Trade Setup For Jan. 14: Options Writing Signals Tight Nifty Range — Check Key Levels

As long as the Nifty sustains above the 25,600 level, a selective buy-on-dips strategy may be considered.

The Nifty 50 index in the current truncated week is likely to consolidate in the range of 26,000-25,500 and only a breakout or a breakdown will signal the next directional move, according to analysts.

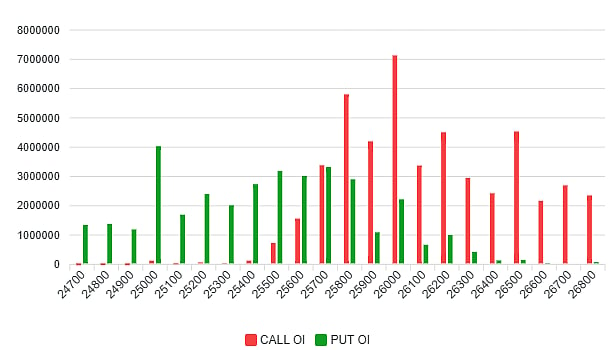

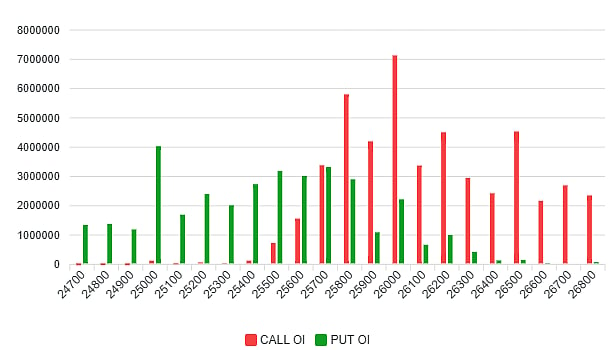

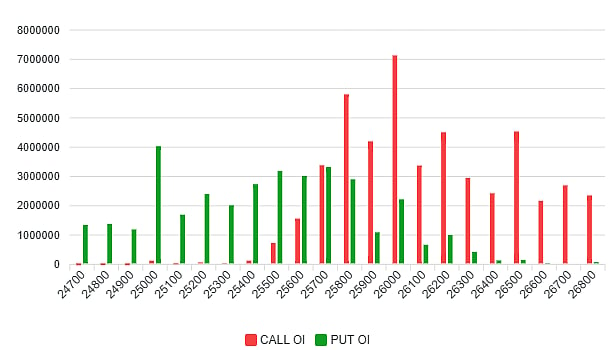

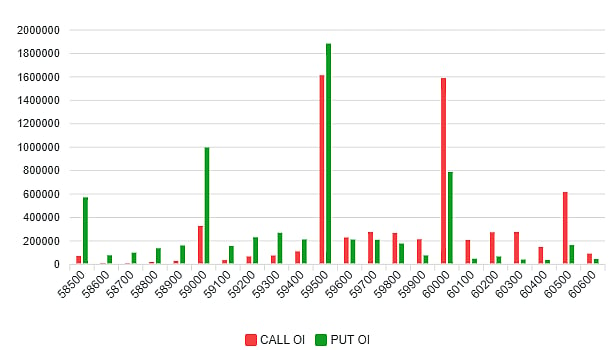

Derivatives data shows heavy call writing at the 26,000 strike along with strong put writing at the 25,700 strike, suggesting a well-defined near-term trading range. As long as the Nifty sustains above the 25,600 level, a selective buy-on-dips strategy may be considered, with strict stop-losses placed at 25,500 to effectively manage downside risk, said Hitesh Tailor, research analyst at Choice Broking.

"On the downside, 25,600-25,550 would act as key support zones, while 25,900-25,950 could be the key resistance areas for the bulls. However, below 25,550, the sentiment could change and the same traders may prefer to exit out from trading long positions," said Shrikant Chouhan, head equity research at Kotak Securities.

