Tata Elxi Ltd.'s shares fell on Wednesday after its fourth-quarter profit missed analysts' estimates. The net profit of the engineering, research and development firm fell 4.6% to Rs 196.9 crore in the quarter ended March 31, 2024. That compares to the Rs 207.37 crore consensus estimate of analysts tracked by Bloomberg.

“Fiscal 2024 was a year of consistent operational performance with a revenue growth of 13% despite macroeconomic uncertainties,” Manoj Raghavan, chief executive officer at Tata Elxsi, said in a statement.

“We have done well to maintain the industry-leading Ebitda margin at 29.5% for the year, even as we continued to expand our talent base with a net addition of 1,535 Elxsians through the year.”

As of March 31, Tata Elxsi had an overall headcount of 13,399 employees, with an attrition rate of 12.4% on a trailing 12-month basis.

Tata Elxsi Q4 FY24 Results Key Highlights (QoQ)

Revenue falls 0.91% to Rs 905.94 crore (Bloomberg estimate: Rs 939.73 crore).

Ebit down 4.49% at Rs 233.70 crore (Bloomberg estimate: Rs 252.63 crore).

Ebit margin declined 96 basis points to 25.79% (Bloomberg estimate: 26.88%).

Net profit down 4.6% at Rs 196.9 crore (Bloomberg estimate: Rs 207.37 crore).

Dividend of Rs 70 per share declared.

Tata Elxsi FY24 Results Key Highlights (YoY)

Revenue up 12.95% YoY at Rs 3,552.14 crore.

Ebit up 7.92% YoY at Rs 946.98 crore.

Ebit margin down 132 bps YoY at 26.65%.

Net profit up 4.90% YoY at Rs 792.23 crore.

What Brokerages Have To Say On Q4 Results

JPMorgan

Maintains 'underweight' rating with a target price of Rs 5,800 apiece.

Growth impacted by ramp down in media and telecom clients.

Management believes demand has bottomed out in media and telecom.

Management aims to go back to fiscal 2023 margins of 28%.

The research firm remains skeptical on the margin target.

JPMorgan continues to find valuations expensive.

Morgan Stanley

Morgan Stanley maintains 'underweight' rating on Tata Elxsi, with a target price Rs 6,860 apiece.

Good commentary is not enough, given the burden of high expectations.

Valuations are expensive.

Morgan Stanley sees limited upside catalysts.

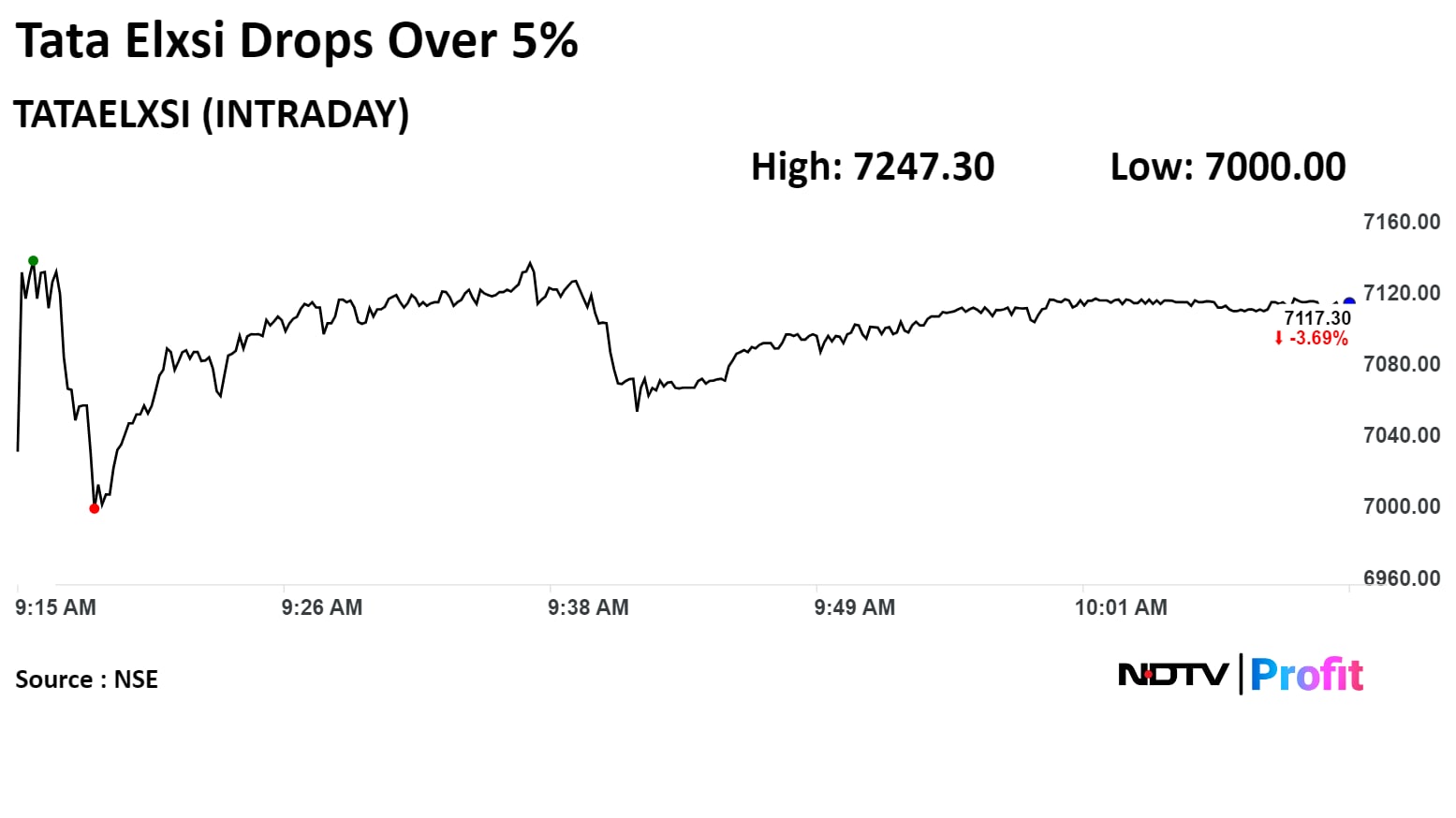

Shares of the company fell as much as 5.34%, the most since Jan. 24, before paring loss to trade 3.75% lower at 10:08 a.m. This compares to a 0.31% advance in the NSE Nifty 50.

The stock has fallen 18.71% year-to-date and risen 13.83% in the last 12 months. Total traded volume so far in the day stood at 10 times its 30-day average. The relative strength index was at 26.81

Of the 10 analysts tracking the company, four maintain a 'buy' rating and six suggest a 'sell', according to Bloomberg data. The average 12-month analysts' price target implies a downside 0.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.