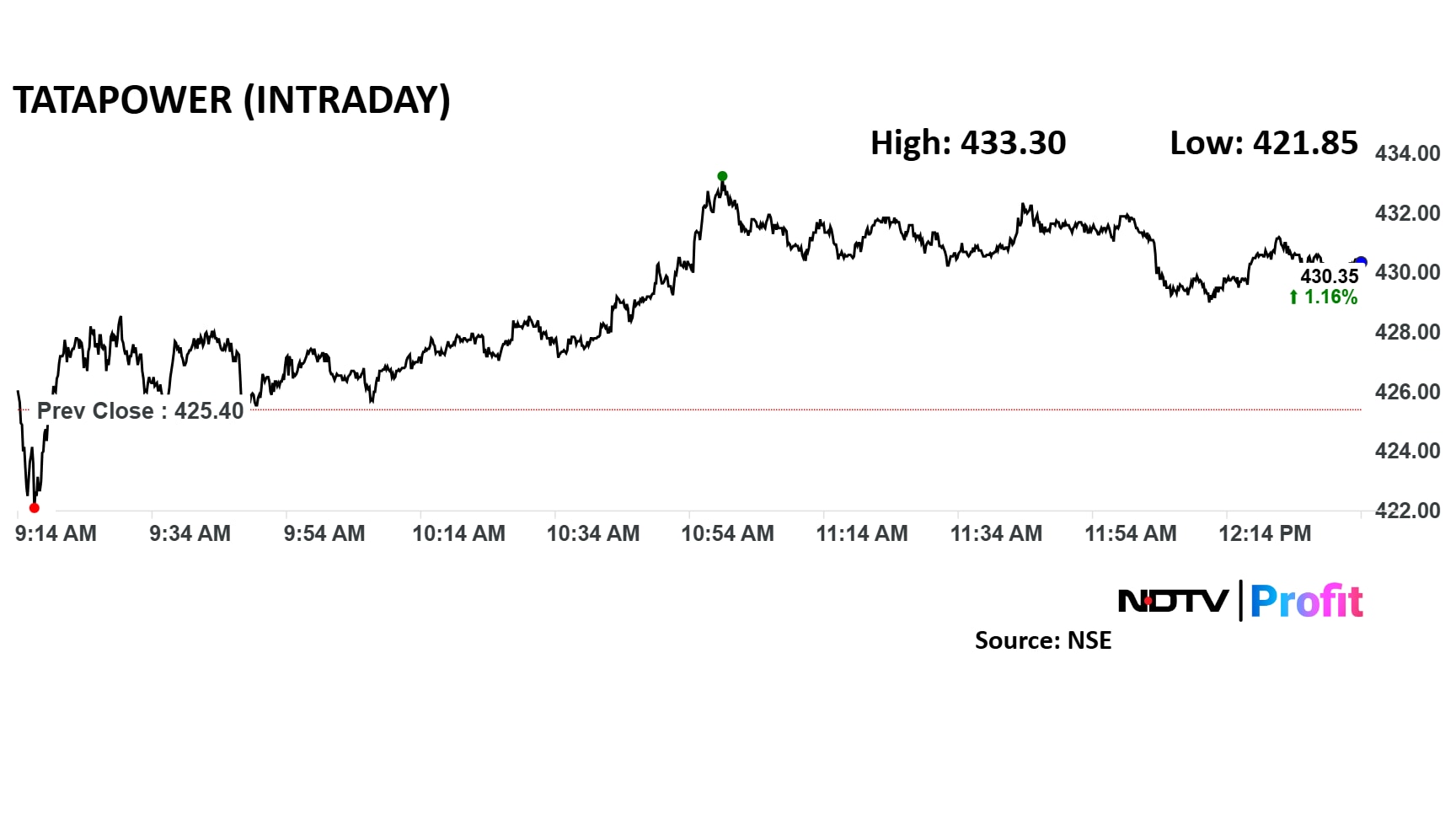

Tata Power Q2 Results - Key Highlights (Consolidated, YoY)

Revenue down 0.3% to Rs 15,698 crore versus Rs 15,738 crore.

Ebitda up 21.2% to Rs 3,745 crore versus Rs 3,091 crore.

Margin at 23.9% versus 19.6%.

Net profit up 7% to Rs 1,093 crore versus Rs 1,017 crore.

Click here to read full story.

L&T Q2 FY25 Results Highlights (Consolidated, YoY)

Revenue from operations rose 20% to Rs 61,554 crore (Bloomberg estimate: Rs 57,621.54 crore).

Operating profit or Ebitda rose 13% to Rs 6,632 crore (Bloomberg estimate: Rs 6,141 crore).

Ebitda margin was down 70 basis points to 10.33% versus 11,03% a year ago (Bloomberg estimate: 10.7%).

