(Bloomberg Opinion) -- Forget everything you've heard about how electric vehicles are running out of charge. In the biggest car market, they're on the brink of victory — and the rest of the world will soon follow.

Battery metals such as lithium, nickel and cobalt are down by, respectively, 80%, 30%, and 25% over the past year. The cells made out of them are heading the same direction, with Goldman Sachs Group Inc. predicting a 40% drop in pack prices between 2023 and 2025, putting the global average well below $100 per kilowatt hour.

That's a level that carmakers have long viewed as analogous to the technological singularity, the point where AI theorists believe machines will irreversibly take over. Below $100/kWh, electric vehicles will be cheaper than petroleum-powered counterparts to buy as well as run. The days of the internal combustion engine will be strictly numbered.

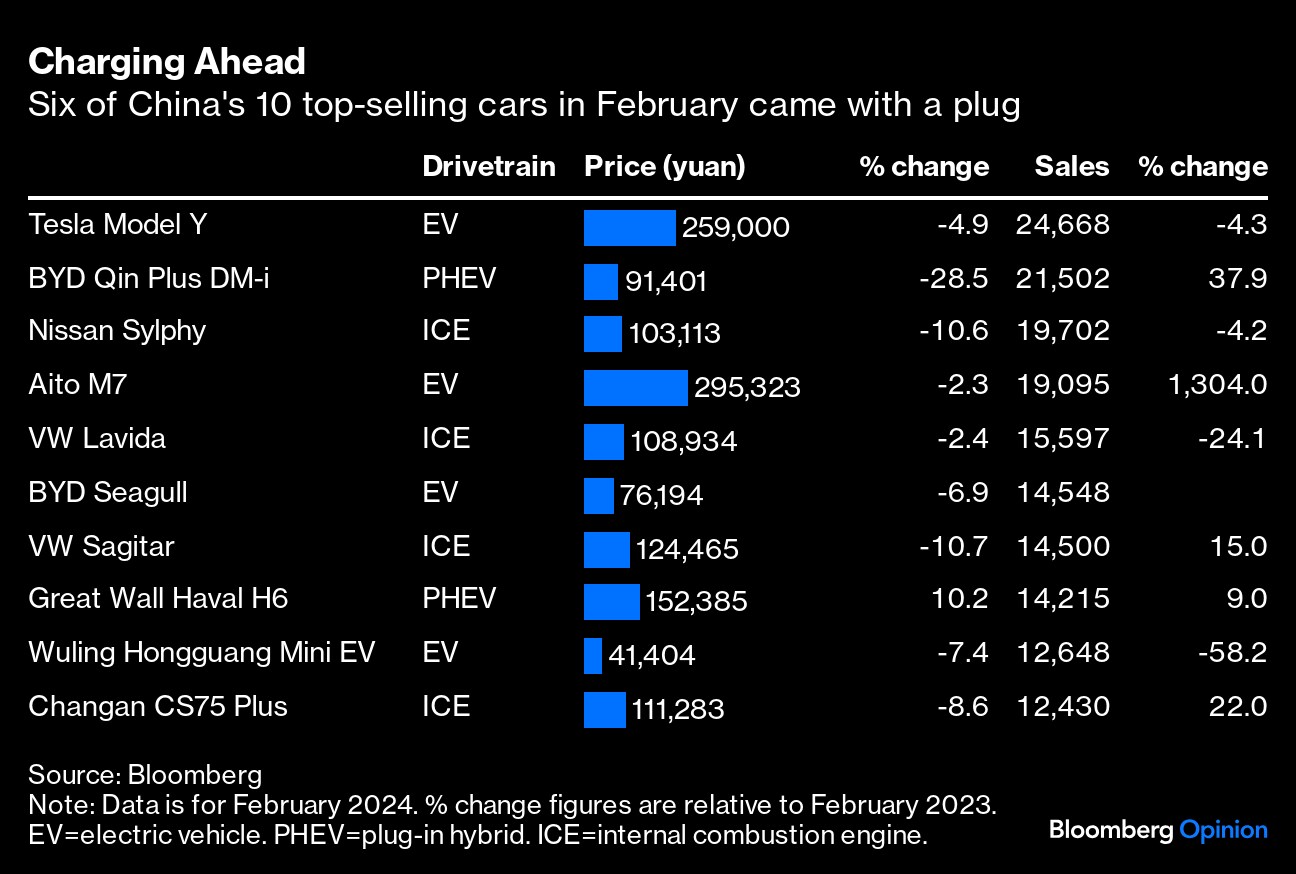

In China, the future has already arrived. Six of the 10 best-selling cars in February came with a plug. Wang Chuanfu, chief executive officer of market-leading EV-maker BYD Co., expects half of all cars sold by the middle of the year to be either battery or plug-in hybrid. You might feel tempted to dismiss that as an executive's customary bullishness, but the China Passenger Car Association, an industry group, expects such new-energy vehicles to already comprise nearly 46% of sales.

BYD's annual results Tuesday confirm the solidity of this shift. It's a truism in other countries that it's impossible to turn a profit selling EVs, but even after China abolished purchase subsidies in 2022, BYD's net income came in at 30.04 billion yuan ($4.16 billion). That's an 80% increase on the previous year, meaning profit is accelerating faster than the 60% increase in sales volumes.

This didn't happen in the middle of a cosy, stitched-up market, either. Savage waves of discounting over the past year have left China's car sector resembling a battle royale where non-battery cars are being squeezed out by a dizzying array of cheaper, more exciting electric models, even as BYD maintains steady margins that are likely to be around $1,000 per car.