Nifty Open Interest Distribution (two weeks)

Nifty Open Interest Distribution (two weeks)

Nifty Open Interest Distribution (two weeks)

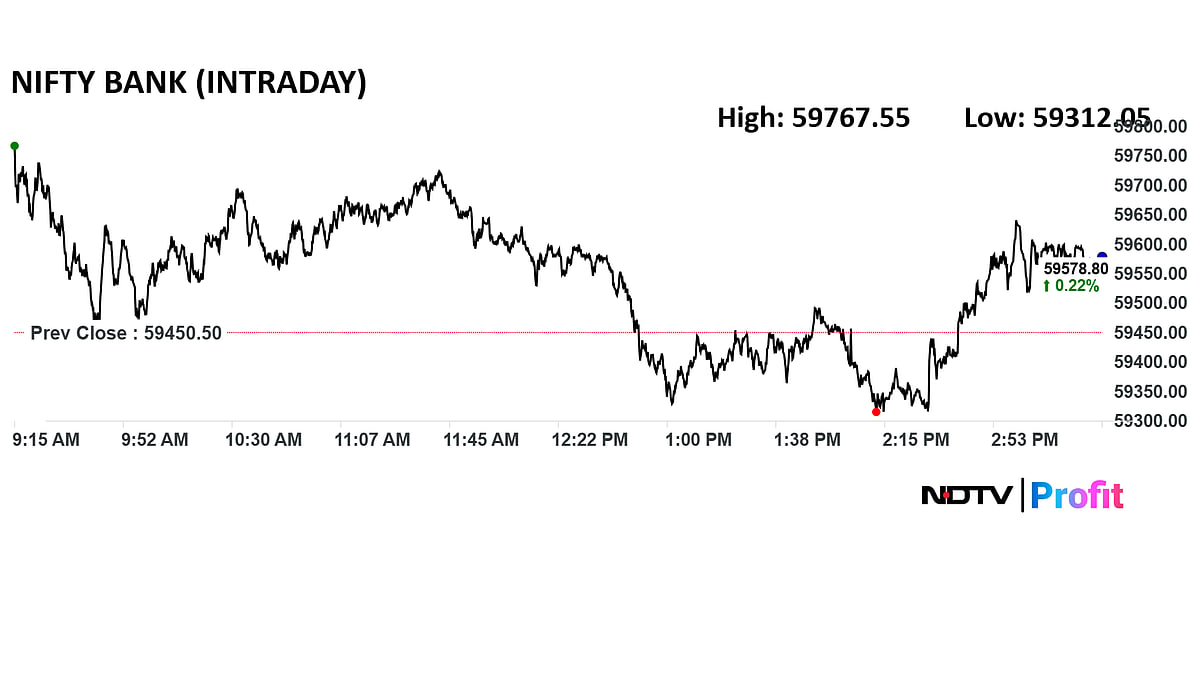

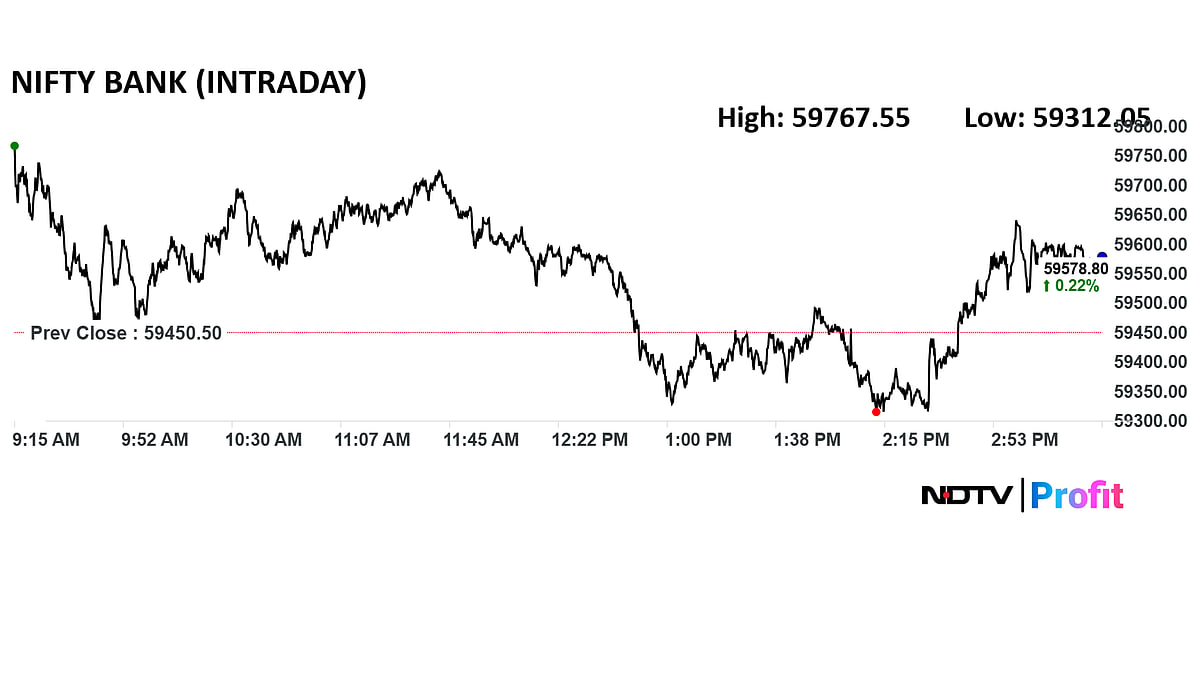

Bank Nifty

The Bank Nifty index is seen rebounding from the lower band of the last five weeks range placed around 58,700-59,000, according to Bajaj Broking.

Analysts expect index to extend the consolidation within the 58,700–60,000 range. A decisive breakout above this range or a breakdown below it will provide clarity on the next directional move. Key short-term support zone lies at 59,000–58,700.

