Shares of Wipro Ltd. rose over 2% on Monday after its fourth-quarter profit rose in line with above analysts' estimates. India's fourth largest IT services firm's net profit rose 5.8% year-on-year to Rs 2,858 crore in the quarter ended March 2024, according to an exchange filing. That compares with the Rs 2,772.10 crore-crore consensus estimate of analysts tracked by Bloomberg.

Wipro Q4 Results: Key Highlights (Consolidated, QoQ)

Revenue flat at Rs 22,208 crore (Bloomberg estimate: Rs 22,226.70 crore).

EBIT down 9% to Rs 3,560 crore (Bloomberg estimate: Rs 3,372.4 crore).

EBIT margin up 131 basis points to 16% (Bloomberg estimate: 15.17%).

Net profit up 5.8% to Rs 2,858 crore (Bloomberg estimate: Rs 2,772.10 crore).

However, brokerages including Goldman Sachs and Motilal Oswal expect the company's revenue growth to underperform its peers in this fiscal.

While CLSA said the company's new CEO has an advantage over his two previous predecessors, it also noted that it will be a tough ask for him to "turnaround Wipro's fortunes, which have been weak for the last two decades now."

For the June quarter, the company has guided for a 1.5% sequential fall in revenue, but in revenue from its IT Services segment, it expects a 0.5% rise in constant currency terms—in the range of $2,617-2,670 million.

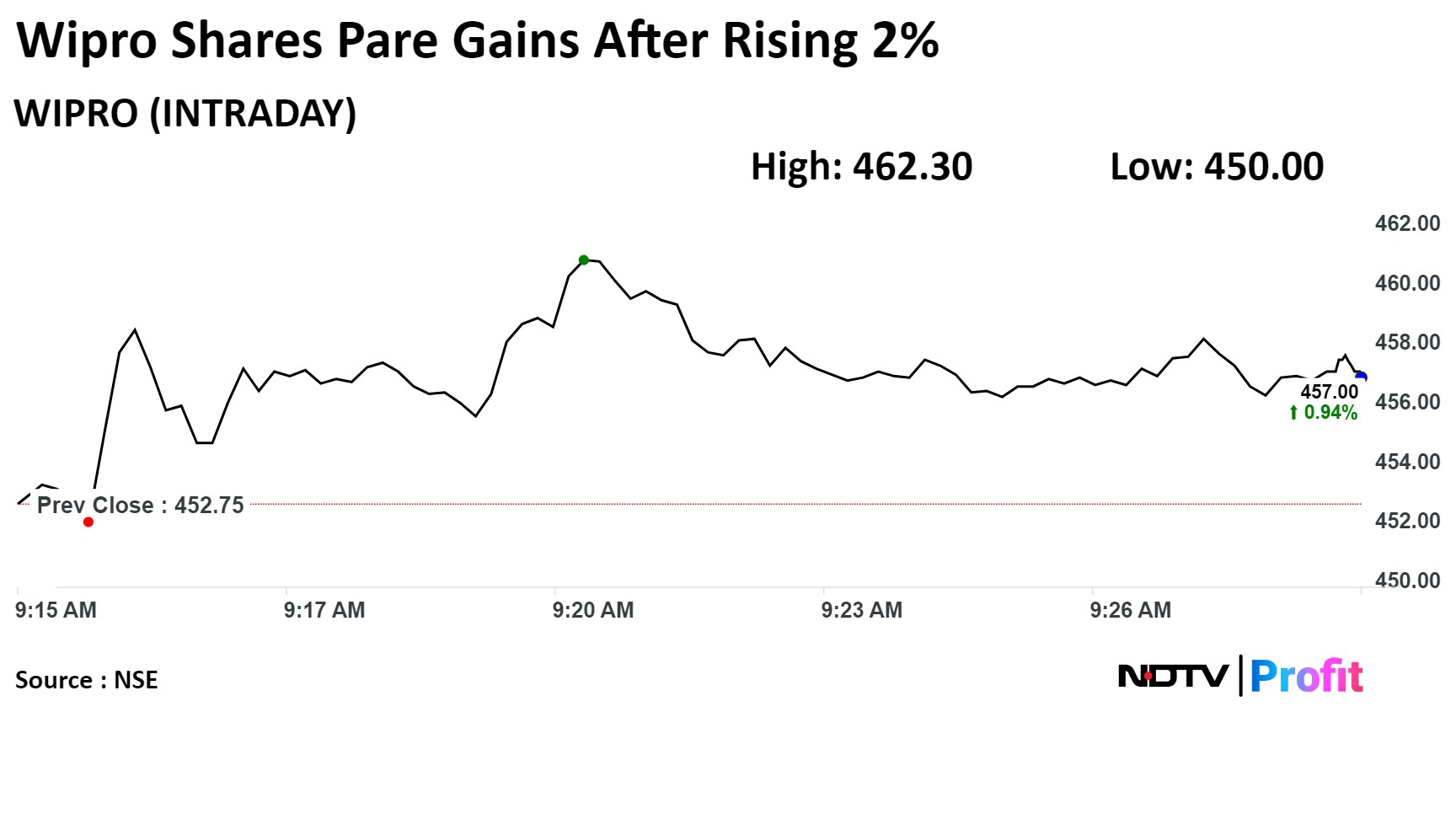

On the NSE, Wipro's stock rose as much as 2.11% during the day to Rs 462.30 apiece, the highest since April 15. It was trading 1.33% higher at Rs 458.55 apiece, compared to a 0.48% advance in the benchmark Nifty 50 as of 9:38 a.m.

The share price has risen 19.79% in the last 12 months but fallen 2.24% on a year-to-date basis. The total traded volume so far in the day stood at 0.26 times its 30-day average. The relative strength index was at 39.26.

Out of 47 analysts tracking the company, 10 have a 'buy' rating on the stock, 15 recommend 'hold' and 22 suggest 'sell,' according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 0.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.