Net profit was up 6.69% to Rs 4,113 crore (Bloomberg estimate: Rs 3,205 crore).

Click here to read full story.

Biocon Q2 Results - Key Highlights (Consolidated, YoY)

Revenue up 3.7% to Rs 3,590 crore versus Rs 3,462 crore (Bloomberg estimate: Rs 3,623 crore).

Ebitda down 7.6% to Rs 685 crore versus Rs 742 crore (Bloomberg estimate: Rs 741 crore).

Margin at 19.1% versus 21.4% (Bloomberg estimate: 20.5%).

Net profit down 84.3% at Rs 27.1 crore versus Rs 173 crore (Bloomberg estimate: Rs 24 crore).

Click here to read the full story.

Electrosteel Castings Q2 Earnings - Key Highlights (Consolidated, YoY)

Revenue down 4.7% to Rs 1828 crore versus Rs 1919 crore.

Ebitda down 10.9% to Rs 268 crore versus Rs 300 crore.

Margin at 14.6% versus 15.6%.

Net profit down 11.2% to Rs 155 crore versus Rs 175 crore.

The board declared interim dividend of Rs 3 per share. The record date is Nov. 8.

Kitex Garments Q2 Highlights (Consolidated, YoY)

Revenue up 48% at Rs 216 crore versus Rs 146 crore

Ebitda at Rs 54.8 crore versus Rs 13.9 crore

Margin at 25.4% versus 9.6%

Net profit at Rs 36.7 crore versus Rs 7.8 crore

TCI Express Q2 Highlights (Consolidated, YoY)

Revenue down 2.6% at Rs 312 crore versus Rs 320 crore

Ebitda down 27% at Rs 36.8 crore versus Rs 50.4 crore

Margin at 11.8% versus 15.7%

Net profit down 30% at Rs 24.9 crore versus Rs 35.6 crore

IRB Infra Developers Q2 Highlights (Consolidated, YoY)