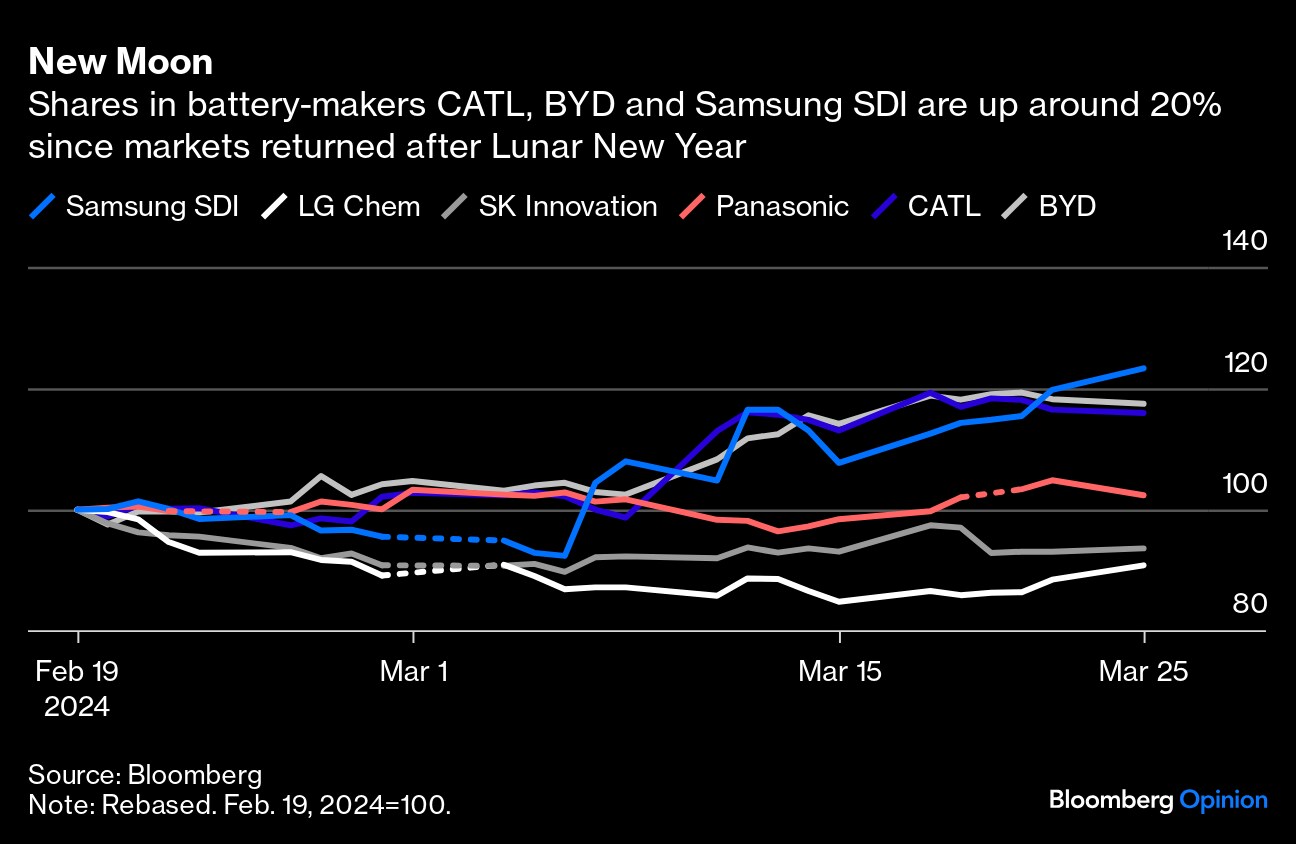

March is traditionally the peak season for China's car industry as consumers return from the lull around Lunar New Year, and sets the tone for the year. With lower battery prices promising relief on costs, EV-makers this year are going in for the kill with price reductions that conventional vehicles will be unable to match.

BYD's Seagull, a zippy battery compact which is unlikely to be offered in many overseas markets, now sells for less than $10,000, as Bloomberg News reported this week. The Qin Plus, a plug-in hybrid with the range and specs to compete head-on against mainstream sedans, is barely more costly at $11,000. If you're really short of cash, the Wuling Hongguang microcar can be had for less than $6,000.

That's particularly damaging for offshore brands, who've been slow to ramp up their electric offerings. Volkswagen AG's sales in China last year were their weakest since 2011, while Honda Motor Co. sold the smallest number of vehicles since 2015. Volumes from Nissan Motor Co. and General Motors Co. have fallen about 40% since 2019, when they were respectively the fourth- and sixth-biggest auto brands in the country; neither is even in the top 10 now.

The industry outside China can't expect to stay immune for long. The average price of EVs in the US continues to decline, but at $52,314 in February is well above the 100,000 yuan to 150,000 yuan ($14,000 to $20,000) range where BYD and its rivals are competing most aggressively. Even with a 27.5% import tariff and up to $1,000 of shipping costs, a Chinese import offers drastically better value than anything available in Europe or North America, one reason that they're likely to take up about a quarter of Europe's EV market this year.

