Bandhan Bank Ltd. will appoint an interim chief executive officer for the transition period, according to outgoing Managing Director and Chief Executive Officer Chandra Shekhar Ghosh.

The bank, in an exchange filing on Friday, said that Ghosh would cease to be the private lender's MD and CEO after the completion of his services on July 9.

However, he will transit to a higher strategic role at the group level after this, the filing said.

In the analyst call, Ghosh clarified that if a new CEO is not selected by the time he leaves, the bank will appoint an interim CEO for the transition period.

"My decision to retire was made voluntarily... I am transitioning to a higher strategic role. ... can't go into details of my larger role as of now but will clarify after July 9," he said.

While explaining the timing of his retirement, Ghosh said that under his leadership, the institute has transitioned into the largest microfinance institute and then a universal bank.

"Today, the bank has a diversified portfolio across geographies... The bank is ready to take a leap of growth with capable leadership... We will ensure a smooth transition," he said.

He also added that even though the pandemic made things worse, there was gradual improvement in the bank in 2022–23, and it was only in 2023–24 that the business momentum became very good.

The bank was going through a bit IT transformation, he said an an explanation as to why he didn't take the decision before the renewal of his term in November.

"... and October, if you recall, we had the biggest transformation of IT and I needed to stabilise it. During that period, in November, my board decided for my renewal and subject to RBI's nod... and I can't say anything because it was very crucial time for my bank's IT transformation too; it was very important for the bank," he said.

However, it was after more senior executives like a new Executive Director and Chief Financial Officer joining, that Ghosh's confidence in taking this decision strengthened.

"...After joining of another ED and CFO in March, it helped me in taking the decision confidently...and you should also know that every bank has a business continuity plan, and in that we are planning that if within three months of time, everything does not happen, in the interim period, one would like to take a call until the final nod happens," he said.

Bandhank Bank's credit guarantee portfolios are also currently under audit by the National Credit Guarantee Trustee Co.

NDTV Profit previously reported that the forensic audit is for loans worth Rs 23,300 crore and is a part of the Credit Guarantee Fund Scheme for Micro Units and the Emergency Credit Line Guarantee Scheme, for which the lender registered and obtained guarantees.

The audit is still ongoing and will take another month or so to complete, Ghosh said. He would also be present along with the top management to address the results of CGFMU audit, he said.

"We haven't heard anything from the auditor or NCGTC in this regard... This (retirement step) has no link with the audit," the bank's management said.

Jefferies, in a note dated April 7 , downgraded the bank to 'underperform' from 'buy' with a target price of Rs 170 apiece, implying a downside of 14%.

It said that there is no word from the Reserve Bank of India on re-appointment yet, and the bank's business may see an impact on both slower growth and higher credit cost fronts.

"... slippages have stayed sticky, and recovery of CGFMU claims is pending and being audited. In this backdrop and given Mr Ghosh's long stint as founder-CEO of the bank and, more importantly, the leader for micro-financing business, we see this event as a risk from execution and strategy perspectives," it said.

It added that smooth succession at the bank level will be critical, given that many in senior management are also new.

Emkay Global, too, in an April 8 note, downgraded the bank to 'reduce' from 'buy' with a target price of Rs 175 apiece.

The note also commented on Ghosh's team. It said that prolonged asset quality issues, including recent CGFMU audit, leading to sharp deterioration in RoA and management attrition had already raised the prospects of a shorter term extension by the RBI.

"Mr Ghosh's sudden resignation at this crucial juncture could usher in business/management uncertainty and potentially delay, if not derail the bank's recovery story, unless he is replaced by a credible candidate," it read.

The note also added that since the incumbent ED is relatively inexperienced, the bank may end up looking for an external candidate to fill the MD and CEO's position. This, in turn, could then be a long drawn-out process, it said.

