FPIs Stay Net Sellers For Seventh Session, Offload Equities Worth Nearly Rs 1,500 Crore

Domestic institutions remained net buyers of Indian equities and mopped up shares worth Rs 1,181.78 crore.

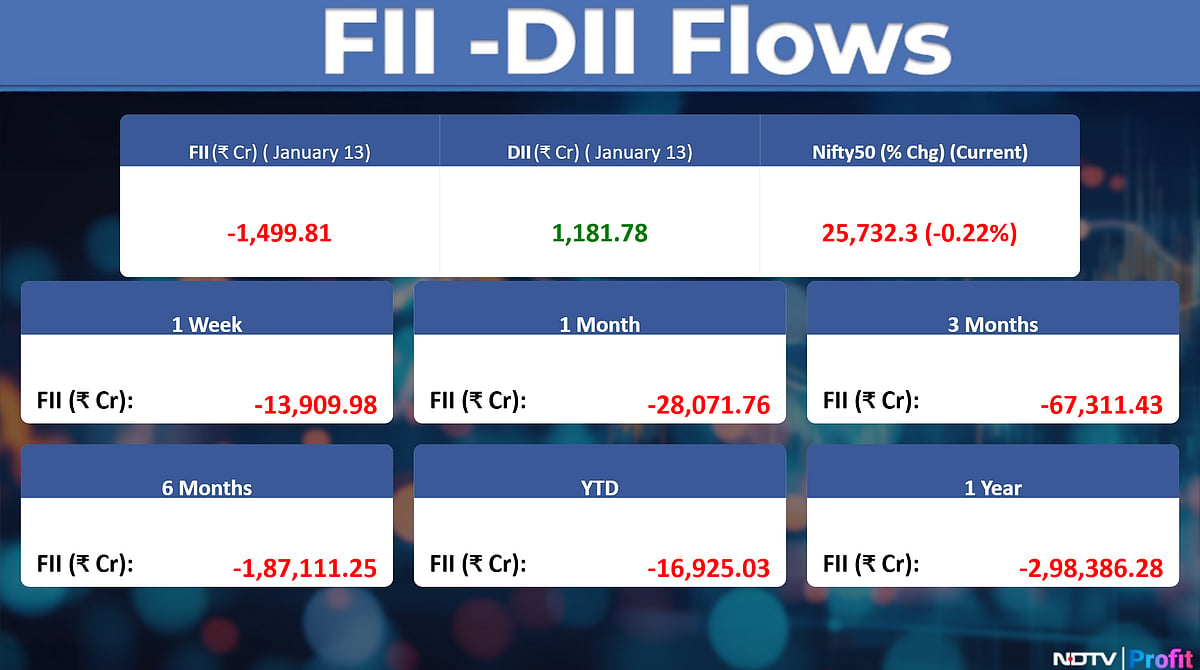

Foreign portfolio investors continued their selloff of Indian equities for the seventh consecutive session on Tuesday. The overseas investors net sold stocks worth Rs 1,499.8 crore, as per provisional data from the National Stock Exchange.

They had kickstarted the week by selling Rs 3,638.4 crore on Monday. Last week, the FPIs offloaded Rs 3,769 crore on Friday and on Thursday, they had sold shares worth 3,367 crore.

The outflow in local shares has crossed Rs 18,000 crore and amounted to Rs 18,585 crore so far in 2026, as per data from the National Securities Depository Ltd.

Domestic institutions, on the other hand, remained net buyers of Indian equities and mopped up shares worth Rs 1,181.78 crore. On Monday they had bought Rs 5,839.3 crore. The DIIs had ended last week after buying equities worth Rs 5,596 crore on Friday and have been buyers for over 50 sessions.

Market Recap

Indian benchmark indices ended marginally lower on Tuesday, with the Nifty closing below the 25,750 marks amid weekly F&O expiry-related volatility.

Sentiment was also weighed down by renewed geopolitical concerns after US President Donald Trump announced a 25% tariff on countries trading with Iran, raising potential risks for India’s exports and strategic projects such as the Chabahar Port.

The BSE Sensex declined 250.48 points (0.3%) to close at 83,627.69, while the Nifty slipped 57.95 points (0.22%) to 25,732.30.

In the broader market, the Midcap index eased 0.2%, whereas the Smallcap index outperformed, gaining 0.6%.