Revenue down 9.1% at Rs 1,586 crore versus Rs 1,745 crore

Ebitda down 3.5% at Rs 767 crore versus Rs 794 crore

Margin at 48.3% versus 45.5%

Net profit up 4.3% at Rs 99.8 crore versus Rs 95.7 crore

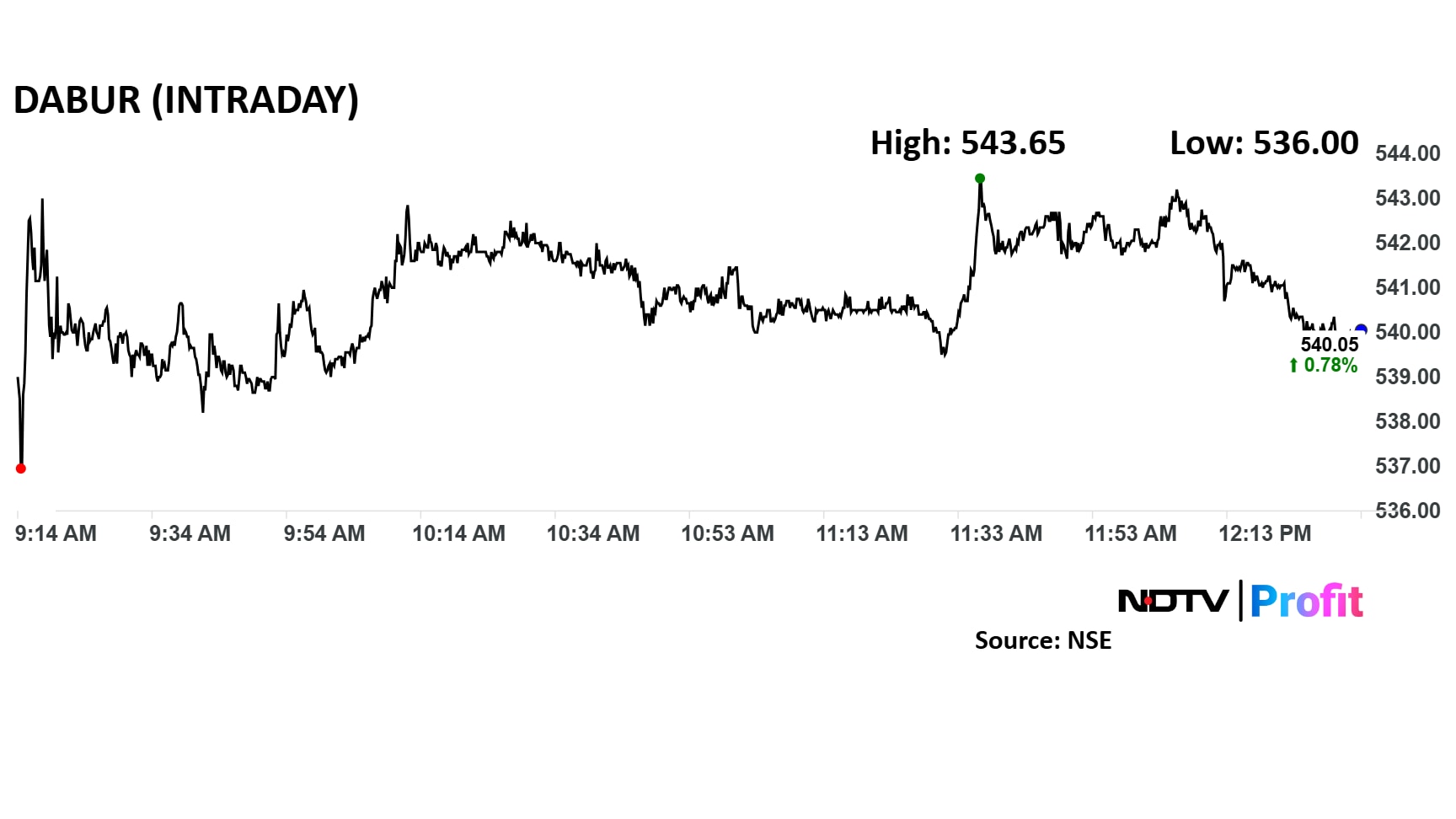

Dabur India will acquire Ayurvedic personal care and wellness company Sesa Care at an enterprise value of Rs 315-325 crore.

"The proposed merger brings substantial revenue and cost synergies. Dabur's extensive distribution network, category expertise, and access to key international markets can be leveraged to grow the brand and expand its footprint," the company said.

Source: Exchange filing

The Board has declared an interim dividend of Rs 2.75 per equity share for the financial year 2024-25. The record date is Nov. 8 and payout will be done on Nov. 22.

Dabur India Q2 Highlights (Consolidated, YoY)

Revenue down 5.5% at Rs 3,029 crore versus Rs 3,204 crore (Bloomberg estimate: Rs 3,042 crore)

Net profit down 17.5% at Rs 418 crore versus Rs 507 crore (Bloomberg estimate: Rs 446 crore)

Ebitda down 16.3% at Rs 553 crore versus Rs 661 crore (Bloomberg estimate: Rs 574 crore)

Ebitda margin at 18.2% versus 20.6% (Bloomberg estimate: 18.9%)

Read full story here.

Grindwell Norton Q2 Highlights (Consolidated, YoY)

Revenue up 4% at Rs 694 crore vs Rs 667 crore

EBITDA down 2% at Rs 129 crore vs Rs 131 crore

EBITDA margin at 18.6% vs 19.7%

Net profit down 5% at Rs 97 crore vs Rs 102 crore

TTK Prestige Q2 Highlights (Consol, YoY)

Revenue up 3% at Rs 750 crore vs Rs 729 crore

EBITDA down 10% at Rs 72 crore vs Rs 81 crore

EBITDA margin at 9.7% vs 11.1%

Net profit down 11.5% at Rs 52 crore vs Rs 59 crore

Larsen & Toubro, Tata Power, Dabur India Q2 Results Today — Earnings Estimates

P&G Hygiene Q2 Highlights (Consolidated, YoY)

Revenue down 0.3% at Rs 1,135 crore versus Rs 1,138 crore (Bloomberg estimate: Rs 1,244 crore)

Net profit at Rs 73.5 crore versus Rs 73.8 crore

Ebitda up 2% at Rs 291 crore versus Rs 285 crore (Bloomberg estimate: Rs 315 crore)

Ebitda margin at 25.6% versus 25% (Bloomberg estimate: 25%)

AIA Engineering is likely to report a standalone revenue of Rs 1,299 crore, an Ebitda of Rs 344 crore, and an Ebitda margin of 27%, resulting in a net profit of Rs 301 crore, as per Bloomberg estimates.

Sterlite Tech Q2 Highlights (Consolidated, YoY)

Revenue down 5% at Rs 1,413 crore versus Rs 1,494 crore

Net loss of Rs 14 crore versus profit of Rs 32 crore

Ebitda down 30% at Rs 151 crore versus Rs 216 crore

Ebitda margin at 10.7% versus 14.5%

Dabur India is expected to post a revenue of Rs 3,042 crore and an Ebitda of Rs 574 crore, with an Ebitda margin of 19%, leading to a net profit of Rs 446 crore.

Diwali Picks 2024: Tata Power To Tech Mahindra - Here Are The Top Mahurat Stock Picks By ICICI Direct

Larsen & Toubro, Tata Power, Dabur India Q2 Results Today — Earnings Estimates

Stock Market Live: Nifty, Sensex Off Day's Low As BEL, TCS Share Prices Gain