Shares of Godrej Consumer Products Ltd. jumped nearly 8% on Tuesday to an all-time high even after reporting a one-time loss in the fourth quarter as the company said that this charge will be cash-positive.

Profitability was impacted as the company has incurred a one-time exceptional loss of Rs 2,378 crore due to restructuring of business in Africa, US and the Middle East region and another Rs 95 crore in other costs. Without the one-offs, GCPL reported a 22% growth in profit after tax to Rs 574 crore in the fourth quarter, according to an exchange filing.

GCPL Q4 FY24 Earnings Highlights (Consolidated, YoY)

Revenue up 5.8% at Rs 3,386 crore (Bloomberg estimate: Rs 3,360.8 crore).

Ebitda up 14% at Rs 760.4 crore vs Rs 664.8 crore (Bloomberg estimate: Rs 742.2 crore).

Margin at 22.5% vs 20.8%

Net loss at Rs 1,893.2 crore vs profit of Rs 452.1 crore

Underlying volume grew 12% during the quarter, and 9% organically.

India business reported a 7% increase in organic volume and 5% growth in organic sales to Rs 1,870 crore.

"We have taken an exceptional accounting charge of Rs 2,378 crore in our consolidated P&L (profit and loss) statement. The impact of this charge is cash-positive," the company said in a release.

Emkay Global maintains its 'add' rating for the stock on limited upside potential. The brokerage has a price target of Rs 1,350 apiece, implying an upside of 8% from the previous close.

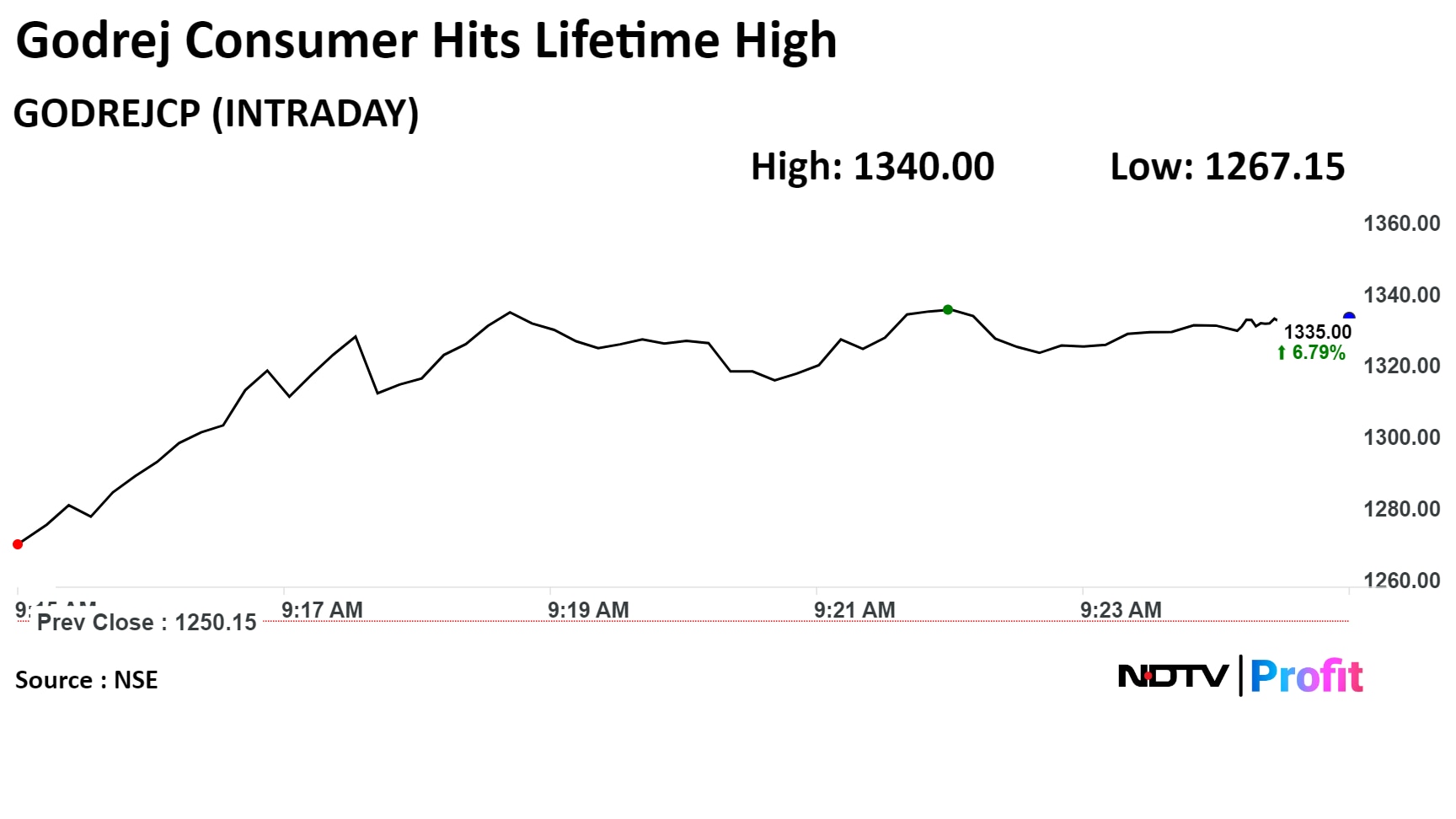

GCPL's stock rose as much as 7.72% during the day to Rs 1,346.70 apiece on the NSE. It was trading 6.7% higher at Rs 1,332.10 per share, compared to a 0.12% decline in the benchmark Nifty 50 at 9:57 a.m.

The share price has risen 17.57% on a year-to-date basis and 25.68% in the last 12 months. The total traded volume so far in the day stood at 2.7 times its 30-day average. The relative strength index was at 71.91, indicating that the stock may be overbought.

Out of the 37 analysts tracking the company, 28 have a 'buy' rating on the stock, six recommend 'hold' and three suggest 'sell,' according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 1.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.