It's not impossible that governments in developed countries try to tighten restrictions even further to protect local industries, as we've argued. Still, those industries have vocally opposed such moves, especially in Europe — both because they're fearful of retaliation from Beijing, and because they hope to take advantage of China's low production costs to export to the rest of the world from their factories there.

“Protectionism is a value destruction move,” Mercedes-Benz Group AG Chairman Ola Källenius told investors in February. VW's Chief Executive Oliver Blume makes the same point. “It is important to have a free world trade,” he told investors this month. “We are concerned of rising of protectionism.”

Rich countries where the EV revolution is still yet to break are missing what's happening in the rest of the world. They're about to find themselves wrong-footed by the pace of change. Oil demand will keep growing into the 2030s because moves toward electrification outside of the developed world are slowing down, Russell Hardy, chief executive of commodities trader Vitol SA, said in February. Try telling that to a Chinese car dealer.

More From Bloomberg Opinion:

- Vietnam Is in Danger of Losing Its China +1 Appeal: Karishma Vaswani

- Detroit Makes the Same Mistake on EVs It Did With Japan: David Fickling

- A Manufacturing Giant Can Do Without an iDistraction: Tim Culpan

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

David Fickling is a Bloomberg Opinion columnist covering climate change and energy. Previously, he worked for Bloomberg News, the Wall Street Journal and the Financial Times.

More stories like this are available on bloomberg.com/opinion

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.