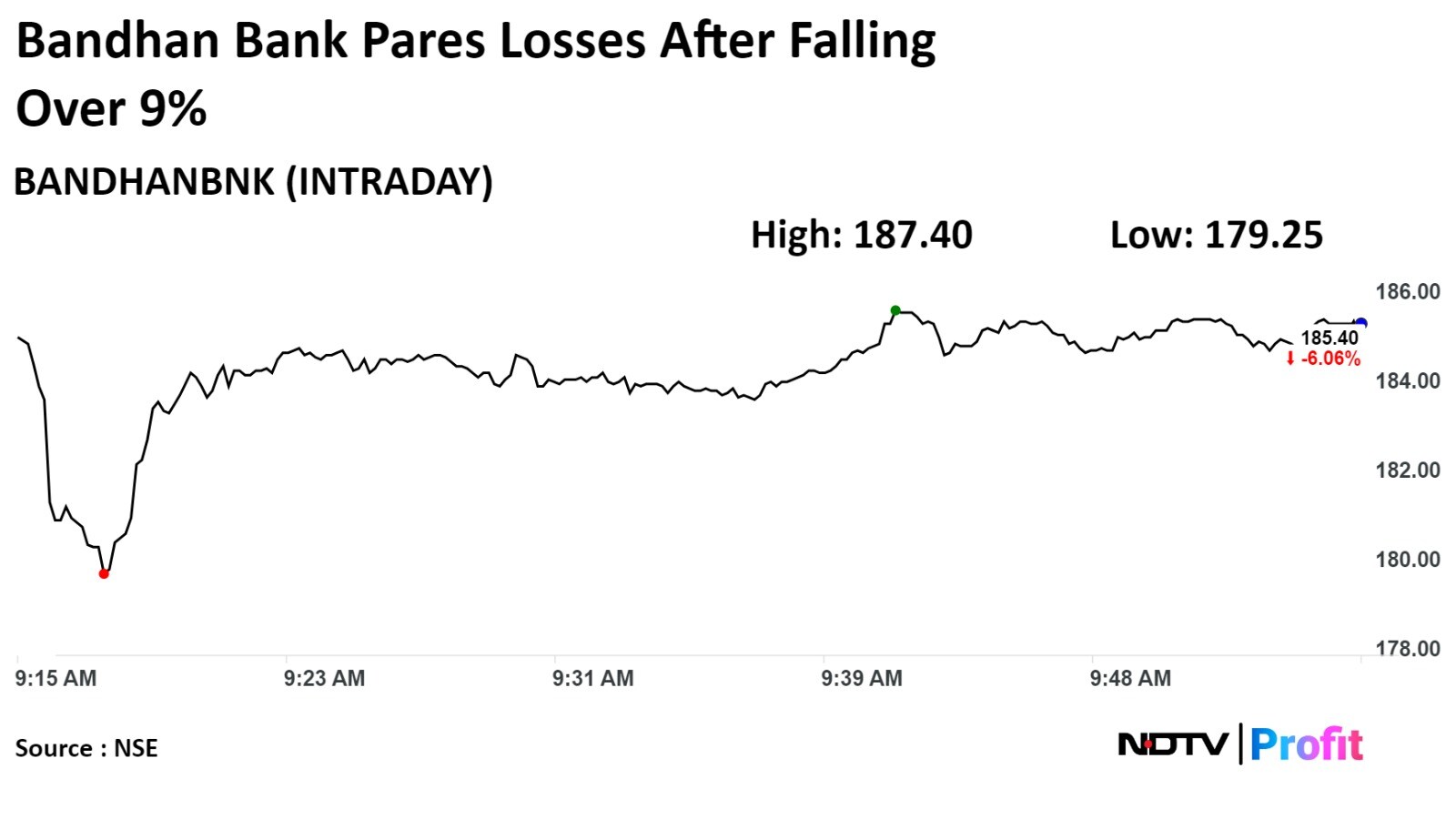

Shares of the bank fell as much as 9.17% to Rs 179.25 apiece, the lowest level since March 20. It pared gains to trade 6.3% lower at Rs 184.90 apiece as of 9:53 a.m. This compares to a 0.43% advance in the NSE Nifty 50 Index.

The stock has fallen 19.3% in the last 12 months. Total traded volume so far in the day stood at 2.38 times its 30-day average on the NSE. The relative strength index was at 43.64.

Out of 27 analysts tracking the company, 20 maintain a 'buy' rating, four recommend a 'hold', and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 34.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.