BSE Ltd. is unlikely to get into a price war after the National Stock Exchange of India Ltd. cut overall transaction charges across segments, according to Jefferies.

"Despite the inch-up in competition from BSE—which has gained 6% monthly premium market share—the smaller quantum of cuts also showcase limited appetite of exchanges to indulge in price wars," the brokerage said.

"The price cut by the competitor won't impact BSE's price discounts; it can remain intact," it said.

Jefferies reiterated a 'buy' rating on BSE with a target price of Rs 3,000 apiece, implying an upside of 37.30%.

NSE's overall blended equity options yield 3.15 basis points, which is 21% higher than BSE's flagship equity option products. The reduction is unlikely to shrink the gap significantly. Therefore, BSE is not expected to deliver any price cuts in the near future, Jefferies said.

BSE is witnessing steady improvement in option volumes, with average daily volume in this segment rising by 40% sequentially in February, it said. In addition, market share in notional and premium turnover was growing at 15% and 6%, respectively, in February.

"Even as its pace of growth has moderated in the beginning of March 2023, current run-rate keeps us comfortable with our FY25E average daily trading volume of Rs 6,200 crore (8% market share)," Jefferies said.

NSE has approved the reduction in overall transaction charges across cash equity and equity derivatives segments / products by 1%, with effect from April 1, 2024, the board of directors of the company said at its meeting held on March 11.

The cut is a regular exercise by the exchange, Jefferies said. The price reduction will result in an impact of Rs 130 crore on revenue from transaction charges of the company, the brokerage said in a note on Tuesday.

Key Takeaways:

Jefferies reiterated a 'buy' rating on BSE with a target price of Rs 3,000 apiece, implying a gain of 37.30% from Tuesday's closing price.

Indian bourses are trading at a premium to Asian peers for a longer-term and higher-growth outlook.

BSE is on track to drive more than a 2.5-time earnings jump over FY24–26, Jefferies said in a note.

The outlook for non-derivatives businesses like cash and MF remains at a healthy 20% CAGR. Even after 100% growth in FY24E,.

Over the next 2-3 years, BSE will likely monetise its success in the derivatives market to enhance realisations and new lines like co-location income.

NSE's price cut is unlikely to prompt BSE to go for any large price cuts. Hence, BSE's discount offerings remain intact.

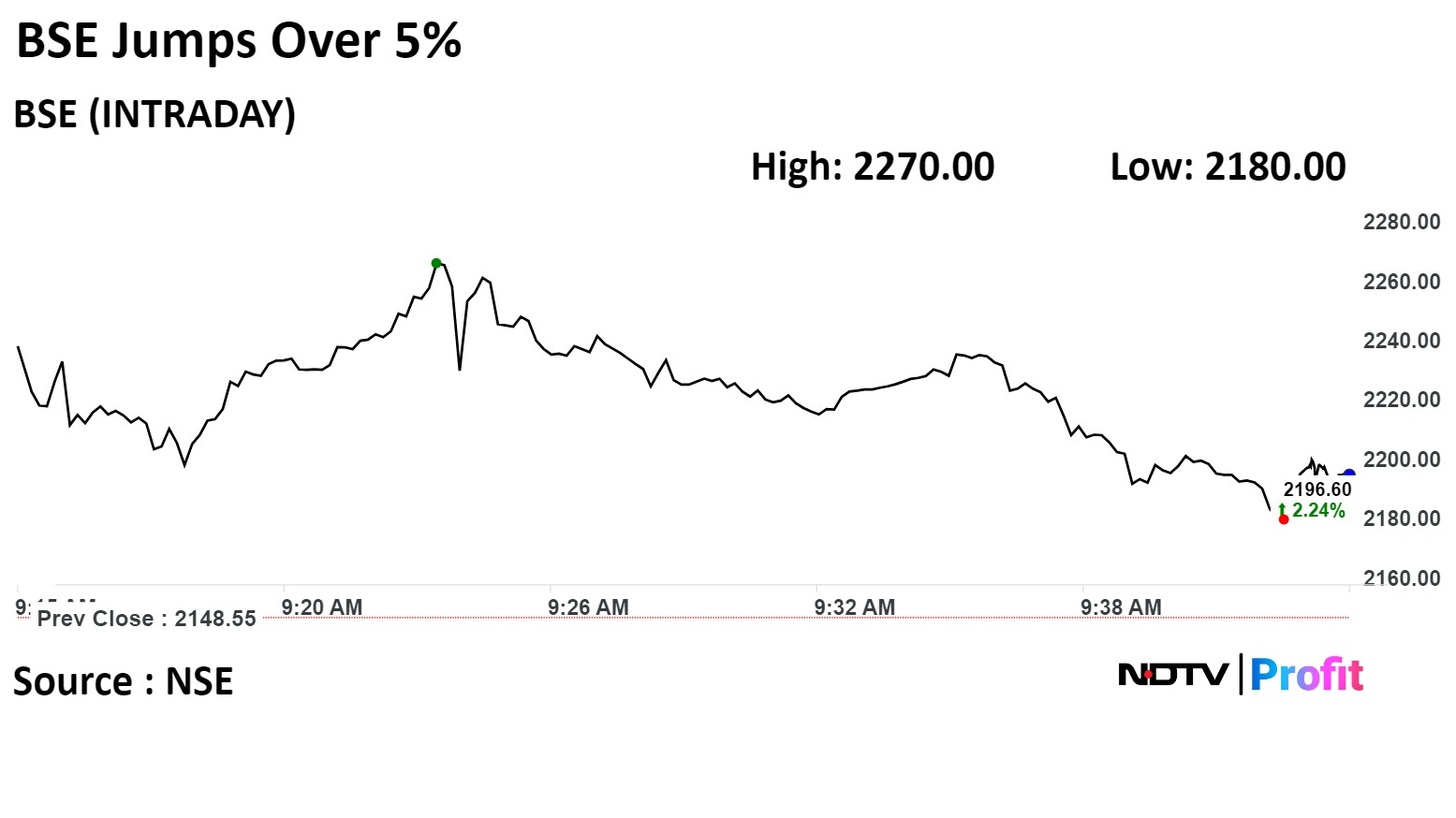

Shares of BSE rose as much as 5.7% to Rs 2,270.00 apiece, the highest since March 7 on NSE. It pared gains to trade 2.53% higher at Rs 2,201.25 apiece as of 09:40 a.m. This compares to a 0.07% decline in the NSE Nifty 50 Index.

It has risen 405.95% in past 12 months. Total traded volume so far in the day stood at 0.70 times its 30-day average. The relative strength index was at 41.01.

Out of seven analysts tracking the company, four maintain a 'buy' rating, three recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 25.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.