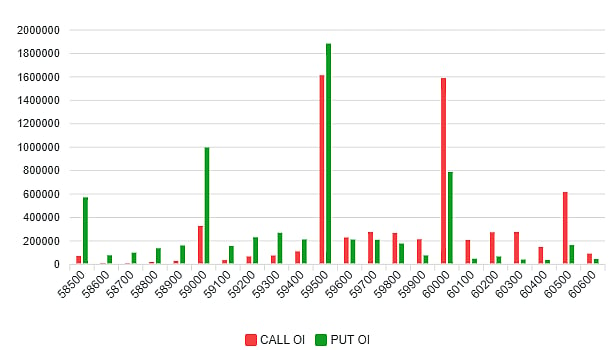

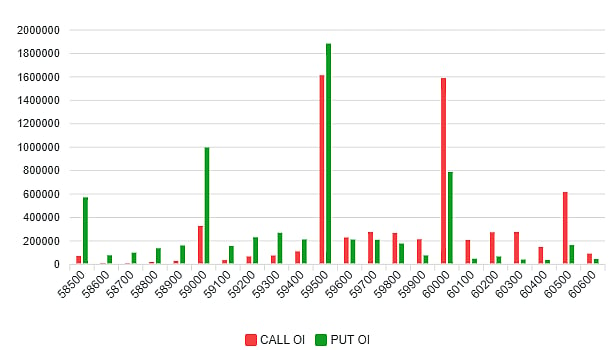

Bank Nifty Open Interest Distribution

Bank Nifty Open Interest Distribution

Bank Nifty Open Interest Distribution

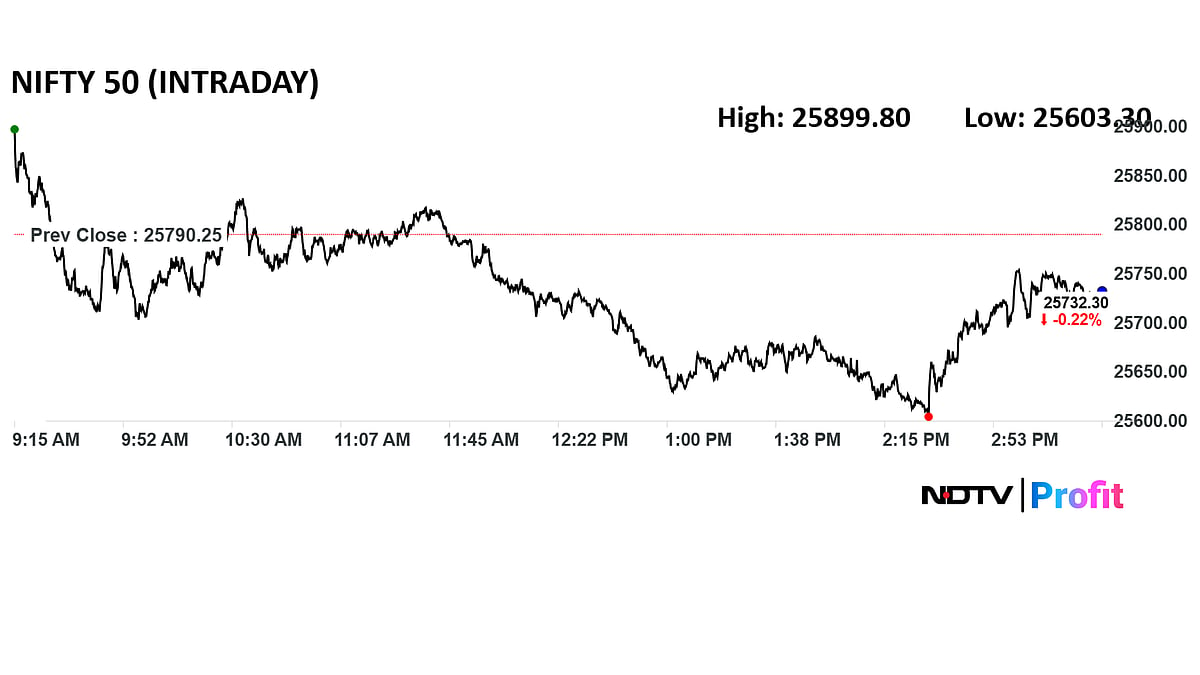

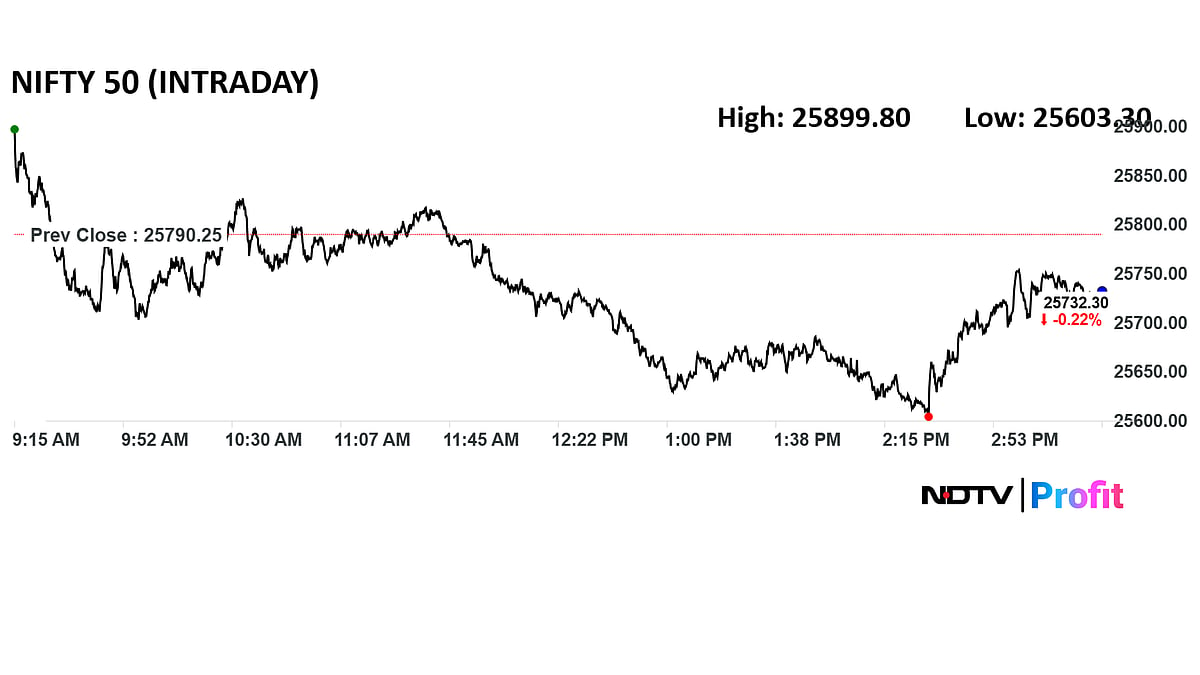

Market Recap

Indian benchmark indices ended marginally lower on Tuesday, with the Nifty closing below the 25,750 marks amid weekly F&O expiry-related volatility.

Sentiment was also weighed down by renewed geopolitical concerns after US President Donald Trump announced a 25% tariff on countries trading with Iran, raising potential risks for India’s exports and strategic projects such as the Chabahar Port.

The BSE Sensex declined 250.48 points (0.3%) to close at 83,627.69, while the Nifty slipped 57.95 points (0.22%) to 25,732.30.

In the broader market, the Midcap index eased 0.2%, whereas the Smallcap index outperformed, gaining 